Druzhba Pipeline - No more friendship just business?

on

Druzhba Pipeline - No more friendship just business?

Former members of the Council for Mutual Economic Assistance (COMECON) were linked through pipelines showing their Brotherhood – Bratstvo (natural gas) or Friendship – Druzhba (oil). During the Cold War nobody could really imagine any supply disruption between the socialist allies. But after the collapse of the Soviet Bloc, only uncertain business and “empty” names remain. This has been proven few times when Russia and Ukraine/Belarus had price disputes leading to the supply shortages (e.g. 2007 for oil, 2009 for natural gas). Therefore, in the following article we would like to tackle, particularly, the security of oil supply (SoS) of the Central European members of the EU. Are they ready for a potential Druzhba breakdown? What do they do with the purpose of improving their SoS? Do the concerned refineries have access to any alternative crude oil supply route?

Old-fashioned partnership

|

| Druzhba Pipeline - (c) Reuters |

The Druzhba pipeline starts in the region of Samara and is fed by oil from Western Siberia, the Urals and Caspian Sea. In the Belarusian town of Mozyr it divides into two branches (Fig. 1). The Northern Druzhba supplies Polish refineries in Plock and Gdansk and German ones in Schwedt and Leuna. The Southern Druzhba, at Uzhgorod in Ukraine, splits into the “Czecho-Slovak” and Hungarian lines. It deliveries oil to Slovnaft - the Slovak refinery in Bratislava, Duna – the Hungarian refinery in Százhalombatta and partly also to the Czech refineries in Litvínov, Kralupy and Pardubice. In the beginning, the Druzhba pipeline also ran to the Baltic States but currently this part is “out of order”.

|

| Figure 1: Map of the Druzhba pipeline, source: ILF CONSULTING ENGINEERS, PURVIN & GERTZ: Study on the Technical Aspects of Variable Use of Oil Pipelines - Coming into the EU from Third Countries, p. 9 |

While sufficient and reliable crude oil deliveries were available during the period of socialism, the dissolution of the Eastern Bloc has brought supply disruptions threatening the energy security of the concerned states. It has already happened few times that the oil flows were halted via Druzhba, among others, to Lithuania in 2006 or to the Czech Republic in 2008. Suddenly, the question of security of supply has appeared.

Readiness for Potential Supply Interruptions

|

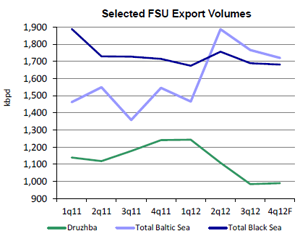

| Figure 2: Selected FSU Export Volumes, source: Weekly Tanker Opinion (14 December 2013): “FSU Pipeline Optionality Shifts Export Flows” published by the Commodity Consulting & Analytics department at Poten & Partners |

Consequently, factors such as a) disputes over transit fees and commodity prices between Russia-Belarus/Ukraine, b) strategy to support the high-value-added export c) underutilization and d) allegedly deteriorating condition of the Druzhba pipeline are so serious that they might lead to its shutdown. To what extent are the Central Europeans ready for this possibility?

First of all, the situation differs significantly between the Northern and Southern line. While the Polish and German refineries are linked to the oil terminals placed at the coast (Gdansk and Rostock), the inland plants along the Southern route are much more vulnerable. Secondly, short-term cut offs could also be cushioned by the emergency crude oil inventories. According to Article 3 (1) of the Directive 2009/119/EC on minimum stocks of crude oil, each of the Central-European members of the EU is obliged to maintain at least the volume corresponding to 90 days of average daily net oil imports or 61 days of its average daily oil consumption, whichever of the two quantities is greater.

In case of a shortcut in supply of crude oil on the Northern branch, the capacities of Gdansk’s Naftaport, the port of Rostock, and the respective pipelines located in the Polish and German territories are able to feed the concerned refineries.

On the other hand, the closure of the Southern branch would cause much graver troubles. Although the Czech Republic has already diversified its supply routes by constructing the IKL pipeline, its energy security is strongly contingent on the spare capacity of the precedent TAL pipeline. In this regard, MERO, the Czech operator of oil pipelines, has recently acquired a 5% share of TAL enabling the usage of its free capacity.

| It seems that the Druzhba route is not the Russia´s priority anymore |

Alternative routes and commercial solutions

As already mentioned, oil transport via Druzhba is becoming less attractive and some Central European countries would currently be unable to entirely cover their medium or long-term needs if the flow via the Southern Druzhba was suddenly cut off. Fortunately, they are actively searching for solutions - either backup supply routes or commercial projects raising the attractiveness of Druzhba. In this regard, the following options are considered to be the most promising:

a) Construction of the Bratislava-Schwechat pipeline (BSP)

b) Expansion of the Adria pipeline and Southern Druzhba interconnector

c) Utilisation of Odessa-Brody pipeline.

While the first two projects feature fierce competition between OMV and MOL, the utilisation of the Odessa Brody route represents the fight between the suppliers of the Caspian and Russian oil (REBCO) to Central-Eastern Europe (CEER).

|

BSP (Fig. 3) is a project which could ensure incremental transport via the Southern Druzhba, hence improving its attractiveness. Moreover, the Slovak operator of Druzhba - Transpetrol would be able to compensate its losses caused by the lower utilisation of Druzhba by Czechs. Another beneficiary would be the Schwechat refinery profiting from the access to cheaper REBCO oil. After the unavoidable technological adaptation to medium sour type of oil, OMV would erase the competitive advantage of the MOL refineries in the region. On the other hand, this project can hardly enhance the security of supply of Slovakia/Czech Republic due to a minimal spare capacity of precedent pipelines. Sufficient reverse flow to Bratislava would require the enlargement of the concerned lines - TAL and AWP. The permit granting procedure is also problematic because the designed routes cross a protected water area. Certainly, the 2nd regional giant, MOL Group, is not lagging behind. It has initiated the modernisation and expansion of the interconnector between the “Czecho-Slovak” and Hungarian lines of the Southern Druzhba (Fig. 4) [note 4]. The project would enable it to increase its capacity to 6 MTA and even an additional 1.5 MTA could be achieved provided that the drag reducing agents are used. Although the planned capacity fully covers the needs of Slovakia and also ameliorates the energy security of the Czech Republic, the precedent Adria pipeline could be a bottleneck. In this respect the project also assumes the installation of another pumping station allowing Adria to reach the required capacity (14 MTA). Once the project is implemented it would create a real alternative to the Southern Druzhba and not only in the case of its shutdown. One might expect that the MOL Group would try to prevent stranded costs and these measures could either reduce or encourage the usage of the Southern Druzhba. The latter is most probable due to the fact that piped oil is usually cheaper than seaborne oil with regard to transport fees. Arguably, the largest potential to replace the permanent shortfall of the Druzhba network is with the Odessa Brody pipeline as it is already in place (Fig. 5). At first it was intended to deliver Caspian oil to the CEER. However until 2010 it was used in the reverse direction, thus transporting REBCO to the oil terminal of Odessa. ILF Consulting Engineers assume that a) the 50% of the oil needs of the refineries along the Southern Druzhba could be satisfied without additional investments and b) the full backup for the Czech Republic, Slovakia and Hungary (17 MTA) would require € 18.1 mil. Moreover, there is Sarmatia project planning to prolong the concerned line to Plock in Poland in order to enable the transportation of the Caspian oil to the port of Gdansk. This idea seems like a real challenge for the Russian position in the region. |

|

Conclusion

During the Cold War, Central Europe was part of the Soviet sphere of influence. Today the Eastern Bloc is over but the infrastructure veins connecting former socialist allies remain. Although friendship has been replaced by business, sometimes market forces do not work adequately and Central Europeans have to face supply interruptions.

| Today the Eastern Bloc is over but the infrastructure veins connecting former socialist allies remain |

Notes

1) Energy Strategy of Russia, p. 71 and 72 [back]

2) ILF CONSULTING ENGINEERS: Study on the Technical Aspects of Variable Use of Oil Pipelines - Coming into the EU from Third Countries, p. 20 [back]

3) Energy Strategy of Russia, p. 15 [back]

4) See slovnaft.sk [back]

Discussion (0 comments)