Charming unbundling - a core element of market liberalisation

on

Charming unbundling – a core element of market liberalisation

One of the crucial parts of the Energy Packages has been linked with measures aimed at the provision of equal access to the electricity and natural gas infrastructure. This meaningful request has represented the reaction to the fact that “national champions” were not willing to open the market and compete. Quite the opposite, the status quo, based on the control of all parts of the chain in the electricity and/or gas business, permitted them to generate profit without any pressure on efficiency or prices. Therefore, the unbundling of transmission system operators (TSOs) – leading to free and fair competition has been introduced. A review of history and a view on actuality that concerns the infringement of proceedings and certification procedure.

|

| (c) Thinkstock |

Background

Historically, all activities in the electricity/gas business (generation, trading, transmission, distribution and storage) were integrated under one roof. From one point of view, this approach enabled better coordination and synergies, but on the other hand, it didn’t induce efficiency gains and innovations. Why should these companies, controlling domestic energy industries, encourage the opening of the market by building interconnectors or serving the needs of new entrants? Understandably, a hindrance of competition would preserve their comfortable positions.

In this regard, the European Community initiated, at the end of 20th century, market liberalisation, a process permitting customers to choose their supplier. Its essential component, aiming at a non discriminatory 3rd party access to the grid and unbiased investment decisions of network operators, is innovative unbundling. This measure has implied a gradual separation of commercial activities (generation and supply) and infrastructure management (especially transmission). While the former have a great potential to be competitive, the latter should prevent competition by their nature.

Just as appetite comes with eating, the Energy Packages have also become more courageous by requiring a further unbundling.

Particular models

The first attempt to restrain discrimination was represented by the adoption of Electricity (1996) and Gas (1998) Directives introducing account unbundling. More transparency into the inter company transactions between competitive segments and network operations and the delimitation of the scope of their activities aimed at the prevention of cross subsidisation.

Another step forward, trying to remove conflict of interest, was represented by the Second Energy Package (2003) which, among others, required legal and managerial unbundling of TSOs, thus strengthening their independence.

| Just as appetite comes with eating, the Energy Packages have also become more courageous by requiring a further unbundling |

The central point of the subsequent legislative discussions concerning further liberalisation was to design the form of the breaking up of utilities. Finally, on 13 July 2009, the European Parliament and the Council of the EU passed the 3rd Energy Package allowing various models through which a level playing field for all competitors could be assured:

a) Ownership unbundling (OU) – supplier and/or producer is prohibited to control TSO (clear cut separation); possession of minority shares is not excluded; separate public bodies in case of the state ownership;

b) Independent system operator (ISO) – VIU keeps the shares of assets in its hands but loses control over it; the grid is managed by an ISO entity capable of carrying out all TSO activities; The ISO’s investment decisions approved by the national regulatory authority (NRA) have to be financed by the VIU;

c) Independent transmission operator (ITO) – network owned by ITO which remains a subsidiary of the VIU; managerial independence (cooling off periods, no remuneration dependency); VIU cannot furnish services to ITO; rendering of services from ITO to VIU as long as they are available to all suppliers/producers; sufficient number of ITO personnel; no sharing of premises, IT systems, corporate identity; commercial/financial agreements between ITO and VIU must be approved by NRA; exceptionally also “ITO +” (if more effective independency could be guaranteed).

Moreover, any TSO, irrespective of the chosen model, has to follow information unbundling, thus not reveal commercially sensitive information to other parts of its VIU. Referring to the date of establishment, every TSO founded after 3 September 2009 has to comply with the OU model. Similarly, any ISO or ITO could be transformed into OU, vice versa is not possible.

Infringement proceedings

The 3rd Energy Package is composed of different legal acts of the EU:

a) 3rd Electricity and Gas Directives and

b) Three Regulations concerning the creation and tasks of the Agency for the Cooperation of Energy Regulators (ACER) and the European Networks of Transmission System Operators for Electricity and Gas (ENTSO-E/G).

While the Regulations have been binding and directly applicable since September 2009, the Directives should have been transposed into the national law of each Member State by 3 March 2011.

| The central point of the subsequent legislative discussions concerning further liberalisation was to design the form of the breaking up of utilities |

So far, ten countries are still lagging behind and, therefore, have to face the infringement proceedings commenced by the European Commission. There are different stages from a) sending a letter of formal notice - identifying the problem, through b) delivering a reasoned opinion - giving the deadline for the Member State to comply, and c) referring the case to the Court of Justice of the EU. In the 3rd stage, the Commission has also taken advantage of the innovation provided by the Lisbon Treaty (Article 260, paragraph 3) and specified daily penalty payments for a late transposition (see Fig. No. 1).

| Electricity Directive | Gas Directive | |

| Bulgaria | Referrals to court (2x €8.448) | |

| Cyprus | Reasoned Opinions | |

| Estonia | Referral to court (€5.068) | Referral to court (€4.224) |

| Finland | Referral to court (€32.140) | Referral to court (€28.569) |

| Ireland | Supplementary Reasoned Opinion | x |

| Lithuania | Reasoned Opinions | |

| Poland | Referral to court (€84.378) | Referral to court (€88.819) |

| Romania | Referrals to court (2x €30.228) | |

| Slovenia | Referrals to court (2x €10.287) | |

| UK | Referrals to court (2x €148.177) | |

| Fig. 1: Current state of the infringement procedures concerning the implementation of Electricity and Gas Directives (based on the information from the Commission’s website as of 4 June 2013) | ||

In this respect, it is no a surprise that the Commission considers the delays in transposition to be a factor jeopardizing the fulfilment of the European Council’s goal to complete the internal energy market by 2014. Therefore, the Heads of State and Government, forming the European Council, at their session on 22 May 2013, called for effective and consistent implementation of the Third Energy Package and invited the Member States to complete its transposition as a matter of urgency.

Certification Procedure

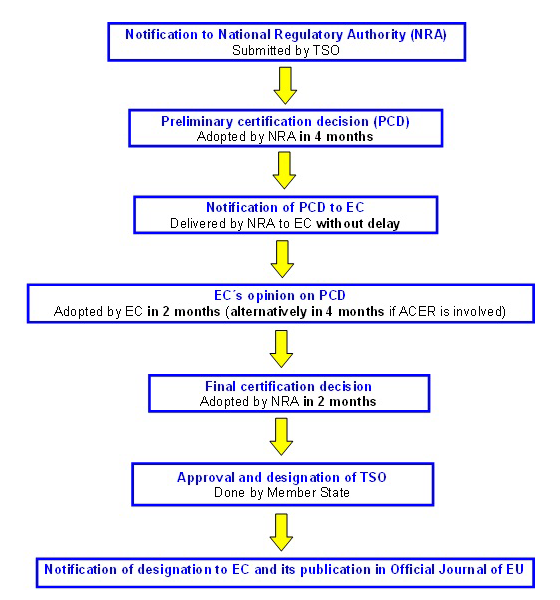

Despite the late transposition, mandatory certification procedures in majority of the Member States are currently pending or already finished. All electricity and gas TSOs in the EU are obliged to undergo this process where NRAs and EC play the central role by analysing whether their compliance with the legislative requirements on independence and security of energy supply in case of the non EU party controlling the TSO have been reached (see Fig. No. 2).

At the moment, the certification procedures are usually initiated by respective TSO and one may think that this is a single-shot examination. Just the opposite, the NRA, conducting constant oversight, should re open the whole procedure if any doubts have arisen about the TSO’s autonomy (or upon the request from the Commission).

| Just the opposite, the NRA, conducting constant oversight, should re open the whole procedure if any doubts have arisen about the TSO’s autonomy (or upon the request from the Commission) |

The first, domestic, assessment, is finished by the adoption of the preliminary certification decision (PCD) which has to be delivered with all relevant documents to the Commission performing the role of the guarantor of the harmonised approach towards all TSOs. Arguably, the transposition of the 3rd Electricity/Gas Directives causes some differences between the Member States. As a result, the EC’s Opinion on the PCD has to be taken in the utmost account by each NRA when awarding a final decision. Undoubtedly, the notion “utmost account” gives the NRAs quite strong position with regard to the setting up of the independent TSOs. Because the EU’s market liberalisation also depends on the weakest link, it is really unfortunate that the interplay between each NRA and EC is difficult to evaluate as the issuance of the NRAs´ final decisions is normally only in their national languages.

Although the unbundling of TSOs should have already been realised (by 3 March 2012, or in case of non-EU controlling parties by 3 March 2013) and the Commission should have published an evaluating report on the most complex - ITO model, neither of them has yet materialised. Clearly, the DG Energy cannot provide a complex overview when some Member States lag behind with a correct implementation of the 3rd Electricity/Gas Directives and many certification procedures are still pending.

Nevertheless, the article on “charming unbundling II” will try to give you a detailed survey of the certification procedure concerning respective TSOs, their individual difficulties and possibly divergent interpretations within the Member States. On the top of it, we will analyse whether the European Commission takes an extreme approach or a more appropriate, pragmatic, one when interpreting the unbundling rules.

|

| Fig. 2: Certification Procedure |

Overview of Commission’s Opinions on particular TSO

The well-known Third Energy Package calls for further autonomy of transmission system operators (TSOs) by means of more effective unbundling. In addition, each TSO has to pass the certification procedure assessing its compliance with the concerned independence requirements. This evaluation is, firstly, conducted by respective National Regulatory Authority (NRA) in line with the national law implementing the 3rd Electricity and Gas Directives. Afterwards, the European Commission provides its comments and invitations on preliminary certification decision. Although, its Opinions are not legally binding, they play a decisive role in order to prevent approaches too divergent.

Opinions are part of the legal acts of the EU’s institutions without binding force [note 1]. The same direction is confirmed in the TPA Regulations which lay down the obligation of each NRA to take the utmost account of that Opinion [note 2]. This article would like to present to you the main observations mostly originating in the already published Opinions, thus showing you the current state of the unbundling in the various Member States.

|

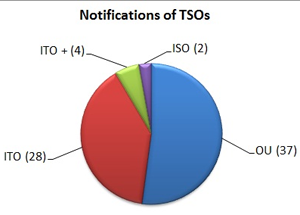

| Fig. 3: Notifications of TSOs delivered to the Commission by 4 June 2013, Source: DG Energy |

After the domestic round of evaluation, the NRAs deliver their certification dossiers to the European Commission. According to the list of notifications (published by DG Energy), currently the most popular model is the ownership unbundling - OU (37), followed by the independent transmission system operator – ITO (28), third place is assigned to the ITO+ (4) and the last but not least position is occupied by the ISO model (2) (Fig. 3).

Certainly these statistics are not final because some NRAs have not yet notified their preliminary certification decisions and some TSOs will most probably change their unbundling model as well. For instance, the French TIGF, Italian Snam Rete Gas and Czech Net4Gas originally separated as per ITO might follow the OU model due to the TOTAL’s interest to sell its shares, the Italian law imposing the OU regime to all regulated natural gas utilities and the purchase of Net4Gas by the Allianz/Borealis consortium.

Ownership unbundling

This model seems like default, albeit the most radical by reason of forcing the owners to divest their controlling shares either in generation/supply subsidiaries on the one hand or in the transmission operator on the other. In practice the latter is more common, e.g.: Open Grid Europe was sold by E.ON and Thyssengas was divested by RWE. Even though the OU model most likely allows only the holding of minority, non-controlling, shares within the TSO [note 3], the Commission has followed more pragmatic approach. It has called for the evaluation of all simultaneous participations on case by case basis. Therefore, it was acknowledged that the certification of TSOs should not be prevented, for example, by

a) controlling the generation activities in the USA and the transmission system in the UK (National Grid);

b) ownership of the Spanish TSO (ENAGAS) and the company producing a small amount of electricity under a regulated framework and

c) managing the Swedish transmission grid (Swedegas) and some electricity generation abroad, where there is no apparent interdependence between these activities.

Regarding the ownership of the Member States, the 3rd Electricity and Gas Directives provide a significant derogation. The OU model could be realised in such a way that one public body administrates the TSO and other one controls commercial activities (generation and/or supply) [note 4]. Commonly, this method is applied through different Ministries with a sufficient degree of independency. For example

(i) the Czech electricity TSO (CEPS) is controlled by the Ministry of Industry and Trade, while the participation in the supplier/generator (CEZ) is administrated by the Ministry of Finance and the Ministry of Labour and Social Affairs and

(ii) the Danish Ministry of Climate, Energy and Building exercises control over the grid operator (Energinet.dk) and the Ministry of Finance takes care about the production and supply activities of DONG Energy S.A.

ITO-model

The ITO is the most complex yet also a very popular unbundling model among the TSOs and their vertically integrated undertakings (VIU) – performing at least one of the functions of transmission, distribution, LNG or storage, and at least one of the functions of production or supply either of natural gas or electricity [note 5].

VIU

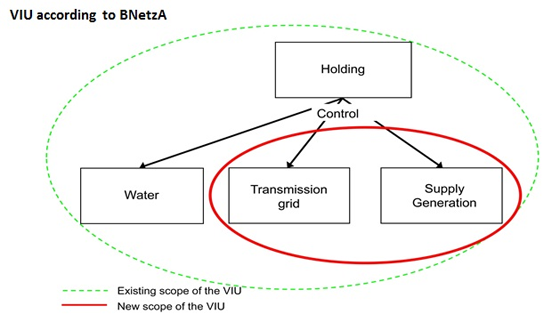

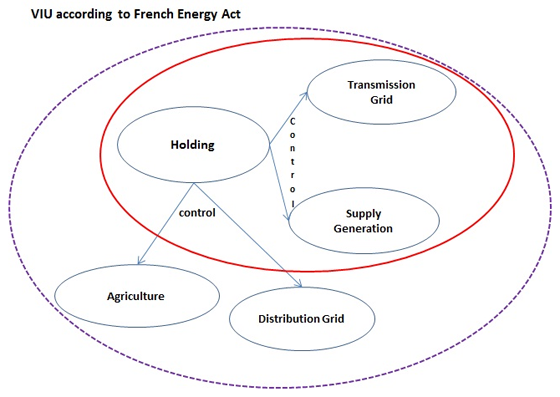

Especially a proper interpretation of this notion is a decisive for the effectiveness of the independence requirement. Nevertheless, the different approaches within Member States still exist. For instance, it is questionable whether a Holding Company, not performing any electricity/gas activity, should be considered as the part of respective VIU. It seems that the German Regulator - BNetzA excludes this subject from the VIU (see Fig. No. 4), while the French Energy Act doesn’t make any exemption (see Fig. No. 5). Furthermore, the Commission stipulated that the VIU definition shouldn’t have any geographic limits (see e.g.: the French GRTgaz or German GASCADE).

|

| Fig. 4: Situation where Holding, not performing electricity/gas activity, IS NOT considered as part of the VIU, Source: German NRA (BNetzA) |

|

| Fig. 5: Situation where Holding, not performing electricity/gas activity, IS considered as part of the VIU; created in line with the definition of VIU given by § L111-10 Code de l´énergie |

Branding

In order to prevent the confusion for consumers between the TSO and its VIU (especially supplier), the provisions on separate corporate identity, communication and branding must be followed [note 6]. In this respect, the Commission pointed at French TIGF (Total Infrastructures Gaz France) and RTE EDF Transport, German ONTRAS-VNG, Austrian Gas Connect Austria and Hungarian FGSZ. While the connection between the first 3 TSOs with their VIU is quite visible, the remaining 2 TSOs express the adherence to respective groups (OMV/MOL) in their official communication. Despite the fact that all of them are already certified, so far, only TIGF and RTE have followed the EC’s comments by exchanging “TOTAL” with “Transport” and eliminating “EDF” from the name.

Personnel

Another provision requires from the TSO to employ personnel necessary for carrying out its essential activities [note 7]. In this regard,

| Regarding the ownership of the Member States, the 3rd Electricity and Gas Directives provide a significant derogation |

Services

The autonomy of the TSO and the prevention of cross-subsidisation should be also secured by the observation of rules on the provision of services. While the TSO can render services to the VIU only if they are available to any network user on a non-discriminatory basis and approved by the NRA, the reverse situation is forbidden [note 8]. Despite this general prohibition, the Commission admits derogation could be envisaged in exceptional cases: a) services are strictly necessary and b) there is no other service provider than the VIU (see e.g.: German terranets bw or Austrian APG). In this respect, the EC objected, among others, the Hungarian MAVIR´s access to the telecommunication network provided by its VIU and the contraction of certain legal and administrative services by the German Thyssengas. On the contrary the Commission also agrees with the public tenders allowing for more than two bidders (see e.g.: Slovenian Plinovodi) and contracting of services from other VIU´s TSO which is certified (see e.g. Austrian BOG). In this respect it is interesting that the Italian NRA (AEEG) was much stricter when excluding ENI and other parts of the VIU from public tenders of Snam Rete Gas.

Management

The 3rd Directives demand the Management of the TSOs comply with certain independence criteria preventing potential conflict of interests [note 9]. Reflecting the comments of some of the EC’s Opinions, it seems that some Member States have implemented the respective provisions incorrectly. For instance, German (see e.g.: TransnetBW) and Austrian (see e.g.: Gas Connect Austria) legislation apply cooling off periods only to those members of the TSO’s management who were appointed after 3 March 2012. Moreover, German law also permits the TSO’s management to hold the shares in its VIU acquired before 3 March 2012 until 31 March 2016, and the same kind of shares for non management staff could be even kept without any time limitation (see e.g.: Bayernets). Additionally, the Commission considers the obligation to increase the salary of managers only after the statement of a specific branch of the VIU as incompatible with the independency requirements (see e.g.: GRTgaz).

Partial Exemptions

Due to the promotion of necessary investments, the exemptions to infrastructure granted under the 2nd Electricity/Gas Directives apply during the effectiveness of the 3rd Energy Package as well. Nonetheless, the non-exempted part of the capacity has to comply with certain unbundling rules in order to ensure that these capacities are marketed independently of the shareholders’ supply interests (see e.g.: NABUCCO or BBL).

ITO +

So far, this exceptional model ensuring more effective independence of TSO has been deployed only in the British Isles. For instance, the Scottish TSOs - SHETL/SPTL share their functions with National Grid having overall responsibility for the Great Britain transmission system while the Irish “couple” is represented by Eirgrid and ESB.

ISO model

This regime enables the supplying/producing company to keep ownership of the transmission network on the one hand, but to lose control over the TSO on the other. In fact, the system owner would provide finance for investments decided by the ISO and approved by the NRA. The actual “popularity” of this option is proven by the fact that, at the moment, there are only two subjects asking for ISO certification.

In the first case, relating to the Austrian TAG, the European Commission has raised doubts over its independence because it is indirectly owned by OMV and directly by CDP, also exercising rights in the Italian energy giant ENI. The second case, in which the Latvian AST is managed by the Ministry of Finance and the grid is controlled by the Ministry of Economics, is not far from the OU model.

Conclusion

Although, the Energy Council has already highlighted the positive effects of unbundling on the energy infrastructure, they cannot be completely quantified yet due to the unfinished certification procedures. As is clearly visible, each TSO’s certification is featured by its own peculiarities caused, among other things, by different transposition by the Member States or views of the NRAs. In this regard, it is important to realise the crucial role of the NRAs in the whole process contributing to market liberalisation. Their constant monitoring of potential material changes within their respective VIU/TSO is more than necessary.

The Article has also showed the Commission’s way of interpretation of the unbundling rules with the purpose of preventing conflict of interests (discrimination between network users) but without discouraging energy investors. Notwithstanding this pragmatic and reasonable approach, at the end, only the European Court of Justice is entitled to provide legally binding interpretation of the EU law.

- Art. 288 of the Treaty on Functioning of the EU

- Art. 3 (2) of Regulations No. 714/2009 and 715/2009 on conditions for access to the electricity/gas networks

- Art. 9 (2c) of the 3rd Gas/Electricity Directives

- Art. 9 (6) of the 3rd Gas/Electricity Directives

- Art. 2 (20) of the 3rd Gas Directive and Art. 2 (21) of the 3rd Electricity Directive

- Art. 17 (4) of the 3rd Gas/Electricity Directives

- Art. 17 (1)(b) of the 3rd Gas/Electricity Directives

- Art. 17 (1)(c) of the 3rd Gas/Electricity Directives

- Article 19 of the 3rd Gas/Electricity Directives

Discussion (0 comments)