Group altruism or defending the nest

on

Group altruism or defending the nest

The European Union counts 28 Member States as of mid-2013. All these countries have a different energy history and their actual energy status reflects their descent and contemporary adulthood. Cultural and political characteristics complete the fundament of today’s state of affairs and developments towards a sustainable future. Although the EU has a central government, in many aspects the Member States are still sovereign. Concerning foreign policy, taxation, military actions and many more fields countries act individually, which also is the case for their energy programmes, aside from targets agreed upon in Brussels. This overall situation deviates strongly from more or totally central steered countries like the United States of America and China, where decisions and laws of the central government in principle apply nationwide. A government with less central power and family members with a history significantly older than itself could be considered to be a disadvantage in achieving a hitherto unparalleled result, but opposite to this one can state that Europe is the biggest energy laboratory on earth with 28 ‘specialised’ departments. A wealth of information to each other and the rest of the world in every respect, be it positive or negative.

|

| (c) unreasonable.is |

The Renewable Energy Directive 2009 established a European framework for the promotion of renewable energy setting mandatory national targets for achieving a 20% share of renewable energy in the final consumption and a 10% share in transport by 2020. Later the targets changed into a clear triptych: 20% more efficiency, 20% less CO2 and 20% more renewable energy. In the beginning the Commission concluded that renewable energy grew strongly. But this conclusion was immediately followed by a worrisome observation: “while the EU as a whole is on its trajectory towards the 2020 targets, some member states need to undertake additional efforts and there are reasons for concern about future progress.”

Current policies to be improved

Member States deviations from their own national energy action plans reflected policy changes which reduce clarity and certainty for investors, increasing their exposure to regulatory risk. Other obstacles were there failure to address barriers to the uptake of renewable energy, such as administrative burdens and delays, slow infrastructure development, delays in connection and grid operational rules. To experienced politicians or business experts this did not come as a surprise. All the reason are common realities if a complex turnaround is at stake with far reaching consequences. And then there is a dominant factor that was not foreseen, at least not for its timeline and duration, the change of the economic climate with a financial crisis as hors d’oeuvre.

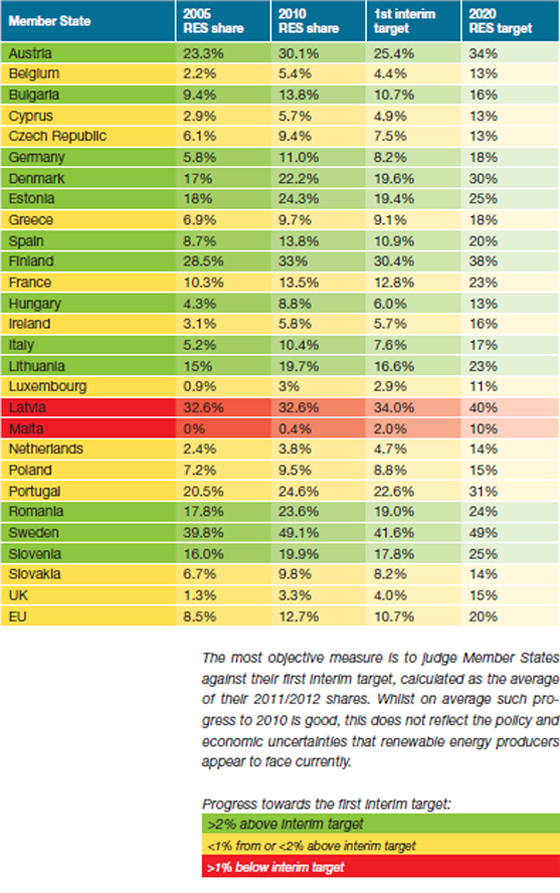

The latest figures (see the chart below) show that for the EU as a whole the progress meeting the 2020 renewables target seems satisfactory,

| All these players have to perform in harmony to reach the renewable energy targets set by the European Commission |

|

| Chart: Overview of Member States' progress |

The financial crisis in the EU partly must be solved by production growth and increasing export. International competition is a key element and low energy prices favour trade chances. However, -just to mention one heavy issue in this corner- the level of EU electricity prices are not helping. Since 2005 the end-user prices for industry have risen significantly. With 2005 as an index the price in OECD Europe went up from 100 to 137,7. Japan electricity increased less than half (116.2), while in the USA prices even dropped under the 2005 index (95.9), excluding taxes.

Furthermore the EU Commission is talking about challenges in meeting the 2020 targets to be considered in the framework of 2030. There is increasing concern about energy import dependency and rising energy prices. Not surprising considering the proposed closure of nuclear plants in Germany (part of the Energiewende) or the diminishing of Danish and Netherland gas reserves, to name a few examples. Stability and costs of renewables support schemes, impacts on the internal market, on grid stability and on capital allocation belong also to the challenges. Furthermore there is the need for massive investments in energy transmission and distribution infrastructure. And last but not least there is the current large surplus of ETS allowances, resulting in a low carbon price and low investment incentives. If the crisis continues and experts are right in declaring that the financial valley is not a dip, but displays structural aspects, the question whether the EU is able to rise to its feet on time to catch the targets is justified.

How united is the Union?

Why should this be disquieting? 2020 is a date not a deadline. How damaging is it if the target dates are shifted a couple of years in view of the fact that the transition to the ogling future and green economy will take the greater part of this century after all? But there is feeling that momentum is essential and not only speed is required but also mental mass and delay can trigger the disinterest of people and blur their focus, especially when they are scourged by actual setbacks like depressingly high unemployment figures and lower income. Shall stakeholders accept proposals, let alone start to work on them, if the existing problems and issues are not dealt with? Bear in mind that the 2030 framework will build on the 2050 Roadmaps and that concrete proposals for climate and energy policies are scheduled in Brussels at the end of this year in the midst of the reigning crisis.

| It is without doubt that this decline is not only the consequence of more efficiency, but for the greater part of less economic activity |

The EU Commission faces a Herculean task, especially as in the present situation in quite some countries the majority of the people have serious doubts about the tenability of the European Union as it is and develops. On the other hand the European Parliament showed faith and unity. Early this year the parliament gave its approval to the report on the Energy Roadmap, voting in favour of setting three post-2020 targets for energy efficiency, renewable energy and greenhouse gas emissions. Stefan Scheuer, Secretary General of the Coalition for Energy Savings, reacted enthusiastically, as could be expected: “this is a clear signal that we need to face the challenges related to energy costs and competitiveness with a comprehensive set of mutually reinforcing targets and that a greenhouse target only is not enough”. But not for long. On May 28, 2013 the headline of a press release of this same Coalition read: “Indicative national energy efficiency targets fall short of 2020 targets.” And another quote read: “….However, large Member States are not showing leadership and the EU target is not in reach, signs that the voluntary approach to targets has failed. Rapid repair will be necessary to avoid damaging the EU’s commitment to its biggest energy resource –energy savings.”

A fortnight before Jean-Francois Cirelli, president of Eurogas and also vice-chairman of the French gas company GDF Suez SA, sounded the alarm over the gas sector. His words could not be misunderstood: “ The state of affairs in the gas sector in Europe is disastrous….The exports towards Europe make a mockery of the green EU policy. We reject shale gas and we import coal…The European market has the ingredients for a perfect storm.” He appealed to the European leaders to use the Energy Summit, that took place a week after his outcry,

| The weakness of the EU is not caused by a major controversy about energy choices as such or the importance of going green it is the structure of the EU itself |

High electricity prices, failing decarbonisation, market disturbing subsidies, doubts about exploration of shale gas, dilemmas regarding the closure of nuclear plants, fear for one-sided dependency, security of supply under pressure, all these major issues do not even represent the whole list of the obstacles in the EU steeple chase to the Transition Results.

To be one or not, is that the question?

The EU should be aware of a the fact that goals are set now. They are based on present insight and represent actuality. They can be altered. Results, however, lie in the future and cannot be changed, but they consist of a long line of connected interim small but consistent resulting steps, everyday again. It sounds contradictory but for whom results are holy targets have to follow results going back in time to the present. In this respect the outcry of The Institutional Investors Group on Climate Change (IIGCC) is an example of such important steps to be considered, in this case necessary in the eye of investors. IIGCC is a forum for collaboration on climate change for European investors. It provides investors with a voice on climate change and platform from which they can engage with policymakers, investors and other stakeholders on addressing long-term risks and opportunities associated with climate change. The group currently has around 80 members, representing assets of around €7.5 trillion. In its response (June 2013) to the European Commission's 2030 Climate and Energy Green Paper this group states that European investors urgently asks the EU to make its energy and climate vision investable by setting out comprehensive policy proposals to 2030.

Stephanie Pfeifer, Chief Executive of the Institutional Investors Group on Climate Change said: “Transitioning to a low-carbon economy requires investment of €1 trillion by 2020,

| It sounds contradictory but for whom results are holy targets have to follow results going back in time to the present |

The ‘EU-Triangle’ is formed by a triptych (financial, economic and political) of crisis, stormy issues and shrinking popularity of the EU in a number of Member States. As everything in this phase indicates the whole journey will consist of a step by step and sometimes on a step by stop character. May be in the end the conclusion must be that the progress concerning the transition towards a sustainable energy future in the EU will depend on a very intriguing choice: Shall these 28 Member States show EU-group altruism or defend their own nest?

Discussion (0 comments)