How solar subsidies can distort the power market: the case of Italy

on

How solar subsidies can distort the power market: the case of Italy

Italian policies to stimulate power production have been a success in the sense that solar power capacity has exploded, but they have also led to formidable costs. What is more, argues Carlo Stagnaro of the Italian think tank Istituto Bruno Leoni, support for green power has profoundly distorted the functioning of the Italian energy market. As solar power is subsidized and given unlimited priority access to the grid, the size of the "contestable market", where power producers compete with each other, has shrunk dramatically. Stagnaro warns that the measures now being discussed to remedy the problems will put further pressure on the market model in Italy and lead to more control from above.

|

| (c) Thinkstock |

But the success of Italian solar power came at a cost. It is built on Italy's very generous incentive scheme, based on an extremely high feed-in tariff that is awarded to PV-installations (at least, to installations that were built before the end of June 2011). In addition, distributors are required to accept and dispatch "green" energy with top priority, regardless of the volumes offered. The combination of a guaranteed high price and virtually unlimited supply created the grounds for the boom.

Not only has government support for solar power led to high costs (€3.9 billion in subsidies in 2011 alone), it has also had another unforeseen effect: it has undermined the very market design that, until recently, had worked remarkably well, and had made Italy one of the most competitive electricity markets in Europe.

In this article I will take a look at how the support scheme developed, how it is undermining the functioning of the market, and what is likely to happen next.

Conto energia

In 2003, Italy introduced a 20-year feed-in tariff, the "primo conto energia", which entered into force on 19 September 2005. Thanks to the generosity of this subsidized tariff (which could be as high as €490/MWh for large solar plants, vis-à-vis an average energy price on the day-ahead market in 2005 of €58.59/MWh) the first energy law was a resounding success. It allowed for a maximum of 100 MW of solar power to be admitted to subsidies. This target was reached in 9 days, and in the following 2 months further requests arrived for 300 MW more. The cap was increased to 500 MW per year already in 2006.

In 2006 a new government under prime minister Romano Prodi appointed a Green politician as Environmental Minister. Alfonso Pecoraro Scanio reformed the feed-in tariff and in 2007 a secondo conto energia was introduced: the cap was removed, a reduced VAT of 10% (instead of 20%)

| Italy has more solar capacity than Japan, the US and China together |

While the burden of incentives grew, the cost of panels started to fall sharply, making PV investments a cash cow with almost no investment risk, wide access to project financing (up to 80/90%) and an estimated return on equity that could be higher than 20%. A wide debate resulted in the new Italian government (Silvio Berlusconi and his center right coalition had won the elections in 2008), which led to a terzo conto energia introduced in 2010, with a sort of haircut on incentives. In order to comply with the EU's climate and energy objectives, a national target of 8,000 MW of PV power to be installed by 2020 was adopted. The 8,000 MW figure relied on a 2007 "Position Paper" adopted by the center-left government. The methodology of the Paper was never made transparent, and many - myself included - believed the target to be overestimated.

Despite the political turmoil, the investment boom in PV continued, and in 2010 the installed capacity tripled (up to 3.47 GW) and so did the incentives (€800 million were paid that year). The haircut had not been sufficient, and the government felt that a new reform was needed. By mid 2011 a quarto conto energia was introduced, with lower incentives that gradually decreased over time, and an annual cap.

But PV producers had found a very convenient legal loophole. In 2010 legislation had been passed (the so-called "decreto salva Alcoa", named after the failed attempt to create conditions for the aluminum producer Alcoa not to shut down its factories in Sardegna), which allowed for PV plants authorized before June 30, 2011 to be operated and subsidized under the (very) generous terms of the secondo

conto energia. Notwithstanding the terzo conto energia being already in force and a quarto conto energia being discussed, the decreto was held to apply to all PV power producers. To make things worse, the number of requests was so high that it was practically impossible to verify all of them within the 60 days deadline established by law. It is now a common belief that a significant number of power plants that were built well after the deadline, but had filed the request in time, were allowed the salva Alcoa benefits. Of course there is no way to tell how many and which ones (in Italy we say "those who gave gave, those who got got, let's forget about the past!").

In Italy we say "those who gave gave, those who got got, let's forget about the past!"

To make a long story short: by the end of 2011, 12,750 MW of PV power had been installed. This time the cost of incentives became definitely too high to be ignored: more than €3.9 billion in one year. This amount will further increase in the next few years, although not as fast as in the past. You can guess the reason for that is... we are now adopting a quinto conto energia.

However, the problem with PV power is not just the burden of incentives. It is also the effect that solar power has on the rest of the market.

Balancing costs and grid congestion

On March 30, 2012 the Italian consumers received bad news. A press release from the Autorità per l'energiaelettrica e il gas (the independent regulatory body for gas and power) announced that electricity prices would increase, for an average household, by 9.8%. (In Italy there is a "reference price" for households that have not yet closed a deal on the free market; they are covered by a government-controlled "Single Buyer".) 4% was attributed to the growing cost of renewable incentives alone. Of the remaining 5.8%, "the indirect effect of intermittent renewables is worth about 40%", the regulator said, or 2.32%. In addition, the Autorità predicted that in 2012 the cost of solar subsidies will increase to €6 billion. In July the cost of electricity to households grew again by 0.2%, resulting from a decrease of the market price of electricity and an increase of subsidies and balancing costs.

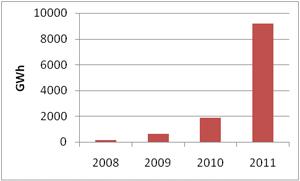

To understand what is happening, one must know how the power market works in the first place. On the day-ahead market supply and demand bids are matched. However, renewable production is awarded a priority dispatch - i.e., whenever green energy is produced and not self-consumed, the network operator must deliver it with priority over conventional production. Everyday, the GSE (Gestore dei Servizi Energetici, a government-controlled entity which is in charge of managing the support schemes for renewables and of marketing the green energy) estimates the solar (and other renewables) production for the following day, so the volume of electricity actually traded is equal to the expected demand minus the demand share covered by bilateral contracts minus the expected "green" production. If green production happens to be higher or lower than expected (for example because the sky is more or less cloudy than expected), conventional producers must be called in to adjust their production on a real-time basis - through the balancing markets - which is more costly than normal production both for economic and technical reasons. This was not a problem when intermittent production covered just a small share of total consumption. Nowadays however, as the graph below shows, things have become quite different. (Admittedly, GSE seems to make little effort to develop reliable forecasts for the intermittent power generation.)

|

| Figure 1. Electricity production from PV power. Click to enlarge (Source: own elaboration on GSE data) |

In 2011 total demand in Italy was around 332.3 TWh. As can be seen from the chart, PV covered almost 3% of this. As small as this share may appear, it is enough to create major disruptions - especially if grid congestions are considered, which amplify the effects of over- or under-production. Moreover, this 3% of total production is generated only during certain hours of the day (when the sun is high in the sky). Under certain conditions (the "Shiny Sunny Sunday") solar production may actually cover almost all the demand!

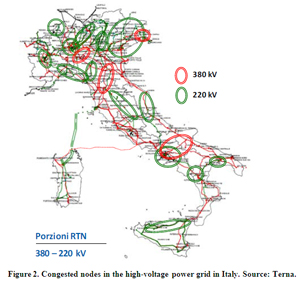

The grid congestion issue is also particularly relevant if one considers that most photovoltaic installations are in the South of the country, while the largest consumers (industries) are based in the North, and that the high-voltage lines on the North-South direction are frequently congested (as the following figure from the TSO, Terna, shows). And we have not even mentioned the technical difficulties for local distributors to manage a high number of small, intermittent inputs. Distribution networks are not always able to deal with such massive, distributed generation: to do so they require major investments. Such investments sometimes need an ad hoc policy framework to be developed, as Simona Benedettini and Federico Pontoni described with regard to Italy's and UK's ongoing reform processes.

|

| Figure 2. Congested nodes in the high-voltage power grid in Italy. Click to enlarge (Source: Terna) |

The cost of imbalances was high enough to lead to a significant increase in the electricity bill for households and businesses. Part of the problem lies in the political decision to charge such cost to the consumers.The underlying justification is that green production is in the "general interest" and, therefore, its costs should be borne entirely by "society". However, it is now clear that such a rule may be consistent with a generating park where renewables cover a small share, but becomes increasingly problematic as the contribution of clean technologies grow. The rule may require a major change - which is, in fact, being considered. The idea is that producers, not consumers, should borne the cost of imbalances. If correctly implemented, this would have several consequences: for example, renewable producers would have an implicit incentive to better manage their generation portfolio in order to offset one plant's imbalances with another plant's production (or lack thereof), or to cover themselves against such risk by investing in either storage technologies (to accumulate and release energy when their plants over- or under-produce) or through financial instruments. Alternatively, they might be interested in marketing their production by themselves, instead of going through the GSE.

Contestable market

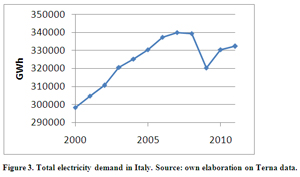

Renewable energy production doesn't happen in a void - it is part of a broader productive context. After a long period of growth, Italian demand for electricity sharply fell as a consequence of the 2009 recession, and then had only a minor rebound.

|

| Figure 3. Total electricity demand in Italy. Click to enlarge (Source: own elaboration on Terna data) |

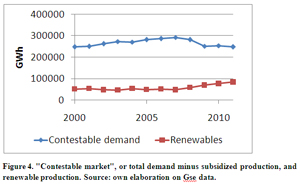

Given the country's economic outlook and the strong correlation between electricity demand and economic growth, it is unlikely that consumption will grow significantly in the foreseeable future – orthat it will grow at all. At the same time, the amount of non-marketed (subsidized) energy is growing, which displaces conventionally produced power and creates a gloomy scenario for itsproducers asthe size of the “contestable”part of the market is shrinking.It fell from292 TWh in 2007 to 248 TWh in 2011 (-15%).

Comparing Figures 3 and 4 one may infer that the size of the "contestable" market did not decrease just because of the crisis - indeed, it decreased also because of the growth in green production (especially solar PV). Green production is independent of market signals, because it doesn't receive any price signal (the tariff is known in advance, at least for PV, while other renewable sources are subsidized through more complex "green certificates" schemes that despite several corrections have proven to be very inefficient - but this is a

|

| Figure 4. "Contestable market", or total demand minus subsidized production, and renewable production. Click to enlarge (Source: own elaboration on Gse data) |

Unfortunately as it happened, while demand was decliningand green production increasing in Italy, conventional generation capacity kept growing. This was mainly a result of the normal project commissioning time lag. Thus average thermal capacity available at peak time in Italy rosefrom 39,900 MW in 2000 to 53,700 MW in 2010 (Italy has no nuclear power). This means that the ratio between "contestable market" and thermal capacity, i.e. the number of hours when conventional plants compete between them, has fallen from 6,204 to 4,620 hours. In other words, the ratio has fallen from over 70% of the total number of hours in a year (8,760) to 53% - and it is still decreasing. In 2012 the ratio may fall further to about 40% (3,500 hours). What this means is that a growing amount of conventional capacity is increasingly under-utilised, making it more and more difficult for operators to recover their fixed costs.

Even this doesn't really catch the whole picture. Conventional production is displaced as far as requested volumes are concerned, butbad news comesfrom the price end, too. Solar power produces in the central period of the day - when demand is also at its maximum, and where prices used to be the highest. In a marginal pricing system, where the clearing price at any given moment is equal to the marginal cost of the marginal power plant (the least efficient and most costly at that given time), solar power usually bids at zero euro - because it gets the tariff after all, so it is indifferent to market prices. That means that the merit order curve shifts and the marginal power plant becomes a more efficient, less costly one. As a result, conventional producers face falling demand and falling prices (therefore shrinking margins). It has been estimated that peak-time power prices in summer might have decreased up to 30-50% as a resultof PV production.

Conventional producers may enjoy just one advantage. When solar production falls late in the afternoon, conventional power plants must start up production rapidly. This requires CCGTs (combined-

| Electricity prices by evening can be higher than peak-time prices - this after a long campaign to convince Italians to shift consumption to the night in order to save money! |

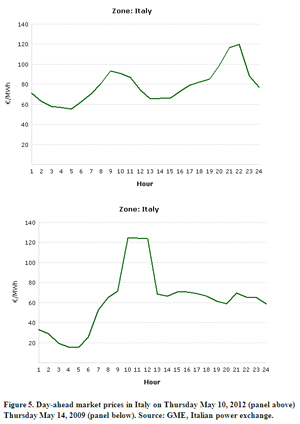

The following figure shows how the market changed. In 2009 (panel below), when the amount of solar power was much lower, the peak price in the market occurred when demand was also at its peak. Now that most demand at peak-time is met by solar power, prices at peak-time are relatively low. At the same time, when the sun goes down solar panels suddenly stop production, and CCGTs start up production, which pushes prices upwards. This happens at a time of day when total demand is relatively low (as compared to morning-time demand) and lasts for a limited period of time.

|

|

|

While the demand levels and shapes aresimilar, the shape of the price curves is radically different, and it is likely to keep changing as solar power increases its contribution.

What should be emphasized is that conventional producers do not suffer as a result merely of normal "market risk". They are losing market shares and profits not only as a consequence of their over-investments, or because they weren't able to foresee the looming economic crisis, but also as a result of political and regulatory measures. Consider, for example, that the time-to-market for a CCGT lasts at least five years, mainly because of the length of the authorization process. This means that a power plant completed in 2010 was conceived in 2005. Could the plant operator possibly have figured out in 2005 that, in 5 years time, 5 different incentive schemes would have been introduced for solar power and that this would have led PV capacity to skyrocket from 7 MW in 2005 to 12.75 GW in 2011? A growth by almost 1821 times, or 182043%, is not a black swan: it is a polka-dotted swan!

Major problems

So we have at least four major problems.

The first problem is the cost of incentives. No conclusive solution is at hand, at least as far as the already-installed capacity is concerned: the government committed itself to pay a given amount of subsidies to PV producers, and commitments must be honored - especially in a country which is already perceived as overly risky to invest in.

The second problem is the increasing imbalance cost due to the amount of intermittent power capacity. Italy's energy regulator has recently proposed a new regulation, whereby the cost of imbalances is no longer charged to the consumers, but is borne by those who caused the imbalance itself. From a distributional point of view, this makes perfect sense. In fact imbalances are the equivalent of a negative externality that can be easily internalized, under a proper set of rules. Moreover, the socialization of balancing costs is the equivalent of a hidden subsidy to intermittent sources of energy, which gives them a competitive advantage over non-intermittent technologies - including the carbon-free ones, such as bio-energies, hydropower, or thermal power plants equipped with carbon capture and sequestration facilities. Such a discrimination cannot possibly be justified on environmental grounds and it causes additional unjustified distortions in the market.

The third problem is that a large and increasing share of intermittent production creates technical problems in the power grid that, perhaps, in the future will be solved by smart grids, but in the present need to be addressed. The most basic answer to this is the creation and maintenance of a significant "reserve capacity", either through "capacity payment" tools, which would remunerate electrical companies for keeping in operationreserve capacity, or by building batteries, pumped-storage hydroelectric plants, or other accumulators. The former solution is supported in Italy by the regulator and by most conventional producers; the latter is suggested by the TSO Terna.

Both these measures would have the effect of further shrinking the area of the "contestable" market, since the increase in production capacity would be subtracted from the usual supply and demand process, and would be substantially dependent on political or regulatory decisions.So, in addition to the cost involved, they would imply a major change in the way markets are organized. There would be less competition "in the field" and more and more control from above, with the consumers paying not for the energy they consume, but for the capacity which is installed and maintained, regardless of whether and how much it is used.

The fourth problem lies in the growing conventional overcapacity. This is not a social problem per se, if it results from wrong investments. But here rapidly changing government policies played a major role. Although conventional power producers should not be paid for mistakes they made, they at least should not be over-taxed. In 2008, Italy introduced the so-called "Robin Hood Tax" on energy producers. After several increases, the Robin Hood Tax is now 10.5 percentage points additional on top of the "usual" corporate tax rate (27.5%). Repealing this tax would be a reasonable measure.

Less competition

So what will happen next? At this moment, some measures are being taken. Green subsidies are being cut - and they are likely to further decrease in the future, to reflect the expected reduction in the costs of solar power. This will at least alleviate the burden of future incentives, but it will have little effect on the subsidies that have already been committed.

Secondly, renewable energy producers will be asked to cover balancing costs at least in part. A war between vested interests is already going on as to how to address the balancing problem. Terna is demanding the right to invest in storage capacity, which is controversial, as it would make the TSO a market player, able to decide where storages are located and how they should be managed. Conventional generators are asking for a capacity payment mechanism to be introduced. This demand is very likely to be honoured, but theamount and the design of the scheme are not sure yet.

Whatever measure - or mix of measures - will be taken, it is clear that the functioning of the market will be affected. The measures that are now being discussed will change producers' incentives and will change Italy's electricity system from a market model characterized by many different market players taking a large number of interacting, decentralized decisions to one dominated by a small number of political or regulatory choices. There will probably be less competition and more lobbying. Consumers will feel the difference, too: as a larger part of the bill will be politically determined, and they will have less choice in electricity provider. Many benefits of competitive markets might be lost.

All in all there seem to be no easy solutions and, perhaps, no solution at all, except that many people will have to pay for the defects in the system - be they consumers, conventional producers, or even, in the future, renewable energy producers. But at least the Italian experience may provide a useful lesson: policies aimed at changing the structure of the power system too rapidly may ensure that targets are met, but not necessarily in a way that is consistent with the "public interest".

|

About the author Carlo Stagnaro (Twitter @CarloStagnaro; carlo.stagnaro@brunoleoni.org) is Research and studies Director of Istituto Bruno Leoni, a think tank based in Milan. |

Discussion (0 comments)