Reality check, call to arms or pipe dream?

on

Reality check, call to arms or pipe dream?

The International Energy Agency (IEA) has updated its technological roadmap to a low-carbon future. If the IEA’s road is followed, it will be bad news for gas producers and good news for the nuclear power sector. The nuts and bolts of a proposed energy revolution.

|

| Twenty to thirty new nuclear power plants are needed every year to reduce CO2-emissions by 50% in 2050. |

The ETP2010 report can be read in many different ways: as a cold-blooded reality check, a rousing call to arms or as a totally unrealistic pipe dream. The IEA itself does not seem quite sure how to interpret its own conclusions. It says that to limit climate change, ‘a truly global and integrated energy technology revolution is essential’. It also notes that this energy-technology revolution is ‘within reach’ and sees ‘early indications that such a revolution is under way’. At the same time, it acknowledges that these ‘early indications’ are just ‘the first small fragmented steps on a long journey’. What is worse, it notes that since 2006, when the first edition of the ETP appeared, ‘the world has continued to move – and even at an accelerated pace – in the wrong direction’.

To make it go in the ‘right’ direction, will be no easy matter, the IEA realises. Simply putting a price on carbon will not be enough, it says. In fact, the energy watchdog of the OECD notes that ‘confidence in the longer-term prospects for carbon trading’ has been diminished. While policies such as carbon trading ‘are likely to be an important driver of change, they are not necessarily the most effective way to deliver short-term investment in the more costly technologies that have longer-term emissions reduction benefits’, the IEA notes.

Rather than the market, it is the politicians who will have take the lead. As the report puts it: ‘Governments will need to intervene on an unprecedented level in the next decade to avoid the lock-in of high-emitting, inefficient technologies.’

Top priority

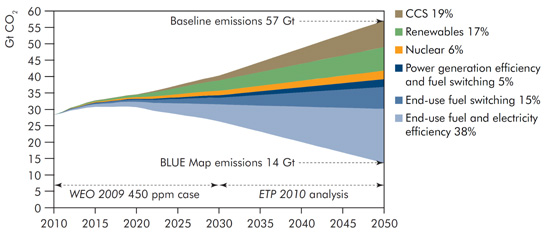

ETP2010 offers two scenarios: a ‘Baseline’ scenaro which assumes that no new energy and climate policies are introduced until 2050, and a ‘BLUE Map scenario’, which is a ‘target scenario’. It assumes that global energy-related CO2 emissions are reduced by 50% by 2050 and then examines how this can be done at least cost. According to the IEA, a 50% emission reduction is the absolute minimum that should be achieved to keep climate change within more or less acceptable limits of to 2-3 degrees Celsius. Anything less, the IEA implies, would be catastrophic.

So what does mankind have to do make the BLUE scenario come true? Quite a lot. The ‘top priority’ should be to increase energy efficiency: to reduce energy consumption and lower energy intensity. BLUE mandates that there should be a global improvement of energy intenstiy of 2.6% a year. This is 0.8%-point higher than the actual improvement of 1.8% that was realised over the last 30 years in the world.

| Key technologies for reducing CO2 emissions under the BLUE Map scenario |

|

| A wide range of technologies will be necessary to reduce energy-related CO2 emissions substantially. |

Thanks to higher energy efficiency, primary energy use will rise just 32% in the BLUE scenario in the period 2007-2050. This sounds achievable, but since population is assumed also to grow by 32%, it means that per capita energy use will have to remain the same over the entire period, while GDP is assumed to grow by 3.1% per year. Quite a tall order.

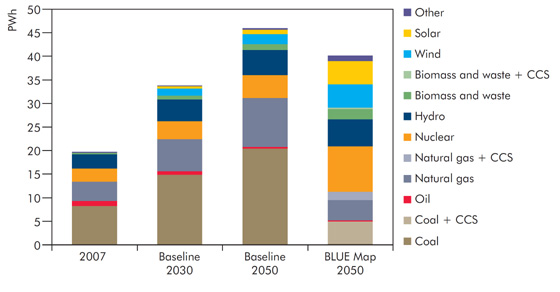

The use of fossil fuels is of course drastically reduced in the BLUE scenario. The ‘carbon intensity’ of energy use will fall 64%. Coal demand will drop 36%, gas demand 12% and oil demand 4%. Renewables will provide almost 40% of primary energy supply and 48% of electricity supply in 2050. 80% of cars sold will be electric, hybrid or hydrogen-powered.

It should be noted that while the world is expected to reduce CO2 emissions by 50% on average in the BLUE scenario, the OECD countries will have to do more than the non-OECD countries. To be precise, the OECD will have to reduce CO2 emissions by 70 to 80% below 2007 levels. To make this possible, the electricity sector in the OECD countries will need to be ‘almost completely decarbonised’ by 2050.

Sharp contrast

In the view of the IEA, one of the most important ways to decarbonise the power sector is by building nuclear power stations. And not just a few. In the BLUE world, nuclear capacity will grow from less than 400 GW (Gigawatt) today to 1200 GW in 2050. Its share in electricity production would rise from 14% today to 24%. As most of the current nuclear power stations will be phased out by 2050, this means that 1200 GW of new nuclear power plants will have to be built. That is about 30 units of 1 GW (1,000 MW) per year (300 per decade) for 40 years. Is this possible at all? The IEA thinks so. It points to the example of the 1980s, when the world embraced nuclear power wholesale. Actually, during that decade, 218 new nuclear power plants were built with an average capacity of 923 MW, so an even bigger effort would be required. At this moment some 59 reactors are being built with a total capacity of 60 GW and some 149 reactors are in the planning stage, with a total capacity of 163 GW. Even if all these plans were realised, it would still not enough to reach the 300 GW needed for the whole decade. (http://www.world-nuclear.org/info/reactors.html)

The BLUE scenario assumes that the investment costs for nuclear power plants will go down – from $3000 - 3700 per kW in 2010 to $2700-3300 per kW. These seem rather optimistic numbers, in view of the skills shortage and the enormous demand that will be made on suppliers if the required investment levels are to be met.

For companies, like Shell, that bank on natural gas as ‘the fuel of choice’ in the low-carbon world of the future, the report is less than positive. Unlike Shell, which foresees continued growth in gas demand over the next decades, BLUE assumes that gas consumption will go down by 12%, as noted, and the contribution of gas to power production will decline from 23% now to 15% in the future. In OECD countries, including Europe, demand gas is assumed to go down by more than 50%, from 1259 Mtoe (million tonnes of oil equivalent) in 2007 to just 526 Mtoe in 2050. This assumption of course flies in the face of current trends in electricity production. It is also in sharp contrast with the current developments in unconventional gas.

| Global electricity production by energy source and by scenario |

|

| There is a major shift from fossil fuels to low-carbon alternatives in the BLUE Map scenario. |

In the BLUE scenario the share of coal in power production will decline even more drastically, from 42% now to 12% in 2050. Virtually all of the remaining coal-fired power production will be combined with carbon capture and storage (CCS). By contrast, only one-third of gas-fired power production will be fitted with CCS. The IEA notes that it is much more expensive to equip gas-fired power plants with CCS than coal power plants.

It is instructive to contrast the BLUE scenario for the power generation sector with the actual trends in the period 1990-2007. During this time, global power production rose 67%. If this trend were to continue in 2010-2050, power production would rise 194%. The BLUE scenario, however, assumes a rise of 121% - despite the large-scale use of electric cars. Also in 1990-2007, the share of fossil fuels in power production grew from 59% to 69%. The share of nuclear power fell from 17% to 14%. The share of biomass grew from 1.1 to 1.3%, the share of renewables (excluding biomass and hydro) from 0.4% to 1.2%. CO2-emissions from power production increased by 59%. All of this shows that a revolution is indeed required to almost completely decarbonise the power sector.

Sense of uncertainty

So what will it all cost? The BLUE scenario requires additional investments (compared to the Baseline scenario) of $46 trillion ($46,000 billion), but, says the IEA, fuel savings in the BLUE scenario will be no less than $112 trillion, so the transition will actually lead to net gains of $66 trillion. Even at a 10% discount rate, net savings would still amount to $8 trillion. Such predictions depend of course on assumptions about price developments. The Baseline scenario assumes that oil prices will rise to $120 per barrel in 2050 ($312 in nominal terms). In the BLUE map scenario lower demand will lead to a lower oil price of some $70 per barrel, leading to considerable fuel cost savings. However, lower demand could also trigger lower supply, in which case the price may not go down as much as the IEA assumes. What is clear is that investment in low-carbon energy technologies levels technologies (this includes investments by energy consumers such as vehicles and electric appliances) will have to rise drastically in the BLUE scenario: from $165 billion per year now to $750 billion per year by 2030 and $1600 billion per year from 2030 to 2050.

The impact of the BLUE scenario on GDP is not clear from the study. The IEA notes that the impact ‘is likely to grow over time and and could become substantial by 2050’. It states that the OECD estimates GDP loss at 4 to 7%, depending on the CO2-scenario, but adds that ‘the OECD does not include some important low-carbon technologies such as CCS’. The IEA also notes that ‘many studies have shown that over the longer term the cost of inaction would far outweigh the cost of reducing CO2 emissions’.

On a more general note, the researchers argue that the transition to a low-carbon energy future is not only necessary to limit climate change, but is ‘also a powerful tool for enhancing energy security and economic development’. However, the report does not really make a case to prove this point.

One thing is certain: ‘as energy producers and consumers’, we are entering a period in which, as the IEA notes, our ‘sense of uncertainty is likely to be amplified’. That seems an understatement. Nevertheless, we hope the IEA’s challenging view of our energy future will not ruin your summer holidays!

Discussion (0 comments)