Reassessing "market relevance": why national boundaries are increasingly irrelevant in measuring competition in gas spot markets in Northwest Europe

on

Reassessing "market relevance": why national boundaries are increasingly irrelevant in measuring competition in gas spot markets in Northwest Europe

The 'relevant market' for gas spot sales in Europe is currently being determined by most regulators along national boundaries. The widely accepted 'Gas Target Model', developed by the Council of European Energy Regulators (CEER), similarly measures competition in the spot gas market on a national basis. In the final segment of a three-part series on European gas hubs, Catrinus Jepma and Santiago Katz of the Energy Delta Institute argue that such an approach does not do justice anymore to the reality of the gas market in North West Europe. On the basis of the criteria specified in the European Commission's key Notice on the definition of relevant market for the purposes of Community competition law, they show that the relevant geographic market for spot gas wholesale is regional (international) rather than national. This is important because it turns out that on a regional basis competition in the North Western European gas markets is much stronger than has thus far been assumed by regulators.

|

| Construction of a gas interconnector (c) Europost |

This is anomalous, because intuitively one would expect to see a positive relationship between liquidity and competition. As the Communication from the Commission into the European gas and electricity sectors states: "low levels of liquidity are an entry barrier to both gas and electricity markets." Therefore, shouldn't highly liquid hubs exhibit high competitiveness?

In order to explain why such highly liquid markets seemingly underperform in competition, we need to look at the manner in which these competition scores are being calculated. In particular, we need to look at the scope of the relevant market, its application in competition law, and its impact on regulatory monitoring and the measurement of competition. To this end, we will discuss the criteria of the EC Notice on the definition of relevant market for the purposes of Community competition law - the definitive source of European jurisdiction in this context - apply them to North West European spot gas wholesale markets and seek to draw meaningful conclusions.

The relevant market: what it is and why it matters

The relevant market is, essentially, the physical dimension over which competition is measured. In order to define the relevant market, a regulator must determine both the product range and geographical scope over which to measure competition. Natural gas being an intrinsically homogenous product, the product range is in this case a straightforward matter, Determining the correct geographic market, however, is a more challenging task.

The European Gas Target Model, developed by the Council of European Energy Regulators (CEER) and endorsed by all gas stakeholders at 21st Madrid Forum in March 2012, calculates competition on the basis of the Herfindahl-Hirschman Index (HHI). So do most national regulatory authorities (NRAs). Simply put, HHI calculates the market shares of the largest firms in a given sector (in this case natural gas wholesale) over the given relevant product and geographic markets, concepts we will address in more detail below. For now, it should be clear that if either of these relevant markets are defined either too broadly or too narrowly, the resulting competition scores may be artificially high or low.

In light of our anomalous results, and assuming that the NRA-provided figures are indeed correctly calculated, we are left with only two possible explanations for why the Continent's most liquid hubs rank among the least competitive ones: either HHI does not effectively measure competition or HHI is a useful tool that is being applied to incorrectly defined relevant markets. The latter seems the more likely explanation. As Jepma and Harmsen showed in an earlier article in European Energy Review, the most liquid hubs are among the most integrated, yet this integration is rarely taken into account by those measuring hub competition levels. For this reason, we will look at the possibility that competition indicators are in fact being measured for isolated sections of the real relevant market, as opposed to the relevant market as a whole.

Historical and legal precedence: leading the way, or holding us back?

The scope of the relevant market for natural gas wholesale has been, and remains, a source of intense discussion at both national and European regulatory levels. Some policymakers argue that the relevant market to which regulators apply competition law ought to be, for institutional reasons, national in scope. This perspective is often shared by NRAs whose competition-monitoring mandate is geographically limited by their uniquely national jurisdiction. Others – in particular representatives of the gas wholesale community - instead argue against an institutionally determined relevant geographical market on the basis that economic indicators relating to evidence of arbitrage and price convergence provide more meaningful insights into market realities. The choice of approach is important, as it ultimately serves as the fundamental basis on which competition law is applied and markets are regulated against market abuse.

Wide relevant geographic markets for energy commodity sales are certainly not anything new. Precedence exists, at a European level, for wider, pan-national and regional markets. For example, in its 2003 Regulation (EEC) No 4064/89 Merger Procedure, the European Commission used statistical data on "the frequency and distribution of different price areas of the Nordic electricity market" to determine that the "generation/ wholesale market is likely larger than Sweden."

| The scope of the relevant market for natural gas wholesale has been, and remains, a source of intense discussion at both national and European regulatory levels |

Because the European Commission has, at various times and in various cases, expressed different opinions as to the scope of the relevant market for gas wholesale, we turn to a more definitive source of European jurisdiction for guidance: the earlier-mentioned EC Notice on the definition of relevant market for the purposes of Community competition law (97/C 372/03) of 1997. Given the European regulatory context of this discussion, the EC Notice serves a primary source for further discussion about the relevant market.

Finding a framework for discussion

The Notice defines the relevant product market as that which "comprises all those products and/ or services which are regarded as interchangeable or substitutable by the consumer by reason of the products' characteristics, their prices and their intended use." The relevant geographic market is then defined as that market which "comprises the area in which the undertakings concerned are involved in the supply and the demand of products or services, in which the conditions of competition are sufficiently homogenous and which can be distinguished from neighboring areas because the conditions of competition are appreciably different in those areas." Since spot market products are sufficiently homogenous and standardized across all Northwest European hubs, we will only focus on the relevant geographic market.

The Commission Notice lists five kinds of evidence for defining the relevant geographic market:

1. Past evidence of the impact of price changes on consumer behavior

2. Current geographic pattern of purchases

3. Trade flows and pattern of shipments

4. Basic demand characteristics

5. Views of customers and competitors

Examples of "basic demand characteristics" include national preferences, language, culture and lifestyle, topics which do not appear relevant to a discussion about homogenous goods, and which, for this reason, we consider outside the scope of this analysis. "Views of customers and competitors," though valuable in their own right, may lead to subjective biases and we similarly leave these outside our current focus. For these reasons, we will address only the first three factors cited in the Notice.

Past evidence of diversion of orders to other areas

"In certain cases, evidence on changes in prices between different areas and consequent reactions by consumers might be available." Commission Notice (97/C 372/03)

Consumers react to price changes in commodity markets when these price changes lead to inter-hub price differences that are significant enough to create an incentive for arbitrage. In other words, taking transportation costs into account, when identical products are priced differently in different hubs, shippers will buy the commodity where it is cheaper, and ship it to a location where it has higher value. This process is called arbitrage, and it should eventually lead to inter-hub price equilibria. The faster price imbalances are eliminated, the more efficient the markets.

In some cases, markets can be so intrinsically linked that prices at different hubs follow nearly identical price dynamics in both the short and long run. This does not necessarily mean that they share the same prices,

| There exists strong evidence, both regulatory and economic-theoretical, that suggests a wider regional relevant geographic market for spot gas wholesale in Europe |

In an article published by European Energy Review in 2011 (North West European gas market: integrated already), Jepma and Harmsen used econometric tests for cointegration to demonstrate that six primary North West European gas hubs form an integrated market for day-ahead products, providing evidence that the relative Law of One Price holds for the entire region. The relative Law of One Price states that, in an efficient market, identical goods will share nearly identical price dynamics over time. Additionally, and importantly, they found that, on the whole, inter-hub arbitrage takes place at a relatively high speed, implying that the integrated market is also a highly efficient one.

Since cointegrated hubs imply highly efficient order diversion (i.e. successful arbitrage), we can view this as evidence that price changes between North West Europe's gas hubs correctly impact consumer behavior to the point that the relevant geographic market should, in fact, be considered transnational. We can conclude from the EC guidelines, then, that the market for spot gas sales is, at the very least, wider than any individual-hub or hub-hosting national market.

Current geographic pattern of purchases

"When customers purchase from companies located anywhere in the Community or EEA on similar terms, or they procure their supplies through effective tendering procedures in which companies from anywhere in the Community or EEA submit bids, usually the geographic market will be considered to be community wide." Commission Notice (97/C 372/03)

Applying the EC guideline on using geographic purchase patterns is slightly complicated by the hub-context of gas spot sales in Europe. For example, it is often difficult to identify customers in the traditional sense, given that those entities purchasing gas on the spot are not necessarily those consuming the gas. In effect, spot markets are comprised of "buyers" and "sellers" which are both qualified, in the context of a hub, as "shippers." If we are to apply the EC guideline on purchase patterns to gas hubs, we need to look at the composition of these shippers in order to determine if those engaging in trades and deliveries are indeed "companies located anywhere in the Community."

|

| An overwhelming majority of hub-registered shippers at TTF are non-Dutch (c) gasunietransportservices.nl |

Standard hub products, standardized EFET contracts and consistent trading counterparties imply that purchases can generally be made in a similar manner at any of the hubs. This is additionally evidenced by the fact that the bulk of shippers are often the same from one hub to another: for example, 72% of the about 71 shippers registered on the Zeebrugge Huberator are also registered on the TTF. We would expect similar counterparties and trading conditions to contribute to overall lower inter-hub transaction costs and, therefore increase arbitrage and efficiency. Jepma and Harmsen found compelling evidence of precisely such an effect when they determined that Zeebrugge and TTF exhibit the second greatest speed of arbitrage of all hub pairings in NW Europe, with 36% of price deviations restored within one day.

Therefore, given that NW European gas hubs are (almost exclusively) virtual points where highly diverse shippers trade with one another on generally similar terms, the EC Notice would lead us to submit that the relevant geographic market for hub-based gas spot sales is broader than the national markets hosting those hubs. Though the relevant geographic market is likely not yet Community wide, given the geographic pattern of purchases, there is strong reason to believe it is certainly, at this point in time, regional.

Trade flows and pattern of shipments

"When the number of customers is so large that it is not possible to obtain through them a clear picture of geographic purchasing patterns, information on trade flows might be used alternatively, provided the statistics are available with a sufficient degree of detail for the relevant products. Trade flows provide useful insights… but are not in themselves conclusive." Commission Notice (97/C 372/03)

We believe that, in the case of European gas hubs, the number of customers is small enough to obtain a relatively clear picture of purchasing patterns. Though it can be difficult to ascertain precisely where particular spot-sourced transit deliveries go, we can proffer a general idea of how significant internationally traded transit volumes are with respect to overall spot-sourced deliveries,

| So what we see is that the NW European spot market performs very strongly on the basis of the criteria set out by the CEER's Gas Target Model. |

Though trade flows and shipment patterns are not considered conclusive evidence for determining the relevant geographic market, they demonstrate that a sizeable proportion of all gas sold on European hubs is international transit gas intended for delivery abroad. This is important because it confirms the wider regional (and, quite frankly, international) character of Europe's gas hubs. Not only do hub "shippers" originate from all over the world, a measurable amount of physical volumes from any single hub are indeed being consumed by "real end-consumers" outside of that hub.

Additional approaches

In our previous EER article, Ranking European gas markets, we modified and then applied the CEER Gas Target Model standards for market functioning, and determined that nearly all NW European gas hubs constitute well functioning spot markets. The EC Notice makes direct reference to the necessity of a certain homogeneity of "conditions of competition" across a single relevant geographic market. However, competition is but one element of the notion of absolute "market perfection," the underlying premise of our modification of the CEER GTM indicators for market functioning and market rankings. We can therefore argue that two or more cointegrated markets that share homogenous market performance conditions and (therefore) share sufficient interconnections would constitute, collectively, a well functioning single market with a single relevant geographic market for the good at hand.

Our results (i.e. NW European gas hubs constitute well functioning markets) appear to corroborate the evidence provided by the analysis of past evidence of order diversion, current purchase patterns and trade flows, all of which point to a relevant geographic market greater than any single nation state, and likely regional in scope.

Further evidence and conclusions

There exists strong evidence, both regulatory and economic-theoretical, that suggests a wider regional relevant geographic market for spot gas wholesale in Europe. Analysis of the evidence listed in the EC Notice certainly points to a geographic market wider than the current national scope often used by regulators today. This is a particularly relevant discussion given the context of rapid European-level progress towards the creation of a single integrated market in which regimes and conditions have swiftly been harmonized, as is evidenced by inter-hub price alignment and the ease of trading it implies. With little over a year left before the 2014 target for fully integrated national energy markets, recognizing market integration where it exists would serve as a strong stimulus to policy makers as well as a positive sign that the EU is moving in the direction it has chosen for itself.

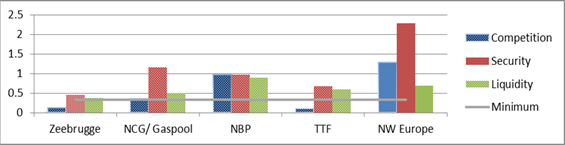

Equally importantly, from a regulatory perspective, recognizing a regional relevant geographic market would radically alter the framework in which competition is currently being measured. A regional HHI score would, on the whole, undoubtedly be lower (i.e. indicating a higher level op competition), than that of the national markets that constitute it. Given the wealth of evidence in favor of a regional Northwest European relevant geographic market for gas spot wholesale, we estimate, on the basis of the data collected for our previous article, a regional Hirschman-Herfindahl Index for NW European gas markets of 481. Because we feel that current econometric results most strongly indicate spot market integration between NBP, TTF, Zeebrugge and the German hubs NCG and Gaspool, we have also calculated a sub-regional HHI. Our analysis of a UK-Dutch-Belgian-German regional relevant geographic market results in an overall HHI figure of 520. Lower HHI figures are indicative of high levels of competitiveness, as the index ranges from 0 (full competition) to 10,000 (monopolistic competition). A score of 481 or 520, therefore indicates a high level of competition, and is moreover well under CEER competition norms set at 2000.

These are surprisingly low numbers, particularly given the relatively high HHI scores that NRAs are reporting for their respective individual national markets. The average HHI figure for these four markets is nearly 3375! An HHI of 481 or 520, then, indicates a high degree of disaggregation bias in many of the reported NRA figures. In other words, by focusing on just a small portion of the larger relevant geographic market, anti-competition authorities achieve sometimes strongly biased HHI results [note: 3]. In order to present a complete picture of what a NW European (UK-Dutch-German-Belgian) market would look like, we have additionally calculated a regional N-1 score, an official indicator for security of supply, of 139. This is well above the minimum required N-1 score of 100 set by the European Commission. [note: 4]

So what we see is that the NW European spot market performs very strongly on the basis of the criteria set out by the CEER's Gas Target Model. It is, by and large a very secure and highly competitive region marked by a substantial level of liquidity. In light of our previous, individual hub rankings, strong regional security and liquidity are not particularly surprising. What is remarkable, however, is the level of competition, given a regional relevant market. There is no denying that this paints a very different picture of competition than do individual hub scores based on national-market centric relevant markets.

Thus, looking at NW European markets as a single wider relevant geographical market does away with any initial anomalous results concerning the relationship between market liquidity and competition levels. As we have demonstrated in this article, a case can be made, in line with accepted European legislative norms, to look at NW European spot gas markets from this wider perspective. This is not only more consistent with economic theory, econometric results and intuition, it may also be more equitable, affording policymakers and market actors a more accurate picture of the state of competition in gas spot wholesale.

|

About the authors Santiago Katz is energy analyst at the Energy Delta Institute in Groningen, The Netherlands. Professor dr. Catrinus Jepma is professor of energy and sustainability at the University of Groningen and Scientific director of the EDIaal programme at the Energy Delta Institute. This is the third article in a series of three. The first article was published on 3 September 2012: The European Gas Target Model: How it Could Be Improved. The second article was published on 23 October 2012: Ranking European Gas Markets. See also their earlier article on European Energy Review: "Regulatory lag threatens to slow down the stormy growth of the European gas market", (1 February 2012) and the article by Rudolph Harmsen and Catrinus Jepma: "North West European gas market: integrated already" (27 January 2011). |

Notes

- Case No IV/M.1383 – Exxon/Mobil. Regulation Procedure (EEC) No 4064/89 Merger Procedure

- Economic Impact of the Dutch Gas Hub Strategy on the Netherlands (Report for the Minstry of Economic Affairs, Agriculture and Innovation by the Brattle Group).

- Our methodology behind the aggregation of market shares has been relatively straightforward. Since national market HHI figures are, essentially, sums of squares, we have taken the square root of each market's HHI and weighted that result by the total contribution of that market's spot volumes to total NW European spot volumes. Finally, we take that weighted root, and re-square it. By summing each national market's new squares, we reach an aggregate regional HHI for a regional European spot market.

- Regulation (EU) No 994/2010 of the European Parliament and of the Council of 20 October 2010 concerning measures to safeguard security of gas, supply and repealing Council Directive 2004/67/EC.

Discussion (0 comments)