Shell's Pearl proves its worth, but it's early days yet for gas-to-liquids

on

Shell's Pearl proves its worth, but it's early days yet for gas-to-liquids

The successful launch of Shell's giant Pearl gas-to-liquids (GTL) project in Qatar has demonstrated not just that GTL technology works at large scale, but also that its economics can be very attractive indeed. So, after a decade of disappointments, and in an era of structurally high oil prices and increasingly abundant natural gas, the GTL industry is looking forward to a more promising future. However, with the technology leaders Shell and Sasol jealously guarding their secrets, and other technologies yet to be tested at scale, growth will be constrained by the availability of proven technology.

|

| 2009 saw the first commercial flight using GTL jet fuel, from London to Doha. Planes using Qatar's new international airport are to be re-fuelled exclusively with a 50:50 blend of GTL kerosene and conventional jet fuel when it opens in 2014 - according to a spokesman for Qatar Airways - in what promises to be the first major commercial use in the civil aviation industry of fuels derived from natural gas. The GTL kerosene will come from Shell's Pearl project. (c) Qatar Airways |

In 2002 Shell executive Rob Dakers arrived in the Qatari capital Doha to single-handedly set up a new office for the company. His first tasks, he says, were to recruit a secretary to support him and to get the phones connected up.

Shell's low-profile return to Qatar was ironic given that in 1971 it had discovered the massive offshore gas field on which Qatar's ambitious natural gas developments have been founded. Shell had left the country before the North Field gas boom got under way, but was returning to invest in what is now the single largest energy project in Qatar and one of the largest in the world: Pearl GTL.

Following long negotiations with Qatar Petroleum over the terms of the Development and Production Sharing Agreement (DPSA) that would govern the project, it took until July 2006 for Shell’s board of directors to reach a final investment decision (FID) on Pearl. Just three years later, the company had 52,000 people working on constructing the project, on a site the size of London’s Hyde Park. Like most of Qatar’s other natural gas projects, Pearl is located at Ras Laffan Industrial City, a massive gas complex an hour’s drive north of Doha.

Less than five years after FID, Pearl delivered its first cargo of product in June 2011. The following November more than 1,000 guests gathered at Ras Laffan to witness the Emir, Sheikh Hamad bin Khalifa Al Thani, inaugurate what is by far the world’s largest GTL project. The highlight of the proceedings came during the speeches over lunch, when the curtains along one side of the massive tent used for the ceremony were drawn back to reveal $19-billion worth of steel and concrete. It was a breath-taking moment.

"GTL capital of the world"

The inauguration was a big deal in Doha, which was festooned with thousands of posters advertising that Pearl would "convert natural gas into high-quality liquid products", making Qatar "the GTL capital of the world" - fulfilling a long-held ambition of the Emir and his former long-standing energy minister Abdullah bin Hamad Al Attiyah.

However, while the plant appeared to be ramping up production encouragingly well, the GTL industry as a whole was holding its breath. Chastened by the difficulties encountered by an earlier GTL project in Qatar, Oryx GTL, it was waiting for Shell to announce that the project was working at full design capacity - a target that Shell said would be reached in "mid-2012".

At full production capacity, Pearl is designed to take 1.6 Bcf/d of natural gas (16 billion cubic metres) from Qatar’s North Field: that’s a lot of gas- about the same as total consumption of countries like Poland or Belgium. It converts this into 260,000 barrels per day (b/d) of liquid products - that's already

| The inauguration was a big deal in Doha, which was festooned with thousands of posters |

In July, at the launch of Shell's second-quarter financial results in London, EER took the opportunity of asking CEO Peter Voser and CFO Simon Henry whether Pearl had ramped up to full production, and what percentage of Shell's cash flow it would account for.

"We have had both trains running at between 90% and 100%, so we have proved the technology," said Voser. "We have established what we wanted to establish. We said in the second quarter that we would take some maintenance shut-down time now, to optimise the two trains, to optimise the product slate. So the two trains are proved and we are now in the optimisation phase. We are very pleased with the progress there."

Henry added that Shell's businesses in Qatar, which include the Qatargas 4 LNG project, would account for 10% of total cash generation in the Shell group, and also for 10% of hydrocarbons production. "That is pretty much what is being delivered at the moment," he said. The largest part of this - probably around three-quarters - will come from Pearl GTL. It is unusual for a single oil or gas project to account for such a significant percentage of the cash generation of a company the size of Shell.

After a decade of disappointments, a new dawn

The completion of Pearl marks a new dawn for an industry which has seen more than its share of disappointments.

For the still-nascent GTL industry the 2000s was a decade of two halves. The first was an exuberant time, marked by the start of construction of the Oryx project in Qatar and a growing list of proposed new projects, most of them also in Qatar. After decades of work on a technology first developed in the 1920s, it seemed that GTL's time had arrived. Then came three events that cast a cloud over the industry.

In 2005 Qatar imposed a moratorium on further gas production from the North Field. That left most of the proposed new projects without a gas source. Project after project was postponed or cancelled.

In 2006 the Emir of Qatar inaugurated Oryx, but the celebration proved to be premature. Oryx had a difficult birth; it took engineers several years to get the technology to work as intended - a source of disappointment felt throughout the industry.

Meanwhile, the other big GTL project that had begun construction during the first half of the decade - Nigeria's Escravos GTL - was facing its own problems: protracted delays and massive cost over-runs. It still has not come on stream today.

The second half of the decade was thus a period of consolidation as Oryx worked to ramp up production, as Escravos grappled with its many challenges, and as Shell set out to construct Qatar's biggest energy project during a period of severe overheating in the energy construction industry.

|

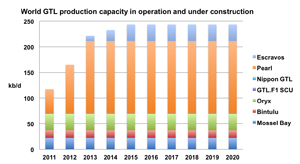

| World GTL production capacity in operation and under construction (click to enlarge) |

Today the long hiatus is over. Shell completed Pearl successfully; Oryx GTL has solved its problems and is looking to expand; and Escravos is due on stream next year. The accompanying chart, which includes only projects that are operational or under construction, shows that world GTL capacity will approach 250,000 barrels/day (b/d) by 2015 but will then plateau. Any further growth will require FIDs on new projects. Investment in new projects will depend on two key drivers: the evolution of GTL project economics; and the availability of proven technology.

Reasons to be cheerful

The optimism felt by the GTL industry today goes well beyond the successes it has achieved in technology implementation. Over the past five years the world has changed in ways that that are helpful to the GTL industry. Two trends in particular will drive future project economics.

The first is that we have entered an era of structurally high oil prices. In early 2012, Saudi Arabia's influential oil minister, Ali Al-Naimi, was saying that in his view $100/barrel was a reasonable long-term

| It is unusual for a single oil or gas project to account for such a significant percentage of the cash generation of a company the size of Shell |

The second significant development - the massive boom in unconventional gas production in North America - took everyone by surprise and is showing no signs of dissipating. Indeed, gas is now so abundant in North America that the US is expected to become a major exporter of LNG later in this decade.

In June last year the International Energy Agency (IEA) published a report posing the question "Are we entering a golden age of gas?" It concluded that we almost certainly are, on the basis that global unconventional gas resources are presumed to be so vast that gas will remain abundant and therefore relatively cheap for the foreseeable future.

Clearly, a combination of cheap abundant gas and tight supply of costly oil works in favour of GTL. In this scenario of maturing technology and supportive market fundamentals, GTL economics start to look very attractive.

A gem of a project

|

| Aerial view of the Pearl GTL site, which covers an area the size of London's Hyde Park. "We have had both trains running at between 90% and 100%, so we have proved the technology," says Shell CEO Peter Voser. (c) Shell |

Capital and operating expenditures and plant parameters such as production capacity and product slate are taken from data published by Shell. The assumed plant availability of 95% is below the average availability over recent years of Shell’s Bintulu GTL plant in Malaysia – where the technology employed at Pearl was proven.

The results show clearly why Shell and the state of Qatar wanted to celebrate Pearl's start-up in style. At $100/b oil, Pearl will generate some $8.6 billion of cash each year, after operating costs. At $120/b that rises to $10.5 billion. Even at $70/b, the kind of oil price that Shell currently uses to test the viability of new projects, annual net income is $5.8 billion. (Shell currently tests projects at $50-90/b, making $70/b the mid-point.)

This helps to explain why Shell is not overly concerned about the high capital cost of the plant. The final cost of $19 billion is around four times the $4-5 billion cost that was assumed when the plant was first mooted in 2002. However, over the past decade oil price expectations have shot up even faster. According to Andy Brown, the man responsible for bringing Pearl to fruition, the final cost of the project is within the range assumed by Shell's board when it reached final investment decision (FID) on the project back in July 2006. (Interestingly, it was Brown, previously head of Shell Qatar, who succeeded Malcolm Brinded earlier this year in the high-profile role of head of Shell’s international upstream business.)

The table also shows how the economics of Pearl stack up in terms of two indicators commonly used to appraise large capital projects: the Internal Rate of Return (IRR), calculated over an operating lifetime of 25 years, and Net Present Value (NPV) at three discount rates. (The analysis takes no account of taxation or production sharing; it looks solely at the ability of the project to generate cash.) Again, it is clear from the numbers that in any conceivable oil price scenario Pearl is a very attractive project.

A tale of two projects

A key factor driving the economics of Pearl is that it is integrated into the upstream. In other words, upstream gas production from the North Field is part of the project's scope. This has important

| Despite continual improvements in technology, oil is becoming more expensive to produce |

The accompanying table looks at the economics of two projects that are not integrated into the upstream and therefore have to buy their gas from external suppliers: Oryx in Qatar and Escravos in Nigeria.

Their economics are driven by four main factors: gas cost; capital expenditure; operating costs; and the prices that can be realised for the products. Other factors that play a role include costs arising from construction delays, and the government take of profits, through royalties, taxes and the terms of production-sharing agreements. However, important as these can be, they vary from project to project. The analysis that follows therefore focuses on the four main factors.

Oryx and Escravos use the same technology and have the same design capacity. Yet Oryx, a joint venture of Sasol and Qatar Petroleum, cost around $1.1 billion, while the latest estimate for Escravos, a joint venture of Chevron and Nigerian National Petroleum Corporation (NNPC), is $8.4 billion. Both plants have a production capacity of around 32,400 b/d. So the specific capital cost for Oryx was $34,000 per barrel per day ($/b/d) of capacity, while specific capital cost for Escravos works out to a staggering $260,000/b/d.

The results of the economic model are intended to be illustrative. So, for example, we have calculated the present value of the $1.1 billion that Oryx cost by assuming the capital was invested in 2006 at a 5% rate of interest, giving $1.4 billion today. (This is not what it would cost today to construct a similar plant in the same location.) The model assumes that both projects start operating at the same time for the purposes of comparison.

The results show just how different the economics of two projects that use the same technology and have the same capacity can be. Oryx is highly profitable in any conceivable oil-price scenario, while the economics of Escravos require oil prices of well above $100/b for the project to be profitable.

The difference is down to two main factors: timing and location. Oryx was built in the project-friendly environment of Qatar’s Ras Laffan Industrial City. And the engineering, procurement and construction (EPC) contract was awarded before construction costs began the steep rise that occurred between 2004 and 2008.

Escravos, by contrast, is being built in a swamp in Nigeria and did not get under way until well into the cost-escalation period already mentioned. Human factors have also played a role, with local politics, militancy and piracy all having their effects.

Where to now?

With two proprietary GTL technologies now proven at world scale, and a growing range of other technologies approaching commerciality, what are the prospects for new projects? The main focus is currently in North America, where gas prices are down to levels not seen for a decade. Shell and Sasol are looking closely at potential opportunities there.

Sasol is pursuing a project in Canada and another in Louisiana in the United States. It is also developing a 38,000 b/d project in Uzbekistan, in partnership with national oil company Uzbekneftegaz and Malaysia’s Petronas. Estimated cost is $4.2 billion.

Shell is considering its gas monetisation options in North America as it seeks to reduce its exposure to low gas prices and increase its exposure to high oil prices. Clearly, GTL is one of those options - and a project in the Gulf of Mexico is a distinct possibility.

At the inauguration of Pearl in November, Peter Voser told EER: "Pearl is an incredible project and I've

| "Pearl is an incredible project and I've always said that once it is working I'm OK to look at the next one" |

Voser also confirmed that Shell would be interested in constructing a third train at Pearl, where there is room on the site - but that will have to wait until Qatar lifts its North Field moratorium, which is unlikely to happen this side of 2016.

Other companies considering GTL projects in North America include GTL.F1 and US-based GTLpetrol.

Competing with LNG?

The question of whether GTL can compete with LNG as a gas monetisation has been much debated. During the first half of the last decade, when numerous new GTL projects were being proposed, most of them in Qatar, it did seem as though GTL's time had come. The North Field moratorium and the problems encountered by Oryx and Escravos made it clear it had not. Today, however, following the success of Pearl, the issue is once again being debated.

There is no simple answer. It is an issue that has to be examined on several levels, taking into account gas availability, specific project economics, location, technology and project execution risk, and, most important of all, the availability of proven technology.

Pearl GTL has demonstrated that GTL can be very attractive economically, given the right conditions. But Qatar is an exceptional place and Shell is an unusual company.

There are several constraints that will limit the growth of GTL during a decade when LNG production capacity will grow hugely, mainly as a result of developments in Australia, which is set to become a bigger LNG producer than Qatar by 2018, and in North America, where LNG exports are being taken very seriously, with one major project already under construction.

GTL is generally more capital intensive than LNG and of the few projects that have come to fruition most have shown that technology and execution risk should not be underestimated. GTL has the advantage of converting gas into high-priced oil products. But a lot of LNG is sold at oil-indexed prices, which achieves much the same result in economic terms.

The single biggest constraint on the growth of GTL will be the issue of intellectual property. GTL companies love to boast of how many patents they hold. But there are still only two companies that have proven GTL technology at world scale: Shell and Sasol. Both have made it abundantly clear that they are not about to share their secrets.

While it is true that other technologies are approaching commerciality, considerable uncertainty surrounds their future prospects, and they are unlikely to make much of an impact on global GTL capacity this side of 2020. Given that it takes around five years for a project to go from FID to first production, any growth of GTL capacity beyond the 250,000 b/d that will be reached in 2015 is unlikely to take total capacity beyond 500,000 b/d by 2020 - and even that looks optimistic.

To put that in context, in 2011 global crude oil supply averaged 88 million b/d. Clearly, GTL is not an answer to tight oil supply or high oil prices, at least not yet. Nor is GTL likely to make much of an impact on natural gas prices, in the way that LNG could in the United States, for example. Nevertheless, in the current and projected oil/gas price environment, well-executed GTL projects will make substantial profits for their stakeholders as they arbitrage the differential between oil and gas prices.

|

Rising to the technology challenge The biggest challenge facing the GTL industry is developing cost-efficient technology that works reliably and efficiently. Only two low-temperature Fischer-Tropsch (LTFT) technologies have been proven at world scale: the Shell Middle Distillate Synthesis (SMDS) process and Sasol's Slurry Phase Distillate (SPD) process. A growing range of other technologies are approaching commerciality.

|

Discussion (0 comments)