The great security of gas supply struggle

on

The great security of gas supply struggle

The Ukraine gas crisis of 2009 may seem a distant memory. But within the EU a debate is raging how to prepare for a next crisis. The outcome of this debate will not only shape the EU’s response to future emergencies, it will also determine to an important extent the future structure of the European gas market.

|

The trigger for the renewed interest within the EU in security of gas supply has of course been the Russian-Ukrainian gas crisis of 2009. Ulrike Rackow, Principal Administrator in the General Secretariat of the Council of the European Union, noted that the EU adopted a Gas Security of Supply Directive already in 2004. This Directive, she says, provides for a flexible framework for member states to implement their own gas security measures. The 2009 crisis, however, revealed a number of shortcomings of the Directive, said Rackow. It emerged that the level of preparedness in different countries differed widely. There was a lack of options to diversify supplies, a lack of information, inadequate coordination of the TSO’s, insufficient demand-side measures, and a shortage of interconnections. Most importantly perhaps there was no strategy at the EU level.

To repair those shortcomings, the European Commission has now proposed a new “Regulation to Safeguard Security of Gas Supplies”. Without going into details, Rackow said that this proposed Regulation accords ‘priority to market measures’. ‘Only when market measures fail, could non-market measures be taken by Member States. The Regulation aims for solidarity, but not for a free ride.’

With this Rackow apparently tried to ward off the criticisms which the gas industry has voiced about the proposed Regulation. Industry representatives claim that the EU’s gas security proposal undermines the gas market, because it confers too much power on the Commission. The Regulation, they say, gives Brussels the power to divert gas flows from one country to the other in the event of a crisis. It also prescribes in detail what sort of preventive measures member states must take to deal with crises. These are matters that, according to the industry, are best left to the market.

Public good

Gerhard König, Chairman of Wingas, the German gas producer, made this same point at the conference. According to König, the Commission’s new proposals are misguided, because they place too much faith in regulation, and too little in the ability of the market to solve shortages. ‘The Ukrainian crisis’, he said, ‘was solved by industry, not by the Commission’.

König said that in those instances when industry failed to supply gas during the crisis, this was not the result of a lack of gas, but of ‘inadequate infrastructure’. ‘We had plenty of gas in storage, we would have loved to sell it, but we couldn’t, because there were not enough interconnections.’ The Chairman of Wingas added that the lack of adequate infrastructure is not a failure of private industry, but of the regulatory framework in which the industry has to operate. ‘In the current, regulated infrastructure market, regulators do not allow for an adequate rate of return’, he said. ‘The framework for investment does not fit. The EU wants us to free up capacity in the case of an emergency, but that is not the solution. If the EU wants to have investment in infrastructure, it has to create the right incentives. Just issuing regulations will not work.’

Jean Arnold Vinois, Head of Unit in charge of security of supply at the Directorate-General for Energy of the European Commission, rejected König’s criticism. ‘We are not trying to take control of the gas market’, he said. ‘Our aim is to make the market work as long as possible in case of crisis, because in such a case member states may be tempted to take unilateral measures which might prevent the market from working, as happened in January 2009. The problem is that at this moment the gas market is not yet functioning very well, as the third Package adopted in June 2009 has still to be fully implemented and as numerous ongoing infringement proceedings show.’

Vinois says the gas industry is misrepresenting the real nature of the proposed Regulation. ‘It is absolutely untrue that the Regulation gives the European Commission the power to divert gas flows or to demand from gas companies that they free up capacity. That is not in the Regulation at all.’ The Regulation, he says, is primarily intended to ensure that member states, together with other stakeholders such as the gas industry, prepare in advance preventive measures, both short-term and medium- and long-term measures. Security of supply is a public good. It is in principle within the competence of the member states to take measures for this. What the Regulation asks for is that the member states show us their plans and that the Commission can check that the measures are not hampering the functioning of the internal market and are mutually supportive. And there is a strong incentive to establish shuch plans at the regional level in a spirit of solidarity as required by the new article 194 of the Lisbon Treaty.’

As to whether the rate of return for investment in infrastructure is adequate, this is a matter for national regulators who have to implement the principles set out in the EU directives, says Vinois. ‘It is now a discussion taking place in Germany, where the rate of return is deemed to be too low to incentivise the needed infrastructure investments.’ Vinois suspects the gas industry does not like the proposed Regulation, because ‘companies are being asked to provide more information and be more transparent about their contracts. ‘They should understand – and they do increasingly understand – that more transparency throughout the Union about preparedness and emergency measures would also enable them to work better together to address a crisis.’

Nuts and bolts

Whatever the motives of the gas companies, it is clear is that for the industry the security of supply Proposal involves much more than just a debate on “emergency measures”. In the end, the legislation will define not just the EU’s response to gas crises, but also what the structure of the future gas market will look like. As Didier Houssin, Directory of Energy Markets and Security of the International Energy Agency (IEA) pointed out, security of gas supply is a ‘multidimensional’ issue. It concerns short-term aspects, such as the protection of vulnerable customers, the use of storage, the diversion of supply routes, and switching capabilities in the power and industrial sectors, as well as long-term aspects, such as diversification of supply sources and investments in infrastructure and in all other parts of the gas value chain. Small wonder perhaps that the industry is getting nervous.

If there is one organisation responsible for creating the nuts and bolts of the future gas market, it is the energy regulators. Indeed, at the conference in Brussels, Stefanie Neveling, co-chair of the Gas Security of Supply Task Force of the Council of European Regulators (CEER), came up with a detailed presentation of the regulators’ “strategy for energy security”, and her presentation made it quite clear that the EU’s approach to security of supply will have a profound impact on the structure of the gas market as a whole.

|

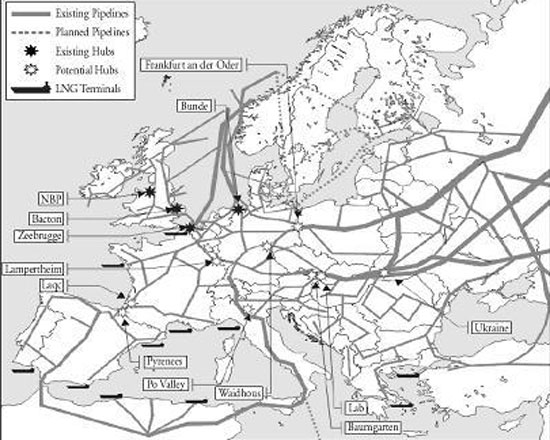

| Major natural gas pipelines and LNG receiving terminals that feed the EU gas market |

According to Neveling, the key to the development of a functioning gas market is ‘access to capacity’. Currently, she said, in many countries there are no mechanisms to bring unused capacity back to the market. This hampers the development of a competitive market. Hence, she said, ‘new principles of capacity allocation and congestion are needed’.

Neveling explained that ERGEG, the European Regulators Group for Electricity and Gas (for more information on how EU energy regulation is organised, see this article, is now drafting ‘framework guidelines’ for capacity allocation and congestion management. The aim of these proposals is three-fold: to organise the different market areas in Europe as entry-exit zones with virtual hubs, to strengthen liquidity at virtual hubs, and to establish a day-ahead capacity and gas market.

Organising market areas as “entry-exit zones” and capacity bundling would mean that gas companies would be forced to sell gas directly at the hubs and to engage in inter-hub gas trading. Neveling said that long-term gas contracts will not be abolished by the regulators but that capacity rights might have to be restricted. ‘They should not be used to prevent third parties from market entry. Unused capacity has to be brought back to the market. The proposed changes to capacity rights will ensure that competitive gas markets can evolve in parallel.’

But restricting capacity rights is precisely what the industry does not want to happen. ‘Establishing capacity restrictions is a disincentive to investment’, said Wingas-chairman König.

The debate – both on the security of supply issue and on the structure of the gas market – clearly is far from over. Perhaps one of the most important implications of the Ukrainian crisis for western gas companies is that, although they may be convinced they can handle crises if they are given the freedom to do so, they will not get this freedom unless they manage to convince the public and politicians of their capabilities. It is a point that was not made at the conference in Brussels, but it was raised in Amsterdam. At the Flame conference, Stefan Judisch, CEO of RWE Supply & Trading, was asked how he thought the gas industry should “sell” gas to the public as a preferred source of energy. His answer: when it comes to how the public perceives gas, don’t underestimate the security of supply issue! Said Judisch: ‘When people don’t think about gas anymore, gas will have a bright future’.

Discussion (0 comments)