The stupendous future of the worldwide LNG market - and the awesome implications for global gas dynamics

on

The exciting future of LNG – and how it will transform the global gas market

Analysis of worldwide LNG investment projects conducted by energy correspondent Alex Forbes reveals a surprising picture. Within just a few years, Australia is set to become a bigger LNG producer than Qatar. North America looks as though it could become a major exporter of gas in the form of LNG. And much of the LNG coming from these sources will be produced using unconventional gas as a feedstock. The message to be gleaned from the behaviour of both LNG buyers and sellers is that global demand for gas is likely to be much more rapid than current projections suggest, with growth led by a ravenous appetite for gas in China. The implications for the global energy market are staggering: the dash for gas will continue with full force.

|

| An artist's impression of Shell's massive Prelude Floating LNG project. It will be the world's largest-ever floating structure, with space for more than four FIFA-regulation football pitches end-to-end on its deck. The project was approved in May 2011. (Source: Shell) |

The natural gas industry has a propensity to spring surprises. Every decade or so since the 1980s a technology advance has re-shaped the industry, transforming its commercial landscape. In the 1980s and early 1990s it was the maturing of combined-cycle gas turbine electricity generation technology. In the 1990s and the first half of the 2000s, it was LNG's transition from a niche fuel to a mainstream gas transportation technology. Then, during the 2000s, came a development that caught everyone by surprise: the unconventional gas revolution in North America. Yet again over the coming decade the industry faces major change - except this time it will be driven by the combination of three decades of technology advances coming together. A key factor will be a huge new wave of LNG, primarily from Australia, which, astonishingly, is well on its way to becoming a bigger LNG producer than Qatar by 2018.

While natural gas is widely used in a broad range of applications across all customer sectors, it is electricity generation that has driven much of the industry's growth over the past three decades- as it will over the coming three.

It was during the 1980s that the technology needed to make this happen began to reach maturity. The concept of using gas turbines and steam turbines together for electricity generation had been around for a while. It made sense because the exhaust gases from a gas turbine are so hot that they can generate steam to drive a steam turbine. The result is a much more efficient system than a gas or steam turbine operating on its own. But it wasn't until the late 1970s that gas turbines achieved the scale and reliability needed to make large combined-cycle gas turbine (CCGT) power stations commercially attractive.

In the mid-1980s, while editor of an international electricity journal, I travelled to the east coast of peninsular Malaysia to see for myself one of the first large-scale implementations of CCGT technology. Close to a village called Paka, the Sultan Ismail Power Station was at that time still under construction. It came on stream in 1987 and remains one of the largest power stations in Malaysia. I remember being impressed by the technology and, on my return, writing an editorial proclaiming that I had seen the future of electricity generation.

Dash for gas

With its ground-breaking thermal efficiency and relatively low capital cost, CCGT power generation technology led within a few years to what became known as the "dash for gas". It began in the UK, in the wake of electricity privatisation, and quickly spread around the world.

The spread of CCGT electricity generation technology was facilitated by a technology that had begun to make a commercial impact during the 1960s: the cooling of natural gas to convert it into a liquid and the

| LNG's transition from being a niche fuel to becoming a mainstream gas transportation technology began to accelerate |

Until the end of the 1990s the LNG industry grew at a more or less steady rate. Costs fell as technology improved. And, occasionally, the select club of LNG-producing countries would welcome a new member. Then, during the early years of the 2000s, the industry reached a turning point. LNG's transition from being a niche fuel to becoming a mainstream gas transportation technology began to accelerate.

Cool fuel

In 2004, while editor of the publication Gas Matters, I attended an LNG conference in Qatar at which the significance of the industry's transition became abundantly clear. At this event, various industry leaders - among them the then Algerian energy minister, Chakib Khelil, and the then Executive Director for the IEA, Claude Mandil - forecast that the industry was projected to grow between threefold and fourfold by 2020. In other words, it was set to grow from an annual volume of 140 million tonnes to between 420 and 540 million tonnes per annum (mtpa) in just over a decade-and-a-half. ("LNG comes of age as a cool, futuristic, mainstream fuel", I concluded back then.)

Those projections now look a touch optimistic - estimated global LNG production in 2011 was 242 million tonnes. But that still represents impressive growth of around 8%/year, and there is plenty more to come before 2020.

Meanwhile, in the United States, a quiet revolution was under way, the full import of which would not become apparent until towards the end of the decade.

For several years the conventional wisdom had been that natural gas production in the US was on a gradual long-term decline from which it would not recover. Much of the LNG production capacity that was sanctioned during the last decade was predicated on the large new market perceived to be opening up in North America. It was not until 2008 that it started to become clear that production of unconventional gas - especially from shale - had taken off in such a big way that total US gas production was growing rapidly.

Talking 'bout a revolution

The unconventional gas revolution in North America took everyone by surprise, including organisations known for making energy projections, such as the US's Energy Information Administration (EIA), the International Energy Agency (IEA) and the big international oil and gas companies such as ExxonMobil and Shell. Even today, these organisations are grappling with the full long-term implications of unconventional gas - along with the rest of the energy industry.

By October 2009, when the triennial World Gas Conference (WGC) was held in Buenos Aires, unconventional gas was the talk of the event. Interestingly, at the previous WGC in Amsterdam in 2006 there had been barely a mention of unconventional gas.

In June last year the IEA published a report posing the question “Are we entering a golden age of gas?” It concluded that we almost certainly are, largely on the basis that global unconventional gas resources

| The unconventional gas revolution in North America took everyone by surprise |

There are considerable uncertainties surrounding this question, not least that it is impossible to be sure how policy-makers will decide to legislate. But some useful indications can be gleaned from looking at recent developments in unconventional gas production and new LNG.

Surprise, surprise

From a supply perspective, the two big gas surprises of this decade bring together unconventional gas and LNG. The first is the emergence of Australia as a major-league LNG producer; the second is the incredible turnaround we are seeing in North America, where LNG importation projects are starting to be converted into export projects and new dedicated export projects are being seriously considered.

The LNG phenomenon of the past decade was Qatar, which, having exported its first LNG cargo as recently as 1997, had by 2006 become the world’s largest LNG exporter, ahead of Indonesia, Malaysia and Algeria. By December 2010, Qatar was celebrating the construction of 77 mtpa of production capacity, around a quarter of the world total. Around half of the huge new wave of LNG that has swept over world gas markets over the past couple of years has come from Qatar.

During the latter half of the decade, as Qatar was consolidating its LNG primacy, there was speculation around which country might become the "new Qatar". Two nations stood out as contenders: Nigeria and Australia. But neither seemed to be in quite the same league.

Nigeria was a significant player thanks to its multi-train Nigeria LNG project, but the other projects then proposed are still on the drawing board today. Australia had five trains in operation at the North West Shelf project and a single train at the Darwin project, giving total capacity of 20 mtpa. It also had several projects in the planning phases, but, again, not enough to challenge Qatar's lead. As recently as 2009 Australia looked destined to remain in the second league of LNG producers.

However, over the past three years Australia's prospects have been transformed. A major factor has been the proposed development of unconventional gas in Queensland, where several major projects plan to use coal-bed methane (CBM) - or coal-seam gas (CSG) as the Australians call it - for feedstock. Three of these projects are already under construction, with a total capacity of 20.8 mtpa. Final investment decision on a second train at one of these projects, expected within weeks, will take that to 25.3 mtpa.

Record-breaking year

Table 1 shows all the projects currently in operation or under construction in Australia. Their combined capacity is 81.0 mtpa. In other words, Australia is on a trajectory that will make it a bigger LNG producer than Qatar by 2018, assuming that the new projects do not encounter any major problems during construction. It is worth noting that it is highly unusual in the LNG industry for a liquefaction project that has entered the construction phase to be abandoned before completion.

Table 2 shows another 54 mtpa of proposed projects still in the planning stages. If all these projects were to go ahead, Australia would end up with LNG capacity of 135 mtpa, almost twice as much as Qatar.

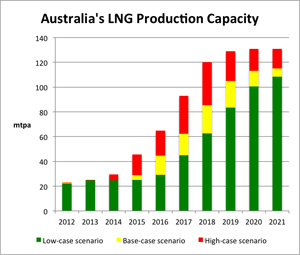

That is not a realistic outcome. So what is? The results of a train-by-train analysis that I made of all the projects is shown in Chart 3 (see graphic above). In this analysis, I assume that plants already under construction will go ahead as planned, but with a delay of around a year in the base-case scenario and of two years in the low-case scenario. A noteworthy project in this category is Shell's Prelude LNG venture, which will be the first implementation of the company's innovative floating liquefaction (FLNG) technology. The barge that will accommodate the plant, currently under construction in a South Korean shipyard, will be the world’s largest floating structure, with room for more than four football pitches on its deck.

Plants still in the planning stage are much less certain and I have assessed their prospects by taking into account: the credibility of the sponsors in terms of track record, technical capability and financial muscle; the availability of sufficient gas reserves; whether the sponsors have obtained purchase commitments from customers, and the firmness of such commitments; the stage they have reached in the front-end engineering and design (FEED) process; and the extent to which projects will be competing with each other for labour and other resources.

In my base case, production capacity rises from 62 mtpa in 2017 to 85 mtpa in 2018, as Australia overtakes Qatar, and reaches 113 mtpa by 2021. In the low case Australia overtakes Qatar in 2019 and capacity reaches 100 mtpa in 2021.

These are astonishing numbers.

Jaw-droppingly expensive

Also astonishing are the estimated capital costs of the Australian LNG projects. Without exception, they are jaw-droppingly expensive. For example, the Chevron-led Wheatstone LNG project, approved last September, will cost an estimated A$29 billion for a capacity of 8.9 mtpa, while the Santos-led GLNG project, approved in January 2011, will cost US$16 billion for capacity of 7.8 mtpa (the same capacity as a single Qatari mega-train). Ichthys LNG, which brings together the Japanese company INPEX and the French major Total, will cost US$34 billion for 8.4 mtpa of capacity.

That the project sponsors are willing and, indeed, able to proceed with these projects despite such high costs speaks volumes about perceptions of future gas demand in Asia-Pacific, on the part of both sellers and buyers.

For the most part, the new Australian projects are underpinned by long-term sales and purchase agreements (SPAs) with buyers, with prices indexed mainly to oil price. In other words, the buyers are not deterred from committing themselves to taking LNG over long periods at what are likely to be continuing high prices. In several cases, buyers are also taking equity stakes in the projects themselves.

A case in point is the Chinese energy company Sinopec, which has signed SPAs to take all the output from the first train of APLNG (one of the Queensland CSG projects) and most of the output from the

| "We dismiss the scepticism, we acknowledge the challenges, and we recognise the amazing opportunities opening up to natural gas in the future" |

The attitude of the big international oil and gas companies involved in these projects was summed up last year by John Gass, president of the global gas business at Chevron, one of the trail-blazers in the massive expansion of LNG capacity in Australia: “I believe we're on the cusp of some truly dynamic growth decades for natural gas," he said. "Some observers may be deterred by the passing showers - the depressed gas prices and supply fluctuations that may be giving pause to some. We see it differently. We take the long view.”

He further said: "We dismiss the scepticism, we acknowledge the challenges, and we recognise the amazing opportunities opening up to natural gas in the future. We're backing up that optimism with some bullish bets - the largest capital investments in our history. We're putting our shoulder behind gas as the world prepares to lean very heavily on this energy resource."

Looking forward to trends over the next couple of decades, Gass highlighted the minor share that gas currently has in the energy markets of China and India and the growing importance of LNG. "Any resulting shift to a larger share for gas in the vast energy markets of China and India and the gas growth phenomenon goes up another notch. As we look around the world, LNG's emergence as a global commodity is transforming the landscape . . . The Gorgon development along with Wheatstone will transform Chevron into one of the world’s top LNG producers. We’re putting our money where our mouth is."

China's gas ambitions

Developments in China will be crucial to how everything turns out. China's big three energy companies - CNPC (and its subsidiary PetroChina), CNOOC and Sinopec - currently appear to have ravenous appetites for LNG.

Sinopec, for example, has big ambitions to grow its natural gas business. It is already working to build a large gas transportation and distribution pipeline network to deliver gas to customers from its own production in China and from imported LNG. It currently imports no LNG at all, but has signed binding long-term contracts for close to 10 mtpa by 2016. This will make it a bigger LNG importer than several of the major Japanese buyers are today.

CNOOC already imports LNG from the North West Shelf project, under a 3.3 mtpa contract that lasts until 2031, and has signed up to take an additional 3.6 mtpa from the BG-led Queensland Curtis LNG project, a CSG-supplied plant, starting in 2014.

Meanwhile, CNPC and its subsidiary PetroChina have been actively pursuing long-term LNG imports, notably from Australia. PetroChina has binding contracts for 2.25 mtpa from ExxonMobil's share of Gorgon, for 20 years; 2 mtpa from Shell's share of Gorgon for 20 years; and 3 mtpa from Qatargas 4 for 25 years. There is also a non-binding HoA for 2 mtpa from Qatargas. PetroChina could also end up taking a substantial volumes of LNG from Australia’s proposed Arrow project, but that project has yet to take FID.

In March 2011 the Chinese government presented its 12th five-year plan, covering the years 2011-2015. A key element of that plan was to increase the use of gas in the nation's energy mix. The major Chinese gas companies see LNG playing a key role as demand increases. It now appears to be only a matter of time before China becomes the world's largest LNG importer.

A recent energy outlook from ExxonMobil forecasts that global gas demand will grow by 1.9% per year over the next three decades, reaching around 5,300 Bcm/year by 2040. It also forecasts that LNG will meet 15% of this, meaning around 600 mtpa. China accounts for half of Asia-Pacific non-OECD gas demand growth over the outlook period.

The potential impact of other markets in Asia-Pacific should not be underestimated, especially Japan. Even before the nuclear accident at Fukushima, Japanese gas and electricity utilities needed to

| It now appears to be only a matter of time before China becomes the world's largest LNG importer |

Meanwhile, new markets for LNG opening up in the Middle East and Latin America are starting to amount to major new demand centres.

A major source of demand uncertainty is what will happen in Europe. Chart 4 illustrates this dramatically. From a presentation by Jean-François Cirelli, Vice Chairman and President of GDF Suez, it shows how disparate are various forecasts of demand to 2030 made by a number of well-known organisations. Demand uncertainty on this scale reduces Europe’s attractions as a potential market for LNG producers and Europe may struggle to source the LNG it needs if demand turns out to be at the high end of these projections.

Australian LNG will not be the only show in town over the coming decade in terms of new LNG capacity. Over the course of 2012 another 14 mtpa of capacity is due on stream, from projects in Angola, Algeria and Australia. And project sponsors in Russia, Papua New Guinea and Equatorial Guinea are hoping to reach FIDs this year, in addition to those likely to happen in Australia.

Reversing the flow

And this is not yet the whole story. Equally intriguing will be the developments that take place in Canada and the United States. Over the past year two projects initially planned as import terminals have made good progress towards becoming export facilities: Cheniere’s Sabine Pass project in the US and the Apache-led Kitimat project in western Canada. Both could end up taking FID before the end of this year, and other projects are in various stages of development.

Many uncertainties remain. Opposition to LNG exports is growing in the US because of fears over the effect that they could have on gas prices. And there remain doubts over how long the divergence between gas prices and oil prices that supports LNG export development in North America will persist. That said, even Shell, a company that knows a thing or two about LNG, is seriously pursuing a green-field gas export project at Kitimat in western Canada.

The new-found abundance of gas in North America, and the effect that this has had on prices, has meant that a region once seen as a major new market for LNG has the potential to become a major supplier from around the middle of this decade, providing welcome diversity to an industry currently looking heavily dependent on Qatar and Australia. Even five years ago no-one would have predicted that.

|

Tables and graphics in this article explained Table 1: Following this month's final investment decision on the Ichthys LNG project, Australia has 81 mtpa of LNG projects in operation and under construction, as this table shows. It is unusual in the history of the LNG industry for a project that has begun construction to be abandoned before completion. However, the sheer number of projects under construction and planned in Australia has raised major concerns about resource constraints. The challenges that will need to be faced even by projects already in the consruction phase may yet prove to be insurmountable for some of them. (source: research Alex Forbes) Chart 4: The demand uncertainty faced by European gas companies - and LNG producers targeting the European market - is dramatically illustrated by this chart from a presentation by Jean-François Cirelli, Vice Chairman & President of GDF Suez. It shows just how wide a range there is between primary gas demand projections to 2030 by various organisations. (source: GDF Suez) |

Discussion (0 comments)