There may be trouble ahead – BP

on

There may be trouble ahead – BP

Launching its Energy Outlook to 2035 in London last week, BP posed three fundamental questions about our energy future: Do we have sufficient energy resources to meet growing demand? Can we meet demand reliably and securely? And can we do so sustainably? The answers, said CEO Bob Dudley were "yes", "maybe", and "not at the moment". Chief economist Christoph Rühl warned that of the many “wild cards” in the forecast, climate policy remains the wildest, with plenty of potential to disrupt our efforts to meet demand securely – and much else besides.

|

| (c) Jim Grier |

“Why would we commit the apparent folly of producing a forecast when we know for certain that at some point it will be proved wrong?” he continued. “The reason is that nothing focuses the mind so much on the possible things that could go wrong – on the forks in the road – than if you have to forecast it and walk from today into the future. We will encounter many of these forks in the road; we will not be able to say whether the system goes left or right; but at least we can point to where they are and hopefully at the determinants of which way the system will turn.”

BP’s forecast takes 2012 as its base year and highlights many such “forks in the road”. This year’s Outlook differs from last year’s in that it extends the forecast period from 2030 to 2035 – and those last five years provide what CEO Bob Dudley described as “interesting new angles on where energy demand is going”.

Do we have sufficient resources?

In forecasting how energy markets are likely to evolve over two decades, some factors can be assigned a high probability. One is that the world’s population will grow; by 2035 there will be 1.7 billion more people. Another is that people will aspire to improve their lot, which will require economic growth, which will require energy. In short, energy demand will continue to grow, by an annual average of 1.5 percent per annum, says BP, which adds up to 41 percent over the forecast period.

While this is significantly less than the 50 percent growth over the past two decades, it is still substantial. Do we have sufficient resources?

Can we meet demand reliably and securely?

On the the question of energy reliability, Dudley was more circumspect.

“Our Outlook predicts challenges ahead for energy security – our industry carries bigger risks than most. But we do see grounds for optimism. Many countries are opening up their domestic resources – the US particularly from shale, but also India and places like Oman. (. . .) This is all about turning on more taps. And the more taps running, the less danger of the energy supply being turned off. From the data captured by the Outlook, we can anticipate how this diversification will continue to develop, with the world moving for the first time – following the eras of wood, coal and oil – to a state where no single fuel is dominant.”

|

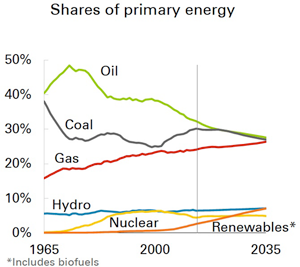

| Chart 1 - BP forecasts that fossil fuels will continue to dominate the primary energy mix, with the shares of coal, oil and gas converging towards 27% each by 2035. Zero/low-carbon sources, meanwhile, each converge on 5-7%, despite the rapid percentage growth of non-hydro renewables. |

However, stressed Dudley, “This need not be a cause for concern if the market is allowed to do its work, shifting things around, with new supply chains opening up to these big consuming regions . . . We are optimistic about prospects for energy security – although of course disruptions will still occur.”

Can we meet demand sustainably?

With the world gearing up to agree an international climate deal at UN talks in Paris in 2015 – the most important such meeting since the Copenhagen failure of 2009 – the message on sustainability from BP’s Outlook is grim.

Carbon emissions are set to grow by 29 percent by 2035, a consequence of the 41 percent rise in energy demand and – shocking to those who have set their hopes on renewables energy sources as the answer to climate change – a continuing overwhelming dependence on fossil fuels. As chart 1 shows, the three main fossil fuels – coal, oil and gas – are on trajectories that will see them each converge on a roughly 27 percent share of primary energy by 2035. In almost a quarter of a century’s time, we will be depending on fossil fuels for more than four-fifths of our energy needs.

Holding out hope for change, Dudley pointed to the example of the United States:

“It wasn’t projected five years ago that 2012 emissions in the US would be below 1994 levels. Hands up if you predicted that one.” However, he also pointed out that one consequence has been a rise in emissions in the UK and Germany, where cheap US coal has displaced gas in power generation, despite Europe’s obsession with climate policy.

One answer to that problem would be universally accepted carbon pricing, he said, “otherwise, you risk playing energy Whac-a-Mole – knocking emissions down in one country with low-carbon gas only to see them pop up in another with displaced coal.” Unfortunately, experience to date with carbon pricing, even in Europe, holds out little comfort.

As to what else should be done, one obvious policy is to maximise energy efficiency – to reduce energy intensity, the amount of energy required to produce one unit of GDP. Another is to encourage a switch from coal to gas in power generation, the single biggest factor driving the decline in US carbon emissions.

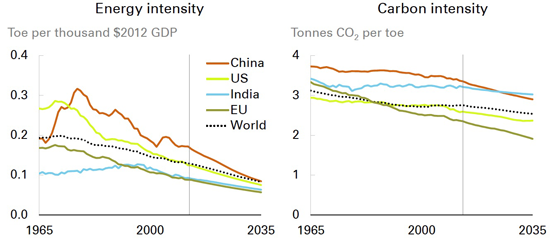

Changing the fuel mix is crucial because as the charts below show, while energy intensity is falling and converging across nations, the same pattern is not seen in carbon intensity – the amount of carbon emitted in producing a unit of GDP.

|

| Chart 2 - Energy intensity, the amount of energy required for a single unit of GDP, is falling and countries are converging as the use of new technologies spreads. However, carbon intensity is not showing the same pattern: it is falling more slowly and there are no signs of convergence. That will require changes in fuel mix, especially in electricity generation. |

Compelling numbers

Rühl put forward some compelling numbers: “What really matters is substitution among fossil fuels, in particular between gas and coal. This is where one has to go if – and that’s an unknown – preferences change and people think carbon emissions need to be curtailed. It is the area of fossil fuel substitution – like it or not – which will have to be dealt with because that’s where the low-hanging fruits are.

“If you switch 1% of global power generation from coal to gas you have carbon emission savings the equivalent of increasing renewables by 11%. A 1% switch can be done in the short term. An 11% increase globally of renewables takes a much longer time and is more costly . . .

“Of all the forks in the road, sustainability is the biggest area of uncertainty. If it’s going to be tackled it will be by changing the fuel mix.”

Is that message getting through to policy-makers? Not if the proposals announced yesterday by the European Commission for a 2030 energy and climate policy framework are anything to judge by.

Discussion (0 comments)