"Availability of affordable energy no obstacle to long-term growth"

on

BP Group Chief Economist Christof Rühl draws optimistic lessons

from BP Energy Outlook 2030

"Availability of affordable energy no obstacle to long-term growth"

For the second time BP has published its annual Energy Outlook 2030, which contains the energy company's projections of future energy trends. In an article for European Energy Review, BP's Group Chief Economist Christof Rühl discusses some of the major implications of the report. He draws a number of important and surprisingly positive conclusions: market forces, he writes, are driving massive and accelerating energy efficiency gains across the world. Thanks to this trend, and to the innovations produced by the market, there will be enough affordable energy available to support global economic growth.

|

| BP Group Chief Economist Christof Rühl (photo: BP) |

Some of the results of BP's annual Energy Outlook 2030, a forecast of long term energy developments published on January 18th, will sound familiar: Global energy demand is set to keep rising, driven by the industrialization and urbanisationof middle and low income countries; global energy consumption 20 years hence will still be based on fossil fuels; the world will demand more, not less, oil from the Middle East.

Others may be more surprising: North America will become self-sufficient in energy; transport fuels globally will remain petroleum based; and despite rapid growth of renewables and the progressive decarbonisation of key sectors, such as power, this looks like a world where carbon emission continue to grow.

With the very notable exception of greenhouse gas emissions, these projections “add up”- not in the conventional sense of demand matching supply (that too), but in the peculiar sense that energy (and its price) will not become an obstacle to long term economic growth. A combination of efficiency gains and fuel supply growth ensures, in particular, that the industrial transformation of non-OECD economies will continueat pace.

The story

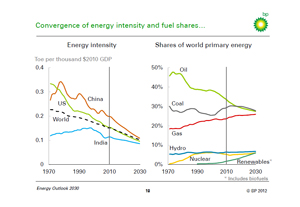

For these projections to be useful, one needs to unlock the story they convey. In energy, two powerful trends encapsulate this story: First, energy intensity converges across countries, at accelerating speed and to lower and lower levels. Energy intensity (the amount of energy needed to produce one unit of GDP)is often seen as the broadest possible measure of energy efficiency. Since the dawn of the industrial revolution, it has differed widely across countries and regions; but since the 1980s, we see massive and accelerating convergence across countries: never since the industrial revolution has global energy intensity been as lowas today; and never have differences across countries been so small.

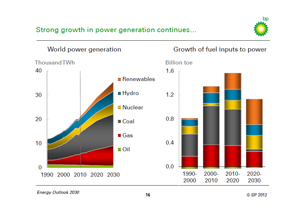

The second trend is the equalisation of fuel shares. As fuel demand grows, fuel shares converge. By 2030, fossil fuels (oil gas and coal) will have about 27% global market share each, non-fossil fuels (nuclear, hydropower, renewables) will converge to about 7% each: for the first time since the industrial revolution, there will be no single dominant fuel in 2030 - as coal and then oil used to be.

These two trends help our outlook (and other projections like it) to "add-up" the way they do. Consider, for example, the question whether continued growth in China may threaten global economic progress, by

| Never since the industrial revolution has global energy intensity been as low as today; and never have differences across countries been so small |

It is true that, if China's energy intensity were to improve at the speed of the last ten years, global coal, oil and gas consumption would be appreciably above our base case, generating repercussions elsewhere in the system. But the simple trend extrapolation of such "business as usual" constructs becomes invalid if energy intensity continues to converge.

Similar for other facets of global energy markets: Middle Eastern oil exports are set to rise - this projection assesses not only available resources, but incorporates improving energy efficiency in the region, as well assuccess in producing natural gas to replace oil in domestic consumption. Without these improvements, higher domestic oil production would not need to translate into higher exports, again with repercussions for the rest of the world. Transport fuel demand is another example. We project it to remain petroleum based as the hybridisation of the vehicle fleet generates the most efficient outcome (in terms of fuel consumption as well as carbon emissions). Given the expected growth of the global car fleet, these efficiency improvements will lower oil consumption growth by about 11 million barrels per day - approximately as much as Saudi Arabia produces today. Again, absence of these efficiency gains would have to have repercussions elsewhere.

Convergence

Our two trends thus incorporate benevolent developments. It pays to ask where these come from.

Energy intensity converges around the world because, for lack of a better word, of globalisation:

| No comparable innovation is expected to come from the vast energy areas under state control - not in production, and not in consumption |

The convergence of fuel shares, though of a somewhat less general nature, is driven by the same forces. The share of natural gas increases because of new supplies, including unconventional production and the rapid growth of LNG; coal loses out to newly available alternatives (gas, nuclear and renewables), and oil's share declines because it is replaced outside the transport sector - where oil remains indispensible and where its potential for efficiency gains remains large.

In a nutshell, the reasons for North America to become self-sufficient encapsulate the main forces at work: supplies are rising because the most open and competitive upstream market in the world has unlocked new resources by generating new production technologies (unconventional gas, offshore oil, oil sands); regulationand high prices are promoting biofuels and fuel efficiency.

These developments are market driven, and supported by regulation able to harness market forces. No comparable innovation is expected to come from the vast energy areas under state control - not in production, and not in consumption.

Applying the lessons

|

| Convergence of energy intensity and fuel shares (click to enlarge the graphic) |

That leaves us with the one piece of our projections that does not "add up" - carbon emissions. Our projections show carbon emissions from energy use continuing to rise. This reflects our view of the most likely outcome; it is not necessarily the outcome we would like to see. It puts the world on an emissions trajectory that is well above the path required to stabilise the concentration of greenhouse gases at around 450 ppm (as recommended by scientists).

Addressing this problem is going to require a great deal of innovation, and as we have seen the best way to encourage innovation is a combination of well-thought-out regulation and market forces. At BP we have long argued for a market-based approach to carbon abatement, using carbon pricing of some form to create the incentives to find lower-carbon ways of doing things. Policy action is required to establish a carbon pricing regime, so that once it is set up and the rules are clear, then market forces can take over and do what they do best, seeking out the most efficient solutions and encouraging useful innovation.

Subsidy schemes need to be avoided which run into the “punishment of success” problem we are currently witnessing in Europe – that subsidized renewables cannot be scaled up beyond the point where their successful scaling up breaks the (financial) means of the support system, or at which, as with feed-in tariffs, the redistributive consequences become unpalatable.

Talk in the energy world often is about “affordability and sustainability”, or some such mix of agreeable words. In the end, these concepts have two meanings. One is the simple need to provide basics - heat, light, or mobility - to as many people as possible. We are not doing badly on this score: GDP has grown much faster than energy consumption for a long time now. If one accepts these measures, than the scissor blades between economic wellbeing and energy consumption is opening ever wider, exemplifying the efficiency gains just discussed. And we know what caused these efficiency improvements.

|

| Strong growth in power generation continues... (click to enlarge the graphic) |

It seems to me a logical conclusion to harness the same forces which have secured a measure of success in the first case, and to apply them to the second. And so, while it has become fashionable to doubt the benefits of "capitalism" in many globalised industries, it is worth keeping in mind a wider lesson: in energy, progress will continue to be driven by competition, bounded by sensible regulation, and that means: progress will come from companies, regions and regulators playing by market rules.

|

BP's Energy Outlook 2030 The 2012 edition of BP's "forward-looking" Energy Outlook 2030 was published on Wednesday, January 18th. It is only the second year that BP has made its outlook for global energy available to the public. The report can be downloaded free of charge here. |

Discussion (0 comments)