A power market for Poland

on

A power market for Poland

In Poland, as in other European countries low prices for electricity in wholesale markets do not encourage new investments in power generation due to lack of returns. This is caused by a model of the electricity market introduced in the European Union based on 'energy only markets' in which power generating companies are only paid for electric energy production, without compensation for the costs of maintaining availability. Additionally, the fast development of renewable energy resources (RES) reduces the operation time of large power units, diminishing the opportunities to recover all costs in competitive electricity markets.

The Polish power sector suffers from two main drawbacks: missing money and missing capacity. In 2014, the Transmission System Operator introduced a so called “cold reserve” and “operational reserve” to avoid reduction of available power reserves. However, both measures are only temporary actions not leading to a solution of the main problems i.e. a lack of investment in power generating assets.

During the next 15 years the Polish power supply sector should be reconstructed due to the shutdown of over 60 power units with the rated capacity of 200MW which were commissioned during the 1970's and are currently obsolete and not worth refurbishments as the average lifetime of such units counts for 30-40 years.

A power market, currently discussed by the power supply industry and Ministry of Economy embraces a centralised capacity support mechanism with by a Contract for Difference (CfD) system for some selected technologies as nuclear power stations.

Centralized power market

The main aim of the centralised power market proposed for Poland is to provide an adequate amount of available power for the Transmission System Operator (TSO) in a four year ahead contracting system. The trading good in the power market is the available power of the certified installations for electricity production and active loads.

| the centralised power market proposed for Poland is to provide an adequate amount of available power for the TSO |

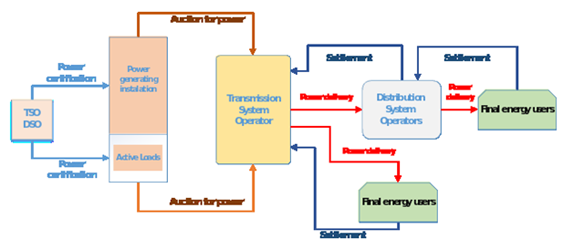

The procurement costs of the power available for electricity generation is covered by the final energy users as a part of their transmission tariffs. The payment is proportional to the maximum transmission or distribution power contracted by final energy users. The settlement of the available power contracted is carried out for a time period between 7am to 10pm on working days. The TSO can call for all available power contracted when higher demand for power is forecasted. In such periods of high power demand the payment for the installation delivering power can be increased. Fig. 1 demonstrates the main relations in the centralised power market proposed for the Polish power system.

The initial plan assumes that the legislation process will take place in 2015/2016 allowing for the first power auction late in 2016 with power delivery for 2020. It is also predicted that the prices for power delivery will be close the level of 150-250PLN/MW/Year (36–60 euro). This level accounts for about 30-50% of necessary capital costs. As prices for power delivery and electricity production are correlated the introduction of the power market should stabilise the average price of electricity for final energy users.

The price for power delivery results from the power demand curve and the bids of power suppliers arranged in a merit order. The cross section of both curves sets the auction clearing price. The methodology proposed is similar to the UK capacity market system.

|

| Fig. 1. Centralized power market for Poland - Source: E&Y |

Contracts for Differences

A contract for differences (CfD) is a financial instrument which can be used to protect investors in power generating assets entirely or partly against financial risk. An investor still takes volume risk but such a risk depends on the operation and trading processes undertaken by installation operators. The lower financial risk of investment results in lower investment costs leading to lower electricity prices for final consumers. Usually, CfDs are used for the investments required large capital costs with a long return time.

The CfDs are the most effective way for the implementation of energy policies. It is assumed that the decision on the introduction of CfDs can be taken by Minister of Economy after consultation with the TSO and Energy Regulatory Authority.

| The CfDs are the most effective way for the implementation of energy policies |

Impact of investment on security of electricity supply.

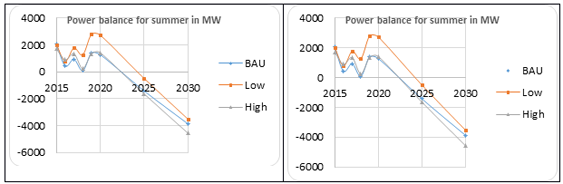

The analysis of power balances is carried out by the TSOs twice a year; for winter and summer in the accordance with the ENTSO-E methodology. The power balance for three scenarios (BAU, Low economy development and Fast economy growth) was carried out by Ernst&Young for the Polish power system and the results are presented in Fig. 2. There are three characteristic periods in power the power balance lines:

- Low power reserve between 2015-2018 when the security of supply is supported by obsolete power installations kept as “cold reserve”

- High power reserve between 2019-2021 when new power generating units being currently under construction are commissioned

- Low and negative power balance after 2023 when old power generating units commissioned 40 years ago are gradually shut down

|

| Fig. 2. Power balance for summer and winter in the Polish power system - Source: E&Y. |

Conclusions

The bulk of the Polish power stations are obsolete and they have to be shut down in next 10-20 years. This relates in particular to power generators with rated power of 200MW, which were commissioned in the 1970s. Their reconstruction is not only not economically viable, but it is also not possible from a technical point of view. Low electricity prices in wholesale electricity markets do not allow for an adequate return which can ensure the construction of new power generating units.

The aim of a new incentive system currently discussed is to provide the adequate amount of power reserves and balance the increasing demand for electricity in such a fast growing economy. The first auction for available power and the Demand Side Response in the Polish power market could take place in 2016 with the power delivery in 2020 in a four ahead power procurement system.

| Wladyslaw Mielczarski is Full Professor at the Institute of Electric Power Engineering, Lodz University of Technology, Poland. www.mielczarski.neostrada.pl |

Discussion (0 comments)