A solar revolution at the IEA

on

A solar revolution at the IEA

The International Energy Agency – the energy watchdog of the OECD that has often been viewed as a protector of western oil interests – envisions a major role of solar power in future global electricity production. In two new landmark reports, prepared at the behest of the G8, the IEA is unusually positive about the prospects of both concentrated solar power and photovoltaic solar power, which it says could supply up to a quarter of global power production in 2050. This is much more than the IEA has ever envisioned in any of its scenarios in its famous annual World Energy Outlook reports.

|

| Solar energy will, according to the IEA, supply a quarter of the world's power supply by 2050 |

In May, the IEA came out with two milestone “technology roadmaps” giving a surprisingly bullish outlook on solar power. One report focuses on solar photovoltaic (PV) technology, which is based on panels that directly convert sunshine into electricity, the other on concentrating solar power (CSP) plants, which use the heat from the sun to boil water or oil to drive a turbine that generates electricity in the same way as an ordinary thermal power plant does.

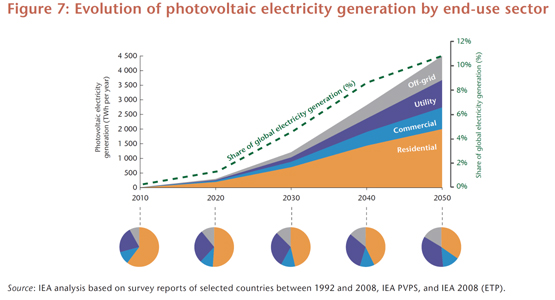

According to these two roadmaps, solar PV and CSP could each account for between 4,000 and 4,500 Terrawatthours (TWh) or 11% of projected global electricity demand in 2050. In other words, 40 years from now, solar power could deliver between 20% and 25% of global electricity. That’s a huge upgrade from earlier projections the IEA made in its famous annual World Energy Outlook (WEO) reports.

In the WEO reports, the IEA sketches a business as usual scenario (called “Reference Scenario”) as well as a “climate scenario” (called “450” or “550 Scenario”). The latter shows how global energy markets could evolve if countries take coordinated action to limit greenhouse gas emissions. In the Climate Scenario of the 2008 WEO the contribution of solar to global power supply in 2030 is estimated to be roughly 550 TWh, a fairly negligible figure. (In fact, it is not even quantified precisely in this report.)

In the Climate Scenario of the 2009 WEO, the contribution of solar PV is projected to be 525 TWh and that of CSP 325 TWh, together accounting for just 2.8% of projected worldwide electricity use. In other words, the two new roadmaps are projecting ten times as much solar power as the WEO reports! Of course the roadmaps look at 2050 whereas the outlook of the WEO is limited to 2030, so the two are not fully comparable. Nevertheless, even for 2030 the roadmaps arrive at much higher figures than the WEO – approximately four times as high.

The IEA’s newfound enthusiasm for solar power has surprised some observers. Eicke Weber, the head of the Fraunhofer Institute for Solar Energy Systems and one of Germany’s leading solar energy experts, says the IEA is trying to boost its renewable energy profile in the face of growing pressure from other agencies. ‘I think this is also a move not to lose too much clout to IRENA’, Weber says. IRENA is the International Renewable Energy agency that was established in Bonn in January 2009 to promote the use of renewable energy. It is now backed by 144 states and is headquartered in Abu Dhabi.

Political signal

Nonetheless, the two studies send an important signal to politicians. They are part of a planned series of 17 technology roadmaps that the IEA is developing at the direct request of the G8. At a meeting in June 2008 in Aomori, Japan, ministers from the G8 countries plus China, India and South Korea established ‘an international initiative with the support of the IEA to develop roadmaps for innovative technologies.’ The two solar roadmaps are the first to come out of this initiative. They are based on extensive consultations with research institutes and experts from across the world.

At the presentation of the reports in Valencia on 11 May, IEA Executive Director Nobuo Tanaka significantly stressed that ‘the combination of solar PV and CSP offers considerable prospects for enhancing energy security.’ He added that ‘long-term oriented, predictable solar-specific incentives are needed to sustain early deployment and bring both technologies to competitiveness in the most suitable locations and times … To support cost reductions and longer-term breakthroughs, governments also need to ensure long-term funding for additional research, development and demonstration efforts.’

Although the reports are very good news for advocates of solar power, it should be noted that the IEA is fairly cautious in its cost projections, at least in the short to medium term. It says rooftop PV installations will not be competitive with household electricity prices until 2020, and with wholesale prices until 2030.

Weber, however, says the IEA is much too pessimistic in its price projections. ‘While the overall prediction, 20-25 percent by 2050, isn’t too bad, the IEA in my opinion is off on its price forecasts for PV and in its forecasts for the relative contributions of PV and CSP’, he says. ‘It has not taken into account how dynamic the price development of PV is today. It predicts a PV system price of $2.70 per watt in 2020, but prices are already close to that. In 2020, prices will be lower. In the sunniest countries, PV power is already competitive with household prices.’

|

| Total PV power generation would grow to between 4,000 and 4,500 TWh by 2050. Source IEA Technology Roadmap for Solar photovoltaic energy |

The IEA forecasts a 17% annual growth for the global PV market. Weber thinks that is too low. ‘We have around 20 GW of PV capacity installed. This year alone, another 10 GW will come online, so that’s already a growth of 50%.’

On the other hand, the IEA’s forecasts for CSP are too ambitious, according to Weber. When it comes to total capacity installed in 2050, PV and CSP will be roughly equal, the IEA predicts, each enjoying a capacity of more than 1,000 GW. Weber doesn’t agree. While PV will profit from a dynamic price fall, CSP banks on proven technologies that won’t become much cheaper, he argues. ‘That’s why PV will grow faster than CSP, keeping the share of CSP down.’

|

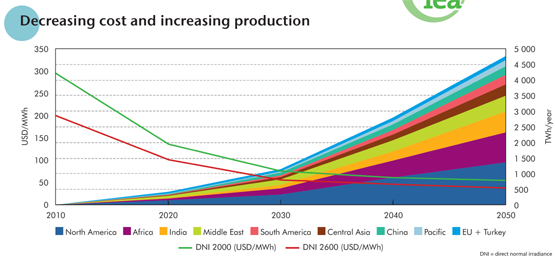

| Costs of concentrated solar power (in USD per MWh) are expected to decrease to some 24% of current prices beyond 2030. CSP power generation is expected to climb to some 4,700 TWh by 2050. Source IEA Technology Roadmap for Concentrating solar power. |

But Thierry Pommier, the assistant secretary-general of the European Solar Thermal Electricity Association (ESTELA), says the IEA is right not to put PV before CSP in terms of installed capacity. ‘CSP has a huge potential worldwide,’ Pommier says. He rates the IEA’s prediction that CSP won’t be able to provide competitive base load power until 2025 or 2030 as too pessimistic. ‘We think that it should be the case before 2025, and in any case by 2025 at the latest.’

Light for all

Aside from these controversial points, the two technology roadmaps offer many interesting insights.

The IEA expects PV to develop rapidly in the OECD countries as well as in Asia, and at a later stage in Latin America. It notes that ambitious PV targets and programs have been launched in the United States, Australia, Italy, India and China.

Last year, China became the world’s biggest producer of PV solar cells – its domestic output increased twentyfold in just four years, from 100 MW in 2005 to 2 GW in 2008. Some 95% of Chinese cells are exported, that’s why there remains significant growth potential for PV inside the country. ‘Experts predict that Chinese installed capacity could reach 1 GW in 2010 and 20 GW in 2020,’ the IEA writes.

Meanwhile, the IEA expects PV to help electrify remote rural regions. Around 1.6 billion people around the world lack regular access to electricity, and as a result are often deprived of lighting, clean water and other basic needs. Often, these people have no choice but to burn dirty kerosene or diesel for basic power needs, jeopardizing their health and fuelling climate change. ‘Deploying PV technology in isolated or under-developed areas can be a cost-effective option for clean electricity production,’ the IEA writes, adding that poor countries in Africa, Asia or Latin America often have abundant sunshine.

In Brazil, PV already lights up rural areas. The PV systems installed in that country are mainly off-grid, applied to public lighting, telecommunications and water-pumping facilities. The Brazilian government in 2003 launched the ‘Luz Para Todos’ (Light for All) program aimed at fully electrifying the country with the help of renewables sources. PV installations play a major role in the ongoing project.

Of course there is much work to be done to boost the large-scale deployment of PV-based solar energy, which in many countries can only compete because of lucrative feed-in-tariffs. The IEA calls on governments to establish market support mechanisms, prepare the large-scale integration of PV into the grid, and boost R&D funding. It also urges PV companies and energy utilities to increase the efficiency of the technology, develop means that the power harnessed by the cells can be stored, and perfect and deploy smart grid technologies.

The improvement of power grids is extremely important because of the highly fluctuating nature of PV. While the minor capacities installed today do not challenge the grid, stability could turn into a real issue down the road. ‘The PV industry, grid operators and utilities will need to develop new technologies and strategies to integrate very large amounts of PV into flexible, efficient and smart grids,’ the IEA writes.

Technical potential

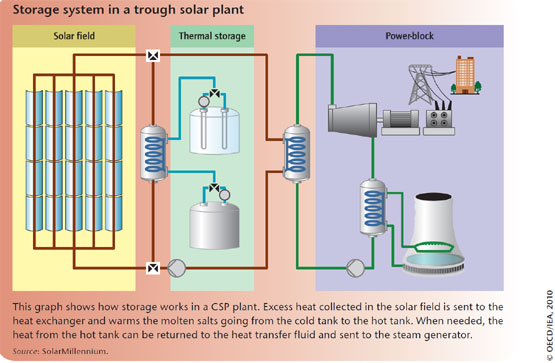

This is one major advantage of CSP plants: they don’t burden the grid. On the contrary, they are able to store heat during the day and convert it into electricity at night, thus providing flexible round-the-clock solar power. That is why the IEA says CSP can ‘help integrate on grids larger amounts of variable renewable resources such as solar PV or wind power.’

The agency says the ‘technical potential’ for CSP power generation is huge, claiming that plants in the south-western US states could meet the power demand of the entire US several times over. The CSP potential of the Middle East and North Africa amounts to 100 times the current consumption of those two regions and the European Union combined. ‘In short, CSP would be largely capable of producing enough no-carbon or low-carbon electricity and fuels to satisfy global demand.’

|

| The possibility of heat storage in a CSP plant makes it possible to supply electricity over night. |

In the IEA scenario, North America is to eventually become the biggest CSP market, followed by North Africa and India. North Africa would most likely export about half its production to Europe.

A key challenge for CSP is that the production sites are usually far away from the demand. An extensive network of efficient high-voltage direct current (HVDC) lines is needed to bring the power created in the deserts to large population centres. The IEA predicts that these direct current lines could feed large countries or span across borders, maybe even continents. In the US, CSP plants built in deserts or semi-arid regions in Arizona, Nevada, New Mexico or California could power cities like San Francisco, Seattle, Salt Lake City, Chicago, Dallas or even Boston. Moreover, ‘Australia might feed Indonesia, the Central Asian countries supply Russia; Northern African countries and Turkey deliver power to the EU,’ the IEA writes.

The IEA expects the first HVDC lines to be built in the years between 2010 and 2020, with the agency mentioning as possible projects connections within larger countries like the US, India and China; a north-south link in Africa between plants in Mali or Niger and Lagos; and a connection between North Africa and southern Europe.

The latter is a nod to Desertec, a €400 billion CSP and renewable energy initiative pushed by several major European companies (See Desertec is slowly becoming really big). The companies involved say Desertec could supply up to 15 percent of Europe's electricity by 2050.

Decarbonising transport

CSP could even come to replace oil-based automotive fuels, says the IEA. Between 2030 and 2050, the researchers expect CSP to expand beyond pure power generation and into solar-assisted natural gas reforming. This is a process in which CSP plants use solar energy to produce hydrogen that can be mixed into gas as well as fuel products. ‘Solar-generated hydrogen can help decarbonise the transport and other end-user sectors by mixing hydrogen with natural gas in pipelines and distribution grids, and by producing cleaner liquid fuels,’ the IEA writes. In 2050, solar hydrogen blended in natural gas will account for 86 million tonnes oil equivalent, ‘or over 3% of the estimated global consumption of natural gas.’

While those are dreams of the future, deploying CSP in the short term will require concerted efforts. The IEA says there is not enough money going into CSP R&D and demonstration projects, urging governments to boost public funds for CSP rapidly from the current $100 million ‘to $500 million per year, and perhaps further … to $1 billion per year in a second stage.’

Unlike Eicke Weber, the IEA does not believe that one technology will keep the other one down. Tanaka himself says the output flexibility of CSP and the fact that PV power directly available to the end-user mean that both technologies ‘appear to be complementary more than competing.’

But regardless of what the IEA thinks of the relative merits of PV and CSP, it is clear that it has undergone a radical transformation in its way of thinking. Especially when you consider that the agency hardly even mentioned in its roadmaps that in 2007, PV supplied 4 TWh and CSP 1 TWh – less than 0.2 percent of global demand today.

Discussion (0 comments)