An uphill battle on Russian gas prices on the horizon

on

Lowering the Price of Russian Gas: A Challenge for European Energy Security Part II

An uphill battle on Russian gas prices on the horizon

Europe's energy discourse has been unjustifiably preoccupied with concerns about potential physical disruptions of Russian gas. The real challenge for European-Russian energy relations, and in fact, for European energy security, lies in settling on a price that leaves both sides content. While Europe will come under increasing pressure to acquire affordable energy resources to enhance its competitiveness, Gazprom may find it increasingly difficult to deliver gas at lower prices in the coming years.

|

| (c) New Europe/ EPA/Sergei Ilnitsky |

For many, this is a cause for optimism that Gazprom would yield to pressures and adopt a more flexible stance in its gas contracts. Indeed, in December 2012, Gazprom announced its intention to cut its long-term contract prices in the European market in 2013.

And yet, pricing disputes with Gazprom are far from over. In fact, an uphill battle may well be on the horizon for years to come. This is because Gazprom may genuinely face growing constraints in response to requests for lower prices, endangering its market position. Also, in certain sub-markets (Eastern Europe), it may not perceive an immediate reason to substantially revise its pricing policy.

Gazprom may still have significant room for maneuvering (with regard to pricing its gas abroad) left in the near future. This is not least because, only two years ago, it still topped Forbes's list of the world's most profitable companies. Its profits stood at USD 44 billion in 2011. While a considerable opaqueness about the company's finances limits our ability to estimate Gazprom's precise room for maneuvering, our analysis suggests that, at least for three reasons, this room may be getting smaller in the coming years:

- a sub-optimal upstream strategy amidst a rapidly changing domestic and foreign market

- an expensive export infrastructure strategy

- the likelihood for increased tax pressure on Gazprom

Gazprom continues to carry out an upstream strategy that fails to take into account new realities in Russia's domestic market and abroad. This will come at a cost that could eventually curb its capacity to cut prices when needed.

Gazprom has invested in upstream capacity that does not look likely to be utilized in the near-term, and possibly by the end of the decade. Since 2007, it has ploughed in over $40 billion in the development of Yamal - its principal greenfield project. Before the Great Recession, such an investment decision was widely applauded, as the key concern at the time was its potential inability to meet both domestic and foreign commitments.

But market conditions have changed abruptly. European demand remains stagnant, and the IEA predicts that in 2020, the EU's total gas consumption will be only 4 bcm higher than in 2010 (540 bcm forecasted in the New Policies Scenario for 2020) [note 1]. Russia's CIS market is not performing any better, where Ukraine, Gazprom's largest market, remains determined to gradually reduce Russian gas imports.

Gazprom's biggest headache, however, may well turn out to be the Russian domestic market. On the one hand, demand growth has drastically slowed down since 2008. Energy efficiency measures, especially in power generation, are expected to curb further growth in gas demand. The IEA's most recent estimate is that Russia will consume only 4.6 percent more gas in 2020 compared to 2010 [note 2].

On the other hand, the Russian domestic market is getting increasingly crowded. Independents and oil companies have aggressively expanded their output in the past decade: their share in Russia's total gas output increased from a mere 10 percent in 2000 to about 24 percent in 2011. With no access to foreign markets, part of their growth is happening at Gazprom's expense.

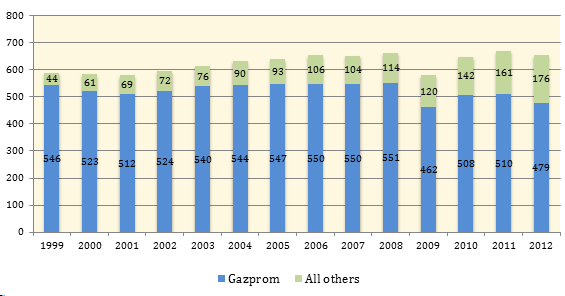

| What is striking is that non-Gazprom output has kept growing even when total Russian output has needed to be cut due to a lack of demand |

What is striking is that non-Gazprom output has kept growing even when total Russian output has needed to be cut due to a lack of demand. Gazprom has taken the hit by cutting its own production to balance the markets. (Figure 1) With more gas expected to come from independents and Russia's oil companies, it appears highly unlikely that Gazprom will reach its pre-crisis (2008) peak output for many years to come, hurting its bottom line.

|

| Figure 1: Gas Production in Russia (in bcm) - Source: Nefte Compass |

In this context, Gazprom has opted for a costly upstream strategy with some potentially significant consequences. Every year since 2009, it has had to curb production below its annual target. What is even more troubling about Gazprom's practice has been its decision to cut production at Soviet legacy fields that produce gas at a relatively low cost, while putting vast sums of capital in greenfield development (Yamal) [note 3]. So far, Gazprom has demonstrated no intention for a restraint in its investment plans in Yamal despite market conditions. Instead, its cheap legacy fields remain as the major candidates for continued production cuts in the future.

With Yamal output rising, this is likely to raise the average cost of Gazprom's output. This comes on top of deteriorating quality at legacy fields, which is an additional cause for rising costs. As a consequence, Gazprom's upstream strategy may constrain its room for maneuvering in its pricing policy in the future [note 4].

Moreover, while Gazprom's average production costs are apparently headed on an upward trend, its export strategy is likely to further raise the cost of bringing Russian gas to the European market. Exports to Europe are not expected to grow significantly by the end of the decade. And yet, Gazprom keeps investing in export pipelines that far exceed its capacity needs. With the recently launched Nord Stream, Gazprom already has a substantial excess export capacity. If South Stream comes online, Russia will have a capacity to export well over 300 bcm of gas to the European market—a capacity that is about twice larger than its forecasted exports to Europe in the medium term. This implies that the average capacity utilization in Gazprom's export network will potentially remain low, raising the average cost of shipping Russian gas to Europe. Someone will eventually have to pay for the extra cost.

Finally, the Russian government has signaled an increasingly assertive stance on the relatively low level of taxation that Gazprom has been enjoying so far at a time, when Gazprom itself needs to maintain large capital expenditures just to sustain current production levels.

| If South Stream comes online, Russia will have a capacity to export well over 300 bcm of gas to the European market - a capacity that is about twice larger than its forecasted exports to Europe in the medium term |

As the Russian oil sector is about to reach its peak in the next few years, the relative importance of the gas sector as a source of revenues for the Russian state is likely to go higher. At present, the oil sector remains the largest source of government revenues. But, it faces a monumental upstream challenge as legacy fields are declining and new fields need to be urgently developed just to keep the current level of output. That is precisely why Rosneft is entering into deals with international majors, like Exxon, Eni, Statoil and BP: to lure in expertise and technology and enhance production from old (tight oil) and new (Arctic, Black Sea offshore) fields alike. But this necessitates the government to forsake substantial tax revenues from the oil sector to create a better investment environment and promote its further development.

With the gas sector possibly headed towards excess supply capacity through this decade, the Russian government may well look at Gazprom and other gas players to compensate for the foregone revenues. While this outcome is not given, it poses a major risk for Gazprom, and could eventually further raise the cost of the gas it brings to consumers in Europe.

Implications for Europe

For Gazprom, its increasingly suboptimal upstream strategy, the needlessly expensive export infrastructure strategy and the risk of higher taxes on the horizon cannot but complicate its pricing policy in Europe. The key question is who will pay for the extra costs that the Russian major is going to face.

The answer will lie in how European clients improve their bargaining position in the upcoming years. This will necessitate enhancing access to

| For Gazprom, its increasingly suboptimal upstream strategy, the needlessly expensive export infrastructure strategy and the risk of higher taxes on the horizon cannot but complicate its pricing policy in Europe |

For many countries in Central and Eastern Europe, immediate access to an alternative source is not in the cards. However, taking credible steps in this direction can make a difference. This would particularly be the case when a long-term contract with Gazprom is close to expiration and awaits renewal. Increasing leverage by actively pursuing diversification strategies, like completing the Southern Gas Corridor, building LNG terminals in Poland, the Baltics and Croatia and developing domestic shale resources is essential. Lack of action, on the other hand, will most likely be a recipe for even more difficult negotiations over the price of Russian gas resulting in protracted loss of competitiveness - a luxury these countries can ill afford.

Moscow is increasingly faced with the need for a new approach towards its gas sector, and particularly towards Gazprom. The company's present strategy, modus operandi as well as its domestic and international pricing model are unsustainable in the longer run. Future shifts on the global gas scene, like the prospects of US LNG exports to Asia and possibly to Europe or large-scale exploitation of shale gas in China may put additional pressure on Gazprom and limit its room for maneuver. If Gazprom continues to lose market share in Europe, and, in the meantime, it remains unable to keep its prices high, action by Russia's leadership will become more urgent. The Kremlin will hardly be inclined to abandon the export monopoly for pipeline gas. Yet, it could enhance Gazprom's competitiveness in Europe by turning rhetoric about dealing with Gazprom's inefficiencies into real action.

notes

1. World Energy Outlook 2012, International Energy Agency [back]

2. Ibid [back]

3. Curiously, Gazprom has - so far - failed to at least measure up domestic shale and tight gas potential though these might easily be closer to the European markets and cheaper to exploit than Yamal. [back]

4. To Gazprom’s credit, in 2012, the company decided to postpone investment in another highly capital-intensive field (Shtokman), which could have further strained it financially. [back]

| David Koranyi is Deputy Director of the Eurasia Center at the Atlantic Council. Adnan Vatansever is non-resident Senior Fellow at the Eurasia Center and the Energy and Environment Program. |

| This article is the second part of the story 'Lowering the Price of Russian Gas: A Challenge for European Energy Security'. Part I was published Monday 11 March 2013. |

Discussion (0 comments)