Bulgaria – gas consumer or future gas hub?

on

Bulgaria – gas consumer or future gas hub?

Being situated at one of the important crossroads between East and West, Bulgaria is frequently seen as a country that could help to improve the EU’s overall energy security. However, the country has not done much yet to live up to this expectation. As member of the EU, Bulgaria will have to prove itself as a positive factor for European gas security of supply. Otherwise it will remain just a heavily-dependent gas consumer.

|

|

Bulgaria’s Minister of Economy and Energy, Traicho Traikov (R), and his Russian counterpart Sergey Shmatko (L), discussed energy matters in Moscow in October 2009. |

Natural gas first entered Bulgaria in the beginning of the 1970s, when a Russian pipeline reached the country. Initially it was used solely for industrial consumption. This changed in the beginning of the 1990s. Currently fewer than 2% of Bulgarian households directly use natural gas – a very small number compared to average EU levels. However, most of the district heating companies that provide heating to

| Most of the district heating companies that provide heating to large towns, including the capital Sofia, depend on gas |

Reversing the flow

Along with the negative effect on the national economy, the gas crisis also provided a possibility for changes. It served as a wake-up call – there is a strong feeling in Bulgarian society now that something should be done to improve national energy security. National energy policy-makers together with the management of state-owned Bulgarian Energy Holding started to look for other sources than Russian gas. A short-term solution was found days before the end of the gas crisis by reversing the gas flow in the pipeline between Bulgaria and Greece. Possibilities for importing gas from Turkey in compressed or liquefied form were also discussed.

Proposed medium-term solutions include other options as well:

- a special gas connection between Bulgaria and Greece, which could provide access to the Greek LNG terminal Revithoussa;

- a connection between the Bulgarian and Romanian gas networks on the Danube River – between Ruse and Giurgiu;

- an idea for compressed natural gas (CNG) ship imports from Azerbaijan through the Black Sea

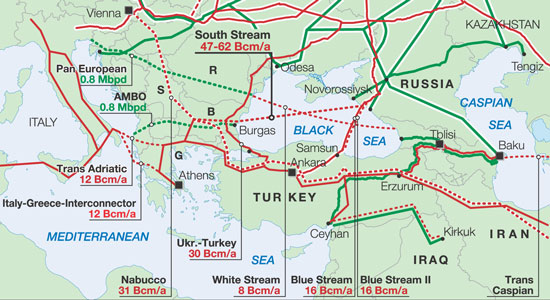

The long-term solutions are both well-known and at the same time quite controversial. Bulgaria is part of the pipeline routes for both Nabucco and South Stream – the two gas pipelines which are intended to bring Caspian (and in the latter case also Russian) gas to Central and Western Europe. Prime Minister Boyko Borissov has said that both pipelines are important and positive for Bulgaria. Former Prime Minister Sergei Stanishev has also expressed his view on the matter, encouraging the current government to continue its work on South Stream. Actually, it makes sense for Bulgaria at this moment to pursue both options. If there is enough gas for both projects, there should be no political hindrances for their development. Nabucco provides a diversity of sources and routes, and South Stream at least provides a new route for gas to be delivered to Bulgaria.

|

|

Overview of pipelines in South Eastern Europe |

Not simple

On July 13, 2009, the inter-governmental contract for Nabucco was signed in Turkey. In February 2010 the new Bulgarian Parliament ratified the Nabucco pipeline contract without a single abstention or negative vote. This makes the international agreement official in terms of Bulgarian legislation. The next important step in the development of the Nabucco project is the so-called “open season” for filling-up the pipeline with real gas supplies. This procedure will be held from July to October 2010, according to the Nabucco Pipeline project company’s schedule, and will demonstrate the real interest for Nabucco.

The Bulgarian government is also negotiating with Gazprom, about several matters, but the talks are not simple at all. Bulgaria has offered a “portfolio of proposals” to the Russian energy minister Sergei Shmatko, according to Bulgarian energy minister Traicho Traikov. The matters discussed include several important energy issues:

- The development of the South Stream project: Bulgaria will hold 50% of the pipeline through Bulgarian Energy Holding, according to the existing inter-governmental agreements, but the structure of the project company and the construction works are still not clarified. Russia has to renegotiate the current contract with Bulgaria for accommodating 63 bcm (billion m3) capacity instead of the initial 30 bcm capacity for the pipeline.

- The transit fees for Russian gas, passing through Bulgaria on its way to the Turkish, Greek and Macedonian markets.

- Removal of the current “intermediaries” in the gas supply contracts between Gazprom and the state-owned wholesale supplier Bulgargaz. Currently there are three contracts between Bulgargaz and three companies: Overgas Inc., Gazexport, and Wintershall.

- Negotiations on the project structure of the future nuclear plant Belene, whose main contractor is the Russian company AtomStroyExport.

|

Georgia enters picture The Bulgarian Ministry of economy, energy and tourism announced on 3 March that the Bulgarian minister Traicho Traykov and his Georgian colleague Aleksandre Hetaguri have discussed the possibilities to supply compressed natural gas (CNG) to Bulgaria. The Georgian minister was in Bulgaria for the Sofia Energy Roundtable, organized by the Atlantic Council. At the meeting the two ministers continued their talk from January this year in Batumi about transporting CNG through the Black Sea, said the Bulgarian ministry. Minister Hetaguri has declared the willingness of Georgia to participate in the talks about gas supplies from Azerbaijan through Georgia to Bulgaria and reaching an agreement before June this year. Georgia is willing to finish a 30-km gas link to the Georgian port of Supsa before the end of 2010. This would give 3 bcm additional capacity and could provide an opportunity to transport gas from Georgia to Bulgaria. The discussion between the two ministers will continue during the second half of March, said the Bulgarian ministry. |

Russian energy minister Shmatko visited Sofia on February 19, right after visiting Bucharest, Romania. According to an announcement, made by the Romanian economy minister Adriean Videanu after the Russian visit, the Romanian gas transport company Transgaz received an invitation by Gazprom to also participate in South Stream. This could remove Bulgaria from the project, because the initial plans for South Stream were to bring gas directly from Russia to Bulgaria through the Black Sea. The “surfacing” point was designated near the Bulgarian city of Varna and no Romanian participation was discussed up to now. Still it is unknown whether the Romanian participation in the project is real or is meant just to be a scarecrow for the Bulgarian government in its talks with the Russian partner.

According to official information from South Stream, Gazprom held talks with Romgaz, the Romanian state-owned gas producer, and Transgaz, which is also part of the Nabucco project, back in 2008. These talks concerned an upgrade of the Romanian transit system in order to support South Stream. There has been a similar situation before – then regarding the Blue Stream pipeline, which crosses the Black Sea and was initially intended to reach Bulgaria. In the end, Blue Stream went to Turkey. Bulgaria’s long hesitations about Blue Stream are generally considered to be the main reason why it did not get the pipeline. If history repeats itself, Russia may decide to switch from Bulgaria to Romania as a future landing point for South Stream. For the EU this will not make any difference, but for Bulgaria it will be harmful.

New gas hub

If Nabucco is fully used, it will bring 31 bcm of natural gas annually to Europe. South Stream is intended to carry up to 63 bcm. Part of this gas will go to the Bulgarian market. Other regional initiatives such as new interconnectors between Bulgaria, Greece, and Romania will provide opportunities to bring in LNG-supplies to Bulgaria. There is also a plan to connect Southeast European with Central European gas networks through the NETS project, promoted by the Hungarian company MOL. All these opportunities should be analyzed by the Bulgarian government in order to maximize benefits for both the national economy and the overall energy security of the EU.

According to some sources, both Bulgaria and Turkey, which was visited by Bulgarian Prime Minister Borissov a month ago, are ready to be “motors” in the Nabucco consortium. Turkey has already made it clear it does not want to be only a transit country, but also a reseller of the gas coming through Nabucco. Bulgaria has not explicitly announced such intentions, but its position as an EU member state and its geographical location define the country’s important future role in securing Europe’s gas supplies. Eventually, from being only a gas consumer, the newest EU-member should become a new gas hub for Southeast Europe. The historical relations of the country to the Eastern markets, combined with its location and EU membership, should provide a good basis for such development. All that needs to be done is for the opportunity to be grabbed.

|

Who is Atanas Georgiev? Atanas Georgiev is assistant professor at the Faculty of Economics and Business Administration (FEBA) at Sofia University. He coordinates the Master Programme “Economics and Management in Energy, Infrastructure, and Utilities”. From 2005 to 2009 he worked at Uconomics Ltd., first as a consultant in energy sector restructuring, later as managing editor of the Bulgarian “Utilities” Magazine and programme manager for a number of trainings and conferences in the fields of energy, infrastructure and utilities. He has published a number of articles about the energy and utilities sector. Since January 2010, he has become managing editor of publics.bg – an online professional medium supporting the development of public services in Bulgaria. |

Discussion (0 comments)