Can power markets resuscitate natural gas in Europe?

on

Can power markets resuscitate natural gas in Europe?

If the integration of variable renewables into Europe’s power systems is to continue in the decades to come, more needs to be done to ensure that the most flexible resources are available in the market. Gas-fired power generation is considered to be a key enabler of the energy transition due to its ability to compensate for variable renewable output. However, increased electricity production by renewables, low coal prices, energy efficiency measures and overall economic woes have reduced gas demand in recent years. In order to obtain the flexibility needed to manage a system with an ever-increasing share of variable renewables, power markets will have to reward generators on the basis of the ramping services they can deliver. Doing so will also help to get the flexible gas capacity back into the market and counter the coal renaissance that has a detrimental impact on Europe’s climate agenda.

|

| Gas steam-turbine element is readied for shipment (c) Combined Cycle Journal |

The integration of the needed quantities of variable renewable capacity will only be possible if it does not endanger the secure management of the power grids. As electricity cannot be stored, a sudden change in production by wind and solar units can lead to large frequency deviations that, if uncontrolled, might lead to system failure. Therefore, transmission system operators (TSOs) always need to have a minimum amount of conventional capacity – hydro, gas, coal, nuclear – at their disposal to enable a secure operation of the power system.

Because sudden changes in production by variable renewables require quick responses, the ability of conventional resources to ramp up or down their production quickly and reliably is of vital importance. And in this respect, gas has a key advantage. Gas-fired power plants can generally adapt its level of production faster, farther and more reliably than its conventional competitors. It is thus commonly acknowledged that gas has a key role to play in (the transition to) a low-carbon electricity system.

Shattered expectations

The rise of variable renewables thus offered great prospects for natural gas in Europe, and in the early 2000s many agreed that gas had its best time coming. The assumption that Europe’s gas demand would grow structurally by 2 percent per year, as it had done until then, underpinned a surge in investments in flexible combined-cycle gas turbines (CCGTs). This surge of gas-fired generation capacity seemed to clear the way for Europe’s energy transition. And then the economic crisis hit.

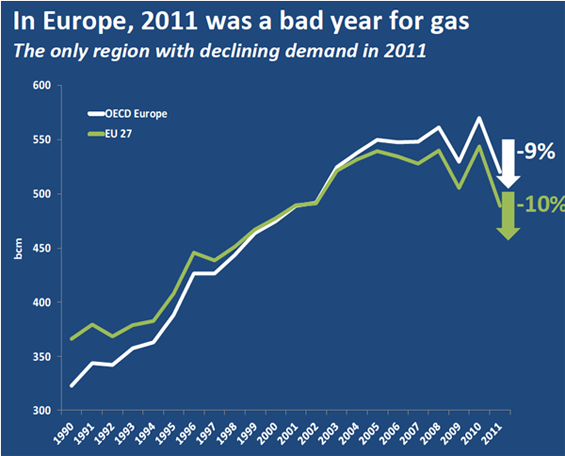

The chart below shows how Europe has lost over 10 years of demand growth since the economic crisis, bringing levels of gas consumption back to those of the late 1990s. Five years into the crisis, it is clear that the much-heralded golden age of natural gas is yet to arrive in Europe, and prospects for growth are dim. The enthusiasm about gas has turned into a situation of excess capacity, and throughout Europe load factors of gas-fired power plants have plummeted in recent years.

|

| Figure 1. EU gas demand 1990 - 2011 - Source: IEA 2012 |

Economic woes are not the only reason the radical change in the outlook for gas in Europe. Back in December, Alex Forbes explained that the rise of renewable production, large imports of cheap US coal and energy efficiency measures have also played their part in driving demand for gas to unexpected lows.

The biggest concern for the gas industry is not the decline in gas demand, but the limited prospect of it bouncing back anytime soon. The only way for the gas industry to recover some of its lost market share is to become more competitive than coal. The two main instruments for doing so have proven insufficient. First, carbon prices as set by the ETS are far from the levels needed to induce a switch from coal to natural gas. Second, liberalization of gas markets and a move away from oil-indexed gas prices have yet to materialize, preventing the emergence of more competitively established gas prices in Europe.

As a consequence, the “arranged marriage” between gas and variable renewables seems to have ended up in an early divorce. Despite the political consensus on the importance of flexible gas in the transition to a low-carbon electricity system, the market prioritizes cheap coal and leaves gas capacity underutilized. In contrast to expectations, coal generators now increasingly take up the “load-following” role (i.e. compensating for variable output from renewables) that had originally been ascribed to gas.

A way out for gas

But because coal is generally less flexible than gas, this trend will put a strain on Europe’s ability to integrate increasing shares of variable renewables. In a low-carbon power system that many envision, it is of vital importance that the most flexible types of capacity are available to compensate the variable output of wind and solar units. However, the proliferation of flexibility necessitates the remuneration of flexibility. Utilities will only consider the ramping services of the capacity they put in place if it has a considerable impact on their revenues.

Rewarding flexibility implies that the economic model of power markets has to change. Currently, generators are only paid for the energy they deliver. Electricity producers compete on the basis of the short-run marginal cost of their production and the flexibility of their capacity is largely irrelevant. In such a market environment, the more flexible capacity that plays a key role in compensating for the variable output of solar and wind units might not be producing energy because its marginal cost exceeds that of its less flexible competitors. The situation of coal and gas in Europe epitomizes this problem – the more flexible gas capacity is out of the market because coal is cheaper. Successfully integrating variable renewable capacity will imply that generators need to be rewarded for the ramping services they can reliably deliver.

Rewarding flexibility

One way to reward flexibility is to incorporate ramping services as an element in the capacity remuneration mechanisms (CRMs) that many European countries are gradually putting in place. These CRMs pay conventional generators for the availability of their capacity (in MW) that the system operator may require for balancing supply and demand in real time. Although such CRMs are likely to guarantee a certain quantity of capacity, they often fail to incentivize the flexible type of capacity that the system needs.

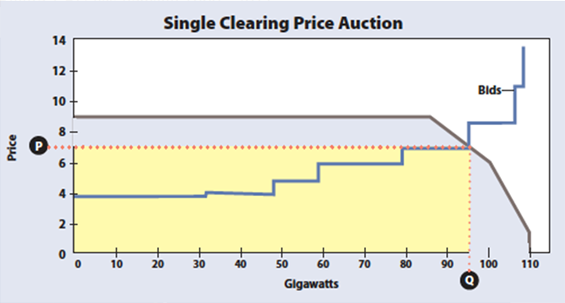

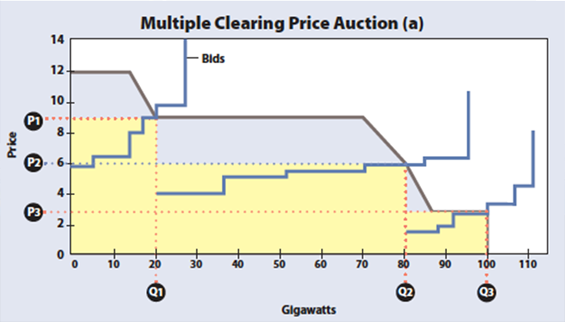

Therefore, CRMs should be adapted to increase the remuneration for those generators that are best able to change their production quickly, reliably and by large increments. Creating multiple “capacity segments”, that have different value and are subject to separate capacity auctions, is one way of doing so. In such a system, there are multiple categories of capacity that each contain resources with a specified level of ramping capabilities. The segment with the most flexible generation capacity is auctioned first and clears at the highest price. Then the second segment, with less flexible firm capacity, is auctioned and clears at a lower price. This process of clearing increasingly less flexible firm capacity continues until the needed amount of firm capacity is procured. All generators bid into the highest capacity segment that they qualify for and receive the clearing price of that segment. The figure below illustrates the functioning of such a system.

In contrast to a single clearing price system where all firm capacity receives the same price, a multiple clearing system rewards conventional generators according to the type of ramping services they have to offer. Because gas-fired power units can generally offer better ramping services, they would receive a higher price for their capacity than other types of generation. Under both types of auctions, the same amount of firm capacity is procured and the overall cost can remain equal as long as the rise in capacity payments for more flexible capacity is offset by a decline in revenues for less flexible capacity.

|

|

| Figure 2. Illustration of single and multiple clearing auctions - Source: Hogan 2012 |

A second way to acquire the type of resources a power system needs is to tender for these resources specifically. Identifying the exact resource needs of the national or regional electricity system is no straightforward exercise. Nonetheless, each TSO can make a forecast of total electricity demand and production by variable renewables. By taking the difference between the two – and taking imports and exports into consideration –, the TSO would then find the “net demand”. Simply put, the net demand indicates how much firm capacity needs to be available in the power system and what ramping qualities this capacity should possess.

On the basis of this net demand forecast, the TSO can then define specific products that it needs to ensure the efficient management of the power grids for the years to come. For instance, in a system with a high installed capacity of solar PV, one can imagine a tender for a ramping product that is available between 6 and 8 PM – the period where output by PV is likely to decline and where electricity consumption is reaching its daily peak. By tendering for these products on a forward basis, TSOs would offer multi-year contracts to the winning bidders and ensure reliability by penalizing non-delivery of the contracted flexibility services. Such tendering systems should allow for equal participation of parties offering demand side management or storage opportunities.

Such a system carries two key advantages: first, it aligns the needs of the power system with the electricity products that market players are bidding to offer. And secondly, it gives those generators who can offer the flexibility services that the market needs access to additional long-term revenues.

Both solutions provide clear frameworks that allow for an optimal delivery of the flexibility services that TSOs require to efficiently manage the power grid. Nonetheless,

| However, improving the situation of the ailing gas sector should not be the objective of a revamp of Europe’s power markets. |

Although the merits of rewarding flexibility are evident from an operational point of view, the implications of such a new payment model are likely to meet important political obstacles. For one, a country like Poland has an interest in keeping its relatively inflexible coal plants running and will thus be reluctant to suddenly cut their revenues and deteriorate their competitiveness. Moreover, if no peripheral measures are put in place to mitigate the rise of unabated coal, it will be difficult to explain the measures described above as anything else than a means to counter the coal renaissance.

No free lunch

Rewarding flexibility has the potential to resuscitate Europe’s idle gas capacity as gas plants remain generally more flexible than their coal competitors. And together with other measures, such as credible carbon pricing, a fast-tracked liberalization of gas markets and a move away of oil-indexed gas pricing, there seems to be a way to counter the coal renaissance in Europe. However, improving the situation of the ailing gas sector should not be the objective of a revamp of Europe’s power markets.

Indeed, TSOs would prefer coal over gas if coal were to be the more flexible source of power. Recent experience shows that the advantage of flexibility that gas has traditionally held is anything but absolute. The supercritical coal-fired power plants that are currently being put in place can ramp up or down their production by around 8 percent per minute, which is not far from the flexibility of modern CCGTs. Moreover, in 2012 Centrica closed two of its gas-fired units – the King’s Lynn plants and the Roosecote facility – due to a lack of flexibility.

State-of-the-art supercritical coal plants with strong ramping capabilities have every right to deliver the flexibility that TSOs need to operate the grid in real time. An unconditional prioritization of gas over coal will serve to the detriment of Europe’s ability to efficiently manage a power system with many variable renewables if it implies that older, less efficient gas plants push flexible coal units out of the market. The goal of energy policy should not be to ban coal plants, but to prevent the proliferation of unabated coal. Speeding up the deployment of CCS technologies is vital. Setting credible carbon prices and stringent emissions performance standards, such as those implemented by the UK in its Energy Bill, are crucial steps in this process. But there should be no free lunch for gas, and in order to regain its place as the bridge fuel to a low-carbon energy mix, the gas industry will have to consolidate its position as the most flexible partner for variable renewables.

Discussion (0 comments)