Energy fever in the Baltics

on

Energy fever in the Baltics

Asked recently by EER what he thought of when he heard the words “energy” and “Baltic States”, Lithuanian Energy Minister Arvydas Sekomokas promptly responded: ‘Two things: renewable energy and nuclear power.’ And natural gas? Sekomokas has no love for this. ‘Nord Stream is a solution of the past’, he says. But things won’t be that simple for the Baltic region. There are still plenty of puzzles to sort out as the Baltic States are feverishly trying to integrate their energy systems with the European Union.

|

| Article Highlights: |

|

- The European Commission in 2008 presented a plan to “end the energy isolation” of the Baltic States |

Since that time, just over a year ago, a lot of progress has been made. The EU set up a High-Level Group (HGL) with representatives from Sweden, Finland, Estonia, Lithuania, Latvia, Poland, Germany, Denmark and Norway (observer), as well as the European Commission itself. They were given the task to sort out the many energy infrastructure projects that were being planned at the national level, and to integrate them into a well-balanced “Project Catalogue” that would set priorities and long-term goals. The HLG quickly went to work and presented its findings already in the summer of 2009. In November, a conference was held in Vilnius with representatives from the financial world to examine their willingness to finance projects. In December another HLG meeting took place in Brussels.

All this action has had positive results, most observers believe. ‘The clear instructions issued by the Chairman of the European Commission have had a positive effect’, confirms Romas Svedas, the Lithuanian Deputy Minister of Energy and a member of the HLG. ‘Now there are no discussions any more. Now there is action.’

Open markets

What Svedas is referring to are the endless disputes and discussions about the various infrastructural projects in the region that took place before Barroso took control. For example, there is the 400 km long NordBalt cable, with a capacity of 700 MW, that is meant to connect Sweden with … well, either Lithuania or Latvia, but the two countries could not agree. ‘We don’t want any more to do with the dispute on the Baltic side’, the Swedes announced in frustration at a certain point. ‘We are waiting for them to come up with an answer.’ It arrived soon after Barroso’s initiative: NordBalt will come ashore in Lithuania and should be operational in 2016.

And there are more projects moving forward. In 2014, the second sea cable between Finland and Estonia, the 650 MW Estlink2, should, again after years of debate, be connected up to the network. At the same time, the Lithuania-Poland LitPolLink has moved to the top of the interconnections list. It will link up Lithuania with the central European network. This will involve extensive development of the Polish-German network including a third 400 kV cable.

Just as important as the interconnections, is the integration of the Baltic markets with the wider EU energy market. Specifically, the Baltic states have announced that they aspire to integration with the Nordic electricity exchange Nord Pool. ‘Nord Pool is the most developed electricity market in Europe, and we want to be a part of it’, says Lithuania’s Minister for Energy Arvydas Sekomokas.

Such integration of course requires that the Baltic States open up their own markets. Until recently, they had no experience of open markets. Monopoly situations and state regulated prices were commonplace. A report by the Italian consulting firm CESI states that: ‘The Baltic Member States present different structures and mechanisms of electricity markets as well as different degrees of market opening.’

|

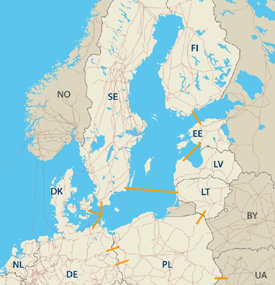

| Planned electricity interconnectors in the Baltic Sea area. |

In Estonia the market is controlled by one (state) company (Eesti Energia) which controls 97% of the production capacity, 100% of the transmission network and 88% of the retail market. From the start of 2009, 35% of the market was deregulated but full liberalisation will not take place before 2013.

Lithuania has a deregulated market in name, but very few consumers have made use of it. No wonder as, according to the CESI report, ‘the regulated electricity price is lower than the electricity price under market conditions.’ The reason for this is Ignalina: the state operator of the huge nuclear power plant set these low prices, which meant that no functioning market could develop. As of 1 January 2010, Ignalina has been closed down, and liberalisation of the Lithuanian market has taken off.

Nuclear fever

Other crucial elements in the BEMIP are the development of domestic infrastructure and power plants as well as the elimination of cross-border restrictions.

The electricity production program involves a host of projects: coal-fired, gas-fired (CCGT), biomass and nuclear power plants, not to mention ambitious wind development plans in Sweden, Finland, Estonia, Latvia, Lithuania and Germany.

One of the most sensitive topics in the region is the future of nuclear power. There are so many plans for new nuclear build that it seems difficult that they will all be realised. The Danish daily newspaper Berlingske Tidende recently even talked of ‘Nuclear fever on the Baltic Sea’.

The subject is particularly painful for Lithuania. As of the 1st of January, the country shut down the second of the two Ignalina reactors. This was a condition of the EU accession treaty and, according to the Lithuanians, more of a political decision than a logical one. Romas Svedas believes that the shutdown happened ‘at the wrong time’, other experts believe it was completely unnecessary, since ‘Ignalina is as safe as any other European nuclear power plant,’ as the former Finnish prime minister Paavo Lipponen put it.

Nevertheless, Ignalina has now been closed, and, as a result, Lithuania’s electricity supply situation has changed drastically. Until now the Lithuanian energy mix was 30% each from gas, oil and nuclear power and 10% from renewables. The country exported electricity to Belarus, Latvia and Kaliningrad. This is now a thing of the past. Lithuania has lost an important source of export income and its energy mix is now 42% each from gas and oil, and 100% of this comes from just one supplier, Russia. ‘This situation is very serious for us. Perhaps this is not understood in the West,’ says Svedas.

This is why Lithuania started planning for a replacement for Ignalina very early on. The BEMIP programme states that ‘Lithuania with stakeholders from Poland and the other Baltic States’ are backing Visaginas, the planned site for a new nuclear plant not far from Ignalina, with a capacity of no less than 3400 MW. Lithuania’s energy minister Sekomokas says to EER: ‘This is a collaborative project. We are also counting on the assistance of a strategic investor, with whom we hope to be able to reach an agreement in 2010.’ According to the BEMIP, Visagina will join the network in 2018 and will cost €2.5 to 4 billion.

In Lithuania, however, there are mixed feelings about the government’s plans, to put it mildly. Critics complain ‘that there is no discussion about cheaper alternatives. Actually such discussions are almost prohibited’, says one energy expert.

The problem for Lithuania is that it is not the only country that wants to have a new nuclear plant in the region. Finland is building the largest new reactor in the world and the Finnish consortium has filed applications for three additional reactors. At least one of those is likely to get a building permit. The 3rd Finnish nuclear reactor of 1600 MW is also included in the BEMIP projects. It is supposed to be ready by 2012 and will cost €3 billion.

The Finns and Lithuanians will get competition from Russia. Russia’s prime minister Vladimir Putin has announced the construction of a new nuclear power station in Kaliningrad, which would get a total capacity of 2400 MW, and is to be located only 12 km from the border with Lithuania. The first reactor should be connected the network in 2016 and foreign partners are welcome to participate, Putin said. He added he could envisage Kaliningrad supplying electricity to the Baltic States, Poland and Germany.

Poland, however, already has plans of its own. Lithuanian energy minister Sekomokas assumes that Poland will become involved in Visaginas, but the Polish government has announced it will start building the first of two nuclear reactors in 2020. Although Poland has its own coal deposits, the country is 95% dependent on Russia for gas and 45% dependent on Russia for oil.

Not to be outdone, Belarus too has said it will build new nuclear power plants. The government has said the first reactor is to be constructed in 2018 – just 10 km away from the Lithuanian border.

One Lithuanian energy expert, who is very familiar with the industry, concludes that not all of these projects can be realised. ‘The (Lithuanian) government apparently believes that the region in the future will need so much electricity that there is enough space for all three power plants (Visaginas, Kaliningrad and Belarus). You may judge the credibility of such a position for yourself.’

Gas bridge

In addition to nuclear power, the BEMIP assumes that most new power production will be based on renewables, mainly wind power and biomass. The BEMIP report states that ‘the Baltic Sea is particularly well positioned to further increase penetration of renewable energy sources.’ Plans for the region foresee an installed capacity of more than 10,000 MW of offshore wind power in the Baltic Sea. When asked what he thought of when he heard the words “energy” and “Baltic States”, Lithuanian Energy Minister Sekomokas promptly responded: ‘Two things: renewable energy and nuclear power.’

By contrast, Sekomokas does not want to hear anything about natural gas. He is opposed to the Nord Stream Gas Pipeline from Russia to Germany. ‘This is a solution of the past. The threat of climate change calls for a new way of thinking.’

Nevertheless, gas remains an important source of energy and this is why the High Level Group believes that liberalisation and integration must also be promoted in the gas sector. In its final report, the HLG has listed a number of plans and projects that are aimed at integrating the gas markets, but they are all designated as ‘to be followed up’. According to Pernilla Winnhed, Sweden’s HLG representative, ‘greater progress has been made with electricity than with gas up to this point.’

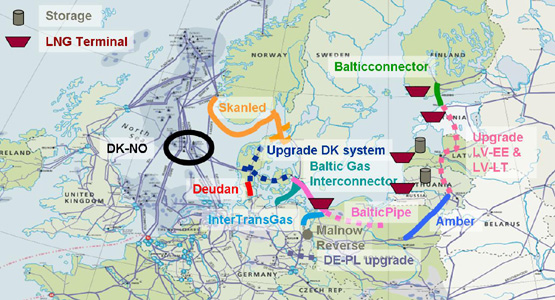

However, the HLG does list a number of concrete gas infrastructure projects with target dates and cost estimates, such as new pipelines and LNG terminals. The main idea the HLG pursues is to assign the role of “gas bridge” to Poland. This country will receive gas from Germany and Denmark, as well as LNG, and transmit this to the Baltic States and Finland.

Concrete projects include the Amber PolLit Pipeline (capacity 3 bcm) between Lithuania and Poland which will cost €300 mln and should be ready in 2014; an offshore gas pipeline between Finland and Estonia (to be decided on); improvements to the gas lines between Latvia and Lithuania and between Latvia and Estonia; an LNG terminal in Finland (to be decided on); LNG terminals in Lithuania, Estonia, Poland and Latvia; and the Amber Pipeline which is to connect Russia with Germany via Estonia, Latvia, Lithuania and Poland. About the latter, the HLG report states: ‘Project left aside for the moment due to lack of interest by the relevant stakeholders in the region’. For the same reason the plan to double the capacity of the Yamal-Europe II pipeline is currently not being pursued.

|

| Planned natural gas interconnectors and LNG receiving terminalsin the Baltic |

Sweden, Denmark and Poland had also had great hopes for a planned gas pipeline from Norway to Sweden and Denmark and on to Poland, but this so-called Skanled project was scrapped in April 2009 for economic reasons. The HLG recommends that the project be ‘revitalised’.

The HLG report only mentions the Nord Stream Pipeline once in passing. Although this 1200 km long pipeline from Russia to Germany will lie on the bottom of the Baltic Sea, it seems to have no place in the conception of the Baltic Energy Market Integration Plan.

Major new Baltic energy projects

| Short description | Target timescale | Estimated cost | |

| Natural gas interconnections | |||

| Amber PolLit connects Poland with Lithuania |

Design capacity of 3 bcm/y | 2014 | 292 million |

| Baltic Interconnector offshore pipeline between Finland and Estonia |

Design capacity of 2 bcm/y | N/A | N/A |

| AMBER connects Russia and Germany via the Baltic states and Poland |

Currently posponed | N/A | N/A |

| Yamal-Europe II Doubling of the capacity of the existing Yamal-Europe pipeline (Russia-Belorussia-Poland) |

Currently posponed | N/A | N/A |

| New LNG terminals | |||

| LNG terminal Estonia | Design capacity of 2.5 Bcm/y | 2015 | 480 million |

| LNG terminal Latvia | Not available | N/A | N/A |

|

LNG terminal Lithuania |

Design capacity of 3 Bcm/y | 2012 - 2018 | 270 - 320 million |

| Finngulf LNG (Fi) | Design capacity of 2 – 3 Bcm/y | N/A | N/A |

| Electricity connections | |||

| LitPolLink connects Lithuania to Poland |

400 KV double circuit power line with capacity of 2 x 500 MW | 2009 - 2015 | 261 million |

| Estlink 2 connects Estonia with Finland |

2nd submarine cable with capacity of 650 MW | 2014 | 300 million |

| NordBalt connects Sweden with Lithuania |

HVDC submarine cable with 700 – 1000 MW capacity | N/A | N/A |

| New Generating Capacity | |||

| Oikiluoto 3 (Fi) Nuclear Power Plant | Max. capacity of 1600 MW | 2012 | 3 billion |

| Visaginas (Li) Nuclear Power Plant | Max. capacity of 3400 MW | 2018 | 2.5 - 4 billion |

| Bechatów (Pl) Thermal Power Plant | Lignite fired, max. capacity of 858 MW (with CCS) | 2010 | N/A |

| Agisza (Pl) Thermal Power Plant | Coal fired power plant with capacity of 457 MW |

2009 | N/A |

| Thermal Power Plant Lithuania | Combined Cycle Gas Turbine with capacity of 444 MW | 2012 | 328 million |

| Lubmin (Ge) Thermal Power Plant | Coal fired power plant with capacity of 1600 MW | 2012 | 1.5 billion |

| Kurzeme (La) Thermal Power Plant | Coal and biomass fired power plant with capacity of 400 MW | 2016 | 450 million |

| Riga 2 (La) Thermal Power Plant | Combined Heat & Power Plant with capacity of 420 MW (gas fired) | 2016 | 450 million |

| Planned wind power projects on the Baltic Sea | Total planned capacity of 12450 MW (excluding Germany) | 2020 | N/A |

| Trade | |||

| Electricity Fully functioning integrated market |

Integration of the separated Baltic markets – e.g. Lithuanian Power Exchange and Estlink – with the Nordic market (Nord Pool spot exchange) | 2013 - 2015 | |

| Natural gas Creation of an integrated gas market between Finland and the Baltic states |

Integrated market with market based supply contracts, third party access (TPA) and independent Transport Service Operators (TSOs) | To be followed up | |

More information on this topic can be found on:

http://ec.europa.eu/energy/infrastructure/bemip_en.htm

http://ec.europa.eu/energy/infrastructure/events/2009_11_25_bemip_conference_en.htm

Discussion (0 comments)