Energy transition in Slovakia - solar Klondike and nuclear destiny

on

Energy transition in Slovakia – solar Klondike and nuclear destiny

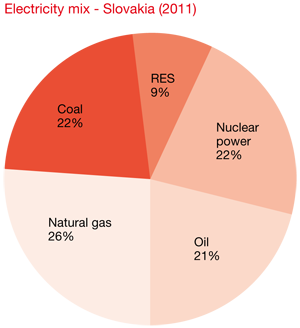

Energy transition in Slovakia seems a bit paradoxical, at least, with regard to environment. By the one single tariff, all electricity consumers support renewables and, at the same time, coal. On the other hand, flexible CCGT are pushed out of the market. Quite generous feed-in prices have provoked a solar boom while deployment of wind farms is currently anecdotal. Another characteristic of the Slovak energy is a strong adherence to nuclear power on its way to reach the autarky in electricity generation.

“Promising” renewables

|

| Slovakian solar power (c) KASKA |

Act No. 309/2009 Coll. on the Promotion of Renewables has introduced attractive support scheme for construction of installations in the form of guaranteed electricity feed-in prices for 15 years. In this respect, Regulatory Office of Network Industries (National Regulatory Authority), set excessively generous feed-in tariffs for electricity from the solar power plants constructed in 2010 - 430 EUR/MWh (up to 100 kW) and 425 EUR/MWh (over 100 kW). Although solar technology was expensive, respective tariffs were more than 7 times higher than at that time real market price of electricity. These conditions, known in advance, had prompted investors to focus on this lucrative business and a solar boom in Slovakia occurred during 2010 and 2011. Despite the fact that later on feed-in prices have been significantly reduced and limited only to PV stations (i) up to 100 kW and (ii) built on the roofs or walls, reality substantially surpassed the estimations. Installed capacity of PV power plants in Slovakia has already exceeded 500 MW, while the NREAP has counted only with the aggregated capacity of 300 MW in 2020 (see Fig. 1).

|

| Fig. 1: Assumed installed capacity of solar and wind power plants in Slovakia source: Ministry of Economy and Construction of the Slovak Republic - National Renewable Energy Action Plan (Slovakia) |

On the other hand, wind energy, progressively developing in other European countries, has been halted in Slovakia. Presently the installed capacity of the Slovak wind farms represents only 3 MW. Why such a negligible figure?

|

| Fig.2: Energy mix of Slovakia in 2011 source: Ministry of Economy of the Slovak Republic - Draft of the Slovak Energy Policy |

However, it seems that Slovakia has learnt its lessons from the initial too generous support scheme and would like to meet its goals in a cost-effective way. With regard to renewables the Draft Energy Policy proposes:

- to move away from feed-in tariffs of electricity produced in solar installations;

- to introduce reverse auction in wind power (if SEPS agrees) and

- to focus on heat generation, especially through promotion of highly effective combined production heat and power (CHP) from biomass (seen as a domestic and predictable source of energy).

Price of energy transition

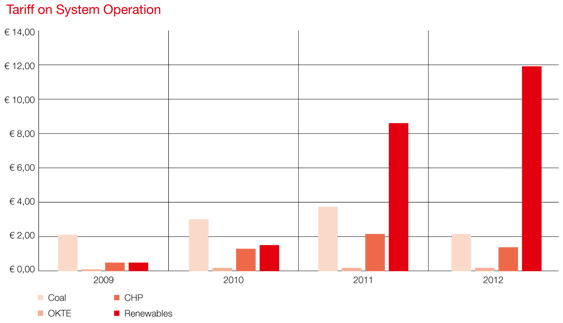

Final electricity price in Slovakia is composed of various parts: a) non-regulated payments: price of commodity and contribution to the National Nuclear Fund [note 2] and b) regulated tariffs for transmission, distribution, supply (in case of households and small enterprises), system services, losses, and system operation (TSO). The fastest growing tariff is TSO (see Fig. 3) which looks a bit controversial, at least, from the environmental point of view. It has been established to support development of renewables, CHP, electricity short-time market operator (OKTE) but also exploitation of non ecological coal.

| Fig. 3: Evolution of the tariff on system operation source: Regulatory Office of Network Industries (Slovakia) |

Because brown coal is a unique domestic energy source, the Slovak Government has approved the preferable purchase of electricity produced from this coal until 2020 (with potential extension to 2035) [note 3]. Its rate varies between 2.25 EUR/MWh and 3.7 EUR/MWh. Nevertheless, the TSO has been mostly affected by solar “Klondike”. It was augmented by 136% from 6.28 EUR/MWh in 2010 to 14.84 EUR/MWh in 2011 mainly due to 417% increase of electricity costs generated from renewables (see Fig. 4). And the TSO could most likely be even higher. In order to maintain the employment in the biggest Slovak steel company, recently prepared amendment of the Act on the Promotion of Renewables assumes financial support to another source of electricity - gases that emerge as a by product in metallurgical production...

|

| Fig. 4: Development of individual parts of tariff on system operation source: Regulatory Office of Network Industries (Slovakia) |

Under these circumstances, not surprisingly, public perception of renewables is negatively affected and its support is pretty low. In this environment, aggravated by the economic crisis, Slovakia started its battle for cheaper energy. Additionally to the declared intention of the Ministry of Finance to impose solar tax having potential retroactive consequence, new investors are also discouraged by lower solar feed-in tariffs for 2014 (99 EUR/MWh). Similarly, the Regulatory Office has introduced a special charge (Generation component) on all electricity producers connected to the Slovak networks which could be discriminatory against their counterparts in other countries. In this respect, DG ENERGY has already addressed the Chairman of the Slovak Regulator with some queries.

Nuclear future

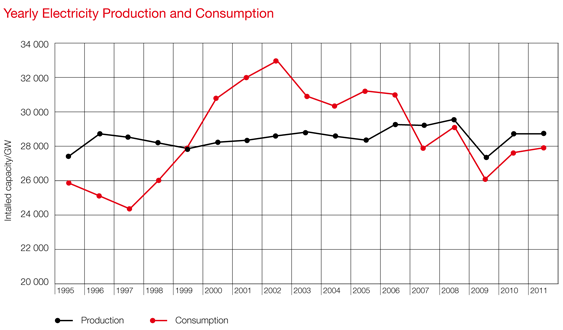

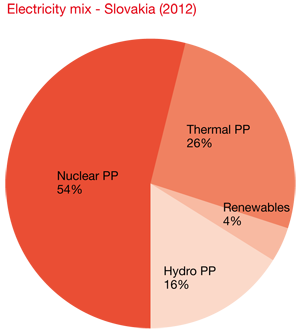

Second pillar of the Slovak energy and its transition to a low carbon economy is nuclear power. This direction has been confirmed by historical experience of Czechoslovakia, present commitments of the Slovak Government and general public support. Shutdown of two reactors of V1 Jaslovské Bohunice (2x440 MW) in 2006 and 2008 due to the Slovak pledge, given in the course of the EU accession negotiations has been seen as premature. As a result the country lost its self sufficiency and became a net importer of electricity (see Fig. 5). Currently, Slovakia operates two units in Mochovce (2x470 MW) and two reactors of V2 in Jaslovské Bohunice (2x505 MW), all of them underwent significant upgrades with regard to capacity and safety.

|

| Fig. 5: Early electricity production and consumption of Slovakia source: Slovak transmission system operator (SEPS) |

The country´s aim - an autarky in the generation of electricity - should be achieved after construction of additional 3rd and 4th unit in Mochovce (2x440 MW). Their commissioning, originally planned for 2012/2013, has been prolonged to 2014/2015 among others due to the EU stress tests. Similarly, the initial budget of this investment already increased from 2.8 billion EUR to 3.8 billion EUR. Certainly, the delay and additional expenses cannot delight the policy-makers because of lower or no dividends in coming years from the investor – Slovenské elektrárne owned by State (34%) and Enel (66%). Therefore, on January 30, 2013, the Slovak Government expressed its serious concern with the current state of the construction.

|

| Fig. 6: Share of sources on electricity production in 2012 (Slovakia) where low-carbon electricity sources stand for 74% source: Ministry of Economy of the Slovak Republic - Draft of the Slovak Energy Policy |

Conclusion

Slovakia, like a responsible student, started its plan to fulfil the climate target with strong enthusiasm. Maybe a bit excessive effort has been converted into quite generous feed-in-tariffs for solar power plants. The following experience has revealed an adverse effect on final electricity prices and security of the grid. In this respect, another renewables (especially wind) will have pretty difficult position to be well established on the Slovak market.

Solar “Klondike” has also affected the public opinion in a way that nuclear energy is a winner. Due to the fact that Slovaks are used to this low-carbon source, it could even benefit from potential support scheme later on. Although, electricity levels in Europe currently don’t create a proper environment for nuclear energy, most probably it doesn’t have to be afraid of its future in Slovakia.

- For instance, EON´s CCGT at Malženice (430 MW) is mothballed and might be relocated soon to more favourable environment of Turkey

- This mandatory payment is determined to cover the decommissioning of nuclear installations and the management of spent fuel and radioactive waste (3 EUR/MWh)

- Arguably, this decision could be endangered by more stringent EU emission standards imposed on large combustion plants as of 2016

Discussion (0 comments)