Europe not ready for unconventional gas, yet

on

Europe not ready for unconventional gas, yet

The stunning development of ‘unconventional gas’ in the United States, has led that country to replace Russia as the world’s largest gas producer last year. Can this happen in Europe as well? Theoretically, yes: the reserves are there. For the moment, however, there are factors that are putting a brake on the development of unconventional gas in Europe: the relatively high population density, a lack of know-how and an experienced service industry, possibly higher exploration and production costs and uncertainties in the regulatory and policy environment. As a result, experts expect only a marginal growth of unconventional gas in Europe in the coming decade. However, after 2020, Europe may come to experience its own unconventional gas revolution.

|

| Shale gas drilling in the Marcellus shale deposit in the northeast of the US |

George Mitchell, who was awarded a Lifetime Achievement Award from the Gas Technology Institute for his achievements recently, was one of the pioneers of the shale gas revolution in the US. Mitchell and others spent many years improving horizontal drilling and hydraulic fracturing technologies which made it possible to produce large amounts of unconventional gas (in particular shale gas) at competitive costs. (See this website for more information on hydraulic fracturing and this link for video demonstrations of these techniques.) The results have been spectacular. The US last year overtook Russia as the largest gas producer in the world. It boasts gas reserves now that will last another 100 years at current production levels and make gas imports unnecessary.

Fully 46% of gas production in the US was from unconventional sources last year – roughly half shale gas and half coalbed methane. It is expected that shale gas alone will be good for 45% of US gas production in 2025.

The American gas revolution not only turned the US market upside down, but had a huge impact on the global gas trade as well. In combination with the economic crisis it led to a gas glut in Europe, which resulted in sharply lower spot market prices. The International Energy Agency (IEA) expects that the oversupply of gas will last till at least 2015. A few years ago no one would have believed this to be possible.

Massive amount

The increase in the production of unconventional gas owes much to the enormous cost reduction that has been achieved by the industry. According to Guy Lewis, Managing Director Exploration & Production at the Gas Technology Institute, which organised the meeting in Amsterdam, ‘of the recoverable reserves in the US, around 60% of the 100 years of supply in the US can be produced for around $5 per Mbtu or less’. And these costs could be lowered by another $1 to S1.50 per Mbtu if shale oil and gas liquids can be developed simultaneously, he added. To compare, average German import prices in 2009 were $8.52 per Mbtu. Prices at the important UK spot market NBP averaged $4.85 per Mbtu. (Source: BP Statistical Review of Energy 2010; Mbtu are million British thermal units, a common standard used in the gas trade.)

Lewis does note however that similar cost levels are not yet feasible in Europe. ‘In the US we have the infrastructure in place, we have the service companies that know that they can go from this job to the next job and on to the next job. All this helps to bring the costs per unit down. Initially in Europe, when you are doing five wells instead of five hundred, the well costs and hence production costs will be higher. The question is: will the costs come down to a level comparable to the US over the next few years as the efforts continue?’

|

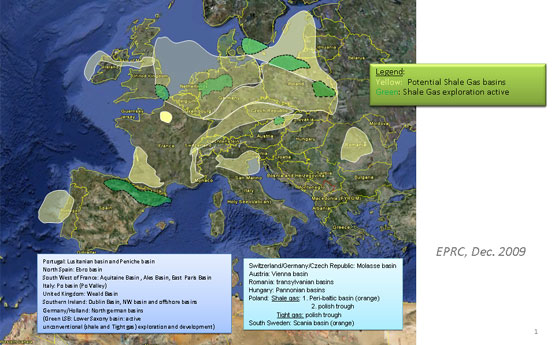

| Prospective regions for unconventional gas development in Europe. Click on the map to enlarge. Source: Schlumberger |

There certainly does not seem to be a lack of unconventional gas resources in Europe. Both the European Commission and the International Energy Agency estimate total recoverable reserves in Europe at between 33 to 38 trillion cubic metres (Tcm), of which 12 Tcm is tight gas, 15 Tcm shale gas and 8 Tcm coalbed methane. This is a massive amount – in theory enough to meet European demand for 60 years at pre-crisis levels. The authoritative BP Statistical Review of World Energy reports total proven conventional gas reserves in the EU at 2.42 Tcm. And the unconventional resources are not concentrated in one region. Although Poland and the Baltic States seem to be the most promising regions, almost everywhere in Europe there are prospects for developing unconventional gas (See the accompanying map above). In other words, many European countries have the opportunity to significantly raise their domestic gas production.

Geologic structures

Nevertheless, none of the experts at the meeting in Amsterdam expected unconventional gas reserves to make Europe less dependent on imports in the short term. Most predicted that it will take until 2020 at least before the first commercial production of unconventional gas in Europe will take off. There are a number of significant differences between the situation in the US and in Europe that form a barrier to the successful and rapid development of an unconventional gas industry in Europe.

To begin with there is still a considerable lack of knowledge in Europe about its unconventional gas resources: where they are, at what depths, in what geologic formations. Lewis points out that the numbers put forward by the European Commission and the IEA are in fact quite dated and only based on rough estimates. ‘A lot of the reserve estimates come from studies that were done in the late 1990s. One of the key things that has to happen up front now is to get a better assessment of the potential. Because we all realise that even where there are assessments from the past, they are all very top down and we need bottom up assessments that take a look at the rock properties and some of the specifics of the geologic structures.’

Up to now there has only been only very marginal testing in Europe. In Poland for example, where the first shale plays in Europe are expected to be developed, several wells were drilled with local and not very suitable equipment, resulting in rather poor data. And shale gas is a very complex resource. Reservoirs have very different characteristics. Techniques that can be applied successfully in one area do not necessarily work elsewhere. According to Lewis, a good example of this is what happened at the Mako reservoir in Hungary. At this field, with estimated reserves of around 600 Bcm, the Hungarian company Mol, ExxonMobil and Falcon drilled several testing wells, but then both Mol and ExxonMobil chose to suspend their license. ‘Mako is a good indication that what we collectively call unconventional gas in fact includes resources that are variable in nature. They are not all the same. Activities that might work in the Barnett shale in Texas, might not work elsewhere. Not elsewhere in Europe, but not even elsewhere in the US. Each resource therefore typically needs some adaptation in technology and approach to make it work for that resource and I think that is what they found in Hungary. The resource there perhaps is not quite as mature as the resource in the US so something else might be needed to get that field developed.

Surface footprint

|

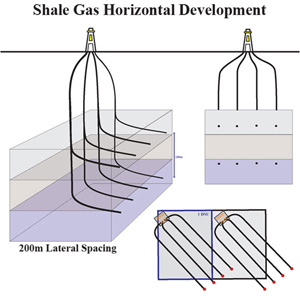

| Increasing the number of laterals per well significantly increases the underground acreage that can be developed per well |

The arrangements in Europe are different. Here landowners do not profit from the drilling activities on their land, but they do experience the nuisance from them and the risks associated with gas drilling. In other words, it is important that the local population somehow or other benefits from the activities, for example through the creation of new jobs. According to Lewis, the sector in the US has created 340,000 jobs and results in additional economic benefits as well.

Europe has another disadvantage in that many prospective regions are more densely populated than in the US. This is a problem because the so-called surface footprint of unconventional gas is hardly insignificant. In the Barnett shale gas area in Texas there are on average 12 wellheads per square kilometre. This would not be possible in the densely populated regions in Europe. One company that is experiencing this problem is I-Gas in the UK, which is active around cities like Leeds and Wolverhampton. Andrew Austin, CEO of I-Gas, says that his company has had to reduce its reserves from 240 Bcm to 17 Bcm as a result of the limited access it has to its reserves, despite a well thought-out land purchasing policy, which it took over from the telecom sector.

According to Lewis there have been projects in the US that faced the same problems. ‘In the US they have also been drilling wells in Dallas and Pittsburgh. And these are densely populated areas too. They do it in a way that minimizes the impact on the direct environment, but there is also a process proceeding this and that is the education of the community. To get people comfortable with the idea of it. Especially in Pittsburgh, where they haven’t been used to drilling activities as they were in Texas. There are lots of parallels with this Pennsylvanian example with what Europe will have to deal with.’

Technological progress could help here. New technologies make it possible to drill more and longer horizontal laterals from one wellhead (see the illustration above). Lewis says that these technologies make the prospects for unconventional gas look much better in Europe. ‘This way the industry can minimize the surface impact, because they can minimize the number of wells they have to drill to access lots of acreage underground. This makes a big difference in costs, but most importantly a big difference in public opinion.’

Market structures

The lack of a complementary service industry in Europe and of suitable drilling rigs is another bottleneck. This, however, may be a chicken-and-egg issue. When the opportunities arise, the industry will no doubt respond. Nevertheless, initial production costs in Europe may be much higher because of this.

Jan Rune Schøpp, Vice-president of Natural Gas Strategy and Analysis at Statoil, points to another factor that may lead to higher production costs in Europe compared to the US. ‘Keeping the costs low will be even more challenging in Europe, given that in Europe you do not have the vast geological plays that you have in the US. The prospective production areas are more scattered in Europe.’

|

| In the US they have also been drilling in densely populated areas, like here in Forth Worth (Texas) |

With this last point Schøpp touches on yet another major difference between the US and Europe: their respective market structures. He says that the extent to which the liberalisation process in Europe succeeds, will have a major impact on the development of unconventional gas. ‘You will need to have a deregulated market, where companies can get fair and undiscriminatory access to trading hubs, to transportation from the hub (where they have bought the gas) and in which they are free to deliver to any customer they want. And it is important to have that liberalisation going and to have it completed, because this is not the case yet. It has started and there is progress with which we are somewhat happy, but there still is a long way to go to make the European gas market more transparent and more liquid. This would be one of the preconditions for unconventional gas to take off.’

Lewis sees another problem in the way in which the European gas market is organised. ‘One thing that is going to be an issue is that you have got a lot of long-term contracts. If a new source of gas finds its way into the market that does not have a place to go and the imports – whether LNG or pipeline imports – are under long-term contracts, all the new gas is going to do is to depress the spot price for the little spot trade that is there. In this case the gas will have big trouble in finding its way.’

Schøpp and Lewis both emphasize that European policymakers should give much more priority to the position of gas in the fuel mix. This is not only important for the development of unconventional gas, but also for conventional gas. Natural gas as the cleanest of the fossil fuels, with its high flexibility, is ideal to be used as backup for renewable energies, and it should get more credit for these properties, the two experts argue. Schøpp: ‘I think it is extremely important that the EU includes a vision of increased gas use in the policy documents. It seems that they don’t really believe that gas can contribute as much in the energy mix as it really can. And I think this is an issue, because investment need to be done in the sector, whether it is in unconventional or conventional. And for the investors to have a stable policy to follow when these investments have to be done is a prerequisite in my opinion.’

Discussion (0 comments)