Finally, the plan for the CCS revolution

on

Study reveals how to build a CO2 transport system for Europe

Finally, the plan for the CCS revolution

European plans for CCS (carbon capture and storage) will require a network of 22,000 kilometres of CO2-pipelines to be built across Europe. The construction of this network, which will be able to transport 1200 million tons of CO2 per year by 2050, will cost some €50 billion. This is concluded by an international consortium of companies and research institutions, CO2Europipe, that has conducted a unique in-depth study to find out what it takes to build a European-wide CO2 transport network. According to CO2Europipe, the most important challenge lies in coordinating all the many activities the complex project requires. For this reason it recommends that a small "vanguard" of nations (UK, Germany, Norway, the Netherlands and Poland) take the lead and develop a Master Plan in collaboration with the European Commission.In an interview with EER, Stijn Santen, one of the authors of the report, calls on policymakers to come forward and support CCS. 'Without CCS, fighting climate change will be much more expensive.'

|

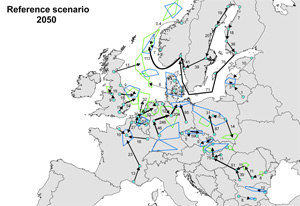

| CO2Europipe's vision of the CO2-pipeline network in Europe in 2050 (source: see here.) |

Santen is one of the authors of a large EU-funded study that has just been completed by an international group of institutions and companies active in CCS, including Vattenfall, Gasunie, Siemens, RWE and EON. The study looks at what is needed to build a transport infrastructure for large-scale CCS in Europe. At this moment, says Santen – who was responsible for the development of the first CO2 pipeline in the Netherlands near Rotterdam when he worked for Shell some years ago – all eyes are focused on the demonstration CCS-projects that are being carried out at coal-fired power stations in various European countries.

But, says Santen, after this phase has been completed, around 2020, the “real” large-scale CCS-projects will get started – and then the problem of how to transport the much larger amounts of captured CO2 will present itself. Or rather, he says, the transport problem should have been solved by then. ‘By that time, the infrastructure should be in place or the whole programmewill be seriously delayed. And as it can take up to eight years to plan and build a CO2-pipeline, this means we have to start now.’

Master plan

As the study of the CO2Europipe consortium makes clear, building the pipelines that are needed to transport the huge volumes of CO2 that are expected to be captured (some 400 million tons per year in

| The technical challenges are the easiest part |

For this reason, one of the most pertinent recommendations CO2Europipe gives is for the European Commission and Member States to make a European Master Plan, which would have to be aligned with national plans, and which would set out in detail the steps that will be taken to build the CO2-transport network. ‘A European Master Plan, in combination with national plans, will give all stakeholders the possibility to adjust their own activities to it. And it will give investors confidence to invest in the project’, says Santen. He notes that the intricate gas transport infrastructure that was built in record time in the Netherlands in the 1960swas strongly centrally coordinated. ‘You need this kind of coordination, or you won’t get the necessary investments.’

Key players

What makes the building of a European CO2 pipeline network so complex is that there are a lot of different stakeholders involved – storage operators, power companies, gas transport companies – who all have different concerns and timetables. At the same time, their interests and activities have to be

| What makes the building of a European CO2 pipeline network so complex is that there are a lot of different stakeholders involved |

For this reason, to make the project more manageable, the report recommends that a small group of countries, that have the most to gain from CCS, take the initiative in getting the pipeline projects started. The ‘key players’, according to the report, are Germany and Poland, with their large coal-fired power sectors, and Norway, the UK and The Netherlands, which have extensive gas activities as well as storage capacity. The CO2Europipe study has been limited in any case to North Western and Eastern Europe; South West and Southern Europe were not included.

In principle, Europe has more than enough storage capacity, the report notes. By 2050 the cumulative stored amount of CO2 will be 18 Gigatons (18 billion tons), whereas the estimated available storage capacity is in the order of 300 Gigatons. Some 13 to 25% of the gas field capacity will have been filled

| Europe has more than enough storage capacity |

Business model

|

| Vattenfall Carbon capture and storage facility in Schwarze pumpe, Germany (photo: Vattenfall) |

In the common carrier model, transport contracts would be separated from commodity contracts.Network owners and operators would get ‘a guaranteedreturn on their investments from emitters based on transport fees that are independent of CO2 value and CO2 prices.’ This is essentially how existing gas and power infrastructure companies work, says Santen.

The researchers have analysed the financial results of gas and power infrastructure companies and conclude that they manage to realize ‘attractive returns’ (on average above 15% return on equity and net profit margins between 20 and 30%). The difference of course is that the market for CO2 is an artificial one: it has to be created by government mandate. At this moment, it is the market price for CO2 emissions generated by the EU’s Emission Trading Scheme (ETS) which is supposed to finance CCS, but, as everyone knows, this price is much too low. ‘There is no CCS business case to be made on the basis of current CO2 prices’, says Santen. ‘Additional, ongoing support from the EU and national governments is required.’

Political commitment

In fact, says Santen, government support should not be confined to financial schemes – across-the-board political commitment is crucial to the success of the entire project. ‘For investors’, he says, ‘the biggest risk is the political risk. There will have to be very strong guarantees they will be adequately paid for their efforts. This cannot be dependent on the political mood of the day.’

This commitment will have to come both from the EU and from national governments. Santen is particularly concerned about the latter. ‘At the European level, I see continuing and consistent support. But without clear national commitments, e.g. from the German government, CCS will not

| The biggest risk is the political risk |

Santen notes that for some European countries there are large economic interests at stake. ‘In The Netherlands fossil fuel activities generate huge public revenues: roughly €40 billion a year in all. This is very important to the national economy and to energy security, quite apart from the climate issue. The same goes for countries like Germany and Poland. You cannot expect Poland to close its coal mines just like the Dutchare not going to close down their gas fields. If you want to secure this source of income and wealth, and want to fight climate change, you have to do CCS. Some people think you can do with it renewables only. Germany for example invests heavily in solar and wind power. That’s important, but it won’t be enough, especially now they have decided to phase out nuclear power.’

|

Some more highlights from the CO2Europipe report

|

|

CO2Europipe Project Within the framework of the collaborative project CO2Europipe over a dozen different studies have been prepared that underlie the Summary Report 'Towards a transport infrastructure for large-scale CCSin Europe'. The Summary report can be found by clicking here. The project was funded by the EU. The CO2Europipe consortium consists of the following members: TNO (Institute for Applied Scientific Research), The Netherlands (project coordinator) |

|

More on CCS These are some of the major articles we published about CCS on European Energy Review: The case against CCS by Peter Droege and Matthew Ulterino To get an exhaustive overview of our coverage, click on Files on the Homepage, select the option Search Files, and select "carbon capture and storage" under themes. |

Discussion (0 comments)