Germany leads spectacular growth in European gas storage capacity

on

PwC study:

Germany leads spectacular growth in European gas storage capacity

The liberalisation of gas markets and the increasing dependence on foreign sources of gas supply are shaking up the European gas storage market. Gas storage capacity in western Europe is expected to grow by some 75% in the coming decade. The most dynamic market, Germany, offers some important lessons for the rest of Europe.

|

| Worker at the gas storage facility in Rheden, Germany. Photo: Wintershall |

| Article Hightlights: |

|

- The demand for gas storage capacity in the EU is growing, as a result of increased import dependence and other factors. |

- Increased imports of gas from outside Western Europe, in particular from the Middle East, North Africa and Russia.

- Heightened concern regarding security and liquidity of supply.

- The popularity of gas-fired power stations (in particular combined cycle gas turbines) in recent years, which is driving overall gas demand.

- A more liberal regulatory environment for gas storage than for other types of assets such as transmission and distribution networks.

- The initiative by the European Commission to create one single European gas market, which has created increased liquidity at certain gas trading hubs, leading to a higher demand for short term gas storage capacity.

In particular the rising demand for gas and growing dependence on imports has made the availability of both seasonal and peak-time flexibility a crucial factor in European gas markets. Most market participants opt for underground gas storage (in addition to swing supply contracts) to acquire sufficient flexibility in their gas portfolio. In the past, access to storage was mainly limited to the major gas players, who controlled most of the storage sites within their vertically integrated companies. With the liberalisation of the European energy markets, access has become available to a much larger number of market participants. This has led to substantial new investments in existing sites and new storage projects. Although some of the projects have been put on hold as a result of the financial downturn, market players expect that the growth of new capacity will continue until 2025.

Regulatory initiatives

With the introduction of the Guidelines for Good Third Party Access Practice for Storage System Operators (GGPSSO), the EU regulatory authorities helped to create an efficient, non-discriminatory and transparent access to storage capacities. The Guidelines, which were developed through an extensive public consultation process, set out the minimum requirements for the provision of fair and non-discriminatory access to storage facilities and services in line with Gas Directive 2003/55/EC. Although the GGPSSO principles as such are not legally binding, they have been widely accepted in the industry and the EU member states as common practice. Countries are encouraged to adjust existing national regulation of storages to the GGPSSO and to adopt one of two approved storage access regimes:

- negotiated third party access (TPA), implemented by e.g. Germany, Austria, The Netherlands, France and the UK, or

- regulated TPA, adopted by e.g. Belgium, Hungary, Italy and Spain.

Although all EU member countries have made a serious effort to align their national legislation to the GGPSSO, progress to date varies. While some countries, such as Germany, the Netherlands and the UK, are more or less fully in compliance with the guidelines, there is still potential for improvement in

| As a result of increased competition, storage fees are already coming under pressure |

Both negotiated and regulated TPA can provide the right incentives for storage operators and investors. This is evidenced by the fact that countries with diverse regimes, such as Germany, Italy, Spain and the UK, all have impressive track records over the last years when it comes to storage investments.

Investments

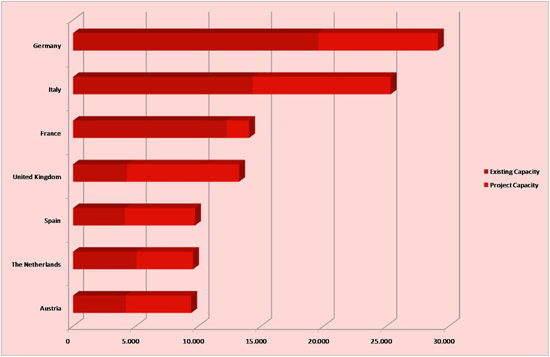

As of February 2009, total gas storage capacity in Western Europe was approximately 66 bcm (billion cubic metres). A further 59 bcm of new capacity is currently being planned and expected to become operational between 2015 and 2025 (Source: GSE Investment Database, 2009).

Germany has the largest storage market in Europe. More than €300 million per year will be spent on new storage capacity in the coming years, resulting in an increase of 40% from currently 20 bcm to 28 bcm between 2015 and 2025. Other countries such as Italy and the UK show similar trends:

- Italy is expected to add 11 bcm to its existing capacity of 14 bcm, an increase of 79%

- The United Kingdom will triple its capacity by 2020 to 13.5 bcm

- Austria is planning to double its capacity to almost 10 bcm

- Spain has plans to expand capacity from 4 bcm to 9 bcm

- Storage capacity in the Netherlands is expected to grow by 4.5 bcm to over 8 bcm

Figure 1: Existing and planned storage capacity (mcm) in selected Western European countries, Germany leads, followed by Italy, France, The United Kingdom, Spain, The Netherlands and Austria. SOURCE: Gas Storage Europe Database, June 2009; PwC research

Although the majority of new capacity will not become operational before 2015, the impact of the planned expansion on current storage tariffs is already visible. As the marketing of the new capacity has already started, planned capacity has already begun to compete with existing capacities in terms of long term contracts and storage service fees. Market experts believe that the sharp increase in storage capacity across Western Europe could result in a temporary oversupply situation, triggering a downward trend for storage service fees.

We have recently analysed developments in the German gas storage market. As Germany is one of the largest and most attractive markets for storage investments in Europe, developments in this country could well be an indicator for future trends in other European markets.

German market

Germany has always been a net gas importer. Over the last 40 years Germany has developed reasonable base load and peak load storage capacities to support a continuous gas flow to ensure security of supply. (Base load storage provides seasonal and long-term flexibility. Such reservoirs are usually large in order to provide a steady supply of natural gas. Depleted gas fields and aquifer structures are the most common type of base load storage. Peak load storage, for which salt caverns are most commonly sued, is designed to have high delivery and injection capacities for short periods of time and to insure quick access to meet short-term increases in demand.)

|

| E.on gas storage in upper Bavaria, Germany |

Structural players such as utilities are keen to get their hands on seasonal storage to manage their supply and sales portfolios as well as their public supply obligations efficiently. Traders tend to focus more on peak load storage to be able to benefit from arbitrage opportunities in Germany and its surrounding markets. Due to geological reasons the majority of peak load storages are concentrated in North West Germany which links them to two of the most liquid hubs in Europe, namely TTF (The Netherlands) and Zeebrugge (Belgium).

In the past access to storage was mainly limited to the supply or sales department of vertically integrated companies such as Eon, Wingas, RWE, GdF and VNG to support the management of their supply portfolios to ensure Germany’s security of supply. Since the beginning of the liberalisation of the German gas market in 2005 a reasonable number of new market participants have entered the market successfully, resulting in increased market volatility and higher demand for gas storage. At the same time Germany’s regulatory authorities started to monitor the storage market more closely to make it comply with the principles outlined in the GGPSSO to ensure non-discriminatory and transparent allocation of available storage capacity. As a result, primary storage capacities are now increasingly allocated to third parties and a secondary market has been established using auctions to market non-interruptible and interruptible storage capacity.

Under pressure

In Germany, storage tariffs and the design of individual storage products have not been subject to intensive regulation but they are closely monitored by the regulatory authorities. Storage operators enjoy a reasonable amount of freedom in terms of the design of the related products and the underlying pricing methodology for the storage tariffs if the storage operator can demonstrate that products, tariffs and contract terms are in compliance with the principles of the GGPSSO.

Recent market signals show that as a result of the increased storage-to-storage competition in Germany, storage tariffs are already coming under pressure. Both the planned new project capacities and the increasing cross-border competition are putting pressure on tariffs. A number of storage operators have already lowered tariffs in order not to lose customers to new storage projects or international players.

Apart from lowering tariffs, many companies also try to adapt to the new market conditions by offering more attractive products or services. In the past years, most operators have decided to offer “unbundled” capacities (i.e. working gas and withdrawal capacity without a firm ratio between each other) in addition to the standard “bundled” units. While this was unusual some years ago, today it is offered by virtually every operator. This is a great advantage for many clients, as it allows them to adjust the ratio between working gas and withdrawal according to their specific needs.

Wingas and Eon Gas Storage, two of the largest German storage system operators, have been the first to offer two totally different “standard bundled units” at one single storage site, thus trying to address several target groups with the same facility. Similarly, GdF’s subsidiary Storengy and German EWE have just marketed their projected new capacity starting in 2015 and 2013 respectively by offering both seasonal and trading products.

Thus, as newcomers enter the market and boost storage capacity, we see that traditional players are beginning to respond and an increasingly competitive market is forming in Germany.

What can we expect of future market developments? The increase in storage capacity might result in a period of oversupply in Germany and neighbouring markets. However, demand patterns are also likely to change. While we have seen a sharp increase in demand for peak load capacity over the last years

| Further regulation could create uncertainty for storage system operators and investors |

With base load tariffs likely to remain flat and peak load storage to drop at least partially we believe operators are likely to respond by offering more specialized products to stop another round of tariff lowering, as we have seen in Germany. Similar trends may be expected to spread to neighbouring markets.

Counterproductive

A strong call has been made recently for further regulation of storage assets on a European level. The decision to increase regulation on storage assets should not be taken light-heartedly, however. Although the current regime is not yet perfect, Germany and other markets show that it is sound and fit for its purposes. It creates a balanced incentive scheme which

- encourages storage investments when needed through a stable, investor-friendly environment,

- increases competition and market liquidity (e.g. in the form of secondary trading)

- maintains non-discriminatory and transparent access to storage assets

Further regulation could create uncertainty for storage system operators and investors. In this time of financial crisis, when funding large projects has become a major difficulty in many countries and substantial investments in assets and infrastructure are being delayed or put on hold, it is all the more important to offer a stable and reliable legal framework and reduce uncertainty to a minimum so as not to scare away investors.

| Reinhard Rümler (reinhard.ruemler@de.pwc.com) is Senior Manager in the energy team at PwC Advisory Utilities & Regulation in Düsseldorf. Robert Senger (robert.senger@de.pwc.com) works as a Consultant in the energy team at PwC Advisory Utilities & Regulation in Düsseldorf. Stefan Tenner (stefan.tenner@de.pwc.com) is Manager in the PricewaterhouseCoopers energy team based in Düsseldorf/Germany. |

Discussion (0 comments)