In a stark message to gas producers and governments last week, the International Energy Agency (IEA) set out seven golden rules which it believes are essential to granting gas producers "a social licence to operate". The IEA's chief economist Fatih Birol estimates that applying the agency's "golden rules" to the drilling of unconventional gas wel...

Golden age of gas comes at a price

By Alex Forbes

In a stark message to gas producers and governments last week, the International Energy Agency (IEA) set out seven golden rules which it believes are essential to granting gas producers "a social licence to operate". The IEA's chief economist Fatih Birol estimates that applying the agency's "golden rules" to the drilling of unconventional gas wells will increase production costs by around 7%. There could also be a price in terms of climate change. In a world awash with cheap gas, Birol fears that governments may be tempted to eliminate much-needed subsidies for renewable energy technologies. The ideal energy mix is probably some combination of renewables with gas and carbon capture and storage, says Birol.

|

| Clear message in the streets of Brighton (c) Alex Forbes |

Why has the IEA chosen now to issue these "golden rules for a golden age of gas"?

We said almost four years ago that we were going to see a silent revolution in the natural gas market, starting in the United States. That silent revolution has become rather loud. Last year we published a report that posed the question "Are we entering a golden age of gas?", looking at what the drivers of such a golden age might be. We put that question mark in because we thought that the environmental and the social implications of shale gas production could end up blocking progress to a golden age.

This year we have analysed the rules that the companies will have to follow to minimise - if not nullify - the social and market implications. What would this mean? How much would it cost? And what needs to be done by governments, by companies, and by the public?

In any case, we have also said that even a golden age of gas doesn't mean that we are going to reach a 2 degrees trajectory [in global warming].

The G8 has expressed an interest in your "golden rules" work. How did that come about?

At their recent meeting in Camp David the G8 countries said that they commended the book, that they would be reviewing it, and that best practices in line with the golden rules are to be shared by developed and developing countries.

As you say, what began as a silent revolution has become very loud - even in my home city here in the UK. On my way in today there was a big poster at Brighton station from an organisation called frack-off.org, protesting at the use of hydraulic fracturing to extract natural gas from shale rock. The pressure against the use of hydraulic fracturinghas grown enormously, in North America and here in Europe. Isn't it a little too late to introduce golden rules? Isn't the reputation of unconventional gas already so tarnished that it will be difficult to reverse the trend?

That's a very good question. The concerns of the public are in many cases legitimate - in terms of water

| "The concerns of the public are in many cases legitimate - in terms of water contamination, air pollution, flaring, noise, trucks and so on" |

contamination, air pollution, flaring, noise, trucks and so on. These activities all started in the US but there is the possibility that the activity will increase and accelerate strongly in the US and will be replicated by many other countries. So we thought "better now than never" to come up with these suggestions. Of course it is up to governments, companies and others to take them up or not.

One has to look, of course,at energy security issues,environmental issues and macroeconomic issues. But we must also consider this from the point of view of the citizens, the local communities.

You have said today that there is a danger that the golden age of gas could threaten the policies that governments have put in place to support renewables. How big a danger is that? Today the growth of renewables is mainly driven by government subsidies. There are about $60 billion worth of government subsidies, about half of this in Europe, and in most cases these subsidies are well justified. However, if gas prices are cheap - which we assume they will be in a golden rules context - that may give wrong ideas to governments to eliminate those subsidies. This could lead to major consequences for the renewables industry, which would be bad news for climate change.

You have stressed that what you're presenting today are scenarios for a golden age of gas, not a golden age of climate. There has to be an ideal mix of policies. What would that ideal mix be? Is that something you will cover in your forthcoming World Energy Outlook (WEO)?

Yes. This year's WEO will again contain a 2 degrees trajectory. In that trajectory we think that gas,among other fuels, needs to replace coal and that a CCS (carbon capture and storage) and gas combination is needed. We will come up with our proposed energy mix.

It's difficult to see CCS technology becoming economic. Do you see CCS working better with gas than with coal?

It can work in both cases but when I look today at the gas industry and the coal industry I see more

| "When I look today at the gas industry and the coal industry I see more appetite in the gas industry to make use of CCS" |

appetite in the gas industry to make use of CCS. But this doesn't necessarily mean that we will see a lot of CCS built with gas. In both cases there are major difficulties in achieving significant penetration of CCS - looking at the economics, looking at regulation, looking atthe other issues.

You've said that the golden rules will probably increase the costs of drilling unconventional gas wells by around 7%. What kind of feedback have you had, or expect, from the producers?

I hope that they take our suggestions seriously. The book has been peer reviewed by many companies - including oil service companies and gas service companies - and our numbers found generally plausible.

If the companies ignore the legitimate concerns of the public they will be shooting themselves in the foot.

|

Shale gas: from anarchy to "golden years" - but the climate challenge remains

If the unconventional gas revolution that started in the US can be replicated worldwide, the result would be a future of abundant supply, low prices and considerable economic benefits. But this can only be done if the industry adheres to strict environmental rules. Otherwise widespread social and environmental objections are like to slow the growth of unconventional gas, or even "halt it in its tracks", says the International Energy Agency.

It is appropriate that the rapid growth of unconventional gas production began in the American states of Texas and Louisiana - "the Wild West". Because of the way the industry grew in the years following the turn of the millennium, it began as what many have described as a "silent revolution". It was not until around 2007/08 that the aggregate effects of numerous relatively small developments began to add up to a surprising - even shocking - trend, now regarded as one of the great energy developments of our time.

In those early days the independent, relatively small, gas producers that were driving the revolution in the Wild West largely escaped the notice of regulators and governments. Some companies were clearly not as careful with the various techniques used to develop these new gas sources as they should have been. It was an anarchic time, which led to a proliferation of incidents that caused major concerns for local communities and environmental regulators.

Even today regulators and governments are struggling to rein in the industry, not least because they face a dilemma. Concerns that the techniques being used to drive the revolution - such as hydraulic fracturing or "fracking" - could contaminate water supplies or cause earthquakes are real and legitimate. On the other hand, the economic benefits of an abundance of cheap gas are helping to pull the United States out of the economic mire - and no-one wants to be accused of getting in the way of that.

It is to address this dilemma that the International Energy Agency has been analysing what measures are necessary to address social and environmental concerns so that the economic benefits of the unconventional gas revolution can be realised. Its conclusions were announced in London last week with the launch of a report entitled "Golden Rules for a Golden Age of Gas" - a follow-up to a report the agency published a year ago posing the question "Are We Entering a Golden Age of Gas?"

Seven golden rules

The over-arching message of last week's report, as expressed by the agency's executive director, Maria van der Hoeven, is that: "The technology and the know-how already exist for unconventional gas to be produced in an environmentally acceptable way." In other words, the potential for a golden age of gas is real.

However, she warns that: "If the social and environmental impacts are not addressed properly, there is a very real possibility that public opposition to drilling for shale gas and other types of unconventional gas will halt the unconventional gas revolution in its tracks."

Public opposition is widespread and growing. It has quickly spread from North America to Europe and a number of countries have already banned some of the techniques used to extract unconventional gas. The IEA hopes that this trend can be reversed if gas producers, governments and other stakeholders implement seven "golden rules" that it has formulated.

Fatih Birol, the IEA's chief economist and lead author of the golden rules report, concedes that following these rules would increase the cost of drilling wells. However, he argues that the increase is relatively small in the case of a single well - around 7% - and that this number could be reduced in a development with multiple wells, as investment in measures to reduce environmental impacts may in many cases be offset by lower operating costs. "For example," he says, "instead of using trucks to bring in water, a well designed pipeline system to get water in might require some significant investment to begin with but the return would be very positive."

So what are the IEA's seven golden rules?

- The first is to measure, disclose & engage. This is about engaging with local communities and reassuring them, ensuring that each phase of a development is well understood, and that concerns are listened to. The IEA suggests that producers should establish baselines for key environmental indicators, such as groundwater quality, before starting work, and monitor and publish data during operations. Disclosure of fracturing fluid additives and volumes should be mandatory. And communities should feel economic benefits from developments happening on their own doorsteps.

- The second is to watch where you drill. Well sites should be chosen to minimise impacts on the local community, heritage, existing land use, individual livelihoods and ecology. The geology should be properly surveyed so that "smart decisions" can be made about where to drill and hydraulically fracture, so as to minimise the risks of earthquakes and of fluids passing between geological strata.

- The third is to isolate wells and prevent leaks. This is about having in place robust rules on well design, construction, cementing and integrity testing, "as part of a general performance standard that gas bearing formations must be completely isolated from other strata penetrated by the well, in particular freshwater aquifers". The IEA suggests that minimum-depth limitations be imposed on fracking to underpin public confidence in water quality. Producers should ensure that waste fluids and solids are disposed of properly.

- The fourth is to treat water responsibly. This is about reducing the burden on local water resources by improving operational efficiency and re-using or recycling wherever possible. Use of chemical additives should be minimised and benign alternatives used where possible.

- The fifth is to eliminate venting and minimise flaring and other emissions. There should be in place a target of zero venting of natural gas and minimal flaring during well completion and operations to reduce greenhouse gas emissions. Air pollution from vehicles and equipment should also be minimised.

- The sixth is be ready to think big. In other words, seek opportunities for economies of scale and co-ordinated development of local infrastructure to reduce environmental impacts, while taking into account the cumulative and regional effects on the environment of multiple drilling and delivery activities.

- The seventh is to ensure a consistently high level of environmental performance. This is aimed primarily at governments and regulators who should ensure that sufficient resources and political backing are in place for robust regulatory regimes. The IEA advises that an appropriate balance is found "between prescriptive regulation and performance-based regulation in order to guarantee high operational standards while also promoting innovation and technological improvement". Emergency response plans should be robust and match the scale of risk.

Climate change

The IEA believes that successful implementation of its rules would create the right conditions for a golden age of gas and has built a scenario to examine what such a future might look like.

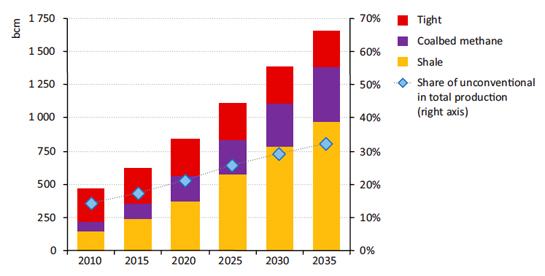

In this trajectory, known as the "Golden Rules Case", world production of unconventional gas more than triples between 2010 and 2035 to 1.6 Tcm (trillion cubic metres) per year. The US becomes a significant player in international gas markets, while China emerges as a major producer. New supply sources help to keep prices down, stimulate investment and job creation in countries rich in unconventional resources, and generate faster growth in global gas demand, which rises by more than 50% between 2010 and 2035.

Conversely, the IEA has examined what the future might look like without golden gas rules in place. In this trajectory, called "the Low Unconventional case", a lack of public acceptance means that unconventional gas production rises only slightly above current levels by 2035. Lower availability and higher prices reduce the competitive position of gas in the fuel mix, so that its share barely rises. Energy-related carbon dioxide emissions are 1.3% higher than in the Golden Rules Case.

Unfortunately for policymakers, the IEA stresses that neither scenario is sufficient to deal with one of the great preoccupations of our time: the need to do all we can to keep greenhouse gas emissions within limits that will achieve the globally agreed goal of limiting the rise in temperature to 2 degrees Celsius above pre-industrial levels.

The golden rules, if implemented as the IEA hopes, may lead to a golden age of gas - but a lot more needs to be done, and soon, if human kind is to successfully address the issue of climate change. That will be a central theme of the IEA's 2012 World Energy Outlook, which will be published on the 12th of November. |

|

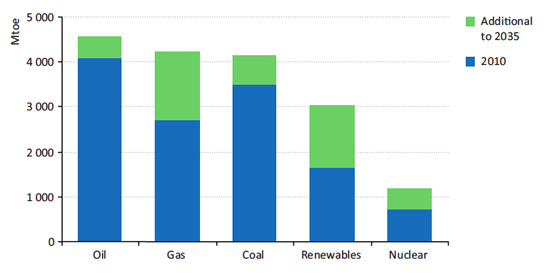

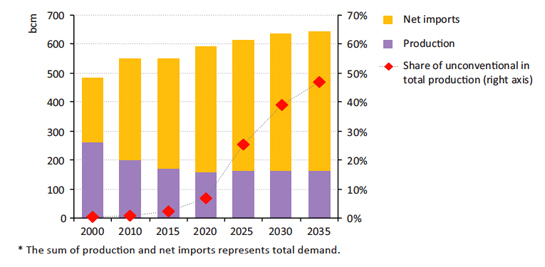

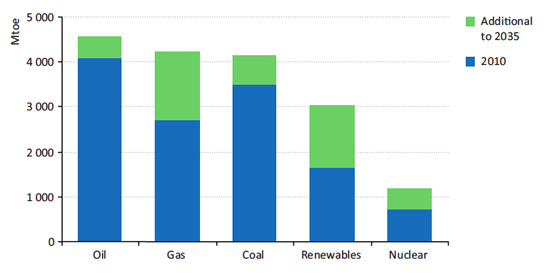

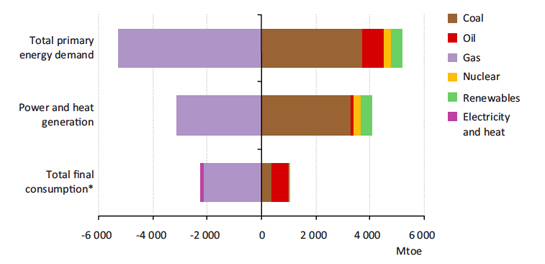

Chart 1 - World primary energy demand by fuel in a golden gas age

In the IEA's Golden Rules Case, demand for natural gas grows by as much as demand for oil, coal and nuclear combined, driven by abundant supply and low prices. This leads to gas becoming the second-largest component of the primary energy mix by 2035.

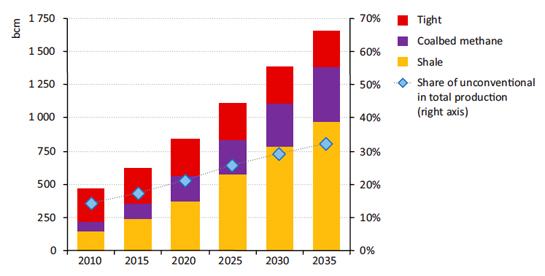

Chart 2 - Unconventional natural gas production by type in the Golden Rules Case

In the Golden Rules Case the share of unconventional gas in total production rises from 14% of the total in 2010 to 32% in 2035. Tight gas is rapidly overtaken by shale gas, which rises to almost 60% of the total, while coal-bed methane also grows, though not as rapidly.

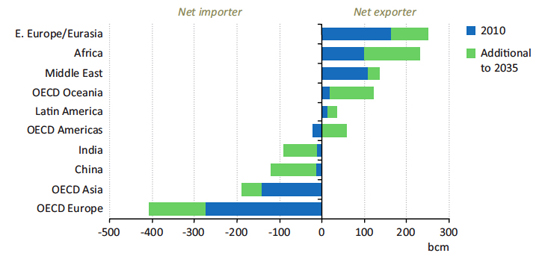

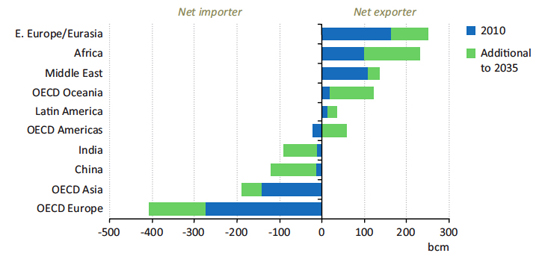

Chart 3 - Natural gas net trade by major region in the Golden Rules Case

In the Golden Rules Case, rising unconventional gas output in China and the United States has major impacts on gas markets and security. Growth in China’s import needs slows down, while North America’s exports grow. These developments would together increase the volume of gas looking for markets after 2020 – particularly LNG.

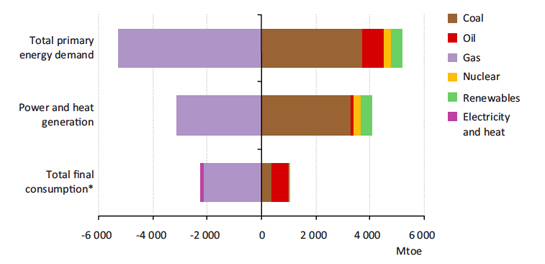

Chart 4 - Cumulative change in energy demand by fuel and sector in the Low Unconventional Case relative to Golden Rules Case, 2010-2035

In the Low Unconventional Case, the competitive position of gas deteriorates, compared with the Golden Rules Case, as a result of lower availability and higher prices. Its share in the energy mix increases only slightly, from 21% in 2010 to 22% in 2035. The fall in gas demand is mostly compensated for by higher coal consumption.

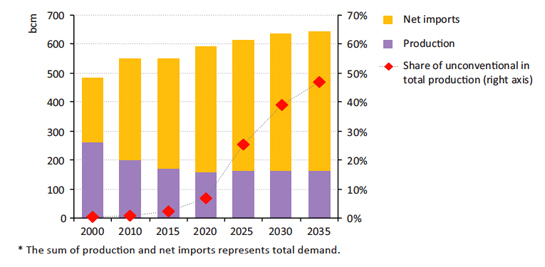

Chart 5 - Natural gas balance in the European Union in the Golden Rules Case

In the Golden Rules Case, unconventional gas production is slow to take off in Europe but accelerates in the longer term. Unconventional gas contributes almost half of the European Union's total gas production and meets just over 10% of its demand by 2035. Growth in unconventional production offsets continued decline in conventional output from 2020.

|

Discussion (0 comments)