Insight in the South-East Mediterranean

on

Insight in the South-East Mediterranean

Potential role of the region in EU’s quest for energy security

The large hydrocarbon discoveries in South-East Mediterranean over the last decade portended the change of the energy landscape in the region, promising a new era of the development of indigenous natural gas reserves in the countries. These developments are expected not only to boost the national economies and strengthen regional ties, but also to contribute to the European energy security and support Europe’s efforts in diversifying both energy supply sources and transit routes.

Against the backdrop of the geopolitical tensions on the Eastern borders of the EU, a strong political momentum has emerged for unlocking the natural gas potential of Cyprus and Greece, as well as accessing the hydrocarbon reserves of Israel. The creation of the Mediterranean gas hub is recognized as one of the key priorities for the EU in the European Energy Security Strategy (adopted in May 2014) [note 1].

This call was strengthened by the establishment of the Euro-Mediterranean Platform on Gas (as well as the Euro-Mediterranean Platforms on Electricity, as well as Renewable Energy and Efficiency) during the Italian Presidency of the Council of the EU [note 2]. At the last EU Council of energy ministers that took place on 9 December 2014 the development of the Mediterranean energy hub was discussed further, while the day before the Council, Greek and Cypriot energy ministers presented the East Mediterranean pipeline project to Maroš Šefcovic, Vice President of the European Commission in charge of the newly established Energy Union.

The conference organized by the Greek Energy Forum (GEF) in Brussels right after the high-level discussions in the EU capital brought together policy-makers, key industry players in the region, regulators and experts on the energy issues in the South-East Mediterranean and captured the political dynamics, economic opportunities and challenges around the development of the planned energy projects. The commitment of the Greek and Cypriot governments to cooperate and ensure the favorable climate for necessary investments in the region was clearly spelled out by the respective energy ministers. The latter, together with the Israeli official reiterated that EU’s support is crucial to open up the new East Mediterranean energy corridor.

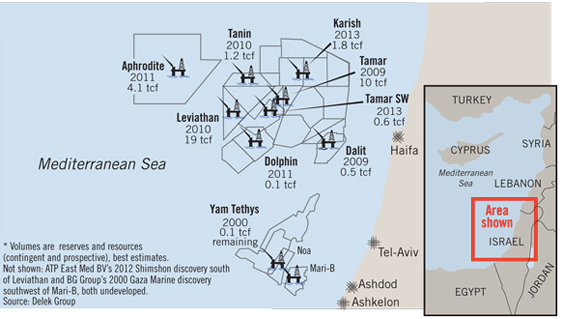

Indeed, the potential of the region to become a net energy exporter is strong. In 2009-2010 enormous natural gas reserves were found - the consortium led by Noble Energy discovered the Tamar field with resource gross mean estimate of 274 Bcm (9.7 Tcf) and the Leviathan filled with 460 to 566 Bcm (17-20 Tcf) located offshore Israel in the Levant basin (see Picture 1).

In this context, the endorsement of the decision taken by the Israeli government and ratified by the High Court has to be mentioned, as it allows Israel to export some 40% of the current proven reserves. Considering this, Nobel Energy - the key operator in the area, estimates that the potential export volumes of the region amount to some 19 tfc (538 Bcm) [note 3].

In 2011 another natural gas discovery was made - the Aphrodite field in Block 12 A-1 of the Cyprus’s Exclusive Economic Zone (EEZ) (see Map 1).

|

| Map 1. Gas discoveries in East Mediterranean - Source: The Oil and Gas Journal [note 4] |

Both Israel and Cyprus have small domestic markets, which would allow for exporting surplus gas. Apart from the savings that it would entail for the domestic use of natural gas resources, there is a great potential for gas in the Cypriot and Israeli power sector. Indeed, despite the recent regulatory uncertainties in Israel [note 5], the above mentioned hydrocarbon discoveries are already changing the national energy balances and are expected to play a crucial role in the region.

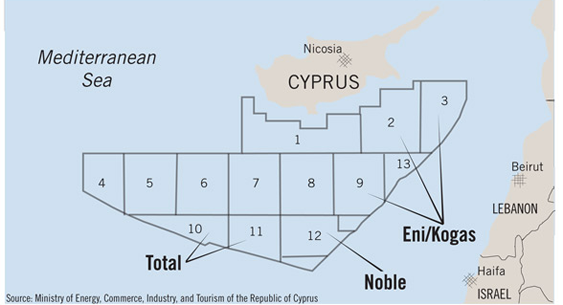

The table below summarizes the status of the upstream activities in the Cypriot offshore, while the indicative map (Map 2) presents the location of the respective Blocks in the EEZ of the country.

| EEZ Blocks | Operator(s) | Status of the exploration drilling | Estimated reserves |

| 2, 3, 9, 13 | ENI (80%) KOGAS (20%) |

scheduled for 2016 | tbc |

| 10, 11 | Total (100%) | scheduled for 2015 | tbc by 2016 |

| 12 | Noble Delek Avner |

2011 – Aphrodite field discovered Exploration of the smaller fields in the block – on plan |

Aphrodite 100-170 bcm 2015 |

|

| Map 2 |

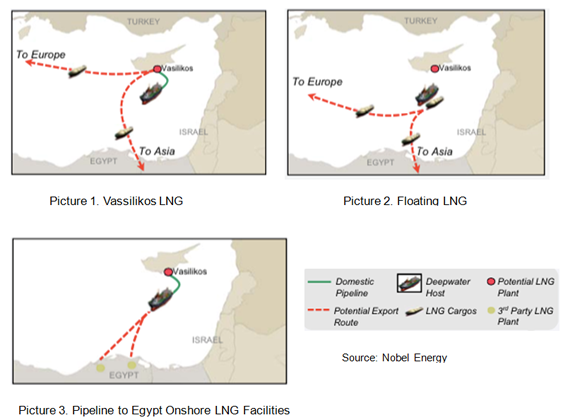

The geostrategic location of Cyprus offers at least three development solutions. The first one, actively promoted by both, industries and the government, is building the Vassilikos LNG facility (with a domestic supply component – see Map 3, Picture 1 [note 6]), which can accommodate some 3 bcf/d (3X5 MTPA) and has the capacity for three trains sized at 4-7 MTPA. It would take only 4 years from the FID to first gas - this option is naturally attractive, as it gives Cyprus the flexibility and the necessary prerequisites to be able to export to both, Europe and Asia-Pacific.

The other two potential projects for Cyprus are building a Floating LNG (FLNG) accommodating 4 MTPA or a pipeline to Egypt (Map 3, Picture 2 and 3). The former would have to be accompanied by an onshore LNG facility that would provide the capacity for the expanding gas field development. While the latter project starts taking shape already: this month a MOU was signed between Cyprus and Egypt, authorizing the Egyptian Natural Gas Holding Company (EGAS) ‘to examine technical solutions for transporting natural gas, through a direct marine pipeline, from the «Aphrodite» field to Egypt’ [note 7], while an agreement should be reached 6 month after signing this document.

|

| Map 3 |

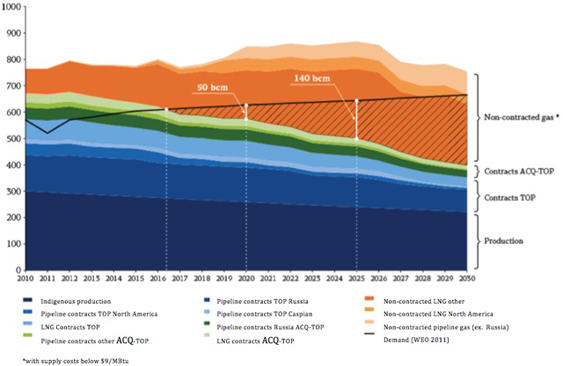

According to the Cyprus Natural Hydrocarbons Company (CNHC), the potential total cost of the Cypriot LNG would be $9-10 per mmBTU (production, transportation and regas included). Hence, it would be competitive in Europe, bearing in mind the market niche foreseen for the future (see chart 1).

|

| Chart 1. Competition for the market niche in Europe Source: WEO,IEA; Cedigaz; SKOLKOVO Business School Energy Centre, presentation by Tatiana Mitrova [note 8] |

At the same time, the minimum amount of capacity (5.5. tcf – 6/7 tcf) to make the Vassilikos LNG project commercially viable cannot be provided by the Aphrodite play alone. Therefore, additional gas will have to come from the blocks 10, 11 operated by Total or 3,9,13 operated by ENI and KOGAS. Another option could be to bring the Israeli Leviathan supplies to the project (this option that is being considered in the Leviathan development plans).

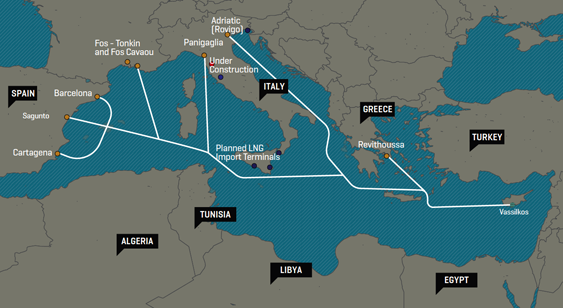

As the demand for LNG is expected to grow and EU’s regasification capacity to increase from 186 Bcm/yr to some 259 Bcm/y [note 9], currently a number of export scenarios are are being explored to monetize the discoveries in the region.

|

| Map 4. Mediterranean regasification terminals Source: MEES on European Rim Policy and Investment Council; Tagliapietra S, 2013 [note 10] |

The possible destination points in the EU for the

| specialists highlight the possibility of bringing the East Mediterranean gas to the Visegrad Group countries |

Having said that, one has to point to the fact that the FID on the Vassilikos LNG faccility is not expected to be made before 2017 [note 12].

The project that has been recently actively promoted by the Greek, Cypriot and Israeli authorities is the so–called East Med pipeline (See Map 5).

|

| Map 5. The East Med Pipeline Project Source: Presentation of the former Greek Energy Minister, Yannis Maniatis, Columbia University, Centre on Global Energy Policy, 5 November 2014 |

While the pre-feasibility study of the project has been completed by JP Kenny proving its technical and commercial viability, the results of the final feasibility study are to be released this year. Currently, there are ongoing discussions on including the project in the 2015 list of the EU PCIs (Projects of Common Interest). One of the significant advantages of the project is that the pipeline would pass exclusively through the territory of four EU member-states, bringing 8-10 Bcm of natural gas from the Levantine basin to the EU markets.

Considering all above mentioned projects, it is clear that there is no silver bullet for diversifying Europe’s energy supplies and brining gas from the South-East Mediterranean. While regulatory predictability and EU’s support are important prerequisites to realize the potential of the region, bearing in mind the current economic reality, when investments in the sector are being cut and strictly prioritized.

That being said, developing both the Mediterranean gas hub and the East Med energy corridor have become crucial in line with the European Energy Security Strategy, the fundamentals of the newly established Energy Union initiative, as well as the 2030 priorities which embody EU’s commitment to diversify energy suppliers and transit routes, support indigenous energy production and move towards low-carbon economy, while ensuring the competitiveness of the European industries.

| Daria Nochevnik is EU Energy Regulatory Affairs and Strategic Analysis Specialist Deputy Head of Brussels Division, Greek Energy Forum. |

Notes

- Communication from the Commission to the European Parliament and the Council, ‘European Energy Security Strategy’ 25 May 2014 http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014DC0330&from=EN

- Final Statement of the Italian Presidency of the EU and of the European Commission , High Level Conference, "Building a Euro-Mediterranean energy bridge: the strategic importance of euromed gas and electricity networks in the context of energy security" , Rome 19 November 2014 - http://www.medreg-regulators.org/Portals/45/immagini_home/Rome_Final_statement_on_the_HighLevel_Conference.pdf

- Noble Energy, Presentation, Analyst Conference, 17 December 2013

- http://www.ogj.com/articles/print/volume-112/issue-4/general-interest/e-mediterranean-gas-work-faces-geopolitical-hurdles.html

- Noble put on hold further investment in the expansion of the Tamar gas field and the development of Leviathan until the regulatory questions are settled, as the Israeli Antitrust Authority did not submit the consent decree for final approval of the Leviathan’s first development phase (although it was agreed upon in March 2014). Currently, many discussions are going on regarding the link of this event with the upcoming national elections in Israel in May 2015.

- ibid.

- MOU Joint Statement available at http://www.mcit.gov.cy/mcit/mcit.nsf/All/C0FAB3D9D752E609C2257DEE003E0FC2?OpenDocument

- Presentation ‘Energy, Oil and Gas: A Macroeconomic Perspective in the Eastern Mediterranean Region’, Dr. Tatiana Mitrova, London, 2013

- l-Katiri, Laura and Fattouh, Bassam and Darbouche, Hakim (2012) East Mediterranean Gas: What Kind of Game Changer?, OIES, 2013

- Tagliapietra, S. (2013), Towards a New Eastern Mediterranean Energy Corridor? Natural Gas Developments Between Market Opportunities and Political Risks, Nota di Lavoro n. 12.2013, Fondazione Eni Enrico Mattei

- Papanastasiou P., Professor, Dean of the Engineering School, Presentation ‘Monetization of natural gas of Eastern Mediterranean’, University of Cyprus

- Presentation Dr Charles Ellinas, CEO, Cyprus Natural Hydrocarbons Company (CNHC), FLAME Conference, Amsterdam, 2014

Discussion (0 comments)