Nord Stream: Neue Sorgen for Europe

on

Nord Stream: Neue Sorgen for Europe

With Nord Stream coming online, South Stream proceeding smoothly and the main German Nabucco-supporter RWE being driven into the arms of Gazprom by Germany's nuclear policy, the geopolitical gas power play in Europe is going Moscow's way. When will European countries wake up to the dangerous situation they are creating for themselves, wonders Matthew Hulbert?

|

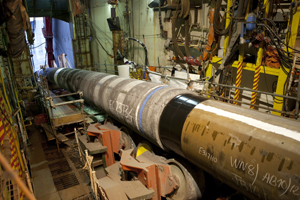

| Solitaire lays last pipe of line 2 of the Nord Stream Pipeline on August 12, 2011 (Photo: Nord Stream AG) |

“Fantastic, Nord Stream is finally open. Pop the champagne corks, the $12.5bn pipeline will provide Western Europe with its first direct export pipeline from Russian gas fields. The days of supply cuts and transit problems in unreliable Eastern European states are over. Glorious EU-Russia relations await.”

Here endeth the German press release. The reality is that Nord Stream will bring far more problems for Europe and EU-Russia relations than solutions. This is a reality that few have been willing to confront, despite the obvious lessons that can be drawn from previous European gas crises. Nord Stream will open a geopolitical Pandora’s box that neither Brussels, let alone Berlin, have a lid for. Europe will not just be split from North to South on Euro-economic lines, but also from East to West on energy supply lines. It will be divided by the ‘gas haves’ and ‘gas have nots’.

Political design

Proponents of Nord Stream have always argued that more gas for Europe will in the end be good for everybody. In fact, the pipeline project is grounded in national interests, not the interests of Europe as a whole. Geopolitical gaps will show, and it’s Central and Eastern European (CEE) states that will slip through the cracks.

In the absence of new ‘backhaul’ capacity (with the minor exception of the OPAL pipeline) that was supposed to have been built to ensure CEE states could get easy access to burgeoning German-Russian supplies, Russia will inevitably use Nord Stream as leverage over former Soviet states, including Ukraine, Poland and indeed the Balkan states – either to exact higher gas prices or greater political influence.

Russia knows now that in times of crisis, EU members will look after their own energy security interests rather than safeguard the autonomy of post-Soviet states. This is exactly what happened in the gas crises of 2006 and 2009 (which Gazprom even used as arguments to support the Nord Stream construction); it will happen again in countries where Russia is able to make cuts without affecting broader European supplies. Actually, things will be much worse this time round, precisely because Moscow will now have no cash incentive to re-open the taps to feed Western European markets.

The upshot of Nord Stream is that a key geopolitical artery linking Europe to post-Soviet space will have been severed, largely with German connivance. The pre-occupation in Germany and other Western European countries has not been about how to protect Central and East European countries from future Russian energy pressures, but how to secure downstream stakes in Nord Stream. France, Holland, Denmark and the UK are all in the queue. This is a strategic reality the EU and its Member States must face up to.

All things relative

Let’s consider Ukraine first. As Ukrainian political watchers will tell you, the general consensus in Kiev is to push for contract renegotiation with Gazprom to mitigate the oil-indexed prices currently embedded in their supply contracts – and that’s irrespective of whichever side happens to be in power. Haggling over volume, price and transit fees will continue ad nauseam.

Surely the murky politics of Ukrainian gas don’t help here. But the fact that the situation is so murky is exactly what will make it impossible for Europe to stand aloof when the next crisis breaks. Non-payment

| The fact that the situation is so murky is exactly what will make it impossible for Europe to stand aloof when the next crisis breaks |

But the core European message will be: ‘Your bill, your problem’. Ukraine will either have to pay Russia with money they haven’t got, or more likely, end up succumbing to long held Russian desires that Ukraine enter a customs union, merging state-owned Naftogaz with Gazprom. Worse still, Kiev might follow Belarus and hand over control of its pipeline network in return for future price discounts. It’s already given Russia extended basing rights in the Black Sea for 30% gas price reductions.

Given that Europe will make it clear its geopolitical interests are more about keeping Russia happy and Nord Stream online, rather than CEE and South East European states warm and alight, the geopolitical writing will be splattered all over Berlin and Brussels. Kiev will become a Russian outpost, South East European and CEE states will be the orbiting satellites.

Unintended consequences

As to the CEE and South Eastern European states, they will be forced to make tactical downstream concessions to Gazprom where necessary to maintain low prices and plentiful supply. In this way, European energy borders will barely make it to the Alps, let alone the Urals.

What could perhaps make matters worse, is that many of these same countries might decide to forgo or postpone tricky and costly shale gas developments and turn to coal instead. Once the dash for coal sets in, major new shale gas supplies will be sacrificed on Nord Stream’s altar. Europe will have passed up the biggest policy fillip consumers have had for decades. It’s also obvious what a ‘dash for coal’ will do for EU emissions.

With Nord Stream increasing dependence on Russia, shale gas far in the future or dying a premature death in Central and Eastern Europe, and LNG markets tightening at an alarming rate, Europe should

| Europe should at least revolutionise its attempts to open up the Southern Corridor |

Despite such developments, the slightly better news is that the dependency penny is slowly dropping for some. Even the most stubborn European players can see that retaining some elasticity (and diversity) of supply is important for those in the self-preservation society. Berlin would eventually be hit just as much as Bucharest or Budapest over price once European gas optionality is shot and South Stream goes live. Talk of spot market pricing (currently all the rage in Europe) would go out the window once Russia controlled all the taps.

(In)elastic timing

Spread bets have been placed on the Europe-inspired Nabucco pipeline accordingly. The bad news is that Europe’s way of going about diversity – namely by proclaiming a new External Energy Policy that is meant to make the EU speak with a 'unified voice' (and presumably a single negotiating party) – could prove to be fatal to the commercial entities that have actually made credible progress in the Southern Corridor. If a far-fetched EU-backed Trans Caspian Pipeline is in the works, it might make it impossible for the smaller rivals of Nabucco – TAP, ITGI, AGRI – to get off the ground.

We can see the clear problem. If Europe fails to deliver Nabucco, it will not only have undermined realistic supply options that were being opened up by commercial players, it will also have provided a crucial window of opportunity for South Stream to seal the deal. Current omens don’t look good.

To be fair to Brussels, Europe has been debating the merits of centralised buying for some time. The European Commission is damned if they do, and damned if they don’t. The industry seems unable to make up its mind whether centralised buying will prove to be good or bad for them. Yet the real problem here is not so much in the concept of collective purchasing, but in Europe’s credibility and timing.

|

| (Photo: South Stream) |

Things wouldn’t be so bad if Nabucco plans were particularly credible, rather than a Commission wish list. Repeated claims that Europe will be able to source 38 bcm/y of gas for Nabucco are nice, but aren’t grounded in supply realities. Azerbaijan alone would struggle to get beyond 10 bcm/y, particularly as Baku will continue to leverage its position to maximum effect amid competing international interest for its supply. That includes approaches from the National Iranian Gas Company to secure “large amounts” of gas for domestic purposes. Not to mention Ankara’s interest in Azeri gas; Turkey is looking for much more than transit agreements and fees.

This is where Turkmenistan comes into the equation of course. An EU brokered Trans-Caspian pipeline between Ashgabat and Baku could offer major prizes, but, despite the recent support from Brussels, it stands close to zero chance of happening. Although Turkmen President Gurbanguly Berdymukhammedov has been promising supplies to pretty much anyone who asks, the country’s gas

| Keeping the old Nabucco vs. South Stream debate going is fine, provided Europe can 100% guarantee that it will win |

In short, by going for a pure play Nabucco option, Brussels is not just playing geopolitical games it probably doesn’t have the stomach for, it might also end up undermining some of the more realistic Southern corridor options to hand. Keeping the old Nabucco vs. South Stream debate going is fine, provided Europe can 100% guarantee that it will win. Otherwise, it really is a case of shooting yourself in the foot.

Europe's Achilles Heel

But this is not all there is to the story. The Russians have a couple of more irons in the fire. Although rarely mentioned, Moscow has the default option of extending the Blue Stream pipeline to tighten its Southern grip. A quick but effective fix.

More importantly, and also rarely mentioned: Gazprom already owns a 50% stake in the Baumgarten hub, where Nabucco gas would arrive. This is where Europe’s real Achilles heel might start to show. The flaw has little to do with Nabucco itself, and everything with national policy making in Germany. I am referring to the parlous state in which the German energy major RWE, which is spearheading the Nabucco project, is in. Brussels has no guarantees that the company will not pull the Nabucco plug when it has to make tough decisions over where its balance sheet priorities reside.

RWE had already been struggling paying oil-indexed gas prices when its bottom line was badly hit by Germany’s decision to phase out nuclear power by 2022. Faced with a massive capital expenditure programme, ratings downgrades and a negative outlook (it lost 20% market capitalisation and 30% installed capacity from closures), RWE went cap in hand to Gazprom, offering a Memorandum of Understanding (MoU) on a major downstream stake in its gas and power plants in return for gas supplies from the Russians.

|

This underpins why the RWE-Gazprom tie-up is so crucial. Although the deal would have to overcome political opposition in Germany and conform to the growing body of legislation that envelops the Third Energy Package, it will be hard to close the ‘vertical integration’ flood gates once Gazprom claims a major stake in German transmission and distribution. As Central and Eastern European states will be left to fend for themselves once Nord Stream comes online, the Third Package might well be remembered as a lore of legal niceties. Russo-German political and commercial realities will hold sway.

From here, it doesn’t take a genius to work out what will happen to RWE’s Nabucco/Southern Corridor ambitions once a Gazprom tie-up goes ahead. RWE will tuck in behind Moscow’s South Stream initiative rather than fight the Russian giant for strategic control of the Caspian. Europe will have to go back to the drawing board, if it’s still worth the effort assuming Russia has pressed ahead with its own supplies, stitched up Azeri gas and collected sufficient signatures to make South Stream a runner.

A seriously bad idea

There may be, however, a final twist in the tail. If Russia pushes Ukraine too hard once its Nord Stream options come good, Europe might finally wake up to the reality that South Stream is a seriously bad idea – and not just for Kiev.

Then again, things might go the other way. After all, that’s the key lesson North West European states

| One day we may find out how small Europe has become |

If this turns out to be the reality of European pipeline politics, then Member States should at least get very serious about storage, very serious about LNG, very serious about shale gas and very serious about integrated grids. Stop being ridiculous about nuclear power would also help, as would far more credible political engagement with North African states.

Meanwhile, the Moscow games will go on. They are now being extended to new Asian markets. One day we may find out how small Europe has become. Greater Berlin won’t cut much global mustard. But the Germans will have plenty of expensive gas to keep them warm.

Related articles on European Energy Review:

- 'It is the market that will decide whether South Stream will be built'

- 'To us it is just a money game'

- We do not want to depend on only one pipeline

- 'For Nabucco it is now or never'

- Shah Deniz: King of the Sea

- China's Pipelineistan War

- South Stream steals a march on Nabucco

- Navigating between Nabucco and South Stream

- To Russia with love

- The riddle of Turkmenistan's gas reserves

- EU policy drives Turkey in the arms of Russia

- Bulgaria: Gas Consumer of Future Gas Hub?

- Brussels open's Pandora's Box

- EU heavily divided on South Stream

- Nabucco's window of opportunity

- Bulgaria Attempts to Break Russian Hold

- Interview Sevak Sarukhanyan, Nabucco Project in Danger

- Russia's great transit game

- Pipeline politics boosts Turkey's profile in Europe

Discussion (0 comments)