Peak oil revisited: the real challenges are investment and sustainability, not availability

on

Peak oil revisited: the real challenges are investment and sustainability, not availability

The general perception of global oil reserves is unnecessarily gloomy and far removed from reality, even among many policymakers and academics. This is dangerous because it obscures the real and serious economic and environmental challenges faced by the oil sector, argues Noé van Hulst. The Director of the new Energy Academy Europe calls on the oil industry to devote more effort explaining the public what the real challenges are.

|

| The intensity of the peak oil debate seems to be correlated with the level of oil prices (c) Peakoil.com |

Time and again the question pops up in energy debates: "but when are we running out of oil?" or "when is oil going to peak?", the implication being that an unprecedented disaster will hit us at or shortly after that critical moment. After some hesitation because of the strangely emotional nature of many discussions on peak oil, I decided to accept the challenge to convey my views in a presentation at a joint session with Total's CEO Christophe de Margerie during the latest World Petroleum Congress in Doha, December 2011. This article is based on that presentation.

Peaks in the debate

Before making my key points, I want to share some preliminary observations that strike me on the subject of peak oil. First, although the peak oil debate is never really absent, its intensity does seem to be correlated with the level of oil prices. It reached its most recent peak when oil prices were very high and rising during the first half of 2008, the infamous 'annus horribilis' of excessive oil price volatility. Trainloads of articles appeared saying that this time the world was running out of oil, that prices would soon hit $200 and more, etcetera. Today, the intensity of the debate is somewhat lower, but it is still raised at nearly every energy conference or debate.

Second, historically it is hard to dispute that, as Daniel Yergin and others have pointed out, the prediction of oil production peaking is a recurring theme, ever since the beginning of the oil age in the 1850's. Analysts have identified 1948, 1956, 1974, the early 1980's and 2007/2008 as 'peaks' in the oil peak debate.

Third, the definition of what's peaking or not matters a lot. Are we talking about non-OPEC supply, crude oil production or, more relevant, liquid fuels including unconventional oil (oil sands, heavy oil, shale oil), Natural Gas Liquids (NGL's), gas-to-liquids (GTL), biofuels? That makes an enormous difference. On a related point, it is often assumed (explicitly or implicitly) that a peak in global oil production is followed by a fast and steep drop (following the shape of the famous Bell curve for an individual field) with all the undesired implications. However, it is not clear why after reaching a peak in global oil production we couldn't experience a plateau even for decades following the moment production peaked. The implications for energy policy are vastly different in that case.

The power of technology

Strangely enough, particularly outside of the oil industry, the power of technology is often severely underestimated. The global recovery rate is now 35%, and it is well-known that only a 1%-point increase in the global recovery rate already provides 2 years of extra global oil consumption at current rates. We

| Strangely enough, particularly outside of the oil industry, the power of technology is often severely underestimated |

The power of technology is also highly relevant when it comes to developing new resources: think deepwater offshore (e.g. the pre-salt reservoirs in Brazil), the Arctic, Gas-To-Liquids (GTL), Coal-To-Liquids (CTL), oil sands, heavy oil,shale and tight oil. In terms of geography, it is also regularly overlooked that vast areas of the Middle East (even in countries like Saudi Arabia and Iraq) and Africa are still largely unexplored. We all now marvel at the unprecedented 'silent' shale gas revolution in the US with its huge impact on global gas markets - a revolution that may well spread to Asia and eventually to Europe (particularly Eastern Europe). Apart from the fact that the huge supplies of shale gas offer fascinating opportunities to be applied more widely in transportation (thus substituting for oil), similar combinations of technologies like fracking and horizontal drilling may well unlock significant supplies of shale and tight oil, as we are now witnessing for example in the Bakken formation in North Dakota. This formation alone is already producing more than OPEC Member State Ecuador. We may be in for more surprises here, a reason why some industry executives are talking about a 'new renaissance for petroleum'. Be that as it may, the indisputable fact is that the barriers are pushed back continuously by the impressive technological development in the oil industry. On the aggregate it is hardly disputed by serious experts that whereas mankind has roughly utilized 1 trillion barrels of oil, the remaining conventional and unconventional oil resources probably are in the order of 3-4 trillion barrels.

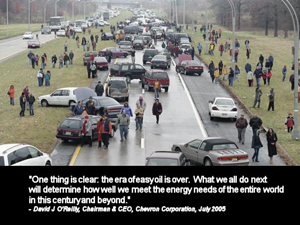

There is, however, one important caveat. Although the technology allows for ever more resources to be developed, in nearly all these cases it concerns technologically challenging projects that are much more costly to exploit and bring the oil to the market. This is increasingly the case even in the Middle East, which traditionally is a low-cost area. In many projects, the average cost of marginal oil barrels being developed is over $80 per barrel; hence the now often quoted slogan that 'the era of cheap (or easy) oil is over'. There seems to be a lot of truth in that one-liner and obviously this has very serious ramifications for oil prices in the longer term, as the cost of marginal oil barrels to be developed with rising oil demand over time is a crucial determinant of long-term oil pricing. More and more we read about 'difficult' or 'tough' and hence costly oil. In many cases, the new oil resources like oil sands and shale oil also pose severe environmental challenges that need to be controlled and overcome, which also drives up the costs.

Finite but plentiful

Of course, there is no disputing that oil in the end is a finite resource that will one day run out. However, this day still seems a long way off and actually further away than we thought 10 or 20 years ago. The US Geological Survey estimates that ultimately recoverable resources have almost doubled since the early 1980's, with the cumulative oil production during the period since then only taking up one-third of that increase in resources. The increase in resources is predominantly caused by technological advances that now allow us to recover significantly more from existing oil fields ("reserves growth"), a factor often ignored in the public debate.

More often than not, the debate focuses on the alleged lack of new discoveries of oil fields in

| If we look at the current estimates of ultimately recoverable resources by serious agencies, then we can conclude that most of them are at or close to an all-time high |

In public discussions, however, one often hears serious doubts expressed about the validity of these estimates because of the lack of third-party verification of reserves statistics. In many countries reserves and resources estimates are considered as highly confidential for understandable reasons.But this fact does in no way automatically imply that therefore actual reserves are lower than the official figures. That is a non sequitur, but often encountered either explicitly or implicitly in discussions.

In theory one can think of as many incentives to understate as to overstate reserves. The reality is that all relevant international energy organizations like the International Energy Agency (IEA), OPEC, the International Energy Forum (IEF) and the US Energy Information Administration (EIA) agree that oil resources are plentiful for many decades to come. Their scenarios imply that oil production could reach a level of 96-110 million barrels per day in 2035. More precisely, this relates to a broad definition of oil, where all kinds of liquids besides crude oil are included. Looking only at crude oil, we are already close to the global peak in crude oil production according to most scenarios.

What about peak oil then?

Does all of the above now imply that we will not see a peak in oil supply defined in the broadest way? No, it doesn't. We still need to take into account that peak oil may occur sometime in the future. This could be either because of setbacks in finding and exploring sufficient resources in the face of rising oil demand or because of insufficient investment coming forward to develop the existing resources.

|

| 'With continuously high oil prices, there is a strong price incentive to become more energy- and fuel-efficient' (c) ZeroHedge.com |

Demand may peak before supply

That global oil demand may peak before supply has been suggested among others by John Browne, the former CEO of BP and most recently by Ali Al-Naimi, the Petroleum Minister of Saudi Arabia in the official publication of the World Petroleum Congress in Doha, December 2011. With continuously high oil prices, there is a strong price incentive to become more energy- and fuel-efficient and to substitute away from oil, particularly in the non-transport sectors. We already see reports about demand destruction in certain applications. If this trend persists, this may well have a significant downward pressure on oil demand, particularly as countries where consumers are still partly protected from the impact of high oil prices by petrol subsidies will need to reduce the budget burden by moving towards global market prices.

In the transport sector, oil is notoriously hard to replace, but even there high oil prices may induce stronger inroads from biofuels, hybrids, electric cars and natural-gas vehicles. At the same time, the fuel efficiency of vehicles still has huge upward potential that will be utilized to a large extent in an era of high oil prices. When oil gets largely restricted to the transport sector and fuel efficiency is boosted, we could well envisage a situation where global oil demand peaks before oil supply does.

Urgent need to change public perception

The public perception on peak oil in much of Europe and the US is dangerously gloomy and far removed from the fact-based picture described above. Many even highly-educated people think that oil is about to run out, if not very soon then in a couple of decades. The power of technology in improving the recovery rate and finding new oil fields is systematically underestimated ('it's the technology, stupid'!). This is the case despite the impressive track record of the entire oil industry since the discovery of oil.

Part of the confusion, however, is also caused by sloppy analysis of complicated technical concepts like the R/P (reserves-to-production) ratio. This is often loosely described as 'we have oil left for 40 years', without explaining that this is just a theoretical calculation based on the entirely unrealistic assumption that not a single extra barrel of oil would be discovered or added through reserves growth. Of course we know that the R/P ratio hasn't gone down significantly in decades despite steadily increasing global oil

| Many even highly-educated people think that oil is about to run out, if not very soon then in a couple of decades |

|

About the author Noé van Hulst is Director of the Energy Academy Europe, based in Groningen, The Netherlands. He is former Secretary-General of the International Energy Forum (IEF) and former Director Long-Term Co-operation and Policy Analysis at the International Energy Agency, as well as former Director General Energy at the Ministry of Economic Affairs in the Netherlands. |

|

Additional reading

|

Discussion (0 comments)