Power market headed for potential oversupply

on

Power market headed for potential oversupply

The economic crisis in Europe is having a far-reaching impact on the electricity market. The collapse of economic growth combined with the growth of renewable energy is leading to a situation of potential oversupply. But this broad European picture hides strong regional differences. Twan Vollebregt, CEO of Energy Fundamentals, a Swiss company that provides data and models to help energy companies with investment decisions, unravels the real story behind the development of European power demand.

Economic events of the last five years have fundamentally reshaped the European energy industry. While it is no surprise that energy demand has reacted strongly, particularly in the industrial and commercial sectors, the response has by no means been uniform across countries like Germany, Spain and Greece. The different responses from different countries highlight some illuminating details about their relative demand elasticity and the power-to-GDP intensity.

When economic crisis hits declining growth

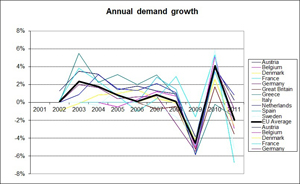

Between 2003 and 2007, the rate of growth in power demand steadily declined across Europe (see Figure 1) despite apparently favourable economic conditions. In many ways, the onset of a recession was already being flagged.

|

| Figure 1: Annual power demand growth in Europe (click to enlarge) |

As rumours of trouble in the US financial markets rumbled throughout 2008 and finally exploded with the collapse of Lehman Brothers in the fourth quarter, demand started to slide before tumbling to a notable downward spike in 2009. As expected, the following year saw a bounce, albeit less strong than the 2009 dip, but rather than a return to normal levels, 2011 saw a further modest drop. Initial reports from TSO's indicate that 2012 will almost certainly show a further fall, as is consistent with the general economic situation.

This dramatic picture is more or less replicated across individual country profiles. However, interesting differentiated patterns do occur. Before the downturn, European countries could be split into three broad groups: those with around two per cent growth (Austria, Greece, Netherlands and Spain); those averaging around one per cent growth (Germany, France); and those growing more slowly or even showing a decline (Denmark, Belgium, Italy and Sweden). These groupings represent the combined impact of GDP growth and the type of economy in each country; those that use power as part of a growth strategy naturally differ from those focused on energy efficiency.

If we look at both Greece and Spain, we can see rapid economic growth that, with the benefit of hindsight, showed certain bubble-type

| Economic events of the last five years have fundamentally reshaped the European energy industry |

Among the lower growth countries, both Belgium and Italy were on a flat economic trajectory with little if any growth in GDP. In contrast, the Nordic countries (Denmark and Sweden) had focused significantly on efficiency and reducing consumption, which led to lower growth in demand.

Comparing apples and oranges

Before we go any further, it is important to understand that "power consumption" is a rather poorly defined term. Does it include network losses? What about de-centralised consumers with on-site generation? And do we count the consumption of pump storage plant? It is all too easy to end up comparing apples with oranges.

Add to that the real challenge of obtaining high quality accurate data for an individual country. If we look at the Netherlands as one example, it is relatively easy to use incorrect numbers: the ENTSO-E figure for power consumption in 2011 was 110.8 TWh, while the transmission system operator, TenneT showed 104.4 TWh. At the same time the CBS - the state statistics office - reported a total consumption of 118.1 TWh. These are material differences, derived from differences in scope and definition - and even using a single source for all years will produce inaccurate results due to definitional changes over time. At Energy Fundamentals we use a very strict definition of power consumption - including network losses and decentralised consumption but excluding pump storage consumption - which is the basis for the charts in this article.

A not so clear north-south divide

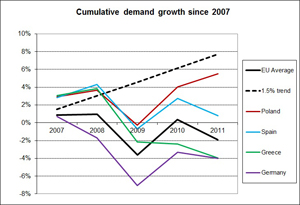

Turning back to the power demand growth rates of European countries, let us zoom in on the cumulative growth of a selection of countries since the pre-crisis year 2007. This reveals some interesting and somewhat unexpected patterns.

|

| Figure 2: Cumulative power demand growth in Europe since 2007 (click to enlarge) |

By 2011, the EU average cumulative power demand growth rate was still approximately two per cent below the 2007 level, indicating a five-year period leading to negative power demand growth: an unprecedented phenomenon in recent decades. However, this played out in different, and often in somewhat counter-intuitive ways in different countries.

In line with the drop in its economic growth, German power demand fell sharply in 2009. However despite its strong economic performance subsequently, there has been a very weak recovery in power consumption. This is mainly due to a structural reduction in industrial demand, offsetting household and services demand that has returned to growth. With its greater economic woes but much smaller industrial sector and strong household/services growth momentum in 2007, Spain was affected less than might be expected, resulting in a cumulative growth rate not far from zero. And despite its very poor economic performance over the 2007-2011 period, Greek consumption growth is relatively inelastic and has carried forward much of its trend momentum - in 2011, a 6% GDP reduction resulted in a power consumption reduction of less than 2%. At the opposite end of the spectrum, Poland is the least affected and its strong economic performance means that power consumption growth is now growing at almost pre-2007 levels once more.

Putting all of this into perspective is the 'trend' growth, which depending on the type of economy would be expected to range between 1 and 2 per cent per year. Had that growth trajectory been followed since

| German power demand fell sharply in 2009. However despite its strong economic performance subsequently, there has been a very weak recovery in power consumption |

Lessons for the future

The key lesson to be learned from unravelling these growth patterns is that long-term fundamental analysis remains a critical part of the risk management process. As rapidly changing economic fortunes have indicated, investment decisions cannot be made purely on the basis of short-term curves or historical movements. The broader context - including the financial environment - must be considered, as well as country-specific factors. Investment decisions cannot be made on over-simplified observation of the markets. In-depth analysis and quality data is key, as the comparison between Greece and Germany demonstrates.

|

About the author

For more information visit www.energyfundamentals.com. |

Twan Vollebregt is of CEO Energy Fundamentals, a Swiss company that provides an integrated fundamental data and modelling system for investment decision makers in European power market.

Twan Vollebregt is of CEO Energy Fundamentals, a Swiss company that provides an integrated fundamental data and modelling system for investment decision makers in European power market.

Discussion (0 comments)