Putting a price on EU's energy security

on

Putting a price on EU’s energy security

As the energy landscape goes through significant changes both in the European Union and outside its borders, the EU finds itself in the middle of energy transformations. On-going liberalisation of European energy markets, completion of the Single European Energy Market initially scheduled for the year 2014, as well as the ambitious decarbonisation strategies that the EU has committed to - these are some of the key issues on the European energy agenda. While taking stock of the achievements that are made after the implementation of the 2020 targets, EU has nearly completed setting itself a new ambitious goal – the 2030 climate and energy policy framework. At the same time, such multidimensional strategies of the EU that aim at the simultaneous achievement of three parallel targets - reducing GHG emissions, increasing energy efficiency and increasing the share of the renewables in the energy mix – expose the European energy markets and industries to unprecedented challenges. The latter do not only impact the energy bills of consumers, but also create critical uncertainties for the investors in the sector, when policy risk becomes an independent variable. The multidimensional character of the European energy concerns, particularly in electricity and gas supplies, is reflected in the multiplicity of accounts of European energy security.

However, if the political rationale behind EU’s energy security strategy has been at the spotlight of debates, since the gas crises of 2006 and 2009, the economic challenge that energy security brings about for Europe has often been out of focus.

|

| Source: www.offshorewind.biz |

The Broader Picture: identifying key energy security concerns

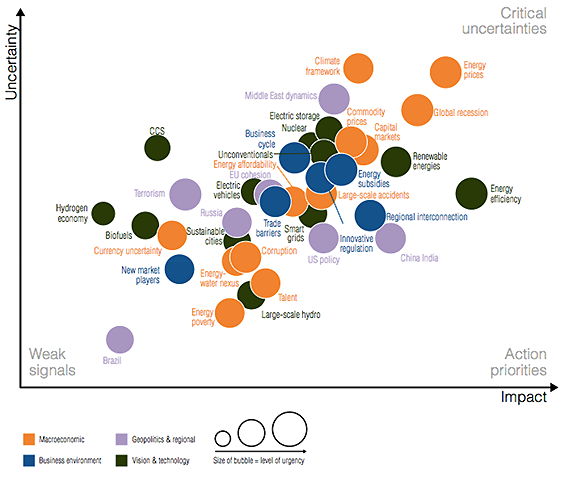

When it comes to identifying the most challenging issues for experts in the energy world, one may turn to the World Energy Council 2014 Energy Issues Monitor entitled ‘What keeps Future Energy Leaders awake at night?’ [note 1] The latter captured the concerns of energy professionals and experts across the networks of the Council in more than ninety countries around the world. The mapping of the issues across the energy sector, according to the degree of impact and uncertainties that they pose for the energy professionals (see below), is based on the survey that was completed by 891 leading energy professionals - government officials, CEOs and top experts - from 87 countries.

|

| Chart 1: The uncertainty/impact ratio of energy issues. Source: WEC World Energy Issues Monitor ‘What keeps Future Energy Leaders awake at night?’ (2014) |

The results of this exercise are indeed noteworthy and particularly interesting today, bearing in mind that the Report was published in January 2014, before the steep escalation of the conflict in Ukraine, and subsequent exchange of sanctions between US together with EU and Russia took place.

The issue of the highest uncertainty for energy leaders was clearly energy prices – that is, ‘high volatility and investment uncertainty (the security of demand concern)’ [note 2] As regards macroeconomic challenges, the absence of a fixed global climate framework is perceived as the most acute one. While energy efficiency is clearly considered to be the top priority for action, the report maintains that due to the capital intensity of energy efficient systems ‘decision makers must abandon the usual short-term mentality, looking not just at financing projects based on initial costs, but also to take account of the lower costs across a longer project life cycle’. [note 3]

Interestingly,

| the lack of EU cohesion was perceived as the issue of a greater uncertainty and long-term impact, than Russia’s energy diplomacy |

One may assume that the results of this survey would reflect the change in the perception of the uncertainty related to the security of external energy supplies today compared to January 2014, against the backdrop of the increasing political tensions in EU’s relations with Russia. Such tendencies were reflected in political statements, for instance, in June 2014 Edward Davey, UK Secretary of State for Energy and Climate Change, speaking about the discussions over the 2030 package during the March European Council, stated that, apart from the vital questions regarding the climate framework that had to be discussed, the 2030 framework could address the issue that has never been as high on the political agenda as it is now: as E. Davey maintains, EU has to ‘thank President Putin for that…for alongside climate, energy security is also now at the top of the European energy debate’ (Davey, 2014).

Indeed, the need for ‘security’ of EU energy supply, which implies – at least according to the current interpretation of the term - the reduction of EU’s energy import dependence, has been in the center of political discussions across the EU [note 5]. However, in the same month of June, the European electricity industry representatives clearly voiced out their concerns putting, yet again, the issue of economic competitiveness and energy prices as the top strategic priority for the coming 5 years, while oil and gas import dependency was indicated as the least important issue [note 6] (Eurelectric Convention, Online Voting, 2014). In a similar manner, the responses of EUROGAS, Eurelectric and EUROCHAMBERS to the 2030 package Green Paper unanimously point to the fact that one of the key challenges in applying the 2020 framework proved to be cost-efficiency and coordination of the three energy targets, that would not compromise other EU objectives.

EUROGAS highlights that despite the importance of indigenous supply sources, diverse imports remain vital for EU’s economic competitiveness, and ‘import independence should therefore not be an aim in itself’ (EUROGAS 2013, p.2).

The International Association of Oil and Gas Producers (OGP) is even more explicit in its account for European energy security in relation to import dependence, as it stresses that ‘security of supply for oil and natural gas is linked to diverse routes and sources, rather than to the misleading notion of “energy independence”’ [note 7] (OGP, 2013, p.2). While National Grid (UK) outlines that energy security issues are primarily within the competence of EU member-states – hence, ‘must be independent of any European targets’ - as ‘otherwise there is a danger that a Member State that places a higher value on security of supply may be subsidizing a less risk-averse State’ (National Grid, 2013, p.3).

All the above demonstrates why ‘energy security’ cannot be regarded as a static concept - comprised of security of demand, supply and transit – as its definition and value varies not only according to the changes of the international political climate, but also, and fundamentally, because of the diversity in energy mix across the EU member-states.

| once ‘the security argument’ becomes a ‘carte blanche’ in political decision-making and impacts the actual legislation, while long-term investment priorities are put under threat, formulating the specific economic and political properties of EU’s energy security becomes crucial |

In this context, the connection between electricity and gas markets has to be considered.

The current situation in EU gas markets and the declining usage of gas in electricity generation in Europe was conditioned by a number of factors, both endogenous and exogenous, that came together: the decline in gas demand due to economic recession, increase in renewable energy generation and energy efficiency, as well as US coal export flow to the EU (the last one being a consequence of the US shale revolution).

Against this background, and particularly due to the inflow of cheap coal from the US, gas-fired power plants in Europe have become uneconomic, unable to cover their operations costs, and ultimately, de-commissioned. At the same time, bearing in mind EU’s decarbonization target, replacing coal-fired power stations with CCGT plants would in fact be the most cost-effective solution allowing to reduce CO2 emission by 50% [note 8]. Aside from the controversial effects of subsidizing the RES on the one hand and the increasing reliance on coal power plants on the other, ensuring the necessary investments in the electricity sector is another major challenge for EU’s security sector.

‘Will Europe keep the lights on?’ [note 9]

According to IEA’s 2014 World Energy Investments Outlook, replacing the ageing electricity infrastructure that would enable reaching the decarburization targets would cost Europe some 2.2 trillion dollars in investments by 2035. The only country that surpasses EU in the forecasted amount of investments in electricity infrastructure is China. Apart from that, by 2025 Europe would need 100 GW of new thermal plants, and according to IEA ‘this investment won’t happen with current market rules: wholesale prices are 20% below cost-recovery levels’ [note 10].

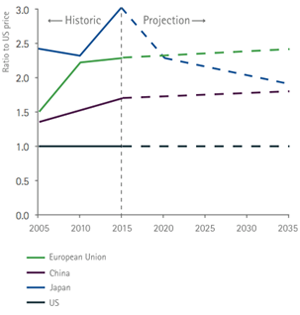

Simultaneously, one also has to consider the issue of rising electricity prices for consumers across the EU, which is recognized as one of the main security concerns. However, the link between energy security in electricity markets and top-down market interventions, such as subsidies in the RES, has been interpreted in different ways by the Commission and the electricity industry representatives.

In its report ‘Energy prices and costs in Europe’ [note 11], prepared in accordance with the European Council’s request, the European Commission conducts the analysis, which is aimed at determining the reasons behind the increasing energy prices across Europe, particularly in the case of electricity. This report builds an evidence for the argument that in fact the increase of electricity prices has its roots in the increase of gas prices and lack of interconnectors, rather than in market interventions and subsidies in renewable energy. It therefore maintains that ‘reducing EU energy dependency would help to offset the effects of energy price fluctuation and security of supply risks’ [note 12].

Eurelectric, in turn, in its official letter to the European Council in anticipation of the March Summit, rather directly puts in question the report on energy prices in Europe issued by the Commission. It states the following: ‘…policies can only be as sound as the data that inform them…We are concerned that the European Commission’s report on energy prices and costs…

| …policies can only be as sound as the data that inform them… |

|

| Chart 2: Ratio of European Union, Japanese and Chinese to US industrial electricity prices, including taxes. Source: Accenture and Eurelectric Report ‘Forging a Joint Commitment to Sustainable and Cost-Efficient Energy Transition in Europe’, p. 3, available at http://www.eurelectric.org/media/132600/eurelectric-accenture_brochure-2014-030-0355-01-e.pdf |

Integrating the issue of competitiveness and regulatory predictability in the concept of EU’s energy security is vital for ensuring the relevant investments in the sector, while the interdependence between European gas and electricity supplies has to be articulated on the strategic policy level in a clear manner and relevant action plans have to be put in place. This issue should be addressed by the national TSOs, as well as ENSOG and ENTSO-E. Apart from that, greater data transparency is needed, in order to enable an unambiguous assessment of impact of political interventions on the energy markets, and of the reasons behind increasing energy prices in Europe. Finally, market design has to be developed through the bottom-up approach, which would enable national regulators and TSOs and DSOs to take the relevant steps in ensuring sufficient liquidity across the different market areas, as well as strengthening competition.

- World Energy Council’s World Energy Issues Monitor ‘What keeps Future Energy Leaders awake at night?’ 2014, available at http://www.worldenergy.org/wec-network/future-energy-leaders/what-keeps-future-energy-leaders-awake-at-night/

- Ibid. p. 11

- ibid. p. 16

- ibid. p. 9 – see pic. 1

- European Energy Security Strategy, COM (2014) 330

- www.europeanenergyreview.com/index.php?id=4289

- International Association of Oil and Gas Producers (OGP) response to the Green Paper “A 2030 framework for climate and energy policies”, 26 February 2014, available at http://www.ogp.org.uk/files/8713/9359/1804/OGP_views_on_2030_climate__energy_package.pdf

- Eurogas response to the Green Paper “A 2030 framework for climate and energy policies”, 2 July 2013, available at http://www.eurogas.org/policy-areas/list-of-documents/?tx_ttnews%5Bcat%5D=9

- IEA World Energy Investment Outlook, Presentation at the launch of the report, 2014, available at https://www.iea.org/newsroomandevents/speeches/WEIO2014Presentation.pdf

- IEA World Energy Investment Outlook, 2014, available at http://www.iea.org/publications/freepublications/publication/world-energy-investment-outlook---special-report---.html

- EC, Commission Staff Working Document ‘Energy Prices And Costs Report’, 17 March 2014, available at http://ec.europa.eu/energy/doc/2030/20140122_swd_prices.pdf

- ibid. p. 195

- Eurelectric letter for European Council of 20-21 May 2014, 25 February 2014, p.2, http://www.eurelectric.org/media/126161/eurelectric_letter_to_european_council__20-21_march-2014-030-0146-01-e.pdf

- Eurelectric ‘Analysis of European Power Price Increase Drivers’, 21 May 2014, available at http://www.eurelectric.org/media/131606/prices_study_final-2014-2500-0001-01-e.pdf

- Accenture and Eurelectric Report ‘Forging a Joint Commitment to Sustainable and Cost-Efficient Energy Transition in Europe’, available at http://www.eurelectric.org/media/132600/eurelectric-accenture_brochure-2014-030-0355-01-e.pdf

- Eurelectric ‘Analysis of European Power Price Increase Drivers’, 21 May 2014, p.20, available at http://www.eurelectric.org/media/131606/prices_study_final-2014-2500-0001-01-e.pdf

Discussion (0 comments)