Ready ... set ... go! The European decarbonisation race is on

on

Ready … set … go! The European decarbonisation race is on

In February European political leaders called for an energy revolution. Next week on 13 December the European Commission will release its long-awaited response to this call: a 2050 Energy Roadmap that sets up the signposts and the routes that are meant to lead Europe to a decarbonised future. However, drafts of this Roadmap, including the accompanying impact assessment, have already been circulating for weeks in Brussels, and have given rise to the first heated debates. EER's Brussels correspondent Sonja van Renssen spoke to stakeholders and gives a first overall sketch of the European energy revolution-in-the-making. Her most important conclusion? Despite all the modelling, it is the decisions taken by policymakers that will determine what our energy future will look like.

|

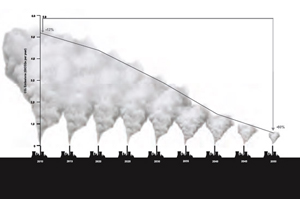

| Despite all the modelling, it's the decisions taken by policymakers that will determine our energy future (illustration: designboom) |

The EU’s new energy 2050 roadmap, due to be officially published on13 December, sets out a series of scenarios to cut Europe’s energy-related carbon emissions by 85% by 2050. This must be the energy sector’s contribution if the EU is to cut overall greenhouse gas emissions by 80-95% by mid-century, as European leaders pledged to do at a summit in Brussels in autumn 2009. Current EU policies are on track to deliver less than half of this. In March of this year, the Commission set out decarbonisation requirements for individual sectors in an overall low-carbon roadmap. The new energy roadmap fleshes this out for the energy sector.

In its roadmap the Commission examines five scenarios, each characterised by a different element: high energy efficiency, technology-neutrality, high renewables, delayed carbon capture and storage (CCS) and low nuclear. The Commission is careful to stress that these are not forecasts of what will happen, but says ‘it is possible to extract some important conclusions which will help shape strategies for the post-2020 period’.

‘The first tool of the EU energy strategy is and should remain energy efficiency’, concludes the Commission. This is the overriding priority in all scenarios. Primary energy demand must come down by at least a third by 2050 compared to pre-recession highs in 2005-6, the Commission says. A second constant is a big jump in the share of renewables to at least 55% in gross final energy consumption (and 60% in electricity production), up from just 10% today. It also imagines a “pivotal role” for CCS, “if commercialised”. Nuclear energy will remain a “key contributor” to emission reductions, with the highest penetration in the case of delayed CCS.

Decarbonising the power sector is essential in all scenarios because electricity will have to contribute to decarbonising the heating and cooling, and transport sectors. Electricity is expected to almost double its share in final energy demand to nearly 40% by 2050. It will fuel two-thirds of passenger cars and light vehicles. Electricity prices rise to 2030 but fall thereafter under all scenarios except the high renewables one, where prices continue to rise, albeit more slowly, to 2050. As for total energy system costs, the Commission draws the important conclusion that an energy revolution will cost no more than business as usual. The EU will have to invest an annual €2.5 trillion a year from now to 2050 regardless of whether it pursues its decarbonisation goals or not.

Comprehensive vision

Josche Muth, Acting Secretary General of the European Renewable Energy Council (EREC), welcomes the comprehensive vision of the draft roadmap: ‘We need an energy roadmap, not a power roadmap’, he says, ‘and this one addresses all sectors, also heating and transport.’ Heating is responsible for half of all energy demand, yet often trails in the shadow of the power sector.

The new roadmap recognises renewable heating and cooling as “vital” to decarbonisation and says we must deploy heat pumps and storage heaters, and move to renewables such as solar, biogas and

| 'The Commission has completely lost the 2020 focus. Is it still supporting the 20%?' |

The transport sector already got its own 2050 roadmap from the Commission in March. The sector must reduce emissions by 60% below 1990 levels by mid-century. Already member states have expressed grave doubts about this goal, whereas the European Parliament wants to introduce an additional 20% emission reduction target for 2020. The feasibility of other proposals, such as a modal shift from road to rail, are being questioned both by the member states and the European Parliament.

In the new energy roadmap, transport is mentioned mainly in connection to bio energy: ‘Decarbonisation will require a large quantity of bio energy, especially in transport.’ The Commission says second and third generation biofuels (i.e. made from waste) will need to be promoted, but expands no further on either biofuels or biomass. Indeed, this is the European paper and pulp industry’s biggest criticism of the draft roadmap. ‘There is no biomass supply strategy’, says Marco Mensink, Deputy Managing Director at the Confederation of European Paper Industries (CEPI).

Many stakeholders applaud the Commission’s recognition of efficiency and renewables as the two non-negotiable priorities whatever the future energy scenario. But why hasn’t the Commission modelled a high efficiency, high renewables scenario? ‘It is incomprehensible’, says Stefan Scheuer, Secretary General of the Brussels-based Coalition for Energy Savings, which brings together NGOs and business associations with an interest in efficiency. One could ask too why, in the wake of Fukushima and obvious delays to CCS, there is no delayed CCS, low nuclear scenario. Or why a shortage of one is assumed to be made up by the other. These are the kinds of questions the Commission will face on 13 December.

Controversial

The energy roadmap has been drawn up to decarbonise the European energy sector. But it is meant to do so ‘while at the same time ensuring security of energy supply and competitiveness’, in the Commission’s own words. Yet the decarbonisation agenda clearly dominates. ‘The impact assessment is really modelled for decarbonisation’, says Muth. He would have liked to see an assessment of how relevant the different scenarios are to energy security, competitiveness and sustainability. The renewables sector has long argued that it contributes to energy security as well as combating climate change, for example.

The draft roadmap has been controversial among climate campaigners because it appears to raise the question of whether the EU should pursue a decarbonisation agenda if there is no new global climate treaty. ‘The scenarios all depend on the conclusion of a global climate agreement. If coordinated action on climate among the main global players fails to strengthen in the next few years, the question arises how far the EU should continue with an energy system transition oriented to decarbonisation.’

This wording may well be changed in the final version, but some stakeholders at least say it makes sense to think about what to do if the world does not follow Europe’s ambitious climate polices. ‘Someone has to raise the question’, says Brian Ricketts, Secretary General for Euracoal, which represents the European coal industry in Brussels. Certainly expectations for UN climate talks currently underway in Durban, South Africa, are modest at best.

A closer look at the Commission’s impact assessment starts to cast doubts on the reality of some of

| The most concrete policy action expected to flow from the new 2050 energy roadmap is a legislative proposal for a renewable energy target for 2030 |

This sends out completely the wrong message at a time when member states and MEPs are discussing Commission proposals for a new energy efficiency law, says Scheuer. The stated purpose of these proposals is precisely to get Europe back on track to the 20% target (it is currently set to deliver just 9%). ‘The Commission has completely lost the 2020 focus’, says Scheuer. ‘Is it still supporting the 20%?’

Certainly member states appear as uncertain as ever about the non-binding target. In a progress report by the outgoing Polish EU presidency to energy ministers at the end of November, it became clear that many member states dislike the proposed 1.5% annual savings target for energy suppliers. Many also oppose a proposed 3% refurbishment requirement for public buildings, saying it would be too bureaucratic (data on all public buildings must be collected) and expensive. At the same time, the European Parliament is considering calling for binding national savings targets and stronger conditions around the 1.5% obligation. The incoming Danish EU presidency has its work cut out for it to broker a deal on this file next year.

The reason efficiency does poorly in the Commission’s 2050 modelling is that the Commission’s so-called PRIMES model is not very good at reflecting non-market barriers and incentives, says Scheuer. These are exactly what energy efficiency is most sensitive to. The fact that the Commission still gives efficiency such prominence in the roadmap could be interpreted as testament to the fact that it recognises the limitations of its model, but the impact assessment remains a potential Achilles heel for efficiency advocates.

Learning rate

|

| 'PRIMES wrongly assumes the electricity market in 2050 will function in the same way as today' (photo: NordREG) |

Renewables advocates also say certain technological assumptions are simply wrong: photovoltaic power is assumed to cost €4,000 per KW for example, when in practice it already costs only €2000-3000 per KW, says Frauke Thies, EU Energy Policy Advisor at Greenpeace. There is also assumed to be no little or no technological learning – and therefore cost decreases – for renewable technologies such as offshore wind and geothermal, she says, while the learning rate for CCS is set to be quite high once it gets going around 2030.

Despite these criticisms, renewables advocates welcome the 2050 roadmap, especially the Commission’s emphasis on more renewables as a no-regret option and its acknowledgement, in apparent contradiction of its impact assessment, that ‘substantial renewables penetration does not necessarily mean high electricity prices’. ‘Renewables are really your driver, your constant in every scenario’, says Dries Acke, Public Affairs Associate at the European Climate Foundation (ECF), which recently published its own report on decarbonising the European power sector by 2030.

Public acceptance

But fully decarbonising the power sector by 2050 requires more than renewables and efficiency: the Commission predicts renewables will account for a maximum three-quarters of gross final energy consumption in 2050. What about the rest? The Commission continues to see an important role for nuclear energy, which represents up to 18% of primary energy consumption by mid-century in the delayed CCS scenario. This assumes a significant amount of nuclear new-build. In the low nuclear scenario, where it is assumed no construction is started, nuclear would represent just 2.5% of primary energy consumption in 2050.

The penetration of nuclear will be determined by policies (e.g. it does better if decarbonisation is driven by carbon prices rather than by a renewables target) but also by public acceptance and the costs for safety, decommissioning and waste disposal, which are rising, the Commission says. The European nuclear industry, represented by Foratom, presented its own roadmap in June, which suggests that nuclear power could continue to provide nearly a third of European electricity needs up to 2050. That report makes no reference to Fukushima. Foratom said the industry could build the five new reactors a year needed in Europe to fulfil this vision. Critics doubt that. Indeed, they doubt even the Commission’s more modest scenario for new-build, pointing out that nearly all nuclear plants currently under construction are delayed and over budget.

This is ominously reminiscent of the current situation for CCS. Its future today is highly uncertain. In the draft energy roadmap, the Commission sees a role for it, but only after 2030 and only ‘if commercialised’. Many in the industry say delaying CCS to 2030 risks stranding the investments and expertise in the technology to date.

The future of coal is tied up with the development of CCS. ‘If power is generated with CCS, coal has no disadvantage over gas’, says Hans-Wilhelm Schiffer, head of General Economic Policy and Science at RWE in Germany. ‘Compared with shale gas, coal even boasts an edge.’ RWE bases its conclusions

| 'If you take the 60 years from 1990 to 2050, 2020 is halfway, so why is our emission reduction target not 40%?' |

Clear signal

Natural gas is receiving a lot more (positive) attention from the Commission than it has in recent years. ‘Gas will be critical for the transformation of the energy system’, proclaims the Commission in its draft roadmap. According to the Commission, gas-fired power is cleaner, cheaper and faster to build, and more flexible than coal in the current system. The Commission’s main caveat is that in the long-term, gas plants too will need to be equipped with CCS.

Some voices in the gas industry are keen to separate their future from that of CCS and even some in the renewables sector suggest the two might not need to go hand in hand. But Beate Raabe, Secretary General at trade association Eurogas, is unfazed by the link. ‘It makes sense to build gas plants now. In 20 years time we can still decide whether we want to go for 100% renewables or CCS’, she says. The Eurogas 2050 roadmap argues that going for gas means leaving your future options open, while cashing in on emission reductions today.

The big issue for gas is concern over security of supply. Raabe points to the growing liquefied natural gas (LNG) market, which is helping ensure gas can reach Europe from a growing number of suppliers. Shale gas could also contribute to security in future, she says, but the industry is not relying on it. Raabe insists that the gas industry wants a clear signal in the Commission’s roadmap that gas has a central role to play in Europe’s low-carbon future, to give certainty to pipeline investors and those who export to Europe.

2030 Renewables target

The most concrete policy action expected to flow from the new 2050 energy roadmap is a legislative proposal for a renewable energy target for 2030. The EU commissioners for climate action and energy, Connie Hedegaard and Günther Oettinger, have already spoken out in favour of this. The draft roadmap points out that under all scenarios, renewables would represent 30% of gross final energy consumption in 2030, perhaps suggesting this could be the level for a new target. Renewables stakeholders want much more however: EREC and organisations such as the European Wind Energy Association (EWEA) are calling for a 45% renewables target for 2030 (and 60% in electricity production).

Others, such as electricity association Eurelectric, would prefer to see a purely market-driven approach – essentially a cap on emissions set by Europe’s carbon market. ‘The EU ETS [emission trading scheme] should be the driver of decarbonisation’, says Nicola Rega, Eurelectric’s Environment and Sustainable Development Advisor. But does this do justice to security of supply and competitiveness? In any case the very low carbon price today (under €10 a tonne) is providing little push for low-carbon investment. More than 80% of the emission reductions required from the EU ETS from 2005-10 were delivered by wind turbines installed in that period, according to a report by Rémi Gruet, EWEA’s Senior Regulatory Affairs Advisor on Climate and Environment.

Like other stakeholders, he advocates a stronger carbon market as well as a renewables target. The cap of the EU ETS will need to be tightened to set the EU on track to an 80% domestic emission reduction by 2050. One solution policymakers are discussing is removing a number of carbon allowances from the system . In effect, this would boil down to raising the EU’s emission reduction goal for 2020 from 20% to 30%. The idea is starting to garner some support beyond the NGO community, but many in the power sector say 2020 is “tomorrow” and it makes more sense to concentrate on 2030 now.

Three utilities in particular stepped out from the mould in November with a call for the Commission to present a second EU climate and energy package that would set binding targets for emission reductions, renewables and efficiency for 2030. Eneco from the Netherlands, SSE from the UK and DONG Energy from Denmark say they need long-term predictability to invest in the technological innovations needed and bring down costs. ‘If you take the 60 years from 1990 to 2050, 2020 is halfway’, said Ian Marchant, CEO of SSE in Brussels, ‘so why is our emission reduction target not 40%?’ A Commission official present at the event said the energy 2050 roadmap would start the debate over a new climate and energy package.

That’s undoubtedly true – and the debate will be far-reaching, from efficiency and renewables to CCS and nuclear; from the role of targets and markets to support mechanisms and public acceptance; from the necessity of a true EU internal energy market to an upgraded, expanded, interconnected grid. Together, these elements will shape the energy revolution European leaders called for back in February.

As Stefan Scheuer of the Coalition for Energy Savings points out, ultimately politics not models decides energy policy. In this sense the Commission’s energy 2050 roadmap is merely the first blast in the political battle to come.

Discussion (0 comments)