Russia. Still-life Under Sanctions

on

Russia. Still-life Under Sanctions

From the headlines that we see in the press lately it seems that Russia’s main problem is economic sanctions imposed by the West in relation to the Ukrainian crisis. The Russian economic situation can be characterized as cautiously pessimistic: in light of the sanctions currently in place, the 2015 economic development prospects aren't very positive. There are certain expectations that the sanctions will be lifted at some point sooner or later; but as it stands today, the Rouble is becoming weaker, prices are increasing and oil price developments aren't favourable for the Russian budget dependent on oil export income. However, it is questionable whether these developments are solely the result of sanctions introduced against Russia by US and the EU throughout 2014; moreover, it is questionable whether the lifting of the sanctions will solve any of the problems effectively, as many of the commenters hope.

|

| Source: Gazprom |

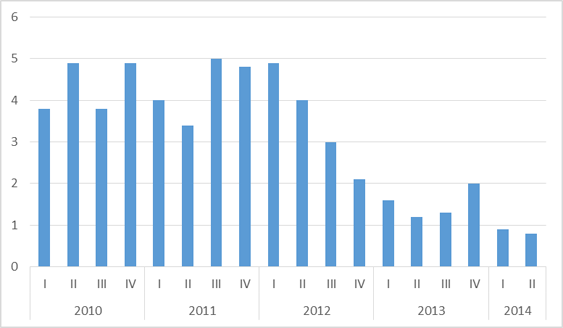

From a formal macroeconomic view, Russian economy looked relatively stable compared to the developed countries’ economies in the aftermath of the economic crisis of 2008-2009. Despite the slowing growth rates (Figure 1), the economy continues to grow, the budget is balanced, the level of debt is lower than in e.g. the EU, the rate of employment is high (around 94-94,5%), inflation is under control.

However, already in 2013 there were some worrying trends.

The first trend is the GDP growth rate falling below world average already in 2013. It had been preceded by a steady decline throughout 2012, which caused the discussions about Russian economy possibly falling into the recession in the near future. The second worrying trend is the tightening of the budget (budget earning used to consistently exceed the planned level during the period of 2000-2012 as a result of higher energy prices on international markets and higher inflation than planned). An important characteristic of the year 2013 is that the share of wages in GDP has increased, while the share of earnings, on the contrary, decreased.

|

| Figure 1. Russia’s GDP growth rate, % increase on a year earlier (Source: Rosstat) |

This development, consistently present in the Russian economy over the past decade, means that the economic system, from the one hand, becomes more socially-oriented, but from the other, less attractive for investors since it creates lower earnings [note 1].

One of the key problems of the Russian economy, preceding the Ukrainian crisis and the introduction of the sanctions regime, was that the model of economic development based on demand growth had been exhausted. This refers to the energy sector in the first place since it provides a lion’s share of Russia’s budget earnings.

The sanctions only made these problems more visible.

The sanctions: energy sector focus

Since March 17, 2014 there have been nine packages of sanctions introduced by the EU (altogether 119 individuals and 23 entities, plus measures against energy, financial and defense sectors). EU sanctions include restrictions on financing and supplies of equipment and technology

| They hit the segment of the Russian energy sector that is critical for its future growth by limiting financing and technology transfer |

The Russian energy companies affected by the sanctions can generally be split into three groups. Firstly, Gazprom and Novatek have avoided direct sanctions of the EU (as generally perceived, largely due to the fact that the EU is dependent on Russian gas supplies) – but the US sanctions do cover these two companies. Secondly, Lukoil and Surgutneftegaz are covered only by the technology transfer sanctions within the US package [note 4] – financial restrictions do not cover these two [note 5]. And finally, the third group includes Rosneft, Gazprom-Neft, and Transneft, who are subject to a full range of sanctions by both the US and the EU.

The export licensing measures are generally employed for three large groups of supplies: pipes; technology and equipment for deep-water/Arctic/ shale exploration and production (E&P); and software solutions.

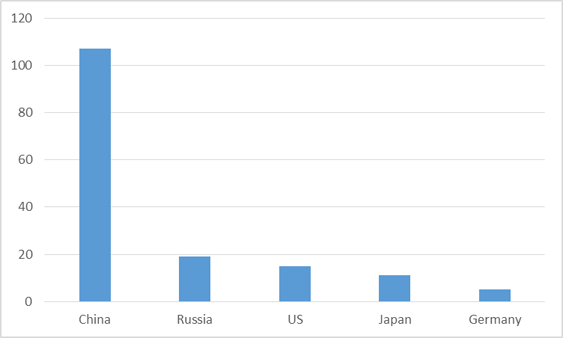

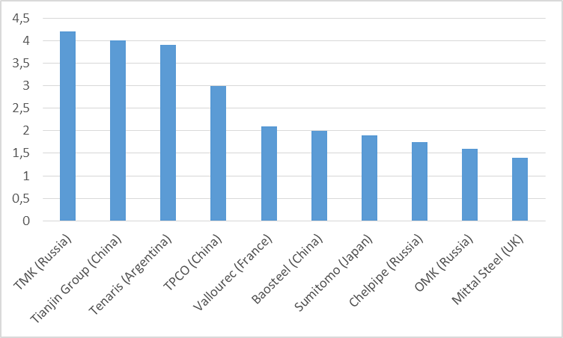

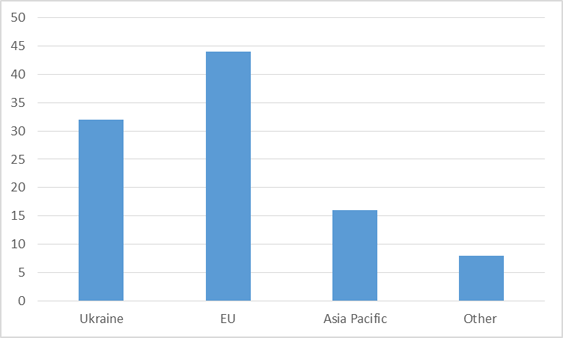

The first group of the restrictions concerns pipes. Russia has become one of the largest pipe importers in the world since the second half of the 1970's, when the ‘gas for pipes’ deal was implemented under the conditions of the long-term gas supply contract with Germany and other EU gas importing countries. However, since the beginning of 2000s a consistent policy to decrease the share of imports of pipes, has resulted in the development of a domestic pipe production industry. As can be seen from Figure 2, Russia’s production capacity was at 19 mln tonnes of pipes in 2012; actual production was at around 10 mln tonnes while its own consumption was at 9,43 mln tonnes [note 6]. Up to 20% of pipes are exported (there are also significant imports). Overall, the Russian pipes industry has the technology and standards to support the oil and gas industry, as more than 65% of its production are already used in this industry. The share of pipes produced in Russia was 70% in 2013, versus only 35% back in the 1990's. Therefore, the line pipes of the kind of different diameters used for oil or gas pipelines, which figure in the sanctions, are not of critical importance, as they can be replaced by domestic production; this measure will primarily lead to the restructuring of the Russian steel pipe market and entrance of Asian suppliers, should the Russian pipe producing sector prove unable to cover for the missing volumes. (For example, China currently produces 72% of world’s steel pipes – see figures 2 and 3 – and is unable to use all of that production internally, thus actively sending it to external markets, including Russia).

|

| Figure 2. Pipe production capacity, million tonnes per annum (Source: Pipe Industry Development Foundation) |

|

| Figure 3. Key steel pipe producing companies in 2012, million tonnes (Source: Pipe Industry Development Foundation) |

|

| Figure 4. Structure of pipe imports to Russia, % (Source: Rossiyskaya Gazeta, http://www.rg.ru/2013/01/29/import.html) |

Limitations on deepwater Exploration & Production (E&P) related goods and services constitute the second group of restrictions and include seismic surveying, drilling, subsea hardware, floating production systems. Besides equipment itself, there is a need for knowledge about how to use and organize it. These services and expertise can commonly be attained by companies through acquisition of assets in relevant projects and joint work with companies in possession of the relevant expertise. For Russian companies, who are not able to independently complete projects for deep-water oil and gas production, this is not possible now since the transfer of technology and sale of related services is restricted. At the same time, deep-water and particularly Arctic exploration and drilling are essential for sustaining Russia’s overall levels of production in order to offset declining output of the existing fields in West Siberia. New production in Russia is mostly implemented with the use of horizontal drilling (e.g. Gazprom-Neft used horizontal drilling for 42% of their wells in 2013) and multi-stage fracking. Arctic mega-projects will need Western technology to ensure their implementation.

The sanctions include restrictions for exporting drilling platforms, details for horizontal drilling, subsea equipment, specific equipment for operations in the Arctic, remote control underwater machines and high-pressure pumps. These are all essential components to implement plans to sustain production levels. Current leaders in respect to

| These are all essential components to implement plans to sustain production levels |

The third group of restrictions concerns software for hydraulic fracturing. Of all the measures, the restriction on providing software is expected to have the strongest negative effect on the Russian energy sector. The providers of such software are Shlumberger, Halliburton, Baker Hughes, all US companies. For instance, Bazhenov shale oil formation (jointly developed by Lukoil and Total) is affected directly by the sanctions, and prospects are it won’t be possible to effectively continue the formation’s operations [note 7].

Overall, restrictions on the energy companies have a potentially large impact on the future of the Russian energy sector: production from existing fields has levelled off;

| restrictions on the energy companies have a potentially large impact on the future of the Russian energy sector |

Future functioning of the Russian energy sector will be complicated and will have an impact on the economic outlook

The effect of sanctions on the Russian energy sector can be summarized as follows. Firstly, there is no doubt that the sanctions will impose additional long-term costs on Russia. Secondly, moderate impact is expected from the sanctions dealing with E&P – deep-water, Arctic and shale oil. Rosneft, as one of the companies having most extensive plans for the Arctic, will be suffering most from these restrictions. Thirdly, the biggest negative impact can be expected to come from the software transfer restrictions: E&P offshore can theoretically be done in collaboration with Asian counterparts, while for software solutions finding the replacement options will be lot more difficult.

With the restrictions in place, the outlook for the Russian energy sector is not looking optimistic and – taking financial restrictions into consideration -

| there is no doubt that the sanctions will impose additional long-term costs on Russia |

Another major implication is that all measures collectively will inevitably lead to a more explicit Russian turn toward Asia in terms of cooperation in equipment purchases, as well as in terms of investment and financing. However, that adds a stronger bargaining position to the Asian partners. The turn will not be as smooth and easy as the Russian companies want to believe, with China already receiving favourable conditions on prospective gas supplies [note 9], and Japan wavering about possibilities of imposing its own sanctions against the Russian energy sector [note 10].

The most critical impact is that the problems inherent to the Russian economy became more evident and acute. There has been a threat of underinvestment already before the introduction of the sanctions regime; underinvestment hinders the perspectives of growth.

| It is clear that the country has to be in the search of a new model of economic growth |

- Mau V. In Search of the New Model of Development: Russia’s Socio-Economic Development in 2013. Voprosy Ekonomiki. 2011, No. 2. Pp. 4-32.

- Council regulation (EU) No 833/2014 of 31 July 2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine. http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014R0833&from=EN and Council regulation (EU) No 960/2014 of 8 September 2014 amending Regulation (EU) No 833/2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine. http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2014:271:FULL&from=EN

- Russian Oil Industry Sanctions and Addition of Person to the Entity List//Federal Register. https://www.federalregister.gov/articles/2014/08/06/2014-18579/russian-oil-industry-sanctions-and-addition-of-person-to-the-entity-list

- Bureau of Industry and Security. Export Administration Regulations: Supplement No. 4 to Part 744 - ENTITY LIST. September 18, 2014.

- They fall under Directive 4 under Executive Order 13662. See: Office for Foreign Assets Control. Sectoral Sanctions Identification List. September 12, 2014. http://www.treasury.gov/ofac/downloads/ssi/ssi.pdf

- Pipe Industry Development Foundation, http://www.frtp.ru/

- “You can’t touch Bazhenov any more. That’s dead,” says a western oil executive in Moscow”. Russian oil: Between a rock and a hard place. Financial Times. October 29, 2014. http://www.ft.com/intl/cms/s/2/fc354a6a-5dcb-11e4-b7a2-00144feabdc0.html#axzz3HfXRnOHV

- Russian oil: Between a rock and a hard place. Financial Times. October 29, 2014. http://www.ft.com/intl/cms/s/2/fc354a6a-5dcb-11e4-b7a2-00144feabdc0.html#axzz3HfXRnOHV

- Russia’s Gas Deal with China is Huge and Here’s Why. Russia Direct.June 3, 2014. http://www.russia-direct.org/opinion/russias-gas-deal-china-huge-heres-why

- Japan Weighs Pros and Cons of Imposing Sanctions on Russia. Russia Direct. September 19, 2014. http://www.russia-direct.org/analysis/japan-weighs-pros-and-cons-imposing-sanctions-russia

Discussion (0 comments)