Surprise, surprise

on

Surprise, surprise

The almost-unnoticed, spectacular exploitation of “unconventional” gas in the US has extended American gas reserves by many decades. Soon the rest of the world will follow, with huge implications for the world energy market.

Down in swampy Red River Parish, Louisiana, they are now celebrating the largest ever gas find in US history. So why had it never been exploited before? Because it is unconventional gas, deep in impermeable shale. With modern technology, it can be recovered. Soon the new technologies will be conquering the world – and changing the global energy market.

While celebrating the 50th anniversary of the Dutch Slochteren field in June this year, Rex Tillerson the CEO of ExxonMobil, announced that Slochteren, Europe’s largest onshore natural gas field, was perfectly capable of producing for another 50 years. The field in Groningen province was not, as everybody was assuming, on its way out.

Given the general political panic in Europe about the energy security of natural gas supplies, this was exciting news. With alarming concerns about the “unreliability” of Russian supplies and the potential for Middle Eastern disruption of LNG flows, news that Europe was not going to be shorn of its indigenous gas supplies in a few years was reassuring. As conventional gas supplies declined, riding to the rescue, perhaps, was something few Europeans had taken seriously: unconventional gas reservoirs, known to the knowledgeable as UGRs.

Slochteren is a particularly interesting field in this regard. The field is thought to contain 2,700-2,800 billion cubic metres (Bcm). So far is has produced around 1,700 Bcm. In conventional thinking, this would suggest that the field is in slow decline like large sections of North Sea production.

However Slochteren is sitting on top of a coal seam and underneath a gas shale seam. This is just below a tight gas strata that also contains heavy oil. If, by a mystery of climate change, it was also sitting underneath a large layer of permafrost, the Groningen basin would be a repository for all four different types of unconventional gas reserve.

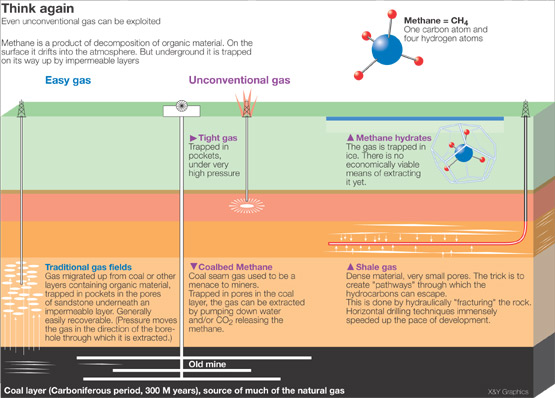

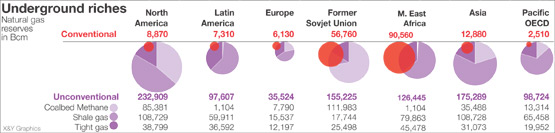

In general there are four different types of UGR: (1) coal seam gas, (2) gas shale, (3) tight gas and (4) methane hydrates trapped in ice. Just how much unconventional gas is actually available from these sources is a matter of some dispute. One American study by the National Petroleum Council (NPC) in 2007 put the total global figure available from the first three of these resources at 32,560 trillion cubic feet, or roughly 914 trillion cubic metres. This is roughly five times the current perceived conventional resource.

Old hazard

So let’s have a look at the different types of UGR. Coal seam gas, in the form of methane, is an old hazard in coal mines, frequently causing disastrous explosions down the ages with enormous loss of life. Indeed, clearing “mine gas” has been a standard procedure in some mining companies, utilizing wells drilled into the coal-seams and water or CO2 uplift to clear the methane prior to coal extraction. What is new, at least in Europe, has been the extraction of methane from deep coal seams for commercial production, either from existing mines or from seams where there is no intention of coal extraction.

This is now a familiar technique in the US. In southern Colorado and northern Utah for example, BP is extracting 800 mcf/d (million cubic feet per day or 22.6 million m3, as much as the total gas production of Denmark) across the San Juan coal basin, utilizing some 3,400 wells across an area of 18,000 square kilometers. The crucial parameter for maximizing production is the permeability of the coal seams and the volume of methane within them. As a rule of thumb, high quality coals like anthracite produce larger quantities of extractible methane than lower brown coal varieties.

Secondly there is shale gas. Shale rock at first sight does not seem a likely candidate for methane extraction. As the world’s most common sedimentary rock, it is frequently the material that holds oil and gas reservoirs in place as an impenetrable barrier to hydrocarbon migration. It does however contain significant quantities of organic matter and dry gas widely dispersed. The trick is to create “pathways” through which the hydrocarbons can escape. This is done by hydraulically “fracturing” the rock. One simple way of doing this is to pump water into the shale under pressures as high as 8,000 psi, with sand in the flow to sustain the cracking process and make it permanent. While gas bearing shale, may not be as productive as oil bearing shale economically, it requires less fracturing because of the easier flow of the gas.

The key technological development here has been horizontal drilling, which enables access to wide areas of the rock. In the massive Texan Barnett Shale Basin the use of horizontal wells has rocketed. With an estimated 120 billion square feet of gas per square mile in place in some of these shales, a single horizontal well in the fractured rock can produce a million cubic feet of methane per day and carry on doing it for 30 years.

Then there are “tight gas” formations. They have in common with “shale gas” the fact that the rock is extremely impermeable. It also frequently needs fracturing and the terms are often used interchangeably. However, tight gas formations often contain significant quantities of gas in pockets rather than spread widely within the rock. Equally, these sizeable reservoirs are often highly pressurized and deep. As such, in conventional drilling, they can be an unexpected hazard as the drill bit hits an unseen over-pressured “pocket” creating a blow out. The key element here is extremely careful targeting of the “sweet spot” through 3-D seismic and mastery of the expected pressure through “mud-control”. Thus, while unconventional shale gas produces relatively small flows of gas over long periods, tight gas formations often produce large quantities of gas extremely rapidly and do not flow for long.

The irony here is that tight gas formations have traditionally been the enemy of conventional hydrocarbon drilling. Hitting unexpected tight gas can trash a 100 ton land-rig, bust drill stems and at worst create an uncontrollable upward flow of potentially explosive gas.

Great transformation

All three of these unconventional techniques for natural gas production have been responsible for sustaining US gas production (excluding Alaska) at an average of 55 bcf/d (some 565 billon m3 per year) since 1990, keeping the US the second-largest gas producer in the world behind Russia, when all expectations suggested it would decline rapidly on conventional resources. Back in 1990 some 16% of US gas production came from UGRs, mostly coal mines. By 2004 UGRs were contributing 40% and since then have dramatically risen, stimulated by the effect of Hurricane Katrina’s impact on Mexican Gulf gas production. By 2008, the US was producing 62 bcf/d and production appeared to be rising, almost entirely due to UGRs as conventional fields declined. The US Energy Information Administration believes that UGRs may now represent two-thirds of onshore reserves, recently increasing them by 13%. Its recent estimate of unconventional gas reserves is put at 1,770 Tcf, including 238 Tcf of conventional reserves, both on and offshore. Industry group, the Potential Gas Committee suggests that the figure is even higher at 2,074 Tcf. If this is true, the US could continue to produce gas at current production levels for 90 years, whereas until recently it was generally assumed that the American conventional reserves-to-production (R/P) ratio was no more than about 10 years. It would also radically change the ratio of onshore to offshore gas.

To a remarkable extent this great transformation in the fortunes of US gas production has been the handiwork of one man: Steve Holditch. Currently Professor of Petroleum Engineering at Texas A&M University, Holditch has spent decades examining the so-called “resource triangle”. Originally developed in the mid-1970s by Masters and Gray, the triangle suggests that oil and gas resources are “log normal” just like any other mineral resource. That is to say, that while there are comparatively small quantities of conventional, easy to extract resources, there are also progressively larger unconventional resources available. The harder they are to extract, the greater will be the resource available.

This has not endeared Holditch to the true believers in peak oil. However a lifetime of finding “down-hole” technical ways to develop such unconventional resources, has not convinced him otherwise. He does however see some urgency in developing such techniques, precisely because it is the only way to avoid a drastic rundown of the available production. The problem is not the resources available. It is how to develop the technology to extract them. As he put in a 2003 paper: ‘Many individuals think that unconventional reservoirs are not important now but may be very important in the future. Actually unconventional reservoirs are very important now to many nations.’

In a report published in 2007, the National Petroleum Council (NPC) made an assessment of the global availability of UGRs. North America turns out to have the most unconventional gas, but this may be the result of much greater knowledge. Russia comes a predictable second. Then comes China and much of Eastern Asia, which, given the general assumption about the lack of conventional natural gas resources there, is a surprise of great geopolitical significance. Europe, including the east, comes in low with around only 3.8% of the total global resource.

The NPC study thus gives Europe, excluding Russia, around 1,234 tcf (trillion cubic feet) or 34.7 tcm (trillion m3) of unconventional gas resources to add to its 6.54 tcm of conventional existing reserves. This would almost increase the reserves by a factor of six. However, others are far less optimistic, suggesting, like Cambridge Energy Research Associates’s Mike Stoppard, that the figure is between 3 to 12 tcm. Furthermore, the speed at which this resource could be extracted might limit its output to some 50 bcm (billion cubic m3) per year by 2030, somewhat less than the Netherlands produces today.

Land grab

But there are considerations involved for Europe. Europe’s electricity infrastructure has been designed around its coal resources for the past 100 years. In many countries its power stations were and remain located near its coal-mines. For sensible logistical reasons, Britain’s coal-fired stations rested close to the coal resource, in Scotland, Wales and England. The same applied in northern France, Belgium, Germany and Poland.

With the exception of Poland, this mining for deep coal has long since been shut down and as a result the methane is shut in or slowly leaching, but the proximity to the thermal power station stock remains. Much of Europe’s conventional power generation thus sits remarkably close to a potential supply of unconventional natural gas in coal seams that are well understood and whose geology and position is well documented.

One problem in Europe as opposed to the US is that water, used for uplift in the United States, is a highly valued resource. Yet it is not inconceivable that CO2 uplift could be used, not only as a way to maximize methane production from old coal mines, but also as a means of carbon capture.

In effect, gas production could be used to offset the cost of carbon separation and its pipeline transport to the former mines. Detailed knowledge of the structures of these old and shut down mines is already available, to the point where no significant seismic would be needed. The depth of any bore wells to the lowest point in the coal strata is already known across Europe. Under pressure CO2 could be pumped under the seams. When the flow of methane ceases, the wells could be capped and the CO2 trapped, effectively capturing it and leaving the mines inert and probably safer.

The NPC study puts Europe’s coal-bed methane resource at around 7.8 tcm, although others like Wood MacKenzie put it much lower at 1.6 tcm. The point however is that it is often close to the power sector’s point of use. The CO2 angle and the potential of the resource has been known since the late 1990s, when the UN Economic Commission for Europe (UNECE) started to examine the issue. It commissioned a test project in Poland’s Silesia, called Recopol, in December 2004, designed to extract methane and replace it with 1,000 tonnes of CO2 at 1,050 metres below ground.

Since then, there has been, very quietly, what one executive described as “a land grab” across Europe for coal-bed methane. Little noticed, companies like European Gas Ltd with three sites in France and IGas in the UK with 1,756 square kilometers and anticipated reserves of 56 bcm, have been testing coal seams for methane in a variety of small operations. These have been encouraged in the UK by tax advantages and in Germany by ownership rights. Nonetheless, there remains a problem that coal-bed methane in particular is seen as being found in too small pockets to be economically viable. CO2 capture might change this. In addition, both coal methane and shale gas technology face many of the onshore “soft issues” that are familiar in Europe: pipeline route and industrial land use objections.

But, as John Corben of the International Energy Agency (IEA) Chief Economist’s Office puts it: ‘The basic problem is that the resources haven’t been well assessed as yet. So this is just the beginning as companies and research agencies examine the issues. I think there will be an increase in activity, with production likely in the medium term.’ Undoubtedly there is a considerable amount of unnoticed licensing, exploration and appraisal activity going on in Europe, for coal methane, shale and tight gas.

Certainly the IEA is taking the matter very seriously, with the forthcoming – November – World Energy Outlook 2009 to devote a large section to the new resource. Perhaps what remains most significant about the arrival of unconventional gas for the near future is its impact on the global gas market. As IEA chief economist, Fatih Birol, pointed out in August, the expansion of UGR extraction in the US could shift the expanding LNG export resources of the Arabian Gulf into European rather than US markets. That alone is not a small matter.

Clathrate gun

So what about methane hydrates, the fourth potential unconventional source of natural gas? Trapped in ice molecules the current estimate of this natural gas resource is put at 700,000 tcf, of which around 200,000 tcf is in Alaska. This roughly increases existing US gas reserves by a factor of a thousand! In effect any economically viable means of extracting this as a resource would transform hydrocarbon economics.

Unfortunately nobody has yet found any such thing. Extracting the methane from the “clathrate” or ice/methane compound seems to need either thermal stimulus, a reduction in pressure, or access to some kind of anti-freeze. Leaders in game are the Japanese. Back in the 1980s, methane hydrates were still esoteric, but the emphasis was on the enormous potential resource.

Attitudes have since been changing, not least with “the Clathrate Gun” hypothesis. This suggests that the geologically accepted “Paleocine Thermal Maximum”, which drove up the global temperature by 8„aC was the direct result of melting permafrost and the release of huge volumes of trapped methane. Given that methane is a much more intense greenhouse gas than CO2, it might be as well that, interesting though the hydrates are, they might be better left in place. But I hope to return to this subject in the next issue of EER.

Discussion (0 comments)