The 40 million barrel question

on

The 40 million barrel question

The world needs another 40 million barrels a day of oil production to come on stream by 2020 if supply is to match demand. So says Shell's CEO, Peter Voser, reflecting a growing consensus in the industry and amongst watchdogs such as the International Energy Agency. But how will that be possible? A growing number of observers believe it won't be.

|

| The oil industry has to find incremental supply of 40 million barrels per day. |

Over the past couple of years it has become clear that meeting our future oil needs will be a huge challenge. Despite the current recession, most observers and analysts expect world energy demand to rise strongly over the long term. And even allowing for a huge rise in energy efficiency measures and rapid growth of alternative energy, oil is expected to remain our biggest energy source. So if supply is running short, we should indeed be concerned.

The challenge is two-fold. On one hand we need to find enough oil to meet growth in demand, as the world’s developing nations industrialise and mobilise. For example, car ownership per thousand people in China is tiny compared with that in OECD countries. Expect it to grow fast. On the other hand, we also need to bring on stream enough production to compensate for the natural decline rate in production at existing fields.

At Shell’s recent strategy presentation, CEO Peter Voser quantified the challenge in these terms: ‘By 2020 the world will need 40 million barrels/day of new oil production onstream, from fields that haven’t been developed yet. To give you some perspective, 40 million b/d is equivalent to about four times Saudi Arabia, or ten UK and North Seas. These are not new observations. But it is a huge challenge for the industry and an opportunity for Shell.’

In other words, the world needs to bring on stream new production of around 50% of total current world production – or another 2,500 Olympic swimming pools per day – within a single decade. But the world’s existing oil production system took decades to develop, cost untold trillions of dollars (in today’s money), and, crucially, is based mostly on giant, easy-to-find and cheap-to-develop oil fields. Exploration rarely turns up such fields today. It sounds a very tall order.

Crunch point

The concept of oil running short is hardly new. Indeed, a whole industry has grown up around the concept of Peak Oil – the arcane science of trying to predict when world oil production will hit its peak, thereafter to enter a period of inevitable and terminal decline, with terrible consequences for society.

To those of us who have followed the debate – with a mixture of at times bemusement and at others amusement – the role call of the protagonists is familiar: Matt Simmons, Colin Campbell, Jeremy Leggett, Chris Nelder, David Strahan. All have written books on the subject. At times some have attracted derision. Campbell even went as far as setting up an organisation called the Association for the Study of Peak Oil & Gas (ASPO).

Ranked against the ‘peak oilers’ are those who believe that technological innovation will always come to the rescue. Their standard-bearer is Daniel Yergin, chairman of Cera and Pullitzer-Prize winning author of the seminal oil industry history, The Prize. Behind him are most of the CEOs of the international energy majors and many politicians. A notable exception is Total's Christophe de Margerie.

The trouble with the Peak Oil debate – ignoring how emotional it can get – is that it misses the point. What matters is not at what date oil production will peak but whether and when it will be insufficient to meet demand; if demand were to peak before production we wouldn't have a problem. On that measure, however, there are signs that the crunch point may not be far away.

The issue has to be looked at on three levels. The first is how demand is expected to grow; the second is whether expected production levels will be able to meet that demand; the third is what are the implications of the expected supply/demand balance for prices. Let’s start with demand.

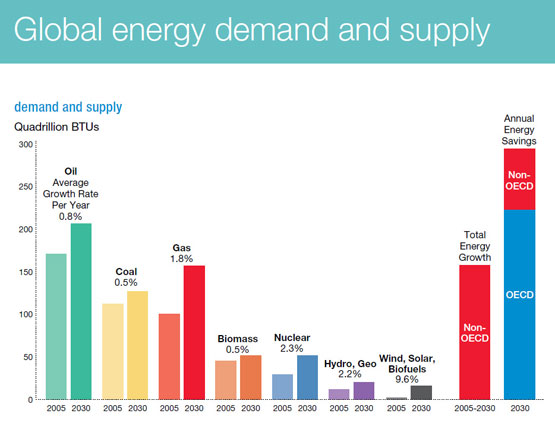

ExxonMobil quantifies its expectations in its latest annual energy outlook, a document that it not only makes publicly available but which the company says forms the basis for its business planning. The latest version, published at the end of 2009, projects that global demand for energy will in 2030 be 35% greater than in 2005, as the world’s population grows to 8 billion, and as the economies of the developing nations grow (see chart). This is despite the assumption that energy efficiency measures will make a very large contribution to restraining demand growth. Oil demand is projected to grow by 0.8%/year between 2005 and 2030.

|

| Despite massive projected growth in energy efficiency measures, renewables and nuclear, ExxonMobil sees oil demand growing by 0.8%/year between 2005 and 2030. Source: ExxonMobil |

The latest World Energy Outlook from the IEA, published in November last year, is similarly bullish about oil demand growth. Its business-as-usual Reference Scenario says that ‘oil demand (excluding biofuels) is projected to grow by 1%/year on average over the projection period, from 85 million b/d in 2008 to 105 million b/d in 2030’. All the growth comes from non-OECD countries, with consumption in the OECD declining. Even in the agency’s ‘450 Scenario’ – which assumes that the world takes seriously the need to keep expected global warming to within 2ºC – oil consumption grows by 0.2%/year, reaching 88.5 million b/d by 2030.

This expectation that oil demand will continue to grow, in any foreseeable scenario, makes the arguments put forward by the peak-oilers worth a listen, despite their early record of predicting doom-and-gloom prematurely. Over the past year – and especially in recent months – academics, policy-makers, businesspeople and even some politicians, have started taking the issue seriously.

Bombshells

As Chris Nelder, a peak-oil journalist and author, wrote recently: ‘A sudden deluge of reports and summit meetings suggest that the oil industry and energy officials are now taking peak oil very seriously indeed.’ He cited several ‘bombshells’:

- In February a report called ‘The Oil Crunch: A wake-up call for the UK Economy’ was published by the UK Industry Task Force on Peak Oil and Energy Security (ITPOES), a grouping of UK companies. It warned that: ‘As we reach maximum oil extraction rates, the era of cheap oil is behind us. We must plan for a world in which oil prices are likely to be both higher and more volatile and where oil price shocks have the potential to destabilise economic, political and social activity.’ The report added that the next five years would see the world facing an oil crunch.

- In mid-March a report published by three authors from the College of Engineering and Petroleum at Kuwait University forecast that world oil production would peak in 2014. Nelder comments that: ‘The results weren’t really news to the peakists, for they matched up quite well with the models of Colin Campbell, Jean Laherrère and other analysts who have warned about peak oil since 1995. What made this report interesting was that first, it was from Kuwait; and second, it brought a new level of mathematical rigour to the study.’

- Just over a week later a paper published former UK chief scientist David King and researchers from Oxford University claimed that world oil reserves had been exaggerated by up to a third, mainly by OPEC member countries. They also anticipated that demand for oil could outstrip supply by 2014-15.

A key milestone in the appreciation of the challenges the world faces in meeting its oil consumption needs was the publication of the 2008 edition of the IEA’s ‘World Energy Outlook’, the agency’s flagship publication, widely read by the energy industry and policy-makers. A major feature of that edition was a detailed field-by-field analysis of the historical production trends of 800 of the world’s fields, including all 54 of the super-giants (fields holding more than 5 billion barrels of reserves).

What the IEA found was that the observed production decline rate world-wide was 6.7% per year for fields that have passed their production peak and that this was expected to rise to 8.6% by 2030. Stripping out the effects of ongoing and periodic investment, the agency found that the natural, or underlying, decline rate for the world as a whole was estimated at 9% for post-peak fields, rising by over 1% to more than 10% per year by 2030 in the Reference Scenario.

This led the agency to conclude that even without any growth in demand, 45m barrels per day of new production would be needed by 2030 – four times the output of Saudi Arabia. Adding to this the oil that would be needed to meet projected demand growth pushed the figure up to 64m b/d, equivalent to six Saudi Arabias.

Bouncing back

A particular factor that the IEA highlighted at that time was a fundamental shift underway in the structure of the oil and gas industry with the ascendancy of national oil companies (NOCs). The agency’s executive director Nobuo Tanaka said that international oil companies (IOCs) were ‘facing dwindling opportunities to increase their reserves and production’. He added that: ‘In contrast, NOCs are projected to account for 80% of the increase of both oil and gas production to 2030.’

This in turn raised questions over whether NOCs will have the will or the means to invest the large sums that will be needed to meet demand growth. So while Voser recently described the oil supply challenge as an opportunity for Shell, the fact is that the major IOCs will contribute only a relatively small part of the needed new production capacity, even in an optimistic scenario.

Eighteen months on, following the worst recession the world has seen since the second world war, there are major concerns at how much potential investment in new oil production capacity has been cancelled or deferred. And while it is true that the recession has depressed demand in the short term, there are signs that demand is bouncing back more quickly than many expected.

The recent ITPOES report contains an interesting, if controversial, analysis of the prospects for the oil market by Chris Skrebowski, an independent oil consultant and journalist who runs a firm called Peak Oil Consulting. He concludes that: ‘Low-cost (under $25/barrel) oil supplies effectively ended in early 2005 and are unlikely to return. The actual global supply of oil is now expected to be limited to 91-92 million b/d of capacity that will be in place by end-2010/early-2011 [which includes OPEC spare capacity]. Global capacity will then remain in the 91-92 million b/d range until 2015 from which time depletion will more than offset capacity growth from then onwards.’

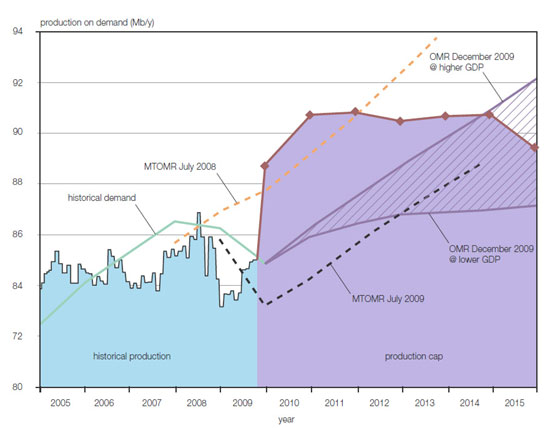

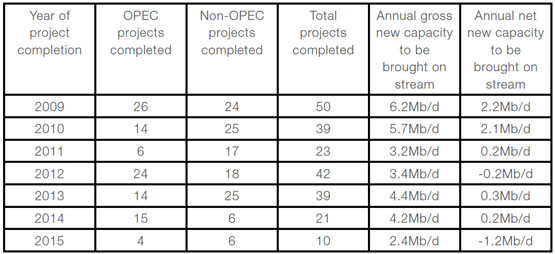

His reasoning is illustrated in the accompanying chart and table. Arguing, reasonably, that oil supply over the coming five or six years is predictable because of the long lead times involved in developing new oil supply projects, Skrebowski lists the major projects that will lead to incremental supply coming on stream between 2009 and 2015. The totals thus generated are used, in conjunction with a 4.7%/year decline rate, to construct a chart which shows a ‘production cap’ forming in the 2010-2015 period. Overlaid on the chart are demand projections made by the IEA in reports produced in 2008 and 2009. The chart shows clearly that if economic growth bounces back from the lows of the recession, the oil market starts to look worryingly tight around 2014-15.

|

| Comparing predictions of demand to production capacity to 2015. The “oil crunch” occurs at the point when demand matches or exceeds the production cap. The most recent projected demand trend (IEA Oil Market Report December 2009) is given for higher and lower GDP growth outlooks. Older projected demand trends (IEA Medium-Term Oil Market Reports) are shown for July 2009 and July 2008. Also shown are historical production and historical demand. Source: ITPOES |

|

| Megaprojects listing of the incremental supply coming on stream in each year for 2009-2015. The gross new capacity figures have been corrected with a delay to account for an unannounced three-month project slippage and 10% reduction to account for the typical operational uptime for a project of 90%. The net new capacity figures take account of loss to depletion. Source: ITPOES |

In such a scenario prices advance strongly as demand outruns immediately available supply. Much depends on how far the fuel mix changes between now and then and how responsive demand is to rising prices. ‘This means there is potentially a relatively benign outcome in which prices rise above $100 but economies are broadly able to absorb this,’ says Skrebowski. ‘There is also the oil crunch outcome in which oil prices are bid up to levels that produce a recession and we get a repetition of 2008-2011.’

Incredibly optimistic

So what does this mean in the longer term? Following the reasoning of Skrebowski: in the 2015-2020 period, he expects a repetition of the post-2008 experience – a rapid price fall caused by recessionary forces followed by a price recovery. However, unlike 2009-2010 during which there are spare OPEC capacity and large volumes of incremental capacity coming on stream, after 2015 depletion will be eroding capacity steadily with only limited new capacity coming on stream.

‘The expectation will be that companies will make heroic efforts to bring on new capacity although it is unlikely that this will be sufficient to fully offset depletion,’ says Skrebowski. ‘A possible outcome is an undulating production plateau at around 90 million b/d.’

There is, however, a plausible alternative scenario for this period, he adds. ‘Here, adaptation and new technology will have reached the point where declining usage of oil in the OECD area and not-too-rapid non-OECD growth are just enough to reconcile supply and demand at around 90 million b/d even though production capacity is likely to be declining. Oil prices are likely to be fairly high to maintain the pressure to minimise usage. This relatively benign outlook becomes less likely if non-OECD growth proceeds at over 3% and OECD growth re-appears, as this would give overall growth approaching 2%/year.’

Intriguingly, Skrebowski raises natural gas as a potential ‘wild card’, speculating that the increasing availability of relatively cheap gas – largely as a result of the accelerating development of shale gas resources – could ‘pressure and reduce oil prices’.

What Skrebowski’s analysis highlights above all else is how complex the picture really is. Relatively small changes in underlying assumptions can have large changes in outcomes. What is clear is that the concept of bringing on stream another 40 million b/d of new capacity within a decade sounds not just challenging but incredibly optimistic.

Discussion (0 comments)