The EU Emission Trading Scheme: designed by committee

on

The EU Emission Trading Scheme: designed by committee

Ever since the EU Emissions Trading Scheme (EU ETS) came into effect on January 1st 2005, it has been surrounded by uncertainty. Although the scheme is intended as the most powerful weapon in the effort to reduce European carbon emissions, doubts about its effectiveness and feasibility have remained. In theory, 'the ETS should allow the European Union to achieve its emission reduction target under the Kyoto Protocol at a cost of below 0.1% of GDP, significantly less than would otherwise be the case', according to the European Commission. (2008). In practice, the efficiency and effectiveness of the ETS remain questionable.

|

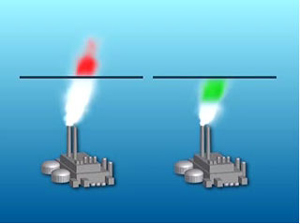

| Emission trading - capping carbon (illustration: European Environment Agency) |

The European Commission aims to reduce 'domestic' carbon emissions by 20% in 2020 compared to 1990. The EU ETS is the flagship in the EU's efforts to meet this goal. The scheme covers all sectors with substantial carbon emissions from point sources, such as the power, steel, iron, petroleum and gas sectors. Mobile sources of emissions (e.g. the transport sector) are not yet included in the ETS.

The fact that the ETS focuses on large, stationary and concentrated sources of carbon emissions is no coincidence. Reducing emissions from a few power plants is easier than reducing emissions from millions of cars. Because the large stationary sources are all covered by the ETS, a stricter reduction target is applied to these sectors than to sectors outside the emissions trading scheme. Effectively, the EU ETS sectors are expected to reduce their emissions by 21% between 2005 and 2020, while sectors outside the scheme are projected to reduce their emissions by merely 10%. Together the reductions suffice to meet the 20% goal in 2020.

The emphasis on the sectors covered by the ETS underlines the key role of the emissions trading scheme: if the 21% reduction target is not met, achieving the overall reduction target will be nearly impossible, because it would require a stronger reduction in sectors where emissions reduction are already more difficult or more costly to achieve. Therefore, meeting the ETS target is crucial.

Why cap and trade is assumed to be effective and efficient…

Under the ETS, allowances are distributed to all the installations included in the scheme. A single allowance provides the owner the right to emit one tonne of CO2 into the atmosphere. Because the number of allowances issued in a year can be set to a specific level, the scheme is assumed to be an effective means to reduce emissions. The level of emissions is limited after all by the number of issued allowances. If companies fail to buy allowances when they exceed their emission limits, they will incur a high penalty. The penalty is set far above the actual market price for allowances, so cheating does not pay off.

By progressively reducing the number of issued allowances towards the desired level, the EU should be able achieve its 2020 reduction targets with great certainty. Companies will either have to buy allowances if they don’t reduce their emissions sufficiently, or they will have to invest in low-carbon technologies to reduce their emissions. This is also assumed to be the most efficient mechanism to reduce emissions, as market forces will ensure that firms with the lowest-cost technology available will invest first. Thus, the emissions reduction target is achieved against the lowest possible cost.

If this is so, then why, as indicated above, do the efficiency and effectiveness of the ETS remain in doubt?

…and why the EU ETS is not

The answer is that there is a big difference in how the scheme was designed in theory and how it works in practice. The actual design of the EU ETS is nothing like the stylized, effective and efficient trading scheme described above. With 30 national governments, various industries and lobby groups involved in the scheme, the actual design of the EU ETS is the result of a compromise between all stakeholders. This compromise has led to a sub-optimal design with several flaws which undermine the effectiveness and efficiency of the scheme. In fact, under the current regime the scheme is unlikely to incentivize substantial investments in low-carbon technologies until 2020. A recent study by the University of Groningen and Dutch technological consultancy TNO (Mulder & Bos, 2010) shows that the probability of achieving the EU ETS reduction target is very low indeed.

Investments will only take place if allowances are in scarce supply or are expected to be in short supply in the near future. Otherwise there is no incentive to invest in emission reduction technology. However, the EU ETS suffers from a large oversupply of allowances. According to the aforementioned study, on

| There is a big difference in how the scheme was designed in theory and how it works in practice |

Starting in 2013 the number of allowances issued will be reduced by 1.74% on an annual basis. However, this does not imply that the market will move from an annual surplus to an annual shortage immediately. Although the annual surplus will decrease, on average, the market is expected to remain in oversupply until 2020 under the current regime. As a result of the continuous oversupply, the total surplus is expected to grow from 1.4 billion by the end of 2012 to 2.1 billion in 2020.

Sources of oversupply

The reason for the oversupply in the market is that the design of the EU ETS includes a number of regulations (loopholes) that allow for a gradual buildup of allowances over time. Three main sources of oversupply can be identified:

1. Banking of Allowances

As of the beginning of Phase II in 2008, firms were allowed to bank their excess allowances. Before that time, during Phase I (2005-2007), allowances could only be used to offset emissions in a specific year and lost their function and value afterwards. The new rule implied that any allowances in excess of immediate demand could now be transferred to future periods and, as such, would hold their value over time. This change enhanced the tradability of allowances but it also meant that emissions were no longer limited to the number of allowances issued in a particular year.

This means that whereas in the past the European Commission could set annual emission levels that would gradually lead to the desired end target, now it can only control the cumulative number of allowances issued over the 13-year period (2008-2020). The result of this banking rule is that you get a

| National governments have an incentive not to act in the best interests of the trading scheme by selling off all remaining allowances in the reserve |

With the banking arrangement in place, the ETS will remain vulnerable to demand shocks in the future. The waterbed-effect removes the ability for policymakers to steer the level of emissions in 2020 to a specific level.

2. The Linking Directive

Another important source of oversupply is the Linking Directive. The Linking Directive allows companies to import extra allowances into the European emissions trading scheme. These allowances originate from two programs under the Kyoto protocol: the Clean Development Mechanism (CDM) and Joint Implementation (JI). Firms are allowed to use these allowances to offset their emissions on top of the allowances that they have already been granted under the scheme. The directive allows companies to raise the number of allowances in the scheme by a maximum of 13.3%.

In 2009 around one third of the potential of the Linking Directive was actually used. This resulted in an extra 82 million allowances that entered the EU ETS in that single year; adding approximately 4% on top of the original cap. As the original cap of the EU ETS is set to decline starting in 2013, and the CDM and JI programs are further developed, the usage of the Linking Directive is likely to grow over time although the European Commission is planning to ban the usage of allowances from certain specific programs.

3. Leftovers from the New Entrants Reserve

The New Entrants Reserve (NER) is the third significant source of oversupply. As the name implies, the allowances in the NER are reserved for new entrants into the EU ETS. For example, if a new power plant is built, allowances are assigned to this installation from the NER.

Five percent of the overall allowance cap is reserved for new entrants. If there are allowances left over in the reserve by the end of Phase II, member states are free to sell these on the market. As these allowances will not be covered by emissions, they will merely alleviate the pressure on incumbents who are able to buy them.

|

| 'European carbon policy lacks internal consistency' |

Phase III: lack of alignment further undermines the ETS

Not only does this analysis indicate that there is hardly a basis for a strong and stable price incentive from the ETS, more importantly it shows that European carbon policy lacks internal consistency. The surplus is after all not the consequence of unforeseen circumstances but the direct result of elements that were deliberately introduced into the system, like the Banking Rule, the Linking Directive and the New Entrants Reserve. These are essentially political choices.

Unfortunately, the elements that undermine the effectiveness of the scheme are not limited to the second phase of the ETS. For example, an NER is also set up for the third phase (2013-2020). Although it is still too early to say whether there will be any allowances left over in the reserve by 2020, the European Commission has already reserved 300 million allowances as a means to fund projects related to innovative energy technology and carbon capture and storage (CCS). Hence, the European Commission is again alleviating the pressure on companies covered by the scheme by releasing more allowances to finance other projects. Although support for the development of technologies like CCS is a necessity in order to reach long term emission reduction goals, the source of financing (allowances from the ETS) once again undermines the ETS. Whereas a high demand for allowances is necessary to stimulate investments, continued oversupply until 2020 is a real possibility. With that in mind even the current price level of €15 per tonne of CO2 should be considered high, even in a few years’ time.

Why a simple reduction of the cap is not the solution

The way to solve the problem of large surpluses seems straightforward: reduce the number of issued allowances. Currently the European Commission plans to reduce the number of issued allowances

| The carbon market will only work efficiently if the carbon price is reasonably stable, so companies can plan their investments accordingly |

Policy measures should therefore first and foremost be focused on eliminating the weaknesses of the ETS. Policy alignment is the key here: eliminate the linking directive, stop using the NER as a financial instrument and eliminate any remaining allowances in the reserve. An agreement that would include these elements would constitute a major step forward. Unfortunately, such a far-reaching agreement is unlikely to be achieved given the number of parties sitting at the negotiation table.

Why subsidies for wind energy are a bad idea

But there is another problem as well. Even if we assume that the parties reach an agreement and do what is necessary to fix some of the main weaknesses of the current scheme, it might still not mean that the emission trading scheme is an effective and efficient method to reach the European emission reduction target.

The carbon market will only work efficiently (i.e. reach the target against the lowest possible costs) if the carbon price is reasonably stable, so companies can plan their investments accordingly. This will only happen if policy makers refrain from interfering with the market and limit their actions to providing a stable and coherent policy environment. In that case an emissions trading scheme could work.

In reality, the past five years have seen an unstable and unpredictable carbon price. In effect, the carbon market is not a real market, in which market forces determine the outcomes. Policy makers are constantly interfering and effectively trying to direct the market. If interfering meant that weaknesses were resolved, that would be a good thing. Yet, in practice, interference is often equal to either crisis management (e.g. repairing the damage of the recession) or providing substitutes for the market (e.g. by subsidising certain forms of renewable energy).

The latter type of interference often goes unnoticed because the interference with the emissions trading scheme is indirect. For example, governments continually come up with new schemes and subsidies to stimulate the use of renewable energy sources and other low-carbon solutions. These subsidies

| 'Athough a tax is generally assumed to be less efficient than a market mechanism, it would provide stability, certainty and feed into the general expectation of rising carbon prices' |

The argument, however, runs even deeper. Companies investing in offshore wind energy with the help of a subsidy do so earlier than they would otherwise do, thereby saving allowances that they would otherwise use to cover emissions. These allowances can now be sold on the market for other companies to use. The companies that buy the excess allowances can postpone their own investments. As a result, policies that speed up the carbon reduction effort in one country effectively reduce the pressure on firms in other ETS member states. On balance, the subsidy does not add anything to the overall reduction effort, but is merely a costly substitute for reductions that would have taken place anyway.

The subsidy for wind energy is just one example of how policies on a local or national (or even European) level work as a substitute to the ETS, with the effect of undermining the allowance price and efficiency of the scheme. Emission norms, regulation, taxes and any other measure that would ‘speed up’ the reduction efforts of industries covered by the scheme would have a similar effect.

To a certain extent policy makers are right when they stress the need for other incentives. The ETS is not providing the type of strong and stable incentive that should be expected from it, so it is understandable that they look for other methods. As long as the ETS is in place, however, policy makers should leave the market free to work, refrain from introducing other incentives and focus on alignment of the ETS to make the ETS an effective and efficient weapon in the fight against carbon emissions.

The alternative is to abolish the ETS altogether and switch to another incentive scheme. An example of an incentive scheme that could bypass all of the mentioned problems would be a progressively rising carbon tax. Although the government would have no direct control over emission levels and a tax is generally assumed to be less efficient than a market mechanism, it would provide stability, certainty and feed into the general expectation of rising carbon prices. As a result, it would create the type of investment climate that could kick start the investments needed to achieve the 2020 reduction target. The monitoring systems are already in place and allowances that have already been issued would not have to lose their value or function. Most importantly, however, ‘allowance surplus’ would become a thing of the past. Governments have to choose: either allow the market to do its work, or introduce a tax without control over the emission levels. But interfering in the market with projects and measures that undermine the CO2 price is at any rate not viable.

|

Who is Arnold Mulder? Arnold Mulder (1985) studied International Economics and Business and is now a PhD Candidate at the University of Groningen. His doctoral thesis focuses on the CCS value chain and incentive systems, with specific attention to the European Emissions Trading Scheme (EU ETS). He can be reached at arnold.mulder@rug.nl References European Commission (2008) “The EU Emissions Trading Scheme”, Office of the Official Publications of the European Communities Mulder, A.J., Bos, C.F.M. (2010) “Current design of EU ETS clashes with its own objectives”, EDI Quarterly, vol. 2 issue 2, pp. 12-16 |

Discussion (0 comments)