The world according to ExxonMobil

on

The world according to ExxonMobil

ExxonMobil – known as the world’s largest, most efficient, and most profitable oil company – has its own distinctive way of looking at the world. In its starkly realistic annual “Outlook for Energy”, it concludes that until 2030: CO2 emissions will continue to grow, fossil fuels will continue to dominate energy supply, and solar power, electric cars and carbon capture & storage will not become cost-competitive. But the company is not without idealism: it believes in the power of efficiency, dreams of turning algae into oil and favours a carbon tax over a cap-and-trade policy.

|

| Todd Onderdonk, Senior Energy Adviser at ExxonMobil |

Todd W. Onderdonk, Senior Energy Adviser in ExxonMobil’s Corporate Strategic Planning Department, and one of the main authors of the “Outlook for Energy”, explains the uniqueness of ExxonMobil’s report as follows: ‘The energy outlooks of some key government institutions typically reflect a set of certain policy assumptions, which help provide a wide bracket of possible outcomes rather than a forecast of what is likely to happen by 2030. For example, they often provide a baseline outlook that assumes no changes in energy policy. By comparison, in developing an outlook to guide our long-term investment decisions, we have to take a view on how policies, energy markets and technology are likely to evolve through 2030 to address economic, energy and environmental challenges worldwide.

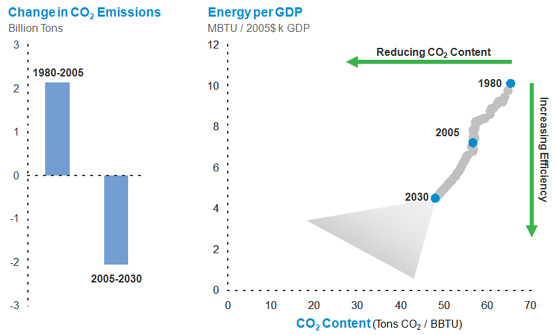

A case in point is the IEA’s “reference case” in its famous annual World Energy Outlook, which has emissions up about 50% by 2030 versus 2005. Of this reference case, the IEA says that it ‘cannot be considered a forecast of what is likely to happen’. On the other end of the spectrum is the IEA’s influential “450 scenario”, which analyses how high CO2-emissions can be allowed to go if the global temperature increase were to be limited to 2 degrees Celsius. According to this “450 scenario”, global energy-related CO2 emissions need to be slightly below the 2005 level in 2030 (and then need to decline by no less than 45% until 2050) to avoid catastrophic (i.e. more than 2 degrees Celsius) warming. By contrast, ExxonMobil’s latest Outlook foresees that global energy-related CO2 emissions will continue to rise by 0.9% per year in 2005-2030, leading to 25% higher emissions in 2030 than in 2005. This despite the expectation that emissions in OECD countries have already peaked and will decline significantly through 2030.

Some people would conclude that ExxonMobil’s scenario is leading us straight to catastrophe. The company itself, after having received a lot of criticism in the past for its critical stance towards the global warming theory, takes a cautious approach. ‘We think that there are risks associated with growing CO2 emissions which should be addressed, though the energy needs of the world’s population, reflecting significant energy demand growth in the developing countries, should be taken into account.’ He adds that ‘people are beginning to realise how difficult it is to lower global CO2 emissions. It is encouraging to see that our outlook for emissions growth is significantly less than overall energy demand growth reflecting a shift to less carbon intensive fuels. That said, curbing greenhouse gas emissions while also meeting rising energy demand will require a tremendous global effort, sustained over decades’.

So how then does the world energy market develop in ExxonMobil’s “View to 2030”? Let us look at some of the main points.

Global demand and supply

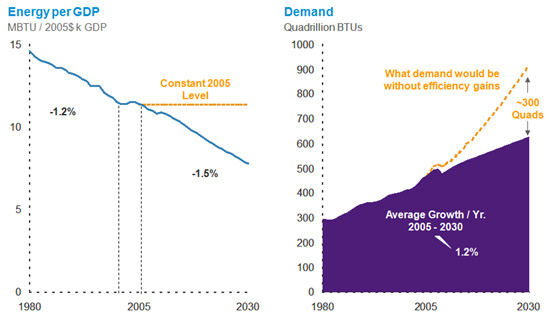

Worldwide energy demand will grow 1.2% per year on average, leading to an almost 35% higher demand for energy in 2030 than in 2005.

Energy efficiency gains will accelerate. From 1980-2000 the world improved its energy efficiency by 1.2% per year (in terms of energy used in relation to Gross Domestic Product). ExxonMobil expects this to grow to 1.5% per year. The reason for this improved energy efficiency are: higher energy costs, government mandates and regulations, technological advances and expected CO2 emissions costs.

ExxonMobil notes that if no energy efficiency gains were made, the demand for energy would be 95% higher in 2030 rather than the predicted 35%! In this respect, ‘the greatest source of energy in the future’, the report notes, ‘is finding ways to use energy more efficiently’.

|

| Efficiency: Reducing Demand Growth, Source: ExxonMobil |

Fossil fuels remain the predominant energy sources, accounting for nearly 80% of demand in 2030, ExxonMobil believes. Oil will still lead, but gas will overtake coal to become the second most used energy source. Solar, wind and biofuels will grow sharply, at almost 10% per year, but because they start from such a low base, their share in the total supply of energy will not rise above a few percentage points in 2030. Nuclear energy will grow at 2.3% per year, but still will account for less than 10% of energy supply in 2030.

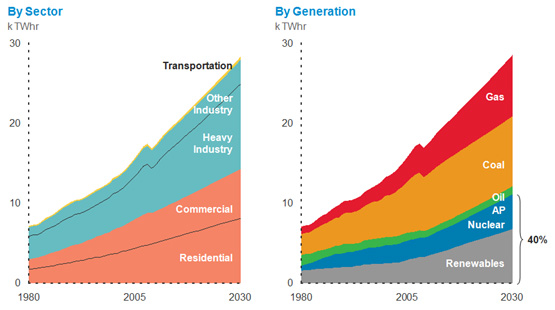

Power generation

Power generation is the fastest source of energy demand. It will account for 40% of total primary energy demand in 2030. In 2005 this was 36% and in 1980 just 26%. In 2030 the power generation sector will use about twice as much energy as the transport sector!

The largest energy source for power generation will continue to be coal. Nevertheless, ExxonMobil does predict a shift away from coal towards natural gas as well as to nuclear and renewables. By 2030, it is expected that 40% of the world’s electricity will be generated by a mixture of nuclear energy and renewables.

|

| Electricity Use is Growing Fast, Source: ExxonMobil |

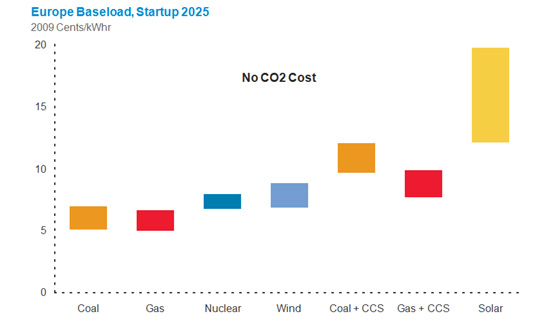

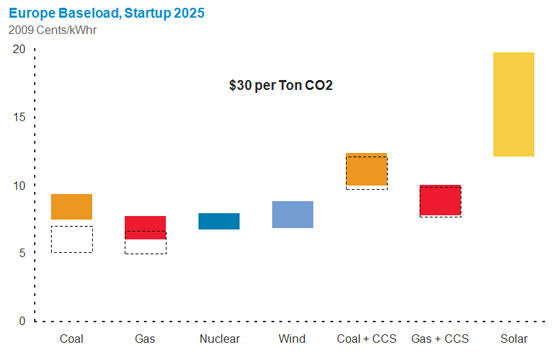

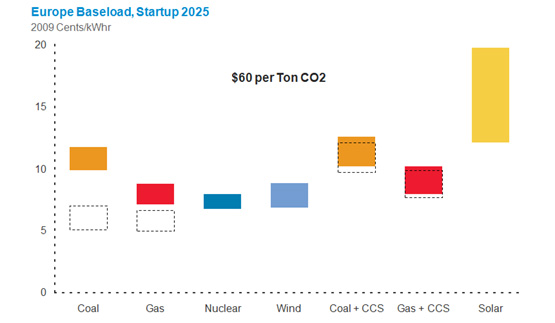

This prediction is partly based on a comparison of electricity generation costs for new power plants: at this moment coal and natural gas are the lowest-cost options for future, new-built power generation. How these costs will evolve, depends on whether governments will impose a cost on CO2 emissions. If CO2 emissions were to cost $30 per ton, natural gas would become the cheapest source of energy for power generation, followed closely by nuclear and wind power. Coal would be slightly more expensive than the other alternatives. At $60 per ton CO2, the picture changes radically: nuclear and wind would become the cheapest, natural gas would be slightly more expensive, but still competitive, and coal would become clearly more expensive. In the United States, ExxonMobil expects CO2 costs to go to $30 per ton over the next ten years.

|

|

|

| Electricity Generation Cost, Source: ExxonMobil |

So what about carbon capture & storage (CCS)? If a coal-fired or gas-fired power plant is equipped with CCS, it obviously emits only a limited amount of CO2. But ExxonMobil is not too optimistic about the competitiveness of this solution in the 2030 timeframe. Even with CO2 emissions priced at $60 per ton, ‘new build-plants with CCS remain very expensive’, says the report. The high cost of CCS, ‘combined with the need to build a regulatory framework for CO2 storage, presents significant challenges for its use over the next two decades beyond government-subsidised demonstration projects.’

About solar power, ExxonMobil’s outlook is even more sombre. ‘The cost of capturing solar energy in photovoltaic cells or concentrators remains generally unaffordable for large, commercial applications’, the Outlook for Energy concludes.

Transportation

Interestingly, ExxonMobil predicts that by 2030 heavy-duty vehicles will use more energy than light-duty vehicles. Heavy-duty vehicles are trucks (lorries) and buses, light-duty are cars, SUVs and light pickup trucks. Historically, light vehicles are the largest demand sector, but as a result of increased shipment of goods across and between nations, the heavy duty segment will become the largest.

ExxonMobil does not think that electric cars and plug-in hybrid vehicles will become competitive in the coming decades. At this moment, a plug-in hybrid (that has a battery range of approximately 60km) adds about $16,000 to the cost of a car and leads to fuel savings of some $1,000 per year. Not a very attractive proposition. By 2030, the cost of the battery may drop to some $6,000 but fuel savings will also shrink, as conventional gasoline and diesel cars will improve their mileage.

ExxonMobil thinks that the mileage of conventional cars can be improved by no less than 35%. This can be achieved by new engine technologies, improving transmissions, improvements to the car body (using lightweight materials) and the use of tires that stay inflated longer.

When it comes to biofuels, ExxonMobil has put its cards on biofuels from photosynthetic (genetically engineered) algae. In this field, the oil company is cooperating with the Californian biotech firm Synthetic Genomics founded by the famous genome researcher Craig Venter. The goal of this program, on which ExxonMobil will spend $600 million, ‘is to produce a commercially scalable, renewable algae-based fuel compatible with today’s gasoline, diesel and jet fuel’. ExxonMobil notes that it could require decades for the program to become successful.

Climate policy

It is clear that ExxonMobil believes it will be very challenging to stabilize CO2 emissions in the 2030 timeframe. Todd Onderdonk notes that achieving a stabilization of energy-related emissions would imply dramatic changes in the amount and type of energy used globally, on top of the significant transition the company already anticipates. Such steps would likely require investments to rapidly reshape the amount or mix of fuels used across the economy for power generation, industrial and transportation activities. ExxonMobil does not say so, but the implication seems clear: this is a next to impossible task.

|

| OECD Transitions to Lower Emissions, Source: ExxonMobil |

When it comes to carbon policy, ExxonMobil clearly favours a (revenue-neutral) carbon tax over a cap-and-trade system. In Europe of course a cap-and-trade system is already in place, but in the US there is still intense debate about what a carbon policy should look like. According to ExxonMobil, a carbon tax:

- creates a clear and uniform cost for emissions, which makes for “price stability”

- avoids ‘the costs and complexity of having to build a new market for emissions allowances or the need for new layers of regulators and administrators to manage this market’

- ‘does not open up significant opportunities for market manipulation, or require complex and costly compliance and enforcement systems’.

By implication, then, a cap-and-trade system is, according to ExxonMobil, costly, complex, bureaucratic and liable to market manipulation. Just one more of those typical ExxonMobil assessments that policymakers might do well to take notice of.

Discussion (0 comments)