After Sanctions: Implications for Energy Cooperation Between Russia, Europe and Asia

November 04, 2015

on

on

At a time when political relations between Russia and the West are being challenged, the issues around energy cooperation between the East and the West have been making news headlines, being increasingly pushed from the realm of business to that of geopolitics.

For the community of energy professionals who have been fostering strong business relations between Russia and the EU over the last 25 years, it has been difficult to see politics so greatly affecting the energy sector over the last year.

However, many argue that the energy sector is arguably the key bridge between the two sides that remains, and that any political attempts to destroy it would lead to nothing more but the overall escalation of conflict and tensions, whilst also being economically damaging to both sides.

As things stand, there are a number of avenues for business cooperation in the energy sector between the EU and Russia, as well as Russia and Asia – both in spite of and as a result of sanctions. While politicians’ views have naturally been dominating the debates in Brussels and Moscow, Eurasian Dynamics, a London-based consultancy firm, hosted their annual Russian Energy Forum in London this summer, which brought together a number of business and finance experts from the energy sector to discuss the challenges and opportunities that have emerged post-sanctions.

This publication therefore aims to illuminate the different areas of the discussion on the future of Russia’s energy sector that emerged from the forum, alongside insights into the impact of sanctions from the perspectives of the EU, Russia and Asia.

A number of energy professionals working in both the EU and Russia stress how little credit the latter has been given for having transformed from a monolithic communist regime until 1990 into a privatised, market-driven economy when it comes to oil and gas, which has embraced many of the same economic tools that have been used in the West for a long time.

As some experts highlight, over the last 10 years Russia has also been part of the consolidation programme that has taken place in the global energy industry. To this end, the acquisition of TNK-BP by Rosneft should arguably be viewed in the context of similar international M&As (i.e. Exxon-Mobil, BP - Amoco, Statoil - Norsk Hydro). These mergers were done within domiciliary, which is a common industry practice (the Shell - BG merger being no exception).

Some energy professionals who have been working with Russia for over two decades argued that in fact Russia did nurture and embrace foreign partnerships. Today, some 10% of Russia’s oil output (20 million bbl/d) is owned by foreign companies.

Apart from the TNK-BP case, TOTAL and NOVATEK are known to be equity-linked, while in September this year Gazprom and Wintershall signed an agreement on closing an asset swap deal. Having said that, compared to oil, there hasn’t been as much consolidation in the Russian gas industry.

NOVATEK, Russia’s second largest producer of natural gas provides another viewpoint from which to see how Russian companies are continuing to do business under sanctions. Yamal LNG (an integrated project for natural gas production, liquefaction and marketing on the Yamal Peninsula, Russia) is a particularly interesting example. In a recent EER publication, Tatiana Mitrova, Head of the Oil and Gas Department at the Energy Research Institute of the Russian Academy of Sciences (ERI RAS), referred to it as the only realistic LNG export project in Russia which will come on stream by 2025.

With the opening of Yamal, Russia will increase its LNG share of the world market from 4% to 15%. Yamal, which has been built on Russia’s Arctic peninsula will produce 16.5 million tonnes of LNG with a worth of approximately $27 billion (shareholders of the project are NOVATEK, 60%; Total, 20%; and CNPC, 20%).

According to the US geological survey, 20% of undiscovered conventional oil and 30% of undiscovered gas reserves are in the Arctic zone. More importantly, 75% of the oil and 90% of the gas resides in the Russian zone of the Artic. Yamal was therefore established to tap into these immense reserves, and from the technological perspective, NOVATEK states that in this particular area due to the 20-25% ambient efficient temperature change, the costs of liquefaction are considerably cheaper. The first stage is expected to be operable by the end of 2016, and first deliveries will be in the second half of 2017. It is estimated that 80% of the extracted LNG will go to the Asia-Pacific Market and 20% to Europe.

Although, currently, LNG and FLNG are not affected by sanctions on materials and equipment, LNG’s vulnerability to sanctions remains a concern for Russia and its partners. The worry comes from the fact that LNG projects require considerable pre-development planning which could be at risk if further sanctions are placed on Russia and furthermore, the large-scale refrigeration systems used in LNG and drivers (which are usually gas turbines), are supplied by major American, European and Japanese companies. At the present time, Russian companies do not produce the necessary turbines and engines themselves, leaving Russia with a high-risk exposure in this field if further sanctions are imposed.

In light of the above, many experts are considering the benefits of joint ventures in construction, e.g. shipbuilding yards and turbines to ensure that Russia has a stable supply of goods for future LNG projects and so that Russia can develop its technological capabilities in the field of LNG.

In other words, there is potential for Russia to grow its indigenous production and now, when the political situation continues to threaten the future of the Russian energy sector, it is time to create opportunities for indigenous content in Russia itself.

Sino-Russian energy cooperation has arguably increased in the aftermath of Western sanctions. Political representatives from China and Russia have recently been highlighting the importance of the Sino-Russian relationship and have created bilateral initiatives in order to demonstrate the closeness of the two nations. To this end, the joint declaration “on cooperation in coordinating development of the Eurasian Economic Union (EEU) and the Silk Road Economic Belt” signed after the latest summit between Putin and Xi in Moscow is considered to be a milestone document for the two partners.

At the Russian Energy Forum in June, Mr Shao Zheng, a Counsellor at the Embassy of the People’s Republic of China in the UK, described the Asian Infrastructure Investment Bank as “not a solo of China, but a concert where different players have to be involved”, alluding to the broader scope of the bank going beyond the One Belt One Road area. Mr Zheng also stressed that “energy cooperation remains the cornerstone of Sino-Russia energy relations, and goes beyond oil, gas and infrastructure development, expanding to cooperation in the nuclear sector, as well as from upstream to downstream markets”. One of the examples of such cooperation is the Tianjin refining complex (China National Petroleum Corporation (CNPC)-Rosneft joint venture) for which Rosneft is set to supply 9 million tons of oil per day.

Another interesting issue discussed at the Forum was the disparity between the Russian media’s perspective on Sino-Russian relations and the Chinese perspective. Speakers argued that Beijing’s priority has been the construction of new pipelines through which China can receive its crude oil supplies – a key driver behind Chinese energy policy towards Russia. However, the negotiations over gas supplies to China received much more publicity both in Russia and internationally.

Regarding natural gas, the experts tended to agree that Europe will remain Russia’s main export market despite the political situation, and that exports of 68 bcm/y to China will enable Russia to enter into the Asian gas market on a wider scale. As things stand, arguably, the Altai pipeline (the proposed natural gas pipeline from Russia's Western Siberia to North-Western China) will not be a priority for China until the Power of Siberia development (a unified gas transmission system (GTS) for the Irkutsk and Yakutia gas production centers and convey gas from these centers to Vladivostok via Khabarovsk) is on track.

With the sanctions has come a great opportunity for private investors from the East, and from China in particular to create their own ventures in the Russian energy sector. China’s strategic interests lie in creating new enterprises overseas due to the fact that their key industrial production areas (including steel and aluminium - industries that are currently facing overcapacity) need new markets to supply their products and machinery to.

From the Russian perspective, as economic pressure increases with the perpetually low price of oil, private investors from Asia provide security not only through cash deals, but also equity-to-equity assets.

Hence, from an investor’s standpoint, the sanctions have created a number of interesting and so far underexploited opportunities. The consequences of the sanctions include limited access to capital, especially for mid-size private businesses in Russia, making them more willing to have partners and to negotiate deals which are much more favourable to investors than they would have been pre-sanctions.

The sanctions have had a significant affect on Russia both politically and economically, however there are still plenty of opportunities in the country and avenues through which to approach new, innovative projects and ventures. At the 3rd Russian Energy Forum to be held in June 2016, Eurasian Dynamics will engage experts from all areas of the energy sector to discuss issues around the establishment of joint ventures in Russia as well as Sino-Russian and EU-Russian relations and a look into the finance and investment opportunities in Russia for interested private investors.

Daria Nochevnik, Chief Analyst for Natural Gas, LNG and Energy Systems Integration, EER

co-authored by Lucy Logan Green, Eurasian Dynamics Ltd.

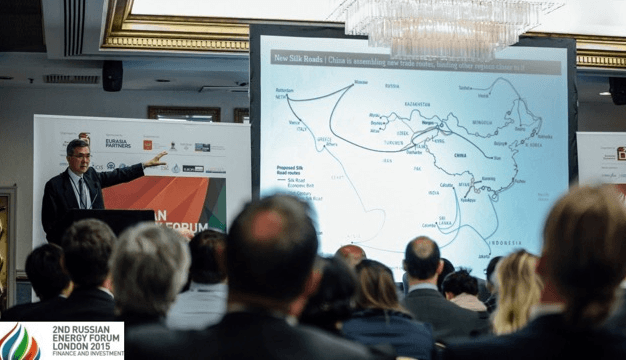

Image: Keun-Wook Paik, Senior Fellow at the Oxford Institute for Energy Studies (OIES) delivering a presentation at the Russian Energy Forum.

For the community of energy professionals who have been fostering strong business relations between Russia and the EU over the last 25 years, it has been difficult to see politics so greatly affecting the energy sector over the last year.

However, many argue that the energy sector is arguably the key bridge between the two sides that remains, and that any political attempts to destroy it would lead to nothing more but the overall escalation of conflict and tensions, whilst also being economically damaging to both sides.

As things stand, there are a number of avenues for business cooperation in the energy sector between the EU and Russia, as well as Russia and Asia – both in spite of and as a result of sanctions. While politicians’ views have naturally been dominating the debates in Brussels and Moscow, Eurasian Dynamics, a London-based consultancy firm, hosted their annual Russian Energy Forum in London this summer, which brought together a number of business and finance experts from the energy sector to discuss the challenges and opportunities that have emerged post-sanctions.

This publication therefore aims to illuminate the different areas of the discussion on the future of Russia’s energy sector that emerged from the forum, alongside insights into the impact of sanctions from the perspectives of the EU, Russia and Asia.

Energy Business between the East and the West: context and consolidation

A number of energy professionals working in both the EU and Russia stress how little credit the latter has been given for having transformed from a monolithic communist regime until 1990 into a privatised, market-driven economy when it comes to oil and gas, which has embraced many of the same economic tools that have been used in the West for a long time.

As some experts highlight, over the last 10 years Russia has also been part of the consolidation programme that has taken place in the global energy industry. To this end, the acquisition of TNK-BP by Rosneft should arguably be viewed in the context of similar international M&As (i.e. Exxon-Mobil, BP - Amoco, Statoil - Norsk Hydro). These mergers were done within domiciliary, which is a common industry practice (the Shell - BG merger being no exception).

Some energy professionals who have been working with Russia for over two decades argued that in fact Russia did nurture and embrace foreign partnerships. Today, some 10% of Russia’s oil output (20 million bbl/d) is owned by foreign companies.

Apart from the TNK-BP case, TOTAL and NOVATEK are known to be equity-linked, while in September this year Gazprom and Wintershall signed an agreement on closing an asset swap deal. Having said that, compared to oil, there hasn’t been as much consolidation in the Russian gas industry.

Russian gas beyond Gazprom: the NOVATEK perspective

NOVATEK, Russia’s second largest producer of natural gas provides another viewpoint from which to see how Russian companies are continuing to do business under sanctions. Yamal LNG (an integrated project for natural gas production, liquefaction and marketing on the Yamal Peninsula, Russia) is a particularly interesting example. In a recent EER publication, Tatiana Mitrova, Head of the Oil and Gas Department at the Energy Research Institute of the Russian Academy of Sciences (ERI RAS), referred to it as the only realistic LNG export project in Russia which will come on stream by 2025.

With the opening of Yamal, Russia will increase its LNG share of the world market from 4% to 15%. Yamal, which has been built on Russia’s Arctic peninsula will produce 16.5 million tonnes of LNG with a worth of approximately $27 billion (shareholders of the project are NOVATEK, 60%; Total, 20%; and CNPC, 20%).

According to the US geological survey, 20% of undiscovered conventional oil and 30% of undiscovered gas reserves are in the Arctic zone. More importantly, 75% of the oil and 90% of the gas resides in the Russian zone of the Artic. Yamal was therefore established to tap into these immense reserves, and from the technological perspective, NOVATEK states that in this particular area due to the 20-25% ambient efficient temperature change, the costs of liquefaction are considerably cheaper. The first stage is expected to be operable by the end of 2016, and first deliveries will be in the second half of 2017. It is estimated that 80% of the extracted LNG will go to the Asia-Pacific Market and 20% to Europe.

Although, currently, LNG and FLNG are not affected by sanctions on materials and equipment, LNG’s vulnerability to sanctions remains a concern for Russia and its partners. The worry comes from the fact that LNG projects require considerable pre-development planning which could be at risk if further sanctions are placed on Russia and furthermore, the large-scale refrigeration systems used in LNG and drivers (which are usually gas turbines), are supplied by major American, European and Japanese companies. At the present time, Russian companies do not produce the necessary turbines and engines themselves, leaving Russia with a high-risk exposure in this field if further sanctions are imposed.

In light of the above, many experts are considering the benefits of joint ventures in construction, e.g. shipbuilding yards and turbines to ensure that Russia has a stable supply of goods for future LNG projects and so that Russia can develop its technological capabilities in the field of LNG.

In other words, there is potential for Russia to grow its indigenous production and now, when the political situation continues to threaten the future of the Russian energy sector, it is time to create opportunities for indigenous content in Russia itself.

Sino-Russian Energy Cooperation

Sino-Russian energy cooperation has arguably increased in the aftermath of Western sanctions. Political representatives from China and Russia have recently been highlighting the importance of the Sino-Russian relationship and have created bilateral initiatives in order to demonstrate the closeness of the two nations. To this end, the joint declaration “on cooperation in coordinating development of the Eurasian Economic Union (EEU) and the Silk Road Economic Belt” signed after the latest summit between Putin and Xi in Moscow is considered to be a milestone document for the two partners.

At the Russian Energy Forum in June, Mr Shao Zheng, a Counsellor at the Embassy of the People’s Republic of China in the UK, described the Asian Infrastructure Investment Bank as “not a solo of China, but a concert where different players have to be involved”, alluding to the broader scope of the bank going beyond the One Belt One Road area. Mr Zheng also stressed that “energy cooperation remains the cornerstone of Sino-Russia energy relations, and goes beyond oil, gas and infrastructure development, expanding to cooperation in the nuclear sector, as well as from upstream to downstream markets”. One of the examples of such cooperation is the Tianjin refining complex (China National Petroleum Corporation (CNPC)-Rosneft joint venture) for which Rosneft is set to supply 9 million tons of oil per day.

Another interesting issue discussed at the Forum was the disparity between the Russian media’s perspective on Sino-Russian relations and the Chinese perspective. Speakers argued that Beijing’s priority has been the construction of new pipelines through which China can receive its crude oil supplies – a key driver behind Chinese energy policy towards Russia. However, the negotiations over gas supplies to China received much more publicity both in Russia and internationally.

Regarding natural gas, the experts tended to agree that Europe will remain Russia’s main export market despite the political situation, and that exports of 68 bcm/y to China will enable Russia to enter into the Asian gas market on a wider scale. As things stand, arguably, the Altai pipeline (the proposed natural gas pipeline from Russia's Western Siberia to North-Western China) will not be a priority for China until the Power of Siberia development (a unified gas transmission system (GTS) for the Irkutsk and Yakutia gas production centers and convey gas from these centers to Vladivostok via Khabarovsk) is on track.

Sanctions: an opportunity for private Asian investors

With the sanctions has come a great opportunity for private investors from the East, and from China in particular to create their own ventures in the Russian energy sector. China’s strategic interests lie in creating new enterprises overseas due to the fact that their key industrial production areas (including steel and aluminium - industries that are currently facing overcapacity) need new markets to supply their products and machinery to.

From the Russian perspective, as economic pressure increases with the perpetually low price of oil, private investors from Asia provide security not only through cash deals, but also equity-to-equity assets.

Hence, from an investor’s standpoint, the sanctions have created a number of interesting and so far underexploited opportunities. The consequences of the sanctions include limited access to capital, especially for mid-size private businesses in Russia, making them more willing to have partners and to negotiate deals which are much more favourable to investors than they would have been pre-sanctions.

The sanctions have had a significant affect on Russia both politically and economically, however there are still plenty of opportunities in the country and avenues through which to approach new, innovative projects and ventures. At the 3rd Russian Energy Forum to be held in June 2016, Eurasian Dynamics will engage experts from all areas of the energy sector to discuss issues around the establishment of joint ventures in Russia as well as Sino-Russian and EU-Russian relations and a look into the finance and investment opportunities in Russia for interested private investors.

Daria Nochevnik, Chief Analyst for Natural Gas, LNG and Energy Systems Integration, EER

co-authored by Lucy Logan Green, Eurasian Dynamics Ltd.

Image: Keun-Wook Paik, Senior Fellow at the Oxford Institute for Energy Studies (OIES) delivering a presentation at the Russian Energy Forum.

Read full article

Hide full article

Discussion (0 comments)