North West European gas market: integrated already

on

North West European gas market: integrated already

The gas hubs in North Western Europe already form one integrated market for natural gas. That is the main conclusion that emerges from recent research carried out by Rudolph Harmsen and Catrinus Jepma at the University of Groningen in the framework of the Edgar research programme. Harmsen and Jepma analysed price movements on six major North West European gas markets and discovered that there are strong statistical correlations which show that the markets function as an integrated whole. The authors describe the result of their research as ‘striking’, since there are ‘numerous reasons that could have prevented expedient market integration’.

|

| 'The European gas markets function as an integrated whole' (picture: TU Delta) |

One price in one market

Before 1998, natural gas markets in EU countries were regulated at the national level. Markets were dominated by national monopolistic vertically integrated firms. However, since 1998 the European Union has been restructuring the national markets to create a single European market. The idea is that this should result in more economic efficiency, increasing competitiveness, and (relatively) lower end consumer prices. In addition a single market is also believed to offer greater security of supply for individual countries. To achieve these objectives liberalisation principles have been introduced into the formerly segmented national markets and interconnection has been stimulated.

As in any segmented market, the role of the integrated market is to facilitate the making of exchanges between buyers and sellers. In a truly integrated market, there is a tendency for the same price to be paid for the same thing, at the same time, in all parts of the market. Arbitrage is the predominant mechanism that forces the prices of identical goods in an integrated market into this equilibrium. The

| Thus, it appears that the gas hubs in North-West Europe form one integrated market for natural gas |

Equilibrium

We used the concept of LOP to measure the market integration in the North West European gas market. Natural gas has traditionally been traded mostly in the form of long-term, take-or-pay contracts. However, as part of the EU integration drive, efforts have been made to create organized trading markets, in which gas is traded as a commodity. These markets are often referred to as (gas) hubs. If it works properly, a hub generates a reference price that is believed to reflect the actual perception of scarcity for natural gas. Prices at hubs are thus ‘real’ market prices, and are not, like the long-term contracts, bound to the oil-price development.

We examined whether a relative LOP holds for six gas hubs in the North Western part of the EU: the NBP (United Kingdom), TTF (Netherlands), Zeebrugge (Belgium), NCG (Germany), Gaspool (Germany), and Peg (France). We looked at price developments over a three-year period, from 23 April 2007 until 7 May 2010. Specifically, we looked at so-called day-ahead contracts, as these are the most frequently traded products. The prices reflect volume-weighted averages of all day-ahead over-the-counter transactions to be delivered at a specific hub.

The statistical method we used is called the Engle & Granger cointegration technique, which we applied to every bilateral hub pair: NBP versus TTF, NBP versus Zeebrugge, TTF versus Zeebrugge, etcetera (15 pairs in all). We argue that if two hub prices are cointegrated, then these prices always have the tendency of moving to their long-run equilibrium (allowing for systematic price differences caused by different costs for transport or arbitrage). If the relative LOP holds, then we conclude that the hubs form an integrated market.

We have also performed a vector error correction (VEC) model which gives insight into the short term price dynamics. Prices may deviate temporarily from their relative LOP, even if they are cointegrated. However, they should always have a tendency of moving back towards the relative LOP. The speed with which prices move back towards their relative LOP says something about the efficiency of the integrated market. The faster the prices adjust to their relative LOP, the more efficient and better integrated the market is.

Striking

The results of our analysis show that in the long run the relative LOP holds for all 15 pairs of hubs. Thus, it appears that the gas hubs in North-West Europe form one integrated market for natural gas. As a result of arbitrage, hub prices never drift too far apart. In other words, the hubs form one large region where demand and supply are related to each other. This means that players are no longer bound to a specific location for selling and buying gas.

This conclusion may not seem too surprising, as economic theory predicts that arbitrage will lead to price convergence and thus integration. However, as the integration process has only started in the late

| As the integration process has only started in the late 90’s, the results are actually quite striking |

Relatively low liquidity of hubs resulting in low trust of traders and other market parties might have prevented market integration as well. But this does not seem to be the case. Note that our findings are based only on the prices of day-ahead contracts. There are other types of contract traded at the hubs, such as month-ahead or year-head contracts. It is very likely that these types of contract show at least equal, but probably stronger signs of market integration, since they allow more time for arbitrage to take place.

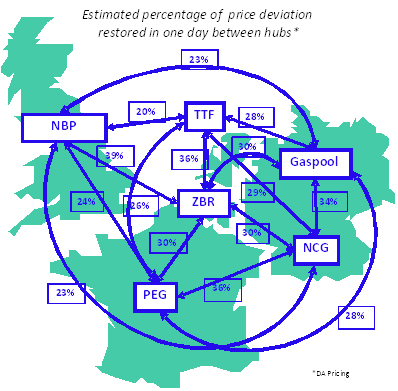

In addition we found that, in case of short term deviations from the relative LOP, there is always a tendency for the relative LOP to be restored. There are, however, minor differences in the speed with which this happens. The accompanying figure shows the percentage of the prices that are restored the next day after a deviation. For example, 23% means that 23% of the deviation has been restored the next day. Obviously the larger the share that is restored, the more efficient the market is.

|

We have put the same results in a table as well:

| Hub-pair | Speed | Hub-pair | Speed |

| NBP-Zeebrugge | 39% | TTF-Gaspool | 28% |

| Zeebrugge-TTF | 36% | Gaspool-PEG | 28% |

| NCG-PEG | 36% | TTF-PEG | 26% |

| NCG-Gaspool | 34% | NBP-PEG | 24% |

| Zeebrugge-NCG | 30% | NBP-Gaspool | 23% |

| Zeebrugge-Gaspool | 30% | NBP-NCG | 23% |

| Zeebrugge-PEG | 30% | NBP-TTF | 20% |

| TTF-NCG | 29% |

| Percentage of deviations restored the next day on the major gas hubs |

The most efficient and therefore best integrated bilateral hub pairs are the following: NBP-Zeebrugge, TTF-Zeebrugge, NCG-Gaspool, and NCG-PEG. This could indicate that there are more arbitrage opportunities between these hubs, for example due to a relatively large pipeline capacity. Less efficient pairs are those of NBP with continental European hubs. This might be due to the fact that these hubs lie geographically farther apart.

It is remarkable that the prices of NBP and TTF restore relatively slowly to their LOP. This might be due to the fact that gas in the BBL-pipeline, which connects the two markets, can only flow in one direction. This may lead to arbitrage constraints. In contrast, the Interconnector-pipeline, which connects the markets of NBP and Zeebrugge, can flow in both directions, resulting in a faster restoration of the LOP. Nevertheless, the overall difference between the pairs is not strikingly large. This supports the notion that there is one integrated natural gas market in North-West Europe.

More inter-hub trade

More liquid hubs will continue to contribute to the process of market integration in the future. It is generally accepted that the only ‘real’ liquid hub in Europe is NBP, as shown by its high ‘churn’ rate (i.e. the ratio between the total volume of trades and the physical volume of gas consumed in the area

| It is likely that the market will become even more strongly integrated in the future and gas hubs will become more connected |

|

Day ahead prices and churn rates You can click here for graphics showing day ahead prices and churn rates. The first graphic shows that the day ahead at six North West European gas hubs have moved in tandem since 2007. Note that, in spite of all the talk of "low gas prices", the prices on the hubs are showing a strong recovery since the second half of 2010! To contact the authors for further information, you can write to Catrinus Jepma at jepma@energydelta.nl or Rudolph Harmsen at rudolphharmsen@hotmail.com. |

Discussion (0 comments)