The coming conflict over rare metals

on

The coming conflict over rare metals

To make a transition a green economy possible, the rare metals used in sophisticated batteries, LEDs, solar panels and even the latest turbines for wind farms need to be readily available as the technologies scale up to meet global demand. The problem is, China controls 95% of the production of these metals and has put a brake on their export. If Europe wishes to remain in the game of this technological advance, then it is time to recycle many more of those old phone batteries and computers pretty quickly.

|

| Yttrium crystal, basic material for a major super-conductor |

| Article Highlights: |

| - New “clean” energy technologies, such as electric cars, LEDs, solar panels and wind turbines, need growing amounts of rare metals or rare earth minerals, such as lithium, neodymium, dysprosium and others. - 95% of the production of these metals takes place in China – and the Chinese are planning to limit their export. - Western countries therefore need to develop new resources of rare metals. Such resources do exist, but many of the mines in Australia and other countries were closed in the 1990s because they could not compete against the Chinese on price. - The problem is particularly acute for the EU, which imports nearly all of its rare metals – and at the same time has great ambitions in clean energy. |

Later in the month, Pike Research, the well-respected clean technology analysts produced a report that said that the global market for lithium-ion batteries would reach $8 billion in sales by 2015, compared with $878 million in 2010.

Pike Research pointed out that in electric and hybrid cars like the Chevrolet Volt, the batteries currently added between $8,000 and $18,000 to the price of the vehicles. One of the analysts, John Gartner, went on to suggest that the residual value of the battery, after 10 or so years, might be taken off the price of the new car, because they could be sold on for use in ‘smart grids’. This is because lithium-ion batteries are likely to be the most-favoured technology for stationary and storage applications, a market which is growing at breakneck speed thanks to President Obama’s stimulus bill that subsidises the development of new energy storage technologies. In short, in the US the hunt is on for ever-larger quantities of lithium. If these cannot be found and the lithium price increases rapidly, it will put a sharp brake on the growth prospects of ‘clean energy’ technologies.

Bad news

Back in December 2006, William Tahil of Meridian International Research did some number crunching about this. At the time, he noted that the lithium-ion car battery used about 0.3 kg of lithium per kWh. To produce it, this needed between 1.4-1.5 kg of lithium carbonate. Consequently a plug-in hybrid electric vehicle (PHEV) with a 5 kWh battery, would need 1.5 kg of lithium from 7 kg of lithium carbonate. However, as he pointed out, 5 kWh is hardly going to get the owner any great distance in purely electric mode. This needs something of the order of 8 kWh, or 2.4 kg of the metal, or 11.2 kg of the carbonate. Existing global annual production of the carbonate would allow the production of around six million of these batteries, or around a tenth of total global vehicle production. To replace the existing car pool with plug-in hybrid electric vehicles would need an annual production of the carbonate of 670,000 tonnes a year. It is currently around 70,000 tonnes a year.

Nor is there any guarantee that as the plug-in hybrid progresses, it will not demand more lithium. GM’s much trumpeted PHEV40 – the 40 stands for miles on electricity only – has a 16 kWh battery. In short the bigger the range, the more lithium required. And the situation is even worse, because Tahil makes the assumption that batteries will be the sole user of lithium. In reality, batteries currently use only around 22-25% of the lithium in the world. Suppliers of lubricants, pharmaceuticals, air conditioners and aluminium use the other 75%. They would not be too pleased if all of it went to this single application.

Tahil, needless to say, got the reaction that tends to come to all bringers of bad news. Most of the criticism was about his pessimism concerning the reserve base, which he put at 13.4 million tonnes, with currently economically exploitable reserves of 6.2 million. Many would at least double this. Equally, critics pointed to the resources of Chile, Argentina and China and noted that Bolivia’s Uyuni salt pans were not yet exploited and were estimated to contain 5.4 million tonnes. However, his point was a valid one; you cannot just make the assumption that certain types of new technology can expand exponentially without taking account of the resources available and what needs to be done to extract them. If we just look at lithium, the US has a reserve of around 38,000 tonnes and a production rate in Nevada of about 1,000 tonnes a year. As for Europe, its star producer is Portugal, which currently produces around 320 tonnes a year. If there is any certainty in European car manufacturing circles, it is that European built electric vehicles will have to import lithium, probably from South America.

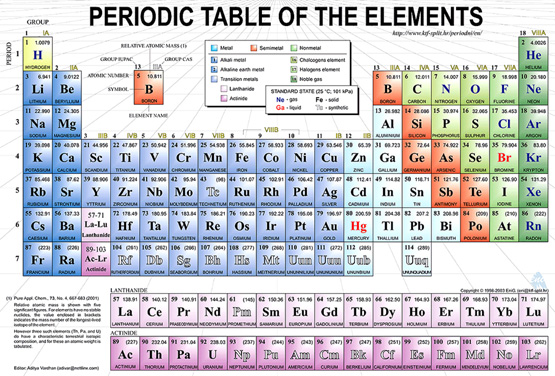

Super-conductor

Lithium is by no means the only relatively rare metal that is used in cleaner cars and other clean energy technologies. For example, the Toyota Prius also uses 1 kg of neodymium and the battery, in addition to the lithium, contains 10-15 kg of lanthanum. Unlike either lithium or gallium – used widely in solar panels and in LED lighting – neodymium and lanthanum are genuine lanthanides or two of the 15 rare earth elements.

Lanthanum is used as the anode in nickel metal hydride batteries. The usefulness of neodymium is contained in its high magnetism, which is roughly nine times more powerful than conventional magnetic materials. Combined with iron and boron, the material creates a super-strength magnet for generators that can be made much smaller than their rivals and consequently much lighter. This is obviously useful in applications like loudspeakers and cordless tools, but it is also highly valued in wind turbines. Clearly the lighter the turbine, the less foundation is required and the cheaper is the construction of the wind farm.

The Prius also uses around 100 grams of another rare earth element, dysprosium. This has the function of stabilising the neodymium in hot environments like drive motors. If Toyota intends to keep using it for its target sales of 2 million Prius cars, then the company will need to find new supplies. Annual global production is around 100 tonnes.

The uses of the other rare earths can be quickly summarised. Cerium is a very useful catalyst performing similar functions to platinum in catalytic converters. Yttrium is valued as a major super-conductor. Europium has the remarkable distinction of being the element capable of absorbing more neutrons than any other. It is thus used – particularly in Russia and Ukraine – for nuclear fuel rods. Most of the rest of the lanthanides have some kind of use in laser technology, except for promethium, which makes a useful nuclear battery and thulium for which nobody has yet found any use at all.

Yet apart from their position on the periodic table of chemical elements, all these raw earth metals have another thing in common; 95% of their production is in China. In the world of the rare earths China is the undisputed king. It is here that the story starts to become political. For in July 2009, the Chinese Ministry of Industry and Information Technology produced a draft report – The Rare Earths Industry Development Plan 2009-2015 – that proposed a total ban on shipments overseas of terbium, dysprosium, yttrium and lutetium, while suggesting that exports of neodymium, europium, cerium and lanthanum be limited to 35,000 tonnes a year combined.

Widespread suspicion

|

|

The net result has been a widespread suspicion of Chinese motives, which is perhaps unfair. Nonetheless, subsequent to China joining the World Trade Organisation in 2006, the disputes were not long in coming, initially over exports of women’s underwear, but now the EU and the US are complaining about Chinese limitations on the exports of coke, bauxite, silicon carbide, fluorspar and zinc. This adds to existing concerns about restrictions on molybdenum, tungsten, antimony, and magnesium. The EU and US argue that by limiting the export of raw materials, the Chinese are putting European and American manufacturers at an unfair disadvantage.

But in many ways the potential dispute about the rare earth minerals and some of the other unusual metals is much more explosive. They lie at the heart, not only of the potential expansion of clean energy technologies, but also of numerous other fundamental areas of perceived western economic growth: mobile phones, lasers, optics, more advanced computer chips. The requirement for rare earth materials for advanced weapons systems in the US can only be guessed at. In short, these minerals lie at the heart of modern technological advance their properties have not even been fully explored.

|

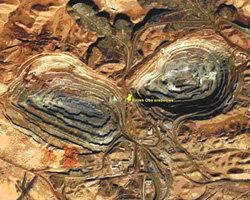

| Bayan Obo, China's large production centre of rare earth metals. Picture: Google Maps |

If you need a neodymium-magnet for your wind turbine try Ningbo Tongchuang Co of Ningbo, Zhajiang province – guaranteed to under-cut alternative suppliers. General Motors, seeing the way things were going, shifted their magnet research facility to China in 2000. Meanwhile Suntech, of Wuxi, Jiangsu Province, is rapidly emerging as one of the largest global suppliers of solar panels, with contracts for 490 MW in Europe and a small new production plant to be built in Arizona.

Given this rapid expansion in manufacturing, the Chinese government defends its export limitations not merely on belated environmental grounds, but on its own requirements. The ministry concerned forecasts that demand in China alone will be sufficient to outstrip indigenous production of some 39 out of 45 major mineral resources by 2020.

Strategic plan

The Ministry of Industry and Information Technology’s proposals to limit export of rare metals are currently grinding their way through the Chinese bureaucracy, but they have caused alarm elsewhere. In November 2009, the Obama administration added a request to the defense procurement bill that the General Accounting Office (GAO) should investigate the entire supply chain of all rare earth elements used by the Department of Defense. It is to report with some urgency by April this year. The GAO is also required to develop a strategic plan for the metals – a demand met with delight by various US rare metals companies who have long regarded Washington as unbelievably complacent on the subject. After the end of the cold war in 1993, the US sold off 99% of its National Defense Stockpile, ironically when mineral prices were rather low.

The Australians have also been alerted. They are proceeding rapidly to rebuild their own rare earth industry. After a tortuous and lengthy approval procedure, work is under way on the Lynas-owned Mt Weld open cast mine in Western Australia, described as one of the largest deposits of rare earth minerals worldwide. Another mine, owned by Arafura, is being opened at Nolan’s Bore, 150 km from Alice Springs.

And the European Union? Well back in 2008, the Commission produced a document grandly entitled “The Raw Material Initiative – Meeting our critical needs for growth and jobs in Europe”. This certainly marshalled the facts. It pointed out that Europe imported 100% of its needs for antimony, cobalt, molybdenum, niobium, platinum, titanium, vanadium and all the rare earths, plus 90% of its requirement for manganese. It also pointed out that out of 33 strategically important metals, China was the largest producer of 13. The only such minerals produced in any quantity in the EU itself were selenium, of which Europe produced 19% of global supply, and tungsten at 4%. The report also noted that the single largest requirement for these strategic materials was either for future energy supply or for energy conservation.

It made a number of other valuable points. It noted that in constant dollars, mineral price indices had hovered around $150 per index unit from 1950 to 1993 when they fell below $90, where they stayed until 2004. They then shot up to a high of $260 before collapsing again, almost simultaneously with oil in 2008. Copper prices reached $4.06 per lb in June and were $1.27 in November.

It also pointed out that many of the rarer metals concerned were by-products of mining more common minerals. Tantalum, particularly vital in mobile phone technology, is frequently associated with tin and had a huge price hike in 2001-2004, because of expanding phone manufacture. Tin at the time was at a ten year low in price. The issue here is that the production of most of these minerals is a function of the wider global economy. It is not possible to cherry-pick most of the rare ones. Equally, in spite of high demand and high prices for the rarer materials, the bulk of mining industry profit comes from the commoner ones.

The EU report mentioned another relevant point, namely that 50% of identified global mineral resources of rare metals are to be found in countries where per capita income is less than $50 per day. Mineral production thus goes hand in hand with development. In this matter naturally, the European sub-text is Africa, although the record of the mining companies on that continent so far suggests that they may be part of the development problem rather than its solution.

Knowledge base

Following this document, the EU Commission refined its policy in September 2008 into three basic ideas. Free trade in minerals was to be pursued, following the route of negotiation in the cheerful hope that the Chinese would play ball in spite of considerable evidence to the contrary. Second, Europe’s own resources were to be hunted down and produced in a sustainable fashion. On the quiet, the Commission pointed out that Europe did not have an adequate “knowledge base” of its own mineral resources and that it might be intelligent if the nation states acquired one. Finally, it would be sensible to reduce consumption, or rather: to start taking recycling very seriously indeed.

In fact, the European recycling record for relatively common metals is very good. Over half of metals like steel and copper produced are now coming from scrap, with some 70%+ saving in energy demand compared with raw refining. Much of this material is exported. In addition the EU already has a series of directives – most notably the Batteries Directive of 2006 and the Waste Electric and Electronic Equipment Directive of 2002 (WEEED), with both now under revision. However, by contrast with scrap metal, under WEEED, after four years of implementation only a third of such waste is being recycled. In terms of batteries, the target is to be a quarter by 2012 and 45% by 2016, but the actual figure is currently around 14%. The vast majority of these recycled batteries are lead-acid ones, which rather misses the point.

Given the change in European recycling habits over the past decade, with paper and glass, it would seem that the green movement is missing a trick over batteries. Certainly in the UK, few mobile phone outlets have very visible recycling boxes. A sense of urgency is lacking.

None of this suggests that the total resources of comparatively rare metals are going to put a permanent block on the growth of ‘clean energy’. China recently announced that a new rare earth deposit with 80,000 tonnes of niobium and 10,000 tonnes of tantalum has been found in the Xinjiang Uygur Autonomous region. When platinum catalytic converters were first introduced, there was widespread fear that the resource was inadequate, but this proved not the case as layers of the metal became systematically thinner as the technology improved. Rather the real issue is that, currently, the rapid expansion of clean energy technologies, mobile phones and more advanced computers is outstripping the rare metal production available now.

Furthermore the issue is likely to become progressively more political. With China’s relationship with the US deteriorating over internet cyber-spying issues, Taiwan and various trade issues, the Chinese are unlikely to be generous, not least because of their own rapid technological advance occurs in precisely the areas that use the rare materials. It is ironic really. A decade ago steel drainage ‘manhole’ covers were disappearing across Europe and the US to feed China’s desperate demand for iron scrap. Now, ten years later, China is threatening to reduce supplies of much more expensive metals.

Rare earth elements and their energy use:

|

|

3 Li: Batteries |

Discussion (0 comments)