The end of the honeymoon period for renewables

on

The end of the honeymoon period for renewables

Electricity markets across Europe are experiencing a once-in-a-generation transformation, which is largely driven by the exponential growth of intermittent generation from renewable energy sources - solar PV and wind in particular. Although the rise of such renewables is both necessary and inevitable in the transition to a low-carbon economy, it is becoming increasingly difficult and costly to integrate them into the current power system. Inevitably renewable generators will be asked to play a bigger role in managing the impact their production has on electricity systems. In addition, they will have to deal with reduced financial support and legal prerogatives as policymakers will try to end their insulation from energy markets. The honeymoon period for renewables is ending, and their existence in electricity markets is bound to get a lot more challenging.

|

| An increased market penetration of renewable energy sources necessitates more efficient management of supply and demand (c) The Earth Times |

Last January, EU Commissioner for Energy Günther Oettinger addressed a Eurelectric conference stating that "no sector will be more deeply affected by the changes which a low carbon economy will bring than the energy sector - in particular electricity". True enough, but what is also true, and less widely understood, is that there is no change that has a more profound impact on today's European electricity sector than the rapid increase in renewables. Long-term network analysis by the European Network of Transmission System Operators for Electricity (ENTSO-E) suggests that by the end of this decade, 80 per cent of the bottlenecks in European power grids are directly or indirectly related to integration of renewable energy sources.

Transmission system operators (TSOs) across Europe - and to an increasing extent their counterparts at the distribution level (DSOs) - are struggling to cope with the overwhelming introduction of intermittent renewable energy, wind and solar power in particular. There are two main problems to consider with renewables. The first is the fact that their generation capacity is non-dispatchable in the sense that its production cannot be increased upon request by the TSO. The second is that their intermittent power generation necessitates the availability of more fast-responding dispatchable power units to maintain system frequency at 50 Hz.

As a result, an increased market penetration of renewable energy sources necessitates more efficient management of supply and demand. The big question is how? What is the best way to smoothen the integration of renewables in such a way that system security is maintained at all times? And who will carry which responsibilities?

The discussion on these issues is evolving. The initial mind-set was that the grid should adapt to the rising presence of renewables. An illustration is the IEA’s 2011 report on harnessing variable

| By the end of this decade, 80 per cent of the bottlenecks in European power grids are directly or indirectly related to integration of renewable energy sources |

Increasingly, however, there are calls for renewable generating units to behave more like their conventional counterparts in order to satisfy the needs of the transmission grid under all operating conditions. In this view, initially propagated by ENTSO-E and Eurelectric, renewables should start to take on a new, more proactive role in the power system.

System at risk

There are reasons to expect that the latter view, that proposes a changing role with more responsibilities for renewables within the power system, is going to gain momentum. One major reason is that in the years to come, a considerable part of conventional generation capacity faces the risk of becoming uncompetitive in the energy market. The problem for conventional plants is that as renewable energy sources have negligible marginal costs, when there is a lot of wind or sun, conventional production (usually gas-fired or coal-fired power) becomes uncompetitive and is shut down. At the same time, renewable energy needs this same conventional generation capacity as backup if the wind or sun fail.

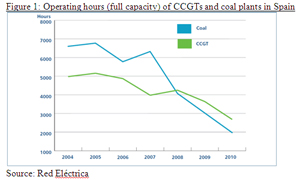

In the long term, this implies that these thermal units are running fewer hours than expected at their initial commissioning and that, in time, their business model and very survival is at risk. Figure 1 shows how operating hours of CCGT’s (combined-cycle gas turbines) and coal plants in Spain slumped by around 50 and 70 per cent respectively between 2004 and 2010. Because these power plants play an important role in controlling the frequency of the network, their disappearance would put the security of the entire system at risk. In addition, further downscaling and decommissioning by 2016 of many thermal units across Europe is expected as many of these will no longer be compliant with the thresholds of the Large Combustion Plant directive. Thus, for example in the UK, approximately half of all coal plants will face closure in the coming five years. At the same time, the business case for investment in new thermal capacity has crumbled and little incremental capacity is expected to enter the market in the coming years. Clearly this development contains the risk of causing insufficient supply availability in the near future.

|

| Operating hours (full capacity) of CCGTs and coal plants in Spain (click to enlarge) |

Although CRMs are an effective way to keep thermal plants alive, they can have serious drawbacks. If they fail to distinguish between base and peak load capacity, they might keep undesirable, polluting power plants in business. If they do not sufficiently consider improvements in energy efficiency and demand response, they might overemphasize generation-based solutions. In addition, they offer no guarantee that adequate generation capacity will be available. Most importantly perhaps is that they separate investment decisions from market signals.

For all of these reasons, the European Commission is very critical of national CRMs. In a leaked draft version of a Communication on the Internal Energy Market, scheduled to be published in mid-October, the Commission shows itself worried about their impact on market functioning. The Communication states that “the Commission expects Member States not to intervene and introduce capacity mechanisms before carrying out a full analysis of the existence and possible causes of a lack of investment in generation”. It continues by stating that “Member States should analyse the necessity and the impact of their planned intervention on neighbouring Member States and on the internal energy market”.

Revision of the status quo

The obvious shortcomings of CRMs will add to the pressure to change the rules underlying electricity markets. In order to achieve the triple ambition of EU energy policy to create a low carbon economy on the basis of competitive markets that guarantee security of supply, renewable generators are likely to be burdened with more duties and lose some of their current privileges. If renewables are the main reason that conventional power plants are driven out of the market, then - recognizing that the potential of demand-side response, stronger interconnections and electricity storage is limited in the short term - they will have to step up their contribution to the long term security of power grids.

The first steps towards a revision of the status quo are already being taken. ENTSO-E has recently finalised a network code setting technical capabilities that all generators - including renewable units - should be able to meet. These technical rules should ensure that renewable generators actively participate to maintain the system's frequency within safe margins at all times. Once into force, new renewable units will have to meet obligations that help to stabilize their output. A retroactive application of the connection requirement rules seems unlikely, although individual member states may choose to oblige existing units to meet these requirements as well. In the case of Germany, for instance, one could argue that there is already so much renewable capacity in the market that it would be undesirable to exclude these units from the new connection requirements.

In addition, there are increasing calls for a pan-European obligation for renewable generators to

| There are increasing calls for a pan-European obligation for renewable generators to become responsible for 'balancing' their own production |

Making renewable generators responsible for balancing will push them to be more prudent in their forecasts, thus reducing the need for flexible reserves. A possible drawback is that wind and solar PV units might be curtailed more to avoid imbalances. In order to prevent structural losses of renewable output, such a measure should therefore go hand in hand with the development of liquid intraday markets, where gate closure time (GCT) - the last moment where producers are able to submit their bids - is as close to real time as possible. Bringing GCT closer to real time will lead to more accurate output predictions and a more efficient activation of renewable power assets.

Grid investments

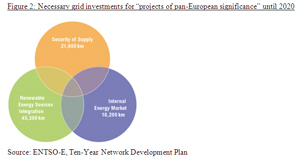

A second major reason why we may expect the role of renewables to change is that currently they are the main driver of grid investment needs, as shown in figure 2. A more integrated vision of renewable production and the needs of the power grid will considerably reduce the need for expensive investments in transmission cables. In most European countries, legal provisions oblige the local TSO to provide any renewable generator access to the transmission grid. The costs of extending and reinforcing the grid are most often 'socialized' through Use of System Charges (UoSC). As a result, renewable energy project developers have no incentive to build plants near demand, and instead build at locations with the strongest wind or the most sun-hours per year. If there were less need for grid operators to connect remote wind and solar plants, or if some of the associated cost is shifted to the generator itself, it would allow for capital-constrained TSOs to address other weak spots in the transmission system.

|

| Necessary grid investments for "projects of pan-European significance" until 2020 (click to enlarge) |

According to the 'Electricity Target Model' (ETM), which is the policy framework that provides the basis for the integration of electricity markets across Europe, the incentives given by locational tariffs could also come from the market. In other words, high market prices should indicate that demand for electricity structurally exceeds supply in a specific market area, and that, by implication, additional generation capacity in that area is needed. In order for these signals to be accurate, prices need to reflect the local supply and demand dynamics. Moreover, price zones will need to be defined on the basis of structural congestion on the transmission network. Once this is the case, investment in renewable generation will increase where it is needed most, and decrease where such need is lower.

Support scheme reform

Renewable generators will only be responsive to such incentives, however, if their revenue stream relies at least partly on market prices. In other words, schemes where the market price is largely irrelevant to renewable generators - feed-in tariffs in particular - will not stimulate project developers to build their renewable plants near demand centres. By contrast, support schemes that let the pay-out of renewables depend on energy market prices in some way - such as feed-in premiums and green certificate markets - will push for a more efficient diffusion of new renewable capacity. Accurate market signals should push renewable generators to build closer to demand, even if it implies choosing second-best locations for their plants.

Across Europe, there is increasing scrutiny of the level and nature of existing support schemes. Various European countries, including the renewable pioneers Germany and Spain, are rapidly cutting back on their tariff levels to reduce costs. The initial justifications for support schemes - the persistence of market barriers, internalizing the external costs of conventional generation, and the relative immaturity of renewable energy technologies - have lost considerable weight in recent years. It makes sense for national governments to adjust the rules to the new circumstances. The European Commission's Renewable Energy Communication from last June also advocates "moving as rapidly as possible towards schemes that expose producers to market price risk", especially for mature technologies. In addition, the Commission pushed for further 'coordination' of support schemes for renewables across Europe in order to “avoid fragmentation of the internal market".

How far such coordination should go remains unclear. A publication by the Centre for European Reform from last April proposes that support schemes should be harmonised throughout the EU at least in structure, although not necessarily in the level of support, to prevent highly skewed investment concentrations across European countries. In the earlier-mentioned leaked draft Communication on the internal energy market, the European Commission repeats its intention from the June Communication on Renewables to "prepare guidance on best practice and experience gained in renewable energy support schemes and on support scheme reform". Such developments clearly indicate that in the years to come renewables will face lower support levels and find themselves less insulated from the market. This will put increasing pressure on mature technologies to become competitive on the wholesale market, and on less mature technologies to prove they are 'marketable'.

Vital role

Some will object that the line of thinking and the changes foreseen here represent an outdated paradigm that places renewables within a conception of a centralised electricity market. Admittedly, most of the potential of renewables lies in their decentralised character, and together with smarter local power grid management they have the potential to strengthen, rather than weaken, energy systems across Europe. However, the fact remains that in the absence of more advanced smart grid solutions that facilitate supply and demand flexibility at a local level, managing the intermittency of wind and solar units remains a responsibility of TSOs. In today’s capital-stressed situation, it will become untenable to shield renewable generators from certain responsibilities.

National and EU policymakers, then, face the challenge of controlling the boom of renewables while ensuring that their measures do not turn the boom into a bust. Changing the role of renewables should not mean that large, conventional generation plants are backed with public money, as they often have

| National and EU policymakers face the challenge of controlling the boom of renewables while ensuring that their measures do not turn the boom into a bust |

Given the potential and development of the renewable industry, the harsher and more demanding market environment that it will face should not prevent its on-going evolution. On the contrary, a well-managed, fair and realistic rearrangement of the roles in the electricity market will allow intermittent renewables to play an ever more vital role in the coming years.

|

About the author Timon Dubbeling is a MA student International Energy Markets at the Institut d'Etudes Politiques (IEP) - SciencesPo Paris. He is currently doing an internship at the European Network of Transmission System Operators for Electricity (ENTSO-E). The views and opinions expressed in this article are the sole responsibility of the author. |

Discussion (0 comments)