New nuclear power in Europe - will Finland show the way?

on

New nuclear power in Europe - will Finland show the way?

With the news in December that EDF's flagship nuclear reactor at Flamanville, France, is going to cost an extra €2 billion to build, ratcheting up costs to €8.5 billion from an initial cost estimate of €3.3bn - you would be forgiven for wondering whether Europe is ever going to get a new nuclear reactor off the ground. But some people still believe it can happen. Hopeful eyes are turned now to Finland, where another European Pressurized Reactor (EPR) is under construction. But this project too is late, over budget and unfinished. Nevertheless, the Finns are confident that they will get their nuclear power plant running -and will solve the nuclear waste storage problem in the process. EER's Brussels correspondent Sonja van Renssen travelled north to learn about the Finnish way.

|

| Underground storage at Onkalo (c) Sonja van Renssen |

The goal is to start storing nuclear waste here in 2020. It would be a world first. Waste would keep being added until 2110, when the site would be sealed off for good and liability turned over to the government. But apart from requiring a construction license to move beyond the current research stage, Onkalo requires, in the first instance, nuclear waste. Will there really be that much to store? With a ban on importing and exporting such waste, it will all have to come from inside Finland. So what are Finland's nuclear ambitions?

European firsts

Finland currently has four nuclear units in operation, which together produce some 28% of the country's electricity. According to official EU Statistics, Finland's total electricity production was 80.7 TWh in 2010, of which 22.8 TWh was supplied by nuclear power and the rest mainly by hydropower, coal, gas and peat. Net imports stood at 2.1 TWh. Total domestic generation capacity was about 18,500 MW, of which 2,700 MW was nuclear.

Of the four existing nuclear units, two are at Loviisa in the southeast of the country and the other two at Olkiluoto in the southwest. The Olkiluoto units are bigger (880MW vs. 496MW for the Loviisa units) and it is at Olkiluoto too that Finland has plans for two new units: Olkiluoto 3 (under construction: to be 1600MW) and Olkiluoto 4 (still at design stage).

All these projects are run by two companies: Fortum, which owns Loviisa, and TVO, which owns the Olkiluoto units. Fortum also has a 25% stake in TVO, and TVO and Fortum together own Posiva, the company behind the final waste repository (60% TVO, 40% Fortum). It's a small club.

Yet in 2007, a new company called Fennovoima entered the scene. Three years later, Fennovoima got the green light to build a nuclear reactor of its own - Hanhikivi 1 - at a green-field site in northern Finland. At the same time, TVO won government approval for Olkiluoto 4 (Olkiluoto 3 had been approved in 2002). Fortum's bid for a third reactor at Loviisa was turned down. To sum up, there are therefore four operational reactors (two at Loviisa, two at Olkiluoto), one under construction (Olkiluoto 3) and two planned (Olkiluoto 4 and Fennovoima).

These different projects include a few European firsts. Olkiluoto 3 was the first of a new generation of nuclear reactors, developed by Areva, EDF and Siemens - the European Pressurized Reactor (EPR). It went into construction back in 2005. EDF's Flamanville reactor in France followed in 2007. Onkalo, situated next to Olkiluoto, is the most developed long-term nuclear storage project in the world. And Fennovoima is the only green-field nuclear construction project in Europe underway today.

Like Flamanville, Olkiluoto 3 is over budget and delayed - possibly because the same French company (Areva) and technology (EPR) are behind both. Like Flamanville, Olkiluoto 3 is now also expected to cost some €8.5bn (vs. €3bn originally planned) and it will enter into service at 2015 at the earliest, six years late. But it is one step ahead of the French project, both in terms of timing for going operational and in having a well-developed final waste disposal solution (Onkalo) so close at hand. Understanding how Finland has got so far - and what stands between it and the finishing line - could contain lessons for moving forward elsewhere in Europe.

Case for nuclear: mankala

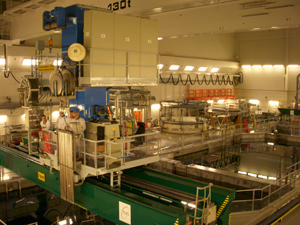

|

| Olkiluoto unit 3 with existing Olkiluoto unit in the background (c) Sonja van Renssen |

The second big driver is affordability and here Finland has a unique approach: the "mankala" business model. TVO is a mankala, which means it is run like a cooperative. All participating companies, call them shareholders, are entitled to a share of the power output proportional to their share in the mankala (and therefore contribution to production costs). Shares don't equal dividends and instead of turning a profit, the purpose of a mankala like TVO is to produce affordable energy for its owners. This is tax-free power at producer prices, i.e. much cheaper than buying it on the open market. Participating companies can use the power directly or sell it.

There are no figures available on exactly how much of a financial advantage the mankala offers, but observers agree that Finnish companies are hard-pressed to join one or they will find themselves at a

| "In the 2020s we want to be self-sufficient in electricity" |

The mankala model was created decades ago when Finnish forest industry companies joined up to develop power supplies for their pulp and paper mills. They consumed a lot of electricity but didn't have the capacity to make large power plant investments on their own. Today, the mankala model is the default option for the power sector in Finland, although it remains relatively unknown outside the country. One of its advantages is that it protects Finnish companies from energy price spikes, in dry periods for example, when Finnish hydropower production levels off.

Greenpeace Nordic energy campaigner Jehki Härkönen, based in Helsinki, does not share the same vision of nuclear power as Finnish industry but he recognizes the success of the mankala model: "It has had a big effect. If some companies have access to tax-free electricity, others need to have it too. The mankala model can make otherwise not commercially viable projects viable."

And so it has been for nuclear. A mankala is typically owned by many different companies, each of which could itself be a mankala. TVO has six shareholders, the largest of which is Pohjolan Voima Oy (PVO), another mankala. The latter's largest shareholder is paper company UPM. Overall, TVO is made up of 44% industrial companies, 30% local energy companies (65 in total, owned by around 140 municipalities) and the rest is Fortum. Fennovoima too is about two-thirds owned by a mankala. The remaining 34% is, until spring, owned by German energy giant Eon.

Worrying blow

For Fennovoima, Eon's imminent departure, announced in October, leaves dark clouds hanging over the project. Even if this is simply part of Eon leaving Finland altogether - as Tigerstedt points out - the fact remains that the mankala's biggest financial backer and source of nuclear expertise is leaving. "In the early stage of the project, when we applied for a decision-in-principle and got the political green light, Eon's expertise had a significant role," counters Tigerstedt. "But since then Fennovoima has continuously and systematically strengthened its own project organisation and we are fully confident that sufficient expertise will be in place throughout the project." Also, Eon's expertise remains available, she adds.

|

| Reactor pool inside Olkiluoto 1 (c) Sonja van Renssen |

Tigerstedt says Fennovoima is now actually "back to its roots" as the company was started by Finnish companies. Outokumpu, a steelmaker that consumes 2% of all Finnish electricity is one of the "founding fathers" and the biggest shareholder in Fennovoima today (10%). Yet Fennovoima has lost Finnish owners too, Härkönen of Greenpeace says: "At the moment Fennovoima seems about to collapse - they lost 40% of their shareholders this fall [that includes Eon] and couldn't replace any of them."Tigerstedt says Fennovoima is proceeding as planned despite the changes in shareholders.

Waste disposal problem

There is a second challenge facing Fennovoima: what to do with its waste. Posiva says that Onkalo has no room for Fennovoima's waste: it can only handle its owners' spent fuel i.e. that of TVO and Fortum. Posiva says this is down to a lack of physical capacity, not politics. What will happen to Fennovoima's waste is "the most interesting question in Finnish nuclear policy [today]", believes Aurela from the Ministry for Employment and Economy. The government will not force the different companies to work together and indeed Aurela says: "If nuclear is really here for good, this Onkalo is not sufficient [anyway]."

But Fennovoima said in its decision-in-principle application that it would prefer to share Onkalo. Tigerstedt notes that what is essential is cooperation: "Fennovoima is confident that through cooperation a solution that is beneficial to all can be reached and is looking forward to continuing taking further steps towards cooperation.

In this regard all eyes will be fixed on the publication of a new report on the option of cooperation at Onkalo, expected to be published on 10 January. It is the final product of a specially created government committee with representatives from TVO, Fortum, Fennovoima, Posiva, and the Ministry of Employment and the Economy. The final deadline for Fennovoima to fix a solution for its waste is 2016: this is stipulated in its permit to go ahead in the first place (usually the green light is only given if there is a waste disposal solution - in this case Fennovoima got six years to sort one out).

Olkiluoto's challenges

The budgetary and deadline problems at Olkiluoto have led Areva to sue TVO and TVO to countersue Areva. This is passing through the International Chamber of Commerce Arbitration right now. Since 2009, TVO's owners have had to buy electricity that should have been coming from Olkiluoto on the open market. Presumably some of the court wrangling relates to compensation for this.

The current biggest challenge for the project is that "the supplier [Areva] needs to show that all the automated systems are not too much linked to one another," says Anna Lehtiranta, Senior Vice President for Corporate Relations at TVO. Härkönen says the Olkiluoto 3 systems were designed to be entirely computer-run, but the Finnish authorities want analogue back-up in case of a cyber attack.

Safety is paramount for nuclear power, especially in the aftermath of Fukushima. But the Finnish

| "We found nothing post-Fukushima that we would need to make big additional investments for" |

TVO does not expect to have to make big changes in light of the EU's recently completed "stress tests" on the disaster resilience of existing reactors. Finland is the only country in the world to have adapted old Soviet-style reactors to withstand a full core meltdown, says the industry, and Olkiluoto 3 features many safety requirements being built for the first time. Higher safety correlates with higher production, one industry representative said.

The big test for Olkiluoto 1 and 2 will come in 2018, when their operating licenses are up for renewal. TVO is confident that its constant upgrading of Olkiluoto 1 and 2 will win them a new 20-year run. In the meantime, the fourth reactor is still awaiting bids. TVO expects five in total. "What kind of plant, what kind of supplier and what kind of contract are all still to be decided," says Lehtiranta. For Olkiluoto 3, TVO has a fixed price, turn-key contract with Areva, but it will not necessarily conclude the same kind of deal for the fourth reactor, she says. Lessons learned to date include the need to work more with suppliers up front and carry out construction feasibility studies. Fennovoima received its two bids - from Areva and Toshiba - last January and is still considering them. First official cost estimates will follow supplier selection.

After the delays at Olkiluoto 3, some wonder how likely it is that Areva will win any of these new contracts. Others, like Greenpeace's Härkönen, question whether Olkiluoto 4 will happen at all. "With 4 I'm quite skeptical it will go forward. They are still building 3 and it's not yet entirely clear if it's going to come online at all."

Storage debate

The regulatory process for developing a final waste repository is pretty much the same as for building a new reactor in Finland. Onkalo too still has a few hurdles to cross. Posiva submitted its application for a construction license to the government on 28 December, only just meeting an end-of-2012 deadline. This keeps it in line however, with a timetable that was launched in 1983 with a decision that permanent storage would begin in 2020. The site was chosen, as planned, in 2000, and a construction license is next on the list.

Finland says that Onkala has "solved" the waste problem. A very similar project in Sweden however -

| "Storage is a political problem, not a technical problem" |

The Finnish nuclear industry says all costs relating to storage are covered. Environmental campaigners often warn that decommissioning and waste treatment costs could ratchet up future energy costs. But the Finnish industry is well-prepared, with a special waste fund already containing €2bn of the €6bn estimated to be needed for the four existing units plus Olkiluoto 3 (remember Fennovoima has no agreed storage site yet). Most of this money will go to long-term storage, the rest to decommissioning, and short- and medium-term storage. "Less than 5% of the cost of nuclear electricity is waste management," says Lehtiranta. "And it's always taken into account [so] there should be no increase in electricity prices in future [due to this]."

"Storage is a political problem, not a technical problem," believes Reijo Sundell from Posiva. "You must get public acceptance." The copper corrosion story may well make that more difficult. Yet for Finns in the business, nuclear is a clean, safe, reliable, affordable base load energy source. There's not even any need for subsidies (although suppliers like Areva are clearly backed by the French government).

Public engagement

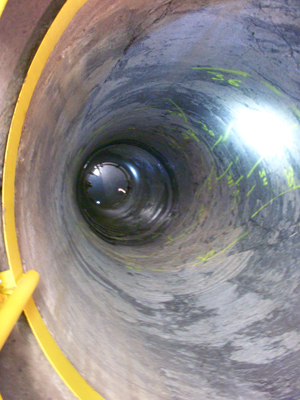

|

| Storage hole at Onkalo (c) Sonja van Renssen |

Perhaps it's easier to return to our original question: how has Finland got to where it has? It has certainly been helped by the country's highly respected nuclear regulator STUK, independent from both industry and policymakers, which has lent credibility to projects. A strong safety record, stable political framework, the mankala model and a final disposal solution apparently within reach are other oft-quoted reasons for nuclear's success in Finland. The stable political framework manifests itself for example, in the fact that the Parliament cannot appeal a government decision on nuclear - although it can appeal every other kind of decision.

Stakeholders also cite extensive information sharing and engagement. "Post-Fukushima almost nothing changed because we have strong bottom-up involvement," says Aurela from the Employment and Economy Ministry. "People here know a little more than in other countries." Engagement is encouraged by the Finns' pragmatic, egalitarian nature, and the clear democratic processes for decision-making, said another. (Greenpeace would question that transparency claim.)

On a more practical note, nuclear projects can create local value: "You don't move a nuclear power plant

|

In Finland, nuclear power is an "open hands" issue like alcohol, where members of parliament are free to vote according to their own conscience |

All of this does not mean that support for nuclear power is unanimous in Finland. Far from it. Every Finnish political party is split on the issue except for the Greens (who are against). In Finland, nuclear power is an "open hands" issue like alcohol, explains Aurela, where members of parliament are free to vote according to their own conscience, even if this goes against the party line. MPs tend to vote for particular projects, not for or against nuclear in general.

So will Finland build the reactors it needs for energy independence in 2020? "Yes, providing we want to stick to our CO2 reduction commitments," answers TVO's Lehtiranta. A nuclear reactor has three lives, she says: technological, economic and political. It will have to survive all three to become a reality. For some, such as Greenpeace's Härkönen, this is a lot to ask.

|

No decision yet on Fennovoima's participation in Posiva On 10 January a working group of the Finnish government came out with a long-awaited advice on whether Fennovoima should be allowed to use the long-term underground nuclear waste storage site Posiva developed by TVO. However, it appears that the government has not made a final decision yet. In essence the working group recommends that the companies “continue negotiating in order to arrive at a solution”. The working group says that “the number of final disposal facilities – one or two – does not play a key role”. |

Discussion (0 comments)