Shell: from oil tanker to floating LNG vessel

on

Shell: from oil tanker to floating LNG vessel

Shell is fairly rapidly changing from an oil into a gas company. While Shell’s gas production has been growing modestly, its oil production has been declining rapidly. As a result, the contribution of oil to Shell’s total production has slipped from 65% just a few years ago to 50% last year. In a few years from now, oil will be good for only 45%, gas 55%. This transformation, partly driven by choice and partly by necessity, opens up new possibilities for Shell, but also entails significant new risks. The most important question, perhaps, is how profitable will the gas market turn out to be?

|

| Shell's CEO Peter Voser (l) and his predecessor Jeroen van der Veer. |

Shell’s current strategy was developed under the leadership of former CEO Jeroen van der Veer after he took over from Philip Watts in 2004 when the reserves scandal had shaken the century old company to its roots. Under Watts and his predecessors Shell had changed from a primarily technology-driven, long-term oriented oil company into a much more commercially driven and short-term oriented investment vehicle. From an oil tanker, you might say, to a cash dispenser. This was the deeper reason behind the reserves fiasco: financial analysts wanted to see Shell’s reserves grow at the same time that Shell’s neglect of its technological roots had made it more difficult for the company to genuinely do so. Hence the pressure to manipulate the figures.

When Van der Veer took over he lost no time in putting technology back on the throne within Shell. But it was already clear by then that it would be technology with a twist: what Shell had decided to specialize in was large, complex and costly projects in challenging circumstances. It was forced by circumstances into this direction. Most of the “easy” oil and gas was being cornered by national oil companies and they did not need Shell to help them develop these resources. And for Shell to focus its efforts on a large number of small resources in OECD countries was no option: margins would be too small and the bulky organization of Shell not agile enough to compete effectively in this area.

So Shell came to concentrate on a limited number of “mammoth” projects – many of them joint-ventures with states or NOCs – in different corners of the globe that ask the utmost of its unique organizational, technological and financial capabilities: a GTL-project in Qatar (Pearl GTL), mega-LNG projects in Qatar (Qatargas), Australia (Gorgon) and Russia (Sakhalin), deep water projects in Norway (Ormen Lange), Nigeria (Bonga) and the Gulf of Mexico (Perdido), heavy oil projects in Canada (Athabasca) and Brasil, and some more traditional, if very large projects, notably Kashagan in the Caspian Sea. Shell is investing $25-$30 billion a year in these enormous projects, and expects to continue to do so in the years ahead.

Gargantuan efforts

Although investors had to wait quite a while before they started seeing results from Shell’s new strategy, the new activities are now apparently beginning to pay off. At this moment 30% of the $175 bn invested by Shell is ‘under development’, meaning invested in projects that may confidently expected to be finished in the short term. These investments will bring 11 billion barrels onstream in the next few years, the company says. This will make it possible for Shell to boost its oil and gas production from 3.1 million boe/d (barrels of oil-equivalents per day, i.e. oil and gas put together) in 2009 to 3.5 million boe/d in 2012. For 2014, further growth is expected to 3.6 or 3.7 million boe/d, according to the latest Five-Year Factbook (2005-2009) that Shell annually publishes.

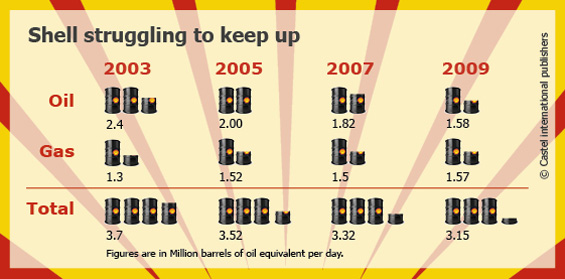

This may be quite an achievement, yet what is rather striking about these figures is that the gargantuan efforts Shell expends on exploration and production of oil and gas, actually yield very meagre results. Over the last seven years, Shell’s production has steadily declined – from 3.7 million boe/d in 2003 to 3.5 million in 2005, 3.3 million in 2007 and 3.1 million in 2009. Thus, if Shell were to boost production to 3.5 million boe/d, it would still not reach its production level in 2003.

In particular Shell saw its oil production erode rapidly. In 2003, Shell still produced 2.4 million boe of oil per day and 1.3 million boe of gas. In 2009, gas production had risen to 1.5 million boe, but oil had declined to 1.6 million boe. Thus, Shell’s oil production declined by one-third over the last seven years! Remarkably, until 2001 Shell actually maintained an explicit production growth target of 5% per year. That is, it promised investors it would produce 5% more oil and gas each year. On 19 September 2001, in a suprise announcement, the company reduced this growth target to 3%, causing a shock on the financial markets, and leading to an abrupt fall of its share price. In retrospect, it is clear that this 3% target also proved to be completely unrealistic. Shell’s real production declined by a cumulative 16% over the period 2003-2009.

The reason for this decline is partly the growing power of the NOCs, which, as we mentioned, have been able in recent years to shut the IOCs out of the “easy” oil fields that they control, but in part also the increasing difficulty for oil companies to maintain oil production in existing acreages, such as the North Sea.

The figures also show the steady transformation of Shell from an oil to a gas company. In 2003, Shell’s production was 65% oil and 35% gas. Today it is roughly equal. The company expects the gas share to grow to 55% in the coming years. One reason why Shell chose (or was forced) to go this way is that there is simply still more gas in the ground than oil. What is more, gas resources have not been as well explored as oil resources, so there are more opportunities to find gas in areas not dominated by NOCs. Another reason is that gas projects offer more chances for the technological and organisational distinctiveness that Shell is looking for. In particular the LNG market is characterised by large, complex and expensive operations that Shell can excell in. Such projects are so challenging that NOCs typically still seek joint-ventures with IOCs in this area.

|

| Shell is the world market leader in LNG |

It is no coincidence, then, that Shell has become world market leader in LNG, even ahead of ExxonMobil. Shell’s LNG production was 18 Mtpa (million tons per annum) in 2009, which is equivalent to 430,000 boe/d, or about 14% of Shell’s total production. By 2015, the company expects LNG production to have grown to 600,000 boe/d (25 Mtpa), which would be more than 16% of Shell’s expected production in that year. Total worldwide LNG production was about 180 Mtpa in 2009, so Shell has a market share of 10%, although the company is actually involved in more than a third of the world’s LNG projects, at the very least as ‘technical advisor’. In addition Shell is on the point of building huge floating LNG tankers – ships 480 metres long with a capacity of 600,000 tons. These floating vessels – in which Shell has put ten years of R&D – make it possible to process gas offshore, so that pipelines to shore are not required anymore. The first of these vessels, about which a final investment decision will be made next year, will be deployed off the coast of Autralia at the Prelude field.

According to Shell, gas has three major advantages which make it the company’s fuel of choice. Shell calls these – in typical Jeroen van der Veer style – the three A’s: gas is “Acceptable, Affordable and Abundant”.

First, gas is environmentally “acceptable”, because it produces the least CO2 of the fossil fuels. Some gas companies argue that for this reason gas is the ideal “transition” or “bridge” fuel on the way to a carbon-free future. Shell, however, prefers to see gas as more than that – namely as a “destination” fuel. After all, the notion of a transition fuel could give the impression that it could be skipped over, which is not what the company would like to convey. Shell in particular emphasizes the gains that can be made if coal-fired power plants are replaced by CCGT plants. For example, the company says that the UK could reduce its CO2 emissions by 24% in 2050 at no extra cost simply by replacing coal-fired by gas-fired generation. If Germany were to do the same, the impact would be even larger.

Secondly, it is “affordable”, in the sense that combined-cycle gas turbines (CCGT) are the cheapest form of electricity production by capital cost and in many cases also in terms of total costs (depending of course on the gas price). According to Shell, the capital costs of a CCGT plant are just 20% of that of a nuclear power plant and 15% of an onshore wind park. Of course this does not include fuel costs, which in the case of wind power are zero.

Thirdly, gas is “abundant”, in the sense that global gas reserves are much larger than oil reserves. Proved reserves of gas will last 63 years at current consumption levels, oil reserves 46 years. That’s just proved reserves – total gas resources are much higher.

For all these reasons, Shell expects that gas will be an increasingly popular source of energy worldwide. It expects global gas demand to grow 2% per year in the decades ahead. And it views itself as ideally positioned to meet a significant part of this demand.

|

| An example of one of the mammoth projects of Shell: Construction of the Pearl Gas to Liquids (GTL) project in Qatar |

Interestingly, Shell’s strategy was developed before the revolution in unconventional gas took place in the US. A revolution that may be followed in the rest of the world, making gas even more abundant than it was – maybe even too abundant.

Ironically, despite Shell’s emphasis on technology on the one hand and gas on the other, the company played no part whatsoever in the development of unconventional gas in the US. Neither for that matter did its fellow “oil majors”, companies like ExxonMobil, BP, Total and ENI. The technology for the production of these huge new resources of “tight” gas and shale gas was developed by small, independent companies who broke new ground where the majors apparently saw little opportunity. The IOCs did act quickly, though, once they grasped the significance of what was going on. They have all made major acquisitions of independent unconventional gas producers by now. Shell bought two of them: Duvernay in 2008 for C$5.9 billion (US$5.7 billion) and East Resources earlier this year for $4.7 billion. Last year, Shell produced 140,000 boe/d in “tight gas” in the US. East Resources will add a similar amount. The potential resources of these two companies are quite large. Duvernay adds 3.7 billion boe to Shell’s gas resources, East Resources 2.7 billion boe. This compares to 14.1 billion boe of total proven global oil and gas reserves that Shell can presently claim its own.

Profound effects

In many ways the unconventional gas revolution is good news for Shell’s gas-oriented strategy. It makes gas even more abundant, which increases consumers’ confidence in it as a fuel and reduces security of supply concerns. And thanks to the distribution of the tight and shale gas resources, which can not only be found in the US, but also in China, Australia and many places in Europe, the IOCs can once again get access to large resources that are not under the control of NOCs.

Yet the new situation also brings worries for Shell. The boost in unconventional gas has thoroughly shaken up the LNG market, on which Shell has put a lot of its cards. In particular, it has made the import of LNG in the US, which the entire market had counted on, superfluous. Shell, however, assumes that LNG will remain the preferred option in Europe and Asia. Thus, the company argues that LNG and unconventional gas will prove to be complementary. That may be true for the time being, but not necessarily in the longer term.

In addition, the unconventional revolution may have profound effects on the gas market structure and on pricing. Shell’s CEO Peter Voser said at the company’s Strategy Update meeting in March that he is convinced that industry will continue to prefer long-term, oil-linked gas contracts to spot market gas, so as to be assured of supply in the long term. Perhaps he is right, but perhaps not. Gas projects often take decades to develop and to pay for themselves, much longer than oil projects, so obviously producers like Shell would like to see long-term, oil-linked contracts stay in place. At the same time, Shell’s own activities in LNG and unconventional gas are helping to undermine this market structure and bring about short-term spot markets delinked from oil prices. It looks like Shell would like to have this cake and eat it too.

This brings us to some of the risks that Shell’s focus on gas bring with it. The most important question perhaps is, how profitable will gas production be? According to Shell, its LNG-projects need an oil price of $50-$90 per barrel to be profitable. This only applies of course if the gas price is linked to the oil price.

In this respect the gas market has a disadvantage compared to the oil market in that there is no OPEC-type of cartel active that is able to keep gas prices high. In the oil market, the activities of OPEC have often been highly beneficial to the IOCs. Just this last year OPEC managed to keep oil prices from collapsing by cutting back production. There is no such mechanism present in the gas market, at least not yet. This is evident in the current market, which is suffering from an oversupply that analysts predict will last at least till 2014.

Another point is that gas cannot very well substitute for oil in the transport sector. The worldwide growth Shell expects in gas demand is almost exclusively based on an expected growth in electricity demand. This may very well come about, especially if the electric car makes a breakthrough. Shell’s own “Blueprints” scenario (one of two scenarios that Shell has developed of what the energy future might look like) notes that ‘By 2050, economic growth no longer mainly relies on an increase in the use of fossil fuels. It is increasingly a world of electrons rather than molecules. Electric vehicles are becoming the norm in the transport sector.’ Still, electricity is not a primary fuel and can be made from many different sources, all of which compete with gas.

Headache

Then there is the security of supply issue, which is particularly relevant to Europe, which is afraid of becoming too dependent on Russia if it relies too much on gas. Shell argues that this problem is exaggerated, as Europe has many options to buy gas apart from Russia. The company expects that LNG imports in Europe alone will be good for 200 bcm in 2020, almost a third of total consumption. It also points to North Africa, the Caspian region and Middle East as sources for piped gas. These are valid arguments, but the question is how much weight they will carry among European policymakers and consumers.

Another issue is that Shell’s focus on a limited number of complex mammoth projects means that the risks of each individual project to the company’s overall performance loom ever larger. The company is aware of this of course and has – fairly quietly – taken steps to ensure as much geographical diversification as possible. It is no coincidence that Shell’s big projects are spread over the globe – from Qatar to Russia, China, Australia, Nigeria, Brasil, the US and Canada. In particular Nigeria has been giving the company a headache for a long time. Until recently Nigeria was good for some 15% of Shell’s total oil and gas production (20% of oil production) and Shell had ambitious plans to further develop its Nigerian fields, but in recent years it has postponed investment decisions in Nigeria. It has a number of Nigerian projects on the planning list for 2014-2020, but these will only be undertaken if the investment climate is stable.

Nevertheless, it is not possible for Shell to anticipate all risks to its mammoth projects. Disaster can strike anywhere, as Sakhalin has shown – or the BP oil spill in the Gulf, for that matter. There is also the larger question of how far technology can be pushed to recover resources that are ever harder to reach. And the even more important question how the climate change situation will evolve. Should climate change happen to accelerate (which I personally don’t believe will happen, but some people do), then the use of gas may be expected to be curtailed, just as coal and oil will be. In that case, Shell has few alternatives to fall back on, although it has belatedly entered the field of first-generation biofuels by signing a memorandum of understanding for a massive, $12 billion joint-venture with Brasilian ethanol producer Cosan in February of this year. Up to then, Shell had always said it did not want to produce first-generation biofuels, which compete with food, but apparently the company has become convinced that Brasilian ethanol can be produced without adverse effects on the food market. The planned joint-venture is undoubtedly a sign that Shell sees biofuels as the most likely renewable alternative for oil in the transport sector. Shell is also still working on the development of hydrogen, but this looks to be a very long-term option.

|

|

Peter Voser |

Discussion (0 comments)