Brussels: energy projects of "common interest" should get special treatment

on

Brussels: energy projects of "common interest" should get special treatment

The European Commission will launch a proposal next week intended to stimulate the construction of major new electricity, oil, gas and CCS infrastructure projects. The primary aim of the proposal, of which EER has obtained a draft copy, is to establish a number of 'projects of common interest' (PCI's) that will be able to benefit from specially designed fast-track permitting procedures. These should override the cumbersome national procedures that are now in place in various member states. The proposal further puts pressure on national energy regulators to grant extra financial incentives to investors and sets out conditions under which projects will get special EU subsidies.

|

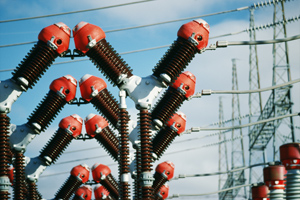

| Investing in cross-border energy infrastructure in Europe (photo:Thinkstock) |

In this battle plan, the European Commission noted that some €210 billion needs to be invested in building cross-border energy infrastructure in Europe between now and 2020: €140 billion for high voltage electricity lines and the development of a ‘smart’ grid; €70 billion for high pressure gas pipelines and €2.5bn for a CO2 transport infrastructure tied to the deployment of CCS. The needed rate of investment is twice what it has been in the last decade, at least for electricity infrastructure (for gas infrastructure it’s about 30% more than the business-as-usual rate). This upgrading and expansion of infrastructure is crucial, the Commission said, to achieve three main objectives: to connect and integrate the EU’s national markets, to diversify supply and transit routes and to fit in the expected large-scale expansion of intermittent renewable energy sources into the energy system. In other words, additional infrastructure investments are crucial with respect to all three pillars of EU energy policy: competitiveness, security of supply and sustainability.

The Commission also noted, however, that as things stand half of the €210 billion of investments will not materialise. It identified three main reasons for this:

- permitting procedures are often too complicated and lengthy (they can take 10 years or longer in some member states, involving 10 or 20 different authorities)

- existing regulation does not provide the right incentives to investors

- sufficient financial support is lacking in many cases

Regime of common interest

At the time, Oettinger promised he would come up with a follow-up proposal that would address these three major obstacles. This new proposal will be unveiled next week, on 19 October. This article is based on a draft copy of the proposal that EER obtained.

So how does the Commission intend to overcome the investment bottleneck that is currently hampering the energy market? First of all, the new proposal sets out rules that will make it possible to designate

| 'If they can get it through the European Parliament and Council of Ministers in this form, it would do nothing less than revolutionise Europe's energy system' |

Second, the proposal provides rules for ‘cross-border allocation of costs and risk-related incentives’, which national regulators are expected to take on board when they set tariffs for the use of energy infrastructure.

Third, it establishes conditions projects must conform to in order to become eligible for EU subsidies: the Commission has set aside €9.1 billion in the EU budget for 2014-2020 to spend on energy infrastructure.

To date, national and even local interests have always dominated European infrastructure decisions. What the Commission is proposing now is a truly European approach that takes a broad, continental view on where investment is needed. This is mostly to: diversify supply routes (e.g. to import gas from outside Russia, or solar power from North Africa), integrate renewables (electricity generated from renewables is expected to double between 2007 and 2020) and to develop an integrated internal market that keeps prices competitive for consumers.

Most stakeholders European Energy Review talked to, including representatives of grid operators and environmentalists, say the proposal by and large goes in the right direction. Jesse Scott, Energy and Climate Programme Director at demosEUROPA, a Warsaw-based research institute, goes further: ‘If they can get it [the proposal] through the European Parliament and Council of Ministers in this form’, she says, ‘it would do nothing less than revolutionise Europe’s energy system.’

Priority areas

One of the most important aims of the proposal is to establish a method to identify which energy projects are ‘of common interest’, and which will therefore benefit from an accelerated permitting process and will get help building a business case, including the right to apply for EU funds. As a first step, the Commission identified twelve broad ‘Energy Infrastructure Priorities’. These include the Southern Gas Corridor, the North Sea offshore grid, a cross-border CO2-network and ‘smart grids deployment’ (see the box below.)

To qualify to become a PCI, a project has to fit into one of these 12 priority areas. But it has to meet

| The Commission goes further still in apparently suggesting that some infrastructure projects should be built regardless of their impact on the environment |

Gas and electricity PCI’s must also be listed in the ten-year network development plans that are being developed by ENTSO-G and ENTSO-E, the pan-European associations of Transmission System Operators (TSOs) for gas and electricity, which were set up as part of the EU’s third energy internal market package. Both associations have already prepared rolling first versions of these plans. It is the TSOs that mostly build and run Europe’s cables and pipelines. For the rest, the criteria for gas and electricity PCI’s are fairly limited. Smart grid PCI’s, on the other hand, have to meet a list of six demands. Some people, such Claude Turmes, a member of The Greens in the European Parliament, already worry that there will be too many gas projects at the expense of smart grid ones.

Regional cooperation

To help decide which projects qualify as priority projects, the Commission will rely heavily on what it calls ‘Groups of Regional Cooperation’. Although the Commission will make the final decisions, it will

|

| The goal is to have a first list of European priority infrastructure projects ready by the summer of 2013 (photo:Thinkstock) |

At the end of the day, the goal is to have a first list of European priority infrastructure projects ready by the summer of 2013. With the number of selection criteria and different bodies involved in sorting through them, this already sounds ambitious. But it is only the start. For those projects that make it onto the list, the next question is: how are they going to get a permit?

One-stop shop

Getting planning permission has been a problem above all for electricity infrastructure projects. There is often a staggering array of authorities involved who all need to give their consent for the project to go

To speed things up more, member states are asked to ‘streamline’ environmental impact assessments (required by EU law) for PCI’s. But the Commission goes further still – and indeed opens a can of worms – in apparently suggesting that some infrastructure projects should be built regardless of their impact on the environment: ‘in case of a negative assessment... for the geographical site considered, the least harmful route of that project [may] be granted the necessary positive decisions, for reasons of overriding public interest’, says the proposal. For this to happen, the project must meet three conditions: environmental impact assessments must have been carried out, no satisfactory alternative routes are available and compensation measures must have been decided before construction starts.

For the definition of ‘overriding public interest’, the Commission refers to the EU habitats directive (a 1992 nature conservation law) and the water framework directive of 2000. Yet although these laws

| Another stakeholder points out that there are similar precedents in national law for defence and transport projects, which would mean that energy is assigned the same strategic significance |

Green MEP Claude Turmes warns of ‘a very dangerous precedent’. ‘We have existing environmental legislation. If we introduce an exemption now, we could introduce one for mining or building highways in future’, he says. It would also create a huge divide among stakeholders, he warns, with NGO’s pitted against project developers. The European Parliament called for environmental legislation to be respected in a vote on infrastructure earlier this year.

If this issue is controversial, the Commission’s proposals for a one-stop shop (per member state) and a maximum permitting period of three years win widespread support . Some even call for a one-stop-shop per project rather than per state in the case of projects involving more than one member state. The Commission actually raised this idea in its original November 2010 infrastructure package, but has not pursued it in the current proposal.

Connecting Europe facility

If permitting is half the problem, financing is the other half. The goal of the new proposal is also to help build a business case for priority projects. First, the Commission calls on the ENTSOs to develop a standardised cost-benefit calculation for individual gas and electricity projects. Second, it sets out a process for network regulators to allocate project costs across borders (a very tricky issue). Third, the Commission calls on regulators to offer tariff-based incentives for priority infrastructure projects that involve more risks than usual, for example because they involve new transmission technologies or very complex coordination. Fourth, the Commission sets out conditions for accessing the €9.1 billion in EU funds it is setting aside for energy infrastructure in the EU budget for 2014-20.

Coming on top of other sources such as the economic recovery funds (nearly €4 billion for energy infrastructure) the additional €9.1 billion is part of what is called the ‘Connecting Europe Facility’. The amount is just a fraction of course of the €210 billion needed by 2020, but it is a lot more than the €155 million that was available for 2007-13 through the Trans-European Networks for Energy (TEN-E) financing regulation. This time project developers will be able to use the funds for actual construction, not just for preliminary studies. Except for oil-related projects, all priority projects are eligible, although certain explicit conditions are spelled out for gas and electricity projects: they must offer ‘significant positive externalities’, their business plan must show they are not viable without EU money, and they must have received a cross-border cost allocation decision.

With these new proposals, the Commission intends to remove any excuse for European priority energy infrastructure projects not to get built. Nevertheless, if problems still arise, there is a back-up in the proposal: the Commission can appoint an ad hoc ‘European coordinator’ to step in and help move forward projects that face difficulties. No names of possible candidates are mentioned of course, but the Commission does note that the European coordinator ‘shall be chosen on the basis of his/her experience with regard to the specific tasks assigned to him/her’. For gas projects, several former German politicians come to mind.

|

The twelve Energy Infrastructure Priorities of the European Commission 1) North Sea offshore grid

|

Discussion (0 comments)