EU's energy transition: the triple challenge of sustainability, competitiveness and affordability

on

EU’s energy transition: the triple challenge of sustainability, competitiveness and affordability

by Daria Nochevnik

On the road to the EU 2050 decarbonisation objective, regulatory unpredictability is considered to be the most important investment challenge by a number of energy professionals in the power sector, while too low prices in the power and ETS markets are perceived as the second biggest challenge [note 1].

The question posed by some leading experts, is ‘do we want to live in 2035 when the politicians of 2015 dictated the terms of the CO2 regime?’ [note 2]

|

| Electricity market Europe - source: CETRI-TIRES |

As the Convention is the biggest event of the year organized by the sector association that represents the European electricity industry, the messages convened by politicians, industry representatives, as well as financial and investment experts, mirror the key trends on the EU’s energy agenda.

Pierre-Marie Abadie, Director of Energy Affairs at the French Ministry of Ecology, Energy, Sustainable Development (MEEDDAT), underlined the fundamental gap in EU’s vision of security of supply and competitiveness, which ultimately have to be linked in the 2030 policy framework for climate and energy. In anticipation of the upcoming meeting of the European Council in June, Abadie pointed to fact that cohesion in policy design will have to be addressed by the EU ministers, in particular the inextricable link between EU’s economic competitiveness and energy security that hasn’t been sufficiently articulated so far.

EU – the ‘old guard’ in the energy revolution?

The speed of developments in the world of energy, as well as the complexity of the sector that requires innovation, political cohesion and interoperability of systems define the uncertainty of EU’s energy present. In order to ensure competitiveness, the vector of EU’s energy strategy was called to be adjusted:

“Here in Europe, we stand in the middle of an energy revolution. History tells that it isn’t an easy place to stand. It is not safe even for the revolutionaries, but it is certainly not safe for the ‘old guard’, and in this revolution we are the ‘old guard” [note 3].

When addressing EU’s energy trilemma - sustainability, competitiveness and affordability – most of the experts saw the solution for a cost-effective energy transition in the market design, while critically assessing the impact of political interventions on the EU’s electricity market. However, despite the shared understanding of the key issues such as rising electricity prices, current delay in investments in the sector and the need for effective and well-functioning EU electricity market, stakeholders were pointing to different sets of solutions.

If governmental officials have been advocating the ETS reform as the key instrument for energy transition, industry professionals and energy experts were calling for less governmental intervention, a smarter market design and predictability for investors.

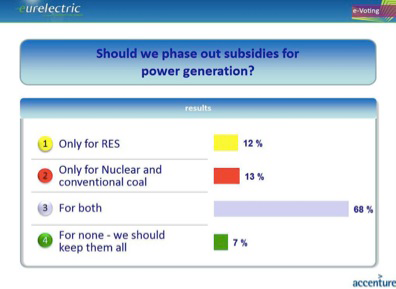

Industry’s view on the current supporting schemes is clearly uniform [note 4]:

|

‘This is a long-term business, while politicians have short-term objectives’

The inherent contradiction between short-term policy objectives on the one hand, and long-term investment plans required by the capital-intensive energy industry on the other, has been highlighted by the Steve Woodhouse, the director of Pöyry Management Consulting.

While EC is currently developing the 2030 policy framework for climate and energy, investors are compelled to look towards 2040 and beyond.

| political interventions guided by relatively short-term goals have proven to be detrimental for the sector |

The multi-dimensional challenge for the industry includes the demand for energy affordability on consumers’ side, coupled with the need for immense investments in innovative engineering and IT solutions to achieve the 2050 decarbonisation goal. Arguably, the financial challenges currently present the biggest concern, as ‘traditional lenders face restrictions on capital ratios’. The industry players across the whole value chain of the power sector would need to establish new ways of interacting not only with one another, but also with consumers. That, in turn, would raise a number of questions with regard to the allocation of risks, revenues, as well as control and governance issues.

As ‘policy and regulatory risks are almost impossible to hedge, particularly for private companies….on-going political involvement should be held to a minimum’, according to the Director of Pöyry Management Consulting.

Market design - the key tool to combine different political and investment goals in a consistent manner.

While the current support schemes were openly characterized as ‘costly, inefficient and prone to policy risk’, a number of experts identified market design as the most effective solution to the cost-effective energy transition challenge.

The energy bills have been used too much for the political purposes, experts would argue, and so far, integrators have demonstrated limited responsibility for optimizing the Renewable Energy Sources (RES).

Hence, the market solution would be to enable better use of existing interconnection capacity, better integrated markets, investments in smart metering, enhanced analytics, as well as optimized, cost-effective networks. There is indeed a major strategic challenge to restore the market that has been destabilized. Smart systems are the drivers of evolution of the business models.

In this context, capacity remuneration schemes were considered the most pressing market design issue.

Rising electricity prices - confirmed to be driven by the RES support schemes.

The EURELECTRIC June 2014 Report (prepared in collaboration with Accenture), presented at the Convention [note 5], concludes that electricity expenditure has been going up with over 5% across the EU annually since 2008 (from €380 billion to €398 billion). Although the volumes of electricity supply have been relatively stable since 2010, rising electricity prices were primarily responsible for the increase in EU countries’ energy expenditures.

The analysis shows that the costs of electricity supply have been relatively stable,

| The regulatory patchwork across the EU is considered to be the driver behind the increasing costs for energy transition |

Moreover, according to the study, electricity prices will continue to increase if the barriers to a sustainable and affordable decarbonisation pathway will not be addressed.

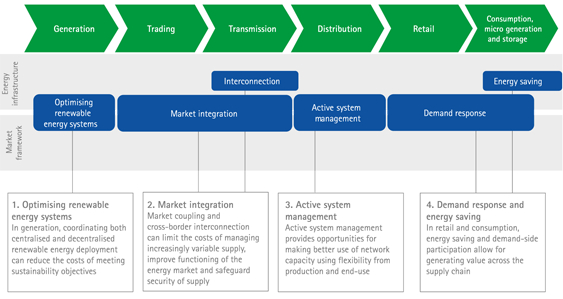

The regulatory patchwork across the EU is considered to be the driver behind the increasing costs for energy transition, which can be tackled through an integrated set of levers across the electricity value chain presented in the scheme below [note 6]:

|

| An integrated set of levers across the electricity value chain - source: Eurelectric |

Although there was an overall consensus with regard to the detrimental effect of regulatory instability on the electricity markets, as well as the fact that policy design and market design have to be more cohesive across the EU, the political response to the challenges seems to be rather ambiguous. In anticipation of the appointment of the new European Commissioner for Energy, Tom Howes, Deputy Head of the Economic Analysis and Financial Instruments (DG ENER), was asked about the prospects of further regulatory interventions from the Commission’s side and whether new policies would be considered. The reply that ‘the new Commissioner will probably want “better policies”’ left experts wondering, whether the issue of regulatory instability will be addressed by the EU policy-initiating organisation in the near future. As the impact of regulatory interventions has been highlighted throughout the presentations and panel discussion of the conference, the lukewarm reception of this reply, perhaps mirrored the acuity of the issue for the power sector.

Choosing priorities for EU energy policies

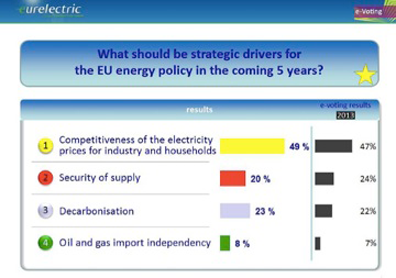

In his keynote speech, current European Commissioner for Energy, Gunther Oettinger presented the recently adopted European Energy Security Strategy and emphasized that moving ‘fast to reduce our dependence on external suppliers’ should be the main priority for the energy industry in Europe. However, when answering on the question ‘What should be strategic drivers for the EU energy policy in the coming 5 years?’, the majority of the European power industry professionals clearly spoke with a single voice [note 7], which did not resonate with the one of the Commission:

|

Despite the willingness of the industry and policy-makers to move towards the 2050 target, the discrepancy in priority-setting remains to be an issue. Putting energy security at the forefront is acknowledged as a reasonable and justified strategic goal, however, how did we come to an understanding of energy security that does not incorporate competitiveness of electricity process for industry and households in itself? Whether or not the necessity of linking security of supply with economic competitiveness will become a political priority remains to be seen, when the final decision on the 2030 Framework is taken in October 2014.

In the meantime, the Conclusions of the latest European Council that took place on 26/27 June 2014, as well as the 'Strategic Agenda in Times of Change', show that this link is clearly underestimated, when European energy security is addressed.

- E-voting results, EURELECTRIC’s Annual Convention, London, 3 June

- Stephen Woodhouse, Director, Pöyry Management Consulting, Presentation at EURELECTRIC’s Annual Convention, London, 2 June 2013

- ibid.

- E-voting results, EURELECTRIC’s Annual Convention, London, 3 June

- EURELECTRIC Report prepared in collaboration with Accenture ‘Forging a joint commitment to sustainable and cost-efficient energy transition in Europe’ - available at http://www.eurelectric.org/media/132600/eurelectric-accenture_brochure-2014-030-0355-01-e.pdf

- ibid., p. 4

- E-voting results, EURELECTRIC’s Annual Convention, London, 3 June

Discussion (0 comments)