High oil prices are caused by consumers, not speculators

on

High oil prices are caused by consumers, not speculators

High oil prices are often blamed on speculators, but it is perfectly possible to explain recent oil price history in terms of supply and demand forces, argues energy consultant Steven Kopits. His analysis shows that it was the reluctance of US consumers to reduce oil demand in the face of rising oil prices that led to the price spike in 2008. If this is true, then why did prices peak again in 2012, although US consumers had adjusted their consumption? Because, says Kopits, prices are not set anymore in the US, but in China. That's the bad news: in the battle for barrels, China and the other emerging economies will force the US and other OECD countries to yield consumption.

|

| The US no longer sets oil prices - but China does. (c) wowlao.blogspot.nl |

When oil prices are high and consumers irritable, politicians are apt to roll out "speculators" as the cause of all ills. It hardly matters that many studies have debunked this notion, including several by James Hamilton of the University of California, San Diego (USCD) and Lutz Killian of the University of Michigan. These show, for example, that although there are similar numbers of open contracts for oil and gas futures, oil prices have recently been near historical highs, even as natural gas prices have collapsed to recent lows. Were the volume of interest - from oil traders, hedge funds, exchange-traded funds (ETFs) and others - the driving factor in price setting, natural gas prices should be as high as oil prices. But exactly the opposite is true. Therefore, the amount of interest from investors in a commodity cannot be shown to be directly correlated to price levels, nor can the presence of financial investors in a given commodity be shown to lead to high commodity prices.

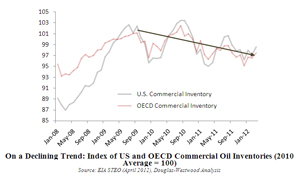

Moreover, speculation (which in reality should be interpreted as "net long positions") should be accompanied by inventory builds. In order to drive up prices, supply must be withheld from the market. Financial speculators, by definition, do not produce oil. Consequently, they cannot by themselves change oil production. They can, however, withhold oil supplies from the market by putting them into inventory. This happened in the silver market in the 1980s, when the Hunt brothers tried to corner the market in silver futures to drive up silver prices. The effort ultimately failed, but nevertheless illustrates how speculation of this sort works. In the case of oil, inventories were in fact being drawn down at a ferocious rate in late 2007 and early 2008, exactly when the price spike occurred. More recently, tensions with Iran led to modest inventory builds - about a half day's global consumption - in the early months of this year, but levels have returned to normal since. Therefore, we fail to find the characteristic fingerprint of upward price manipulation ("speculation"), which is difficult to envision absent inventory builds.

|

| Index of US and OECD Commercial Oil Inventories (click to enlarge) |

Speculation itself is a slippery term. When the US Congress holds hearings about "speculation", they do not mean investors trying to manipulate the price of a commodity both up and down. They mean that oil prices are above levels consumers find comfortable, and members of Congress are receiving complaints from constituents. This is the trigger for hearings on speculation. Some third party - an investor or oil company - must be blamed. But in fact, it is perfectly possible to attribute recent oil price developments to the behavior of consumers both in the US and abroad.

Stagnant supply

Both academics and the media frequently note the "price inelasticity of demand" for oil. This is the rate at which consumers change their behavior when oil prices go up. The price elasticities for oil consumption across a range of countries are variably estimated at -0.25 to -0.33 (Hamilton 2009).This means that, in the short run, for every 10% increase in the price of oil (or gasoline, for some of these estimates), consumers only reduce consumption by about 3%. What happens to the rest? Consumers keep right on spending. Which means for every 10% increase in prices, consumers are willing to accept about 7%.When faced with higher prices, in the short run, consumers are typically willing to accept them rather than reduce their oil-based fuel purchases.

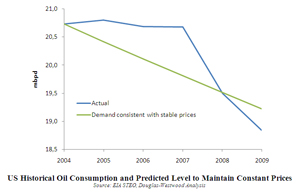

Moreover, if demand continues to rise over time, and if the oil supply fails to respond, then prices will just keep rising. This is much the pattern seen from 2003 until the oil price peak in 2008. Oil prices kept rising, but advanced country consumers - most of all, US consumers - refused to yield their oil consumption. Given that the oil supply was stagnant from late 2004 and given that Chinese and emerging market oil demand was soaring, US consumption should have been falling at the pace of 1.5% per year to hold prices steady. But it wasn't. US oil demand was virtually unchanged over the 2004 to 2007 period. Price elasticity was not the -0.2 or -0.3 academic studies might suggest; it was effectively zero. As a result, China's demand pressure was channeled more or less directly into price increases as US consumers refused to transfer their consumption to a growing China.

|

| US Historical Oil Consumption and Predicted Level to Maintain Constant Prices (click to enlarge) (c) EIA STEO, Douglas-Westwood Analysis |

As a practical matter, therefore, the oil price spike culminating in 2008 was directly the result of a stagnant oil supply, on the one hand, and price inelasticity of demand, on the other. It had virtually nothing to do with speculation, as inventories were plummeting through most of this period, particularly in late 2007 and early 2008.

Inelasticity, emotion and behavior

Of course, inelasticity cannot last forever. At some point, oil consumption must return to sustainable levels for any given country. Put another way, the long-run price elasticity of demand must approach -1.0. At some point, consumers will consume less rather than pay more. But how does this occur?

During the period of price inelasticity, if demand runs consistently ahead of supply, oil prices will rise above long-run sustainable prices - this is implicit in the very notion of inelastic demand. On an

| At some point, oil consumption must return to sustainable levels for any given country |

Oil price shocks of this sort are the death rattle of hope, the psychological blow which resets expectations about future possibilities. Such shocks force consumers to come to the painful and resisted realization that they will have to make do with less.

But this is not the first thing to happen. First, consumers will tend to borrow more, save less, and consume less of other goods - if they expect an oil price spike to be transient or that their wealth or income will continue to grow. And this is exactly what we saw in the 2000s, until the recession. At some point, however, consumers will have exhausted their borrowing opportunities, have a minimal savings rate, and begin to realize that established economic structures cannot endure.

The first tremors of such instability came in the summer of 2007 and culminated in the crash of mid-to-late 2008. US oil consumption collapsed concomitantly; indeed, it fell essentially from the first month of

| Oil price shocks of this sort are the death rattle of hope, the psychological blow which resets expectations about future possibilities |

This collapse of advanced, OECD economy consumption gave China and the emerging economies the opening to seize the OECD oil consumption to which they were - as an economic matter - entitled. Some 4 mbpd (million barrels per day) of consumption transferred from the advanced to the emerging countries in 2009-2010, about 5% of global oil consumption.

Taking the bus

For a while, the collapse in OECD oil demand was enough to cool prices. But in the summer of 2009, the advanced economies began to grow again and sought to regain some of the consumption lost in the downturn. By Q4 2010, the advanced and emerging economies were again beginning to strain against a largely flat oil supply (just as our model predicted). Oil prices advanced quickly - accelerated by the revolution in Libya - and by April 2011 were again at oil shock levels.

But this time, US consumers didn't hold on. They ceded consumption readily. By March 2012, for example, US consumption was off 5%, or 1 mpbd, compared to a year earlier. Why no inelastic demand now? Because the pre-conditions to hold on had evaporated. Few people expect gasoline prices will fall back sustainably to $3 / gallon. At the same time, US households find themselves compelled to de-lever; wages are stagnant, and median household income has fallen for most of the OECD countries in the last five years. The future looks tough - and with cause. There is neither the expectation of cheap gasoline in the future; nor optimism about wages; nor the ability to borrow against the future.

However, it is this very fatalism which is allowing the US to adjust to a world where finite oil resources must be shared with a large and rapidly growing China. People are not hanging on; they are making the changes they need to get by, if for no other reason than that they have little choice. Grown children have moved back in with their parents and given up on having their own car. Low income workers are yielding their vehicles and taking the bus to work.

Fuel to the fire

But still, oil prices have been well above sustainable levels for the US. Once again, consumers have felt victimized and politicians have been parading the usual list of suspect speculators. If US demand is so elastic, why is this happening?

Because the US no longer sets oil prices. These are set in China (or arguably, in the "other non-OECD"). And China's demand was, until just recently, inelastic. Chinese wages are still rising, borrowing capacity had continued to increase, and the Chinese have faith in the future. For the three months ending March 2011, the price elasticity of demand was 0.4; and for March 2012, it was 0.2 (compared to the same period a year earlier and making no separate adjustment for income effects). Thus, for every 10% rise in oil prices, Chinese oil consumption increased 2-4%. According to elasticities from academic studies, consumption should have fallen 2-3%. In China, higher prices have been accompanied by higher oil consumption for the last three years.

The US and Chinese examples, taken together, demonstrate that advanced and emerging economies can exhibit consumer behavior which fuels price spikes. The advanced economies resisted consumption reductions not for months, but for years, prior to the price spikes of late 2007 to mid-2008. To add fuel to the fire, Chinese consumers are willing to substantially expand oil consumption, even in the face of stiff oil price rises. If we are looking for a cause for high oil prices, we have no need to look farther than this.

Unrelenting pressure

If high prices were only a function of short-term demand inelasticities, the prospects for a return of affordable gasoline would be more promising. Unfortunately, China's growing income and phase of development insure that it can sustain oil demand at prices well above those America can afford. Two

| Over time and just as they have for the last six years, China and the other emerging economies will grind down the OECD countries and force them to yield consumption |

Thus, advanced country consumers have been victimized not only by oil prices spike driven by inelastic demand, but the inelastic demand of Chinese consumers as well! Recent high oil prices have broken China's demand, with the result that global oil prices are falling. At present, China's oil demand is effectively elastic - the Chinese oil price bubble has been popped. This may lead to a period of soft prices.

But it won't last. Whether China's tolerance is $110 / barrel or $120 / barrel, it is in either case well above that of the US or the other OECD countries. Soft oil prices will allow both China and the advanced countries to catch their breath and rekindle economic growth - and then oil prices will begin to climb again. Over time and just as they have for the last six years, China and the other emerging economies will grind down the OECD countries and force them to yield consumption. Advanced countries may continue to adjust rapid reductions in oil consumption and increases in efficiency, or the OECD consumer may dig in his heels at some point and fight to keep established consumption levels. But keep in mind, whichever the reaction, these periods - without exception - have historically ended in recessions. We may hope things turn out differently this time.

|

About the author Steven Kopits manages the New York office of Douglas-Westwood, energy business consultants. Douglas-Westwood assists energy companies with market research, strategy development and transaction support. The views expressed in this article are his own. |

Discussion (0 comments)