New nuclear in the UK? It all depends on the government's policies

on

New nuclear in the UK? It all depends on the government's policies

Nowhere in the OECD region has a government shown more enthusiasm for new nuclear power stations than in the United Kingdom. The government's efforts to smooth the path for new projects have so far been impressively successful, with key milestones being reached with only a few months here and there of delay. For now, the proposed new projects - amounting to over 16 GW - have built up a head of steam, despite last week's news that big German investors Eon and RWE have decided to pull out. But even the front-runner projects face the uncertainty of not knowing how much they will be paid for their output. Much will depend on how the government chooses to implement its ongoing electricity market reforms.

|

|

Artist''s impression of the newly to be built nuclear plant Hinkley Point C |

Last week's announcement by Eon and RWE that they would not after all be pursuing proposed new nuclear projects in the UK - through their Horizon Nuclear Power joint venture - was greeted with dismay on the part of the government and headlines bordering on the hysterical in some of the national press. The UK's energy policy lay "in tatters" proclaimed the usually sober Daily Telegraph, while others insisted that the news meant the UK was careering towards an energy supply crisis.

Energy minister Charles Hendry described the news as "clearly very disappointing" though he added "the partners have clearly explained that this decision was based on pressures elsewhere in their business and not any doubts about the role of nuclear in the UK's energy future".

In fact, to anyone following the development of nuclear energy in Europe since last year's Fukushima crisis in Japan, the news was no surprise at all. Eon and RWE had been lumbered by Germany's decision to curtail nuclear generation following Japan's Fukushima crisis. Both companies are major nuclear operators in their home country and both are suffering from loss of revenue and the need to raise finance to meet decommissioning costs. Their claim that their decision is strategic and unrelated to the attractiveness of their proposed UK projects is credible.

Commenting on its decision, RWE blamed two factors: the "accelerated nuclear phase-out in Germany" which has forced the company to make divestments, increase its capital and adopt a "leaner" capital expenditure budget; and the global economic crisis which has meant that capital for major projects is at a premium, making it difficult to raise finance for capital nuclear power projects with "very long lead times and payback periods". Volker Beckers, the CEO of RWE npower, the UK subsidiary, said: "We continue to believe that nuclear power has an important role to play in the UK's energy mix [and] we remain convinced that Horizon's development projects represent excellent sites for new nuclear power stations."

Credible new project

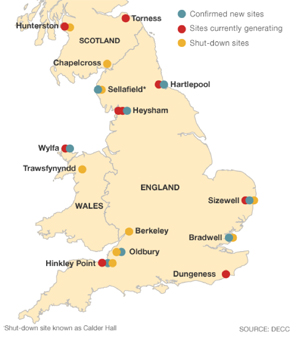

You would, of course, expect to him make such statements, given that his company and Eon now hope to find a new owner for Horizon. Still it would be premature to conclude that the prospects for nuclear new-build in what currently appears to be the most promising country in Europe are now ruined. The other consortia working on new-build nuclear in the UK - EDF Energy with partner Centrica and the NuGen consortium that brings together GDF Suez and Iberdrola - were quick to stress that the Horizon decision would have no impact on their plans (see the accompanying chart).

Vincent de Rivaz, the ebullient CEO of EDF Energy, said: "EDF Energy and Centrica remain focused on our project and nothing has changed with regard to that. We are determined to make UK new nuclear a success . . . With our partner Centrica we are progressing a strong and credible new nuclear project. We are making progress on all fronts towards taking the final investment decision at the end of this year, as planned, on the UK's first two new nuclear plants at Hinkley Point."

NuGen said it had "no comment to make on developments at Horizon" and that it remained "totally committed to and focused on" its Moorside project, which aims to develop some 3.6 GW of new nuclear power at a site near Sellafield in West Cumbria.

Again, you would expect these companies to make such comments at such a sensitive political juncture. A better guide is to look at whether they are putting their money where their mouths are - and on this criterion the seriousness of EDF Energy, the clear front-runner, cannot be doubted. At a Franco-British summit in February the company signed a contract worth over £100 million with Kier BAM for site preparation works at Hinkley Point C. Work under that contract got under way just two weeks ago.

At the same event, the company signed a memorandum of understanding with Areva, co-developer of the EPR reactor design that will be utilised at Hinkley Point C, for delivery of the nuclear steam supply system and instrumentation and control systems. Areva has already started producing the heavy forgings that will be needed for critical reactor components following the signing of a separate contract last July.

EDF Energy has also committed £15 million to establish a national training centre at Bridgewater in Somerset to help alleviate skills shortages in the nuclear energy supply chain.

A further measure of EDF's commitment to new nuclear is that it already has 700 people in the UK and France working on the Hinkley C project.

Nuclear white paper

There is no doubt that EDF Energy would not have got this far without the efforts that the UK government has made to smooth the path for nuclear new-build. Interestingly, these efforts, which began under the previous Labour administration, have continued seamlessly despite the transition to a Conservative/Liberal Democrat coalition government following the general election of May 2010. There are few policies about which that can be said at the present time.

The current UK nuclear renaissance had its beginnings in a nuclear white paper published in January 2008. At that time, following a long-drawn-out process of consultation, the then Labour government had

| Developments over the subsequent 18 months demonstrated a hearty appetite among Europe's major energy companies to pursue the opportunities that the UK had opened up |

It need not have worried. Developments over the subsequent 18 months demonstrated a hearty appetite among Europe's major energy companies to pursue the opportunities that the UK had opened up - despite the ongoing economic downturn:

- In January 2009 EDF completed the purchase of the UK's main nuclear power operator, British Energy, primarily to pursue new-build projects on land adjacent to existing nuclear stations. EDF subsequently partnered with Centrica, which has a 20% stake in the company's eight existing plants and in the project carrying out pre-development work for new build. Centrica also has the option to take up to 20% stakes in the planned new plants.

- In the first few months of 2009, two consortia of major European energy companies - one composed of RWE and Eon, and the other of Scottish and Southern Energy (SSE), Iberdrola and GdF Suez - formed joint ventures to pursue new-build projects. The RWE/Eon joint venture subsequently became Horizon Nuclear Power, while the other joint venture became NuGen. SSE announced it had decided to leave NuGen in September last year.

Overdependent on gas

The government's doubt over whether its proposals would attract private investment stemmed primarily from its own insistence that, while it would do what it could to "facilitate" the investments, it would be for private companies to finance them. And such finance would need to cover not just the capital cost of the power stations but also the full cost of decommissioning and their "full share" of waste management costs.

The companies that had expressed their interest were undeterred. They had looked closely at the issues and believed that the drivers for a new wave of nuclear power construction looked irresistible.

First, around of third of the UK's then generation capacity was due to reach the end of its life over the coming decade. Second, the government had set itself ambitious targets to reduce carbon dioxide emissions. Third, the UK was in danger of becoming overdependent on natural gas for its electricity. What was needed therefore was a proven technology that could deliver large-scale generation capacity with very low carbon emissions. In this scenario, nuclear started to look not just attractive but essential, if the lights were to stay on.

In a sign of the seriousness of the contenders’ intent, an online auction of land nominated for new-build nuclear, arranged in March 2009 by the Nuclear Decommissioning Agency, attracted unexpectedly strong interest. What was meant to last a week lasted for several – as bids spiralled to well above what many had expected.

By then several government initiatives were under way to facilitate the processes of site and technology selection and approval – as outlined in the January 2008 white paper. They included:

- the selection of sites that would be considered for nuclear new-build in a process known as Strategic Siting Assessment (SSA);

- the formulation of a National Policy Statement (NPS) to provide guidance to planning authorities;

- a process of Generic Design Assessment (GDA) aimed at reducing the amount of inquiry time that needed to be devoted to technology;

- a process called regulatory justification, required by European and UK regulations to demonstrate that the benefits of any new class or type of practice involving ionising radiation would outweigh detrimental health effects; and

- determining how much it would cost contenders to establish funds for decommissioning and waste management.

At the time, each of these initiatives was fraught with uncertainty and potential delay. However, progress over the past three years has been impressive, with most of the issues now resolved (see below: "Smoothing the path for new nuclear in the UK").

Investment enabling discussions

That said, the outstanding issues are far from trivial. Still to be determined are the details of the arrangements for how nuclear and other low-carbon forms of electricity generation, which in the UK

| It is hard to believe that in its "investment enabling discussions" with Mr de Rivaz the government will not come up with a deal that will allow EDF Energy to reach FID before the year is out |

The government has also decided to implement a capacity market to enhance security of supply at times of high demand. Again, details of this have yet to be worked out and published.

In short, prospective operators of new nuclear power stations in the UK still do not know how much revenue they will be able to realise from their investment, making a final investment decision (FID) impossible until the rules are clarified.

The government intends to introduce legislation to implement the electricity market reforms in the session of parliament starting next month, with the aim of getting it onto the statute book by 2013. Meanwhile, projects aiming to take FID before then will need to negotiate individual arrangements with ministers in a process referred to in the electricity market reform documents as “investment enabling discussions”.

The agreed position of the coalition government is that "new nuclear stations should receive no public support unless similar support is available to other low-carbon technologies". However, it is hard to believe that in its "investment enabling discussions" with Mr de Rivaz the government will not come up with a deal that will allow EDF Energy to reach FID before the year is out. The loss of Eon and RWE does not put an end to hopes for nuclear new-build in the UK. The loss of EDF Energy probably would.

|

Smoothing the path for new nuclear in the UK Last October the Department of Energy and Climate Change published an indicative timeline (see the accompanying chart) showing the then status of the government's efforts to smooth the path to investment in new nuclear power stations. EER looks at the current status of these efforts andat what front-runner EDF Energy says still has to be done.

Progress so far … 1 - Waste and Decommissioning funding

The EMR white paper was published in July 2011 and the carbon price floor was announced in the government’s 2011 budget. A technical update to the white paper was published in December 2011, as planned, covering the capacity mechanismand the institutional framework for delivering EMR. The update also covers "investment enabling discussions" that will enable early investment decisions to go ahead, in advance of implementation of the FiT CfD. . . . and EDF Energy's wish list Last October, in a speech to the Nuclear Development Forum, the CEO of EDF Energy, Vincent de Rivaz, gave his view of what still needed to be done for his company, and its partner Centrica, to move forward to a final investment decision (FID) on the first of the UK's new nuclear power stations, Hinkley Point C in Somerset, a two-reactor plant with total generating capacity of 3,260 MW.

As for timetable, before the events at Fukushima de Rivaz was confident that EDF Energy's first reactor would begin operation in 2018. He is now much less definitive on timing, acknowledging that development of new nuclear power stations has been "made more challenging by the events at Fukushima". |

Discussion (0 comments)