Shale gas a distant prospect?

on

Shale gas a distant prospect?

In 2013 the US Energy Administration estimated that Europe contained 470 trillion cubic feet (Tcf) of potentially recoverable shale gas, equivalent to 80% of US reserves. Given the size of Europe’s potential shale gas reserves and the EU’s declared intent to constrain climate change, while still protecting energy security, it is surprising that exploration for shale gas has been so little and so slow. Poland, the UK, France, Ukraine, Romania and Germany are all countries, which are estimated to have significant shale gas resources, but, with only 55 rigs in operation, knowledge of Europe’s geological share heritage is sparse, though early indications are that the shale plays are deeper at around 5000-6000 metres compared to 3000-4000 metres in the US.

|

| Halliburton gas operations in the Bakken formation in North Dakota. Source: http://de.wikipedia.org/wiki/Hydraulic_Fracturing |

|

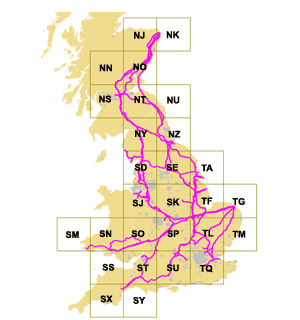

| Figure 1 - Source: nationalgrid.com |

With declining North Sea output, the current government is doing much to promote shale gas development. Whilst the most recent attitude survey found that over 50% of respondents favoured shale gas exploration reports the Shale Gas Investment Guide December 2014 considerable opposition to actual fracking from affected local communities and environmental interest groups remains. Moreover, with environmental impact studies and local government approvals for drilling and fracking to be won, progress has been slow as Howard Rogers, Oxford Institute for Energy Studies says, “I’m not holding my breath - due to the slow pace of approvals and a highly motivated anti-fracking lobby.”

Poland has Europe’s largest known reserves, strong public, and government support. However, “Up until now, the results of shale gas exploration in Europe have been disappointing”, states Gregory Zygan, Energy Specialist, Polish Ministry of the Environment. This is attributable, in part to the fact that comparatively little exploration activity has actually occurred - certainly not enough to determine the actual size of resource and its economic viability. As Howard Rogers, notes, “Since mid-2010, upstream companies in Poland have drilled some 66 wells with a further 20 completed by Spring 2015”. Disappointing results have led to the exit of Canada’s Talisman Energy, ExxonMobil, Marathon, Total and 3 Legs. Future development depends very much on the state energy company PGNiG and the government. Despite a pro-shale government, anxious to end its dependence on Russian gas, Poland has still not produced a new energy law and the rules and bureaucracy are often unclear and unstable. Given the urgency of energy security, the Polish government is introducing a new hydrocarbon law for 2015. To add to the difficulties, the gas pipeline infrastructure needed to link shale supplies with markets is inadequate and, given the traditional dependence on coal, only half of all households are currently connected to natural gas distribution network. See Figure 2.

|

| Figure 2 Polish Gas Pipeline Network - Source: msp.gov.pl |

In France, the moratorium of 2012 on fracking continues and public hostility to shale gas remains in place. However, a subsidiary of Total, the international oil company recently received three research permits for exploration in an area of southern France, thought to hold 84 Trillion TCF.

| In France, the moratorium of 2012 on fracking continues and public hostility to shale gas remains in place |

Table 1 Overview of shale gas in selected European Countries at end 2014

| country | technically recoverable shale gas tcf (1) |

hydrocarbon law for shale in place/due | government support | public attitude towards fracking | activity e.g. wells/fracked? |

| Eastern Europe | |||||

| Poland | 148 | 2015 | positive | positive | est. 84 wells end 2014 |

| Lithuania | 0 | 2015 | positive | positive | zero |

| Bulgaria | 17 | changing | negative | zero | |

| Romania | 51 | supportive | indifferent | surveys | |

| Ukraine | 128 | indifferent | indifferent | surveys | |

| Western Europe | |||||

| UK | 26/130 | 2014 | positive | 24% opposed 24% support 47% indifferent 4% don’t know august 2014 |

9 exploratory wells 1 fracked well 20-40 exploratory wells envisioned 2015-17 |

| France | 137 | changing | negative | tentative | |

| Netherlands | 26 | plans to lift moratorium | slightly positive | tentative | |

| Denmark | 32 | positive | slightly positive | test drilling | |

| Sweden | 10 | positive | slightly positive | test drilling | |

| Spain | 8 | mixed | negative | test drilling | |

| Germany | 17/25-81 | review 2021 | mixed | negative | surveys |

Source: US Energy Information Administration. Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries outside the United States, June 2013 and press reports

Notes: England British Geological Survey 2013 estimate, 130 Tcf in Bowland Shale, England and 2014 estimate of 80 Tcf in Midland valley in Scotland;; Germany: the Federal Institute for Geosciences and Natural Resources estimated 25-81 Tcf.

Inhibitors to shale gas development in Europe

The obstacles to shale gas development have been well and truly rehearsed. However, three aspects deserve comment. The first is the state of public opinion towards “fracking”. Public acceptance of hydraulic fracturing is an essential prerequisite yet, public attitudes are negative in much of the UK, Bulgaria, Spain, Germany and France. Shale exploration companies have failed to put their case to the media, the public, to local communities near proposed well sites and environmental interest groups. In essence, shale operators have failed to win a social licence to operate. As Richard Bass, Director of Energy, DNV states, “The main obstacle facing both industry and government in Europe is the misconception by the media of what fracking is about”. Meanwhile industry experts’ assertions that technological solutions can obviate concerns over water contamination, methane emissions and environmental damage are seemingly ignored.

There is no escape from the second obstacle namely high cost. Europe’s deeper shale plays and more complex geology adds to costs. Deep shale plays require heavier and stronger rigs and pumps, more fracking fluids, water and sand. To drill a 6,562-foot horizontal well in Poland costs around $11 million, if you are lucky, reported Bloomberg January 2014. As Rex W. Tillerson, CEO of Exxon Mobil explained, “Because the technology we have used so successfully in the States is simply not working on the Polish geology someone is going to have to spend a lot of money into basic R&D before it’s going to work”, reports Bloomberg November 2014. Another aspect of cost is the need for additional investment in an EU-wide pipeline network to create a unified gas market to transport the shale gas from production sites to consumers. As Howard Rogers points out, “If European shale gas can be developed at competitive prices; this has benefits in terms of balance of payments and also to a degree, security of supply.” However, shale gas must be price competitive against rival fuels such as natural gas, renewables, coal and LNG, if it is to find customers.

The third inhibitor to aggressive development of shale gas in Europe is the uncertainty of natural gas prices. As Bob Palmer asks, “The elephant in the room is the natural gas price: is it worth looking for more gas at this stage?” The potential impact of imports of American shale gas and its comparative price is impossible to assess before the average well-flow rate from a viable European shale play is established. Meanwhile, notes Grzegorz Zygan Polish Ministry of the Environment, “We have with the British government commissioned a joint study on the expected economic impact of shale gas production on their economies is to be published in spring 2015.”

Future:

The EU-level inconsistencies in reconciling climate change policies and security of supply policies have distracted attention away from the absence of a holistic EU-wide energy policy which envisages an integrated gas-pipeline network based upon a sound understanding of hydrocarbons’ future place as a major fuel source overcoming decades. If Europe is to continue to use hydrocarbons then, according to Richard Bass, the question should be - how is it extracted and where? And for now the real question is - will it pay to extract shale gas in Europe?

Discussion (0 comments)