The Russia-Ukraine political crisis and the armed conflict in eastern Ukraine served as a wake-up call to Europe’s stance toward the rising Russian power in the post-Soviet space and the new challenges it poses to the region. As the crisis hit closer to home after downing of the Malaysian airliner in eastern Ukraine and after Kiev’s a...

The Persian Promise or Betting on Uncertainty

By Saltanat Berdikeeva

The Russia-Ukraine political crisis and the armed conflict in eastern Ukraine served as a wake-up call to Europe’s stance toward the rising Russian power in the post-Soviet space and the new challenges it poses to the region. As the crisis hit closer to home after downing of the Malaysian airliner in eastern Ukraine and after Kiev’s announcement that it may ban the transit of Russian gas through Ukraine, the European Union (EU) imposed economic sanctions on Russia and began seeking diversification of gas supplies. Facing uncertainty over the stable supply of Russian gas that satisfies the EU’s 30% of gas imports, the EU’s energy diversification plan includes increasing gas storage, switching to alternative fuels, and integrating other external gas providers.

In light of the Russia-Ukraine confrontation, Iran’s role as a gas supplier to Europe is no longer as unsound of a prospect as it was recently, but it has emerged as a possibility. That is, if the current thaw in the relations between the West and Iran leads to successful negotiations on the latter’s nuclear program this November with a potential lifting of sanctions. Moreover, Iran’s more moderate stance to the West under the new president Hassan Rouhani and his willingness to cooperate with the U.S. in assisting Iraqi forces to combat Islamist extremists created the atmosphere for further inclusion of Iran. Amid the concern over stable supplies of Russian gas after the EU-imposed sanctions on Moscow, Iran has strongly voiced its interest to export gas to Europe. Cash-strapped Iran would only benefit from selling gas to Europe. Sitting on 17% of the world’s proven natural gas reserves [

note 1], Iran’s potential to export gas is enormous. This article assesses the opportunities of bringing Iranian gas to the EU, and political, economic, and other challenges standing in the way of re-establishing energy trade with Iran.

The Opportunities

The Western attitude to Iran has shifted over the last year from the brink of war to negotiations. The talk between the six world powers –

| The Western attitude to Iran has shifted over the last year from the brink of war to negotiations |

U.S., France, Germany, China, the U.K., and Russia – and Iran over the latter’s nuclear program are slated to reach a comprehensive nuclear deal on November 24, 2014. Aimed at positively reinforcing the Islamic republic, the West is ready to grant a significant relief of economic and financial sanctions in return for “implementation of verifiable nuclear-related actions” [

note 2]. Iran, whose economy has been crushed by years of sanctions, is eager to resume trade with the West, not the least of which is exporting its gas and oil.

Bolstered by the temporary relief of some sanctions as part of the Joint Plan of Action (JPA) in return for Iran’s commitment to freeze its nuclear activities during the six months of negotiations, there is a rise in a number of Western companies willing to invest in Iran. JPA freed up $4.2 billion in Iranian assets frozen in foreign banks and lifted sanctions on trading gold and sales of petrochemical goods and automotives. [note 3] The careful rapprochement with Iran has generated strong mutual interest in Iran’s energy exports at the time when the West’s relations with Russia have deteriorated over Ukraine. As a consequence, European companies have been keen to return to Iran.

In August 2014, the managing director of the National Iranian Gas Company, Hamid Reza Araqi, announced that several European countries, including Germany, Switzerland, Greece, Poland, as well as Turkey,

| Germany, Switzerland, Greece, Poland, as well as Turkey, began negotiations with Iran about importing its gas to reduce their dependence on the Russian supplies |

began negotiations with Iran about importing its gas to reduce their dependence on the Russian supplies. With Turkey’s heightened profile in the European gas supply security by serving as a transit route between Azerbaijan and the EU via the Trans-Anatolian Pipeline (TANAP) (see Figure 1), Iran could either link to TANAP or build its own pipeline to export gas to Europe. TANAP, whose construction has begun this September and is expected to be completed by 2018 with a capacity of 16 billion cubic meters (bcm) [

note 4], will carry gas from Azerbaijan to then link with the planned Trans-Adriatic Pipeline (TAP). As shown in Figure 1, TAP will connect Greece to Italy via Albania and the Adriatic Sea. TANAP is expected to eventually integrate gas supplies from Turkmenistan, Iran or other Middle Eastern sources as it increases its capacity to more than 20 bcm/year.

|

| Figure 1: TANAP and TAP routes - Source: Hurryet Daily News |

Iran has long been endorsing a gas pipeline from its major South Pars gas field to Europe via the so-called Persian pipeline that would cross Turkey. With an estimated 0.85 bcm/day gas capacity and 1,182,000 barrels per day of gas condensates [note 5], South Pars is essential for Iran’s gas export goals. The current output from this field mostly satisfies domestic demand with an expected boost in production for exports in coming years.

| a number of European countries have recently expressed interest in investing in a new internal pipeline, Iran Gas Trunkline-9 |

Iranian officials believe that gas exports to Europe via Turkey would be the cheapest, and safest, route from Iran [

note 6]. According to the Managing Director of Iranian Gas Engineering and Development Company, Alireza Qaribi, a number of European countries have recently expressed interest in investing in a new internal pipeline, Iran Gas Trunkline-9, from western Iran to Turkey, which could facilitate future exports to Europe [

note 7] and make the Persian Pipeline viable. Moreover, ready to change the current oil and gas terms from buy-back contracts to Iran Petroleum Contracts, Iran could make investment contracts more lucrative and less risky to foreign energy companies [

note 8]. Bringing Iranian gas could be a game-changer to Europe. But obstacles to these opportunities appear to be overwhelming, at least in the medium-term.

The Challenges

|

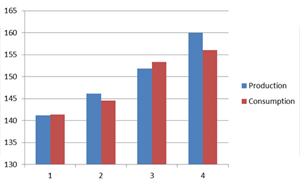

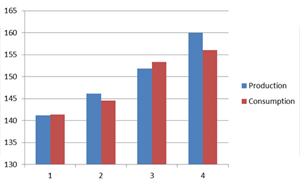

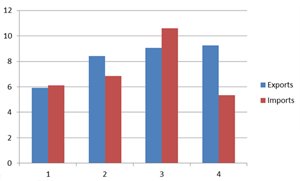

Figure 2: Iran's natural gas production and domestic consumption (in billion cubic meters)

Source: U.S. Energy Information Administration |

Iranian President Rouhani’s statement [

note 9] on October 4, 2014, that his country is not ready to displace Russia as a major gas producer, if sanctions are lifted, speaks of several issues. Iran’s energy sector is in critical need of modernization and new infrastructure. The existing oil and gas infrastructure is inadequate and insufficient to make the increase of exports viable as a result of 20-year of sanctions that deprived it of Western technology. Funding shortages and contractual problems have also slowed down its energy production. It will likely take years before modernization and construction of the midstream infrastructure make it possible to move enough Iranian gas to foreign markets to a level where it would be competitive with Russia or Qatar. But the more immediate challenge to Iran’s ability to export gas stems from its massive domestic gas consumption. As illustrated in Figure 2, Iran uses most of the gas it produces, leaving small amounts for exports. Iran anticipates an increase in gas exports with the development of next phases of the South Pars field in coming years.

|

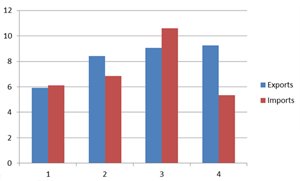

Figure 3: Iran's natural gas imports and exports (in billion cubic meters)

Source: U.S. Energy Information Administration |

Struggling to meet the internal demand, Tehran imported about 18 million cubic meters of gas per day from Turkmenistan in 2013 [

note 10] to meet peak demand and industrial needs of northern Iran. However, gas imports have decreased in half since 2012 (see Figure 3) due to sanctions that impacted Iran’s financial arrangements with Turkmenistan. Gas is also heavily used for reinjection in Iran’s oil fields to increase oil production.

At this juncture, the ambiguity of the outcome of negotiations on Iran’s nuclear program casts uncertainty on doing business there. With the deadline looming over the comprehensive nuclear agreement in a month, the deal is still not close. The negotiations are likely to stretch on past November. Ultimately, the U.S. stance towards Iran will weigh on the decision of European energy companies whether to trade with Iran at the risk of U.S. punitive actions for violating the sanctions. But even if these obstacles were removed, the role of Iranian gas in the EU’s energy diversification efforts is a long-term strategy than a solution to its current dilemma over Russian gas.

Notes

- “Country Analysis Brief: Iran,” U.S. Energy Information Administration, July 21, 2014, p. 20.

- Lawrence Norman, “Iran Nuclear Talks to Resume,” Wall Street Journal, September 20, 2014.

- Jeremy Kahn, “Iran lures investors seeing nuclear deal ending sanctions,” Bloomberg, August 17, 2014.

- “Turkey, Azerbaijan break ground for Trans-Anatolian gas pipeline,” Hurriyet Daily News, September 20, 2014.

- “Country Analysis Brief: Iran,” U.S. Energy Information Administration, July 21, 2014, p. 26.

- Milad Fashtami, “Iran says has long-term plans to export gas to Europe,” Trend News Agency, May 20, 2014.

- “Official: European companies willing to invest in Iranian gas pipelines,” FARS News Agency, September 16, 2014.

- “Iran offers new terms for oil contracts,” Al Monitor, February 26, 2014.

- “Iran won’t replace Russia as top gas supplier: Tass quotes Rouhani,” Reuters, October 4, 2014.

- Ladane Nasseri, “Iran, Turkmenistan agree on natural gas barters, official says,” Bloomberg, March 6, 2013.

Discussion (0 comments)