The low-carbon economy is not in sight yet

on

BP and ExxonMobil energy forecasts

The low-carbon economy: not in sight yet

Long-term energy forecasts just launched by ExxonMobil and BP foresee two decades of robust economic growth, accelerating growth in energy efficiency, and a gradual shift to a less carbon-intensive fuel mix. But these positive trends are not enough to put us on a trajectory to avert damaging climate change. Fossil fuels will continue to dominate our energy mix and greenhouse gas emissions will rise inexorably. The low-carbon economy still lies somewhere far behind the horizon.

|

| The low-carbon economy still lies somewhere far behind the horizon |

This is the vision of our energy future painted by new energy outlooks, not from the International Energy Agency (IEA) or the US Energy Information Administration, but from two of the world’s largest energy companies: ExxonMobil and BP.

What makes these forecasts worthy of our attention is that, according to both super-majors, they will form the basis for future investment decisions worth tens of billion dollars each year. In 2010, ExxonMobil’s spending on capital investment and exploration was a record $32 billion, while BP’s, despite its disastrous oil spill in the Gulf of Mexico, was $23 billion. Both companies have said they aim to maintain spending at those kinds of levels for the foreseeable future. In short, these companies are putting their mouths where their money is.

Not as optimistic

Both ExxonMobil and BP have been preparing long-term forecasts as a basis for investment planning for decades. However, until recently the results were seen as appropriate only for internal use. ExxonMobil decided to make its forecasts public several years ago and has been publishing them annually ever since. For BP this is the first time.

One immediate question is: why has BP chosen to make these forecasts public now, after decades of keeping them under wraps? What CEO Bob Dudley said at the recent launch of BP’s forecast is that ‘one of our responsibilities is to share the information we have, to inform the debate on energy, and now on climate change’. To some of the cynics amongst us that sounds rather like a polite way of saying ‘it’s about time the public debate on energy was informed by people who really understand the energy business and how it interfaces with human issues and with climate’.

Others might take the view that these forecasts are what the companies would like to see happen because it would suit their business interests. Not so, insisted both companies as they launched them.

| ‘We are not as optimistic as others about progress in reducing carbon emissions. But that doesn’t mean we oppose such progress’ |

Forecasts, rather than projections

A crucial difference between these outlooks and that produced by the IEA is that they are billed as forecasts, something the IEA strenuously avoids doing with its World Energy Outlook (WEO). Indeed the central theme of the latest WEO was the ‘unprecedented uncertainty’ facing all the stakeholders in the global energy economy. Key sources of uncertainty included: the rate of economic growth, especially in the near-to-medium term as the world climbs out of recession; the rate of progress of technology; and the policies that government will decide with regard to energy and the mitigation of climate change.

The IEA is always careful to stress that the various scenarios it constructs are projections rather than forecasts. These, it insists, show how the future could look under carefully considered combinations of assumptions about population growth, economic growth, energy prices, technology advances and – most important of all – future government policy. The key differences between these projections are the policy assumptions. The latest WEO presents three scenarios:

- The most pessimistic, the Current Policies Scenario, assumes no new energy or climate policies after the middle of 2010. It projects energy consumption growth of 1.4%/year between 2008 and 2035.

- The most optimistic, the ‘450 Scenario’, assumes that governments strenuously pursue policies to restrict global warming to within 2°C of pre-industrial levels – as agreed in the non-binding Copenhagen Accord of December 2009. In this case energy use grows by only 0.7%/year.

-

The central case, the closest that the IEA gets to making a forecast (but without calling it that), is the New Policies Scenario. It ‘takes account of the broad policy commitments and plans that have been announced by countries around the world, including the national pledges to reduce greenhouse gas emissions and plans to phase out fossil-energy subsidies, even where the measures to implement these commitments have yet to be identified or announced’. It projects energy consumption growth of 1.2%/year.‘It’s hard for us to imagine that societies around the world are suddenly going to stop thinking about carbon dioxide emissions’

The latest energy outlooks to be released by ExxonMobil and BP are unashamedly forecasts rather than projections. Indeed, according to Bill Colton: ‘We... forecast future technologies, such as what kinds of cars people are going to be driving, as well as policy decisions taken by government.’

Reasons to be cheerful

While both companies caution that the future presents challenges, both see encouraging trends. In an age of growing concern about security of energy supplies and potentially disastrous climate change, two such trends stand out. Energy consumption is expected to grow much less quickly than economic output, while greenhouse gas (GHG) emissions will grow significantly less quickly than energy use.

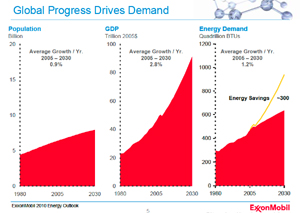

It is widely agreed that two main factors drive the growth of energy consumption. The first is the growth in population, because more people means more energy is required to meet their needs. The second is economic growth, because as nations develop and industrialise, and the living standards of their people improve, their need for energy tends to increase, initially at least. Most forecasters use United Nations population projections, which assume growth of just under 1%/year over the coming two decades. In other words, total population will grow to 8 billion by 2030.

The link between economic growth and energy use tends to change over time. As nations industrialise, energy consumption growth initially tends to be faster than economic growth. However, as economies mature they tend to become more energy-efficient. In other words, the amount of energy consumed per unit of GDP – a ratio known as ‘energy intensity’ – tends to fall. Moreover, as decades go by, newly industrialising economies tend to reach lower energy-intensity peaks than countries that developed before them, because they have access to more modern technologies.

|

| Chart 1: Global progress drives demands (click to enlarge) |

The yellow line in the energy consumption chart shows how energy use would grow without the expected efficiency improvements. Colton stressed that without them, energy growth would be three times greater. That would lead to global energy consumption doubling in just two-and-a-half decades.

BP is more bullish on global energy growth, expecting it to rise by 1.7%/year between 2010 and 2030, a total of 39%, but the general trends it foresees are similar.

Wide disparities

However, global averages mask a wide disparity between the developed nations of the OECD and the emerging and developing nations outside the OECD. In ExxonMobil’s forecast, economic growth in the OECD is 60% until 2030, but rapid and accelerating efficiency improvements keep energy demand more or less flat. In the non-OECD world, rapid economic growth and expanding prosperity lead to an increase in energy demand of more than 70% by 2030 compared with 2005, despite efficiency gains. Without such gains energy demand would rise by 200%, said Colton. Part of the demand increase stems from more people gaining access to modern fuels. Today, some 1.4 billion people have no access to electricity and 2.4 billion people cook with wood or dung.

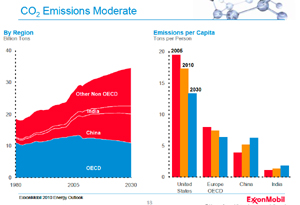

Chart 2 shows what this would mean for global emissions of carbon dioxide. The chart on the left shows that emissions in the OECD are lower in 2030 than in 2005, so all the growth comes from non-OECD nations, especially China and India.

|

| Chart 2: CO2 emissions moderate (click to enlarge) |

This distinction helps to explain why climate-change negotiations have made such disappointingly slow progress. The OECD world cannot effectively address climate change without the co-operation of the developing world, but the non-OECD countries have little choice but to increase their emissions if they are to even approach the living standards of the developed world. Moreover, most of the global growth in population occurs in non-OECD countries.

A shift to lower-carbon fuels

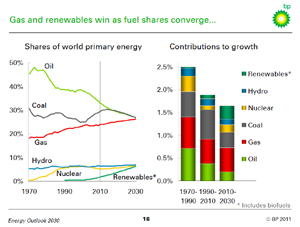

When it comes to the energy sources that will make up the fuel mix over the coming two decades, ExxonMobil and BP again have strong views. Again they agree on the general trends, though the numbers differ here and there. For those who believe strongly that renewables and nuclear will take over the energy world there are surprises and disappointments. The clear message is ‘not in this timeframe’.

The broad-brush trends are clear. Fossil fuels continue to dominate, but natural gas emerges as a clear winner, continuing to grow strongly at the expense of more-carbon-intensive coal and oil. Renewables and nuclear grow strongly but still make up a small portion of the energy mix, even when combined, by 2030.

|

| Chart 3: Gas and renewables win as fuel shares converge (click to enlarge) |

Electric prospects for gas

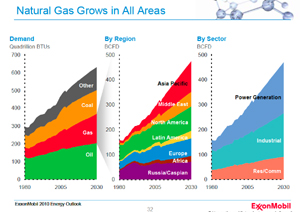

Both companies agree that power generation will be the largest and fastest-growing source of energy demand. ExxonMobil believes it is likely to represent 55% of energy demand growth to 2030, when it will account for 40% of total primary energy demand. And while demand for natural gas will rise in several end-use sectors, it is its role as an electricity-generation fuel that will drive most of its rapid grow to 2030. ExxonMobil sees gas demand growing by an average of 2.0%/year, or 49% between now and 2030.

BP concurs. ‘We project natural gas to be the fastest-growing fossil fuel, growing by some 2.1% a year,’ says Dudley. In other words, 52% growth between now and 2030. According to the company’s chief economist, Chistof Rühl: ‘The diversifying fuel mix is being driven largely by developments in the power sector. Energy used to generate power remains the fastest growing sector, accounting for 53% of the growth in primary energy consumption from 1990 to 2010 and projected to account for 57% of the growth to 2030.’

Chart 4 from ExxonMobil shows gas growing strongly in all regions and all sectors. Within the OECD, much of its growth is forecast to come from displacing coal in power generation. A key driver, says the company, will be policy decisions to impose a cost on carbon emissions. It expects this to reach around $60/tonne of carbon dioxide by 2030. The result is that gas becomes more competitive than coal in power generation.

|

| Chart 4: Natural gas grows in all areas (click to enlarge) |

Colton added that ExxonMobil was advocating that a price be put on carbon emissions and that the market should then be left to work out the best way to meet reduction targets. ‘Picking winners and losers is dangerous for the economy,’ he said. ‘We certainly wouldn’t support picking losers to be winners, which is the case for some of the technologies that are out there now.’

An interesting aspect of both forecasts is that neither ExxonMobil nor BP see huge growth in demand for liquid fuels for transportation, partly because although vehicle numbers are expected to rise substantially, efficiency is expected to improve radically and average distances are expected to get shorter.

Pointless to pretend

An interesting omission from both the ExxonMobil and BP outlooks is any forecast about how energy prices are likely to evolve. This was explained by Rühl in answer to a question at the launch of BP’s outlook: ‘I should say clearly that we do not forecast prices as part of this exercise. The prime reason is

| For those who believe strongly that renewables and nuclear will take over the energy world there are surprises and disappointments |

It is refreshing to hear someone say that it is pointless to pretend there is certainty where non exists. Forecasting energy prices with any precision over an extended timeframe has always been - and remains - a mug’s game. What has happened in natural gas markets since the unconventionals revolution took hold is a case in point.

Much of what the super-majors are forecasting is the result of natural gas now being seen as abundant over the long term because of the unconventional gas revolution that has taken place already in the US and which is expected to spread to a greater or lesser extent to other regions of the world. Their assumptions about how policy is likely to develop appear very sure-footed. What we have yet to see is how long it will take policy-makers to catch up.

Discussion (0 comments)